Car Insurance Low Cost

In the ever-evolving landscape of personal finance and asset protection, finding low-cost car insurance is a pursuit that resonates with many vehicle owners. This quest for affordable coverage is not merely a matter of saving money; it's a strategic move towards optimizing financial resources while ensuring the security and well-being of one's assets. The complex interplay of factors influencing car insurance rates demands a comprehensive understanding, one that this article aims to unravel. From the fundamental aspects that determine premiums to the nuanced strategies employed by industry experts, we delve deep into the world of low-cost car insurance, offering an in-depth guide for those seeking to navigate this essential aspect of financial planning.

Understanding the Fundamentals of Car Insurance

Car insurance is a financial safeguard designed to protect vehicle owners from the potential costs arising from accidents, theft, or other vehicular incidents. It serves as a crucial aspect of personal finance, offering peace of mind and a safety net against unexpected expenses. The cost of this protection, often referred to as the insurance premium, is influenced by a myriad of factors, each contributing uniquely to the overall price.

Key Factors Influencing Insurance Premiums

-

Vehicle Type and Usage: The make, model, and year of your vehicle play a significant role. Insurers consider factors such as the vehicle’s safety features, repair costs, and its propensity for theft or accidents. Additionally, how you use your vehicle – whether for commuting, business, or pleasure – can affect your premium.

-

Driver Profile: Your personal information, including age, gender, driving history, and marital status, is a critical factor. Young, inexperienced drivers, for instance, often face higher premiums due to their perceived higher risk. Similarly, drivers with a history of accidents or traffic violations may also see elevated costs.

-

Location and Environment: The area where you live and drive can significantly impact your insurance rates. Factors like crime rates, traffic density, and even weather conditions can affect the likelihood of accidents or vehicle-related incidents.

-

Coverage and Deductibles: The level of coverage you choose – liability-only, comprehensive, or collision – directly influences your premium. Additionally, selecting a higher deductible (the amount you pay out-of-pocket before insurance kicks in) can reduce your premium, though it means you’ll pay more in the event of a claim.

-

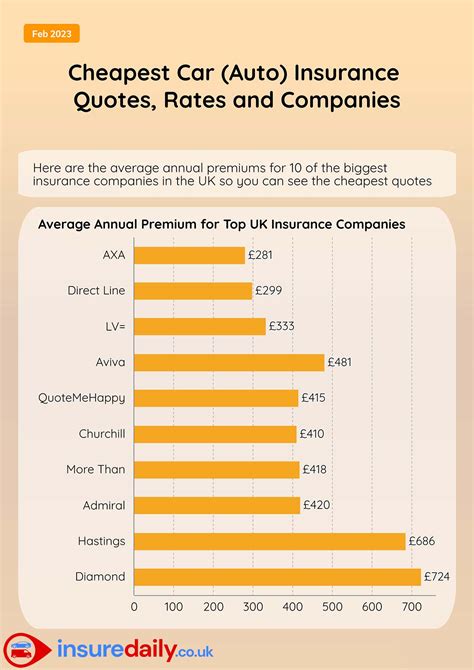

Insurance Company and Policy: Different insurance companies offer varying policies with different rates and benefits. The reputation, financial stability, and services provided by the insurer can impact your decision and the cost of your policy.

Strategies for Securing Low-Cost Car Insurance

Navigating the complex world of car insurance to secure the best rates requires a strategic approach. Here are some effective strategies employed by industry experts and savvy consumers to achieve this goal.

Research and Compare

The insurance market is diverse, with numerous providers offering a wide range of policies. Conducting thorough research and comparing quotes from multiple insurers is essential. Online platforms and insurance brokers can provide a wealth of information, allowing you to identify the best deals and understand the nuances of different policies.

Optimize Your Coverage

Reviewing your coverage regularly and ensuring it aligns with your needs is crucial. Consider factors such as the age and condition of your vehicle, your driving habits, and your financial situation. For instance, if you own an older vehicle with a low market value, you might consider dropping collision or comprehensive coverage, which can significantly reduce your premium.

Improve Your Driving Record

A clean driving record is a powerful tool in securing low insurance rates. Avoid traffic violations and maintain a safe driving habit. If you’ve had accidents or violations in the past, work on improving your record. Many insurers offer discounts for safe driving and accident-free periods.

Utilize Discounts and Bundles

Insurance companies often provide discounts for various reasons. These can include safe driving records, vehicle safety features, good student status, and multi-policy discounts (e.g., bundling car insurance with home insurance). Additionally, some insurers offer discounts for completing defensive driving courses or installing safety devices in your vehicle.

Consider High Deductibles

Choosing a higher deductible can lead to significant savings on your premium. This strategy is particularly effective for responsible drivers who are confident they won’t need to make frequent claims. However, it’s essential to ensure you have the financial means to cover a higher deductible in the event of an accident.

Explore Group or Organizational Discounts

Many insurance companies offer discounted rates to members of specific groups or organizations, such as alumni associations, professional organizations, or even certain employers. These discounts can provide substantial savings, so it’s worth investigating whether you’re eligible for any such programs.

The Future of Affordable Car Insurance

The landscape of car insurance is evolving rapidly, driven by technological advancements and changing consumer preferences. The rise of telematics and usage-based insurance, for instance, offers a new paradigm where premiums are based on actual driving behavior rather than traditional risk factors. This technology allows insurers to offer personalized rates, potentially benefiting safe drivers with lower premiums.

Additionally, the integration of artificial intelligence and machine learning is enhancing the accuracy of risk assessment, allowing insurers to offer more tailored and competitive rates. The future of car insurance also includes a greater focus on preventative measures, with insurers incentivizing safe driving behaviors and providing resources for accident prevention.

As we navigate this evolving landscape, it's essential to stay informed and adaptable. The strategies outlined in this article, coupled with an understanding of the future trends, can empower vehicle owners to make informed decisions and secure the best possible car insurance deals.

What are some common mistakes to avoid when seeking low-cost car insurance?

+Some common pitfalls to avoid include neglecting to shop around for quotes, not reviewing your coverage annually to ensure it’s optimized, and failing to take advantage of available discounts. Additionally, be cautious of choosing the lowest premium without fully understanding the coverage and potential limitations.

How can I ensure I’m getting the best value for my car insurance?

+To ensure you’re getting the best value, thoroughly research and compare quotes from multiple insurers. Review your coverage regularly to ensure it meets your needs, and take advantage of discounts and bundles. Regularly maintaining a safe driving record and staying informed about industry trends can also help.

Are there any resources or tools that can assist in finding low-cost car insurance?

+Yes, there are various online resources and comparison tools that can assist in finding low-cost car insurance. These platforms often provide a comprehensive overview of different insurers, their policies, and the associated premiums. Additionally, insurance brokers can offer personalized advice and help navigate the complex insurance market.