Car Insurance Liability Limits

When it comes to car insurance, understanding liability limits is crucial. These limits play a significant role in protecting you financially in the event of an accident. In this comprehensive guide, we will delve into the world of car insurance liability limits, exploring their importance, how they work, and why they are a vital aspect of your insurance policy.

Understanding Car Insurance Liability Limits

Liability limits in car insurance refer to the maximum amount your insurance provider will pay out in the event you are found legally responsible for causing an accident. These limits are typically set for bodily injury and property damage coverage.

Bodily Injury Liability Limits

Bodily injury liability coverage is designed to cover medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by you. The limits are often expressed in the form of three numbers, such as $100,000/$300,000/$50,000. Here's a breakdown of what these numbers represent:

- $100,000: This is the maximum amount your insurance will pay for bodily injury to one person in a single accident.

- $300,000: This is the total amount your insurance will pay for bodily injury to all persons in a single accident.

- $50,000: This is the property damage liability limit, which we will discuss in the next section.

It's important to note that these limits apply per accident, not per person. So, if multiple individuals are injured in an accident, the total payout for bodily injuries will not exceed the second number in your liability limits.

Property Damage Liability Limits

Property damage liability coverage covers the cost of repairing or replacing vehicles and other property damaged in an accident caused by you. The limit for property damage is usually a single number, such as $50,000. This means your insurance provider will pay up to $50,000 for property damage in a single accident.

| Insurance Provider | Bodily Injury Liability Limits | Property Damage Liability Limits |

|---|---|---|

| Provider A | $100,000/$300,000/$50,000 | $50,000 |

| Provider B | $250,000/$500,000/$100,000 | $100,000 |

| Provider C | $500,000/$1,000,000/$200,000 | $200,000 |

How Liability Limits Work in Practice

Let's illustrate how liability limits work with a hypothetical scenario. Imagine you're involved in an accident where two other vehicles are damaged, and three individuals suffer injuries. Here's how the liability limits would apply:

Scenario: Multi-Vehicle Accident

Your liability limits are set at $100,000/$300,000/$50,000.

- Bodily Injury: The injured individuals' total medical expenses, lost wages, and pain and suffering amount to $250,000. Your insurance will pay up to the total limit of $300,000, covering the full cost.

- Property Damage: The repairs for the two damaged vehicles cost $40,000 in total. Your insurance will cover this amount, as it falls within the property damage liability limit of $50,000.

The Importance of Adequate Limits

Adequate liability limits are essential for several reasons:

- Legal Protection: Liability limits help protect you from potential lawsuits and legal liabilities arising from accidents.

- Financial Security: Higher limits provide greater financial security, ensuring you're not left with significant out-of-pocket expenses after an accident.

- Peace of Mind: Knowing you have sufficient coverage can give you peace of mind, allowing you to focus on other aspects of your life without worrying about the financial impact of an accident.

Choosing the Right Liability Limits

Selecting the appropriate liability limits is a crucial decision. Here are some factors to consider when making your choice:

Assessing Your Financial Situation

Evaluate your financial resources and determine how much risk you're comfortable with. If you have substantial assets, you may want to opt for higher liability limits to protect your financial well-being.

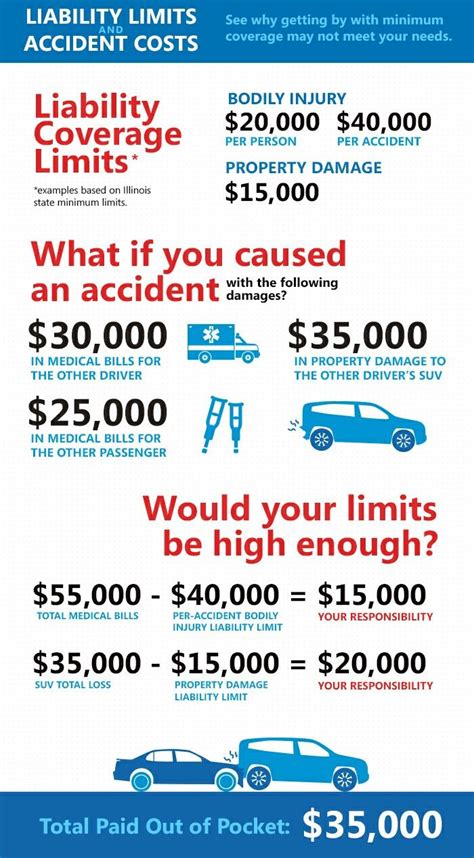

State Minimum Requirements

Each state has its own minimum liability limits that drivers must carry. While these minimums provide a legal safety net, they may not offer sufficient coverage in the event of a severe accident. It's recommended to exceed these minimums for added protection.

Consideration of Potential Risks

Think about the types of accidents that could potentially occur and the associated costs. If you frequently drive in high-risk areas or have a history of accidents, higher liability limits may be a wise choice.

Cost-Benefit Analysis

Higher liability limits often come with a higher premium. Conduct a cost-benefit analysis to determine the right balance between coverage and affordability. Consider your budget and the potential financial impact of an accident.

Adjusting Liability Limits

Liability limits are not set in stone. You can adjust your limits at any time by contacting your insurance provider. Here are some scenarios where adjusting your limits might be beneficial:

Life Changes

Significant life changes, such as purchasing a new vehicle, getting married, or starting a family, may prompt you to review your liability limits. These changes can impact your financial situation and risk profile.

Accident History

If you've been involved in an accident, especially one with significant damages or injuries, it's a good idea to reassess your liability limits. You may want to increase your coverage to ensure you're adequately protected in the future.

State Law Changes

Keep an eye on any changes in state laws regarding minimum liability limits. If the minimums increase, it may be a good time to review your coverage and consider adjusting your limits accordingly.

The Future of Liability Limits

As the automotive industry evolves, so too will the landscape of liability limits. With the rise of autonomous vehicles and advanced driver-assistance systems, the nature of accidents and liabilities may change significantly. Here are some potential future implications:

Autonomous Vehicles and Liability

As self-driving cars become more prevalent, the question of liability shifts from drivers to manufacturers and software developers. This could lead to new insurance policies and liability limits specifically designed for autonomous vehicles.

Advanced Driver-Assistance Systems

ADAS technologies, such as lane-keeping assist and automatic emergency braking, are already reducing the severity of accidents. However, as these systems become more sophisticated, the potential for accidents caused by software glitches or malfunctions may increase. This could impact liability limits and insurance policies.

Changing Legal Landscape

As technology advances, the legal system will need to adapt. New laws and regulations may be introduced to address the unique liability challenges posed by emerging automotive technologies. These changes could influence the structure and limits of car insurance policies.

Frequently Asked Questions

What happens if I exceed my liability limits in an accident?

+If the damages and injuries exceed your liability limits, you may be held personally responsible for the remaining amount. This could result in significant out-of-pocket expenses, so it's important to choose limits that provide adequate coverage.

Can I customize my liability limits for different types of coverage?

+Yes, you can customize your liability limits for bodily injury and property damage coverage separately. This allows you to tailor your coverage to your specific needs and budget.

Are liability limits the same for all states in the US?

+No, liability limits can vary significantly from state to state. It's essential to understand the minimum requirements in your state and consider whether those limits are sufficient for your needs.

How often should I review and adjust my liability limits?

+It's a good practice to review your liability limits annually or whenever there are significant changes in your life or the automotive industry. Regular reviews ensure your coverage remains up-to-date and aligned with your needs.

In conclusion, understanding and selecting the right car insurance liability limits is a critical aspect of financial protection. By choosing appropriate limits, you can safeguard your assets and peace of mind while navigating the complex world of automotive insurance. Stay informed, and don’t hesitate to consult with insurance professionals to make the best decisions for your unique circumstances.