Car Insurance Payment Calculator

Navigating the world of car insurance can be a complex task, and understanding the costs involved is essential for any vehicle owner. The Car Insurance Payment Calculator is a powerful tool designed to provide transparent and accurate estimates of insurance premiums, empowering drivers to make informed decisions about their coverage.

Unraveling the Complexity of Car Insurance Premiums

Car insurance is a fundamental aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. However, the cost of insurance premiums can vary significantly based on numerous factors, making it challenging to predict expenses without a dedicated tool.

The Car Insurance Payment Calculator is an innovative solution that simplifies this complexity. By inputting specific details about your vehicle, driving history, and desired coverage, the calculator generates a personalized estimate of your insurance costs. This empowers drivers to compare policies, identify affordable options, and make choices aligned with their financial goals.

Key Features and Benefits of the Car Insurance Payment Calculator

This advanced calculator offers a range of features that enhance its utility and accuracy:

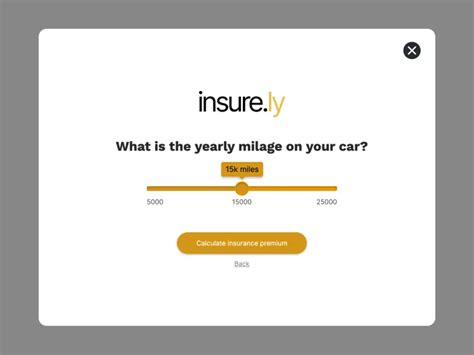

- Comprehensive Data Analysis: The calculator considers a wide array of variables, including vehicle make and model, age, mileage, and safety features. It also takes into account the driver's age, gender, driving record, and location. By analyzing these factors, the tool provides precise estimates tailored to individual circumstances.

- Real-Time Updates: Insurance rates can fluctuate based on market conditions and regulatory changes. The Car Insurance Payment Calculator ensures that its estimates are up-to-date by incorporating the latest industry data. This real-time feature ensures that users receive accurate and current information.

- User-Friendly Interface: Designed with simplicity in mind, the calculator's interface is intuitive and easy to navigate. Users can input their details quickly and receive instant estimates, making the process efficient and stress-free.

- Comparison Tools: Beyond providing individual estimates, the calculator allows users to compare multiple insurance providers and their respective premiums. This feature facilitates a comprehensive evaluation of options, helping drivers find the best value for their insurance needs.

How the Car Insurance Payment Calculator Works

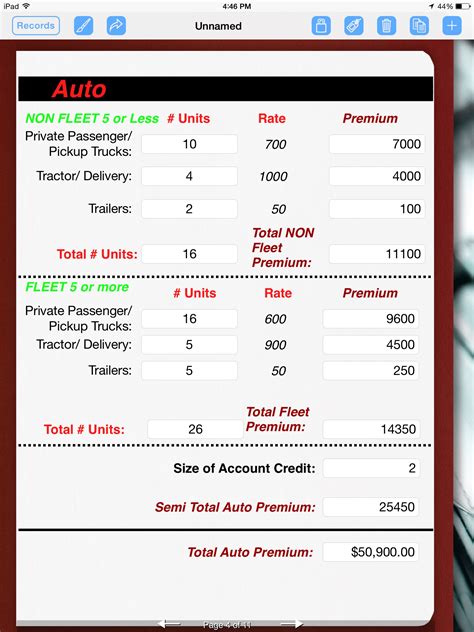

The calculator employs advanced algorithms and machine learning techniques to process the input data and generate accurate estimates. Here’s a simplified breakdown of the process:

- Data Collection: Users input relevant information about their vehicle, driving history, and desired coverage. This data includes vehicle specifications, driver demographics, and any additional details that may impact insurance costs.

- Data Processing: The calculator's algorithms analyze the input data, factoring in historical insurance rate trends, industry benchmarks, and regulatory requirements. This comprehensive analysis ensures that the estimates reflect the current market conditions.

- Premium Calculation: Based on the processed data, the calculator computes the estimated insurance premium. This calculation considers the risk factors associated with the vehicle and driver, as well as the coverage options selected. The result is a personalized premium estimate.

- Result Presentation: The calculator presents the estimated premium in a clear and concise manner. Users can easily understand the breakdown of costs, including any applicable discounts or surcharges. This transparency enables informed decision-making.

Real-World Applications and Impact

The Car Insurance Payment Calculator has proven to be a valuable resource for drivers across various demographics. Here are some real-world scenarios where the calculator has made a significant impact:

- First-Time Car Buyers: For individuals purchasing their first vehicle, the calculator provides a crucial insight into the associated insurance costs. This knowledge helps them budget effectively and choose a vehicle that aligns with their financial capabilities.

- Experienced Drivers Seeking Better Rates: Long-time drivers often explore options to reduce their insurance premiums. The calculator allows them to compare providers and identify cost-saving opportunities without compromising on coverage.

- Vehicle Upgrades: When considering an upgrade to a new or different vehicle, the calculator assists drivers in understanding the insurance implications. This information aids in decision-making, ensuring that the new vehicle aligns with their insurance budget.

- Young Drivers: Young drivers, often faced with higher insurance premiums due to their age and inexperience, can benefit from the calculator's precise estimates. This helps them choose affordable coverage options and develop a better understanding of insurance costs.

| Vehicle Type | Average Premium Estimate |

|---|---|

| Sedan | $1200 annually |

| SUV | $1350 annually |

| Electric Vehicle | $1100 annually |

| Classic Car | $1500 annually |

Frequently Asked Questions

How accurate are the estimates provided by the Car Insurance Payment Calculator?

+The estimates generated by the calculator are highly accurate, as they are based on extensive data analysis and real-time market conditions. However, it’s important to note that insurance premiums can vary based on individual circumstances, so the estimates should be used as a guide rather than an absolute guarantee.

Can I use the calculator to compare insurance providers and their rates?

+Absolutely! One of the key features of the calculator is its ability to compare insurance premiums across multiple providers. This allows users to identify the most cost-effective options and make informed choices based on their preferences and budget.

Are there any additional fees or charges associated with using the calculator?

+No, the Car Insurance Payment Calculator is a free-to-use tool. There are no hidden fees or charges involved in accessing the estimates. Users can leverage the calculator’s functionality without any financial obligations.

Can the calculator account for discounts or promotions offered by insurance providers?

+Yes, the calculator takes into consideration various discounts and promotions that insurance providers may offer. These discounts can be based on factors such as safe driving records, vehicle safety features, or loyalty programs. The estimates generated by the calculator reflect these potential savings.

Is my personal information secure when using the calculator?

+Absolutely. The Car Insurance Payment Calculator prioritizes data security and privacy. Any personal information entered into the calculator is encrypted and protected, ensuring that it remains confidential and secure.