Car Insurance Old

Car insurance is a crucial aspect of vehicle ownership, offering financial protection in the event of accidents, theft, or other unforeseen circumstances. As vehicles age, the type and cost of insurance coverage can change significantly. This article aims to delve into the world of car insurance for older vehicles, exploring the factors that influence coverage and providing valuable insights for vehicle owners.

Understanding Insurance for Older Cars

When it comes to insuring older cars, there are several key considerations that differ from policies for newer vehicles. Firstly, it’s important to understand that the value of a vehicle generally decreases as it ages. This depreciation can impact the type of insurance coverage available and the associated costs.

The Role of Vehicle Age and Value

Insurance providers typically categorize vehicles into different age groups, with specific policies and rates tailored to each group. For instance, a car that is over 10 years old may fall into a different category than a vehicle that is 5 years old. This categorization often leads to distinct insurance options and premiums.

The decreasing value of older cars can influence the type of insurance coverage chosen. For example, comprehensive and collision coverage, which typically cover vehicle repairs or replacements after accidents or damages, may become less cost-effective for older vehicles due to their reduced value. Instead, owners of older cars might opt for liability-only coverage, which focuses on protecting against legal and financial responsibilities in the event of accidents.

| Vehicle Age | Coverage Type |

|---|---|

| Newer Vehicles (0-5 years) | Comprehensive, Collision, Liability |

| Older Vehicles (6-10 years) | Comprehensive, Liability |

| Vintage Cars (10+ years) | Liability-only, Specialized Classic Car Insurance |

Factors Influencing Insurance Rates

Beyond the age and value of the vehicle, several other factors can influence the cost and availability of insurance coverage for older cars.

- Make and Model: Some vehicle makes and models are known to be more expensive to insure due to their repair costs, safety ratings, or theft risks. For older cars, this can be particularly relevant as certain models may have outdated safety features or be more prone to specific mechanical issues.

- Mileage: The number of miles driven can impact insurance rates. Higher mileage often indicates a vehicle is more likely to need repairs or be involved in an accident, leading to increased insurance costs.

- Safety Features: Older cars may lack modern safety features like lane departure warning systems or automatic emergency braking. The absence of such features can affect insurance rates, as these technologies are designed to reduce the risk of accidents.

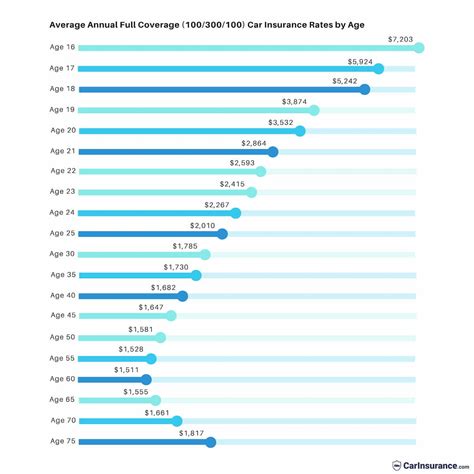

- Driving History: A driver’s record plays a significant role in insurance rates. Older drivers with a clean driving history may be eligible for discounts, while those with multiple violations or accidents may face higher premiums.

Maximizing Coverage for Older Vehicles

Despite the challenges of insuring older cars, there are strategies to ensure adequate coverage while managing costs.

Shop Around for the Best Rates

Insurance rates can vary significantly between providers, so it’s essential to compare quotes from multiple companies. Online comparison tools can be particularly useful for quickly obtaining a range of quotes based on your vehicle’s make, model, and age.

Consider Bundle Discounts

Many insurance providers offer discounts when customers bundle multiple policies, such as auto and home insurance. If you’re insuring an older car, explore the possibility of bundling to take advantage of these savings.

Explore Discounts for Safe Driving

Insurance companies often reward safe driving with discounts. This can include rewards for maintaining a clean driving record, taking defensive driving courses, or even using telematics devices that monitor driving behavior. If you’re a safe driver, be sure to inquire about these potential discounts.

Opt for Higher Deductibles

Choosing a higher deductible can lower your insurance premiums. However, it’s important to ensure that you have the financial capacity to cover the deductible in the event of an accident or claim. This strategy is particularly beneficial for older vehicles, as it can reduce the overall cost of insurance.

Specialized Insurance for Classic Cars

For vehicle enthusiasts with classic or vintage cars, specialized insurance policies are often the best option. These policies are designed to cater to the unique needs and values of older vehicles, offering comprehensive coverage without breaking the bank.

Key Features of Classic Car Insurance

- Agreed Value Coverage: This type of insurance allows owners to agree on the value of their classic car with the insurer. In the event of a total loss or theft, the agreed value is what the insurer will pay out, ensuring fair compensation.

- Flexible Usage Policies: Classic car insurance policies often offer more flexibility in terms of vehicle usage. This can include allowances for occasional pleasure driving, participation in car shows or events, and even limited commuting.

- Low Mileage Discounts: Since classic cars are often driven less frequently, insurance providers may offer discounts for low mileage. This can be a significant savings for vehicle owners who only use their classic car for special occasions.

- Specialized Repair Networks: Classic car insurance policies often come with access to specialized repair networks or preferred shops that have the expertise and resources to handle the unique needs of older vehicles.

Future of Insurance for Older Cars

As technology advances and the automotive industry evolves, the landscape of car insurance for older vehicles is likely to change. The increasing popularity of electric vehicles (EVs) and autonomous driving technologies will undoubtedly impact insurance rates and coverage options for all vehicles, including older models.

The rise of EVs may lead to a shift in insurance focus, with more attention given to battery health, charging infrastructure, and the unique risks associated with electric powertrains. Similarly, as autonomous driving technologies become more prevalent, insurance providers may need to adapt their policies to cover the new risks and liabilities that come with self-driving cars.

Despite these potential changes, the fundamental need for insurance coverage will remain, and older vehicles will continue to require protection. As such, it's essential for vehicle owners to stay informed about the latest trends and developments in the insurance industry to ensure they have the right coverage for their needs.

What is the best insurance option for an older car with high mileage?

+For older cars with high mileage, a liability-only policy might be the most cost-effective option. This type of coverage protects against financial responsibilities in the event of accidents, which is crucial regardless of a vehicle’s age or mileage. However, it’s important to consider your specific needs and risks, and consult with an insurance professional to ensure you have adequate coverage.

Are there discounts available for older drivers with classic cars?

+Yes, many insurance providers offer discounts for older drivers, especially those with a clean driving record. Additionally, classic car insurance policies often come with age-related discounts, as older drivers are generally considered to be more experienced and responsible on the road. Combining these discounts can lead to significant savings on insurance premiums.

How do I choose the right insurance provider for my older vehicle?

+When selecting an insurance provider for your older vehicle, it’s important to compare quotes from multiple companies to find the best rates. Look for providers that specialize in older or classic cars, as they are more likely to offer tailored policies and competitive rates. Additionally, consider the provider’s reputation, customer service, and claims handling process to ensure you’re getting the best overall value.