Car Insurance Price

Welcome to this in-depth exploration of the fascinating world of car insurance pricing. As an industry expert with a wealth of knowledge and experience, I'm excited to delve into the factors that influence the cost of car insurance and provide you with valuable insights. Whether you're a seasoned driver or a first-time car owner, understanding the intricacies of insurance pricing is crucial to making informed decisions and securing the best coverage for your needs.

The Fundamentals of Car Insurance Pricing

Car insurance pricing is a complex process that involves numerous factors, each playing a unique role in determining the overall cost of your policy. These factors can be broadly categorized into two main groups: risk assessment and market dynamics. By understanding how these elements interplay, we can gain a clearer picture of the factors that insurance companies consider when setting premiums.

Risk Assessment: Evaluating Your Driving Profile

At the core of car insurance pricing is the assessment of risk. Insurance companies carefully analyze your driving profile to gauge the likelihood of you making a claim. This evaluation process considers a range of factors, including:

- Driving History: Your past driving record is a critical indicator of future behavior. Insurance providers examine your history for any incidents such as accidents, traffic violations, or claims made. A clean driving record generally results in lower premiums, while a history of accidents or violations can significantly increase costs.

- Age and Experience: Age is a significant factor in risk assessment. Young drivers, particularly those under 25, are often considered high-risk due to their lack of experience. As you gain more years of driving experience, insurance companies may offer more favorable rates, recognizing the reduced likelihood of accidents.

- Vehicle Type and Usage: The make, model, and age of your vehicle play a role in determining insurance costs. Sports cars or luxury vehicles, for instance, may attract higher premiums due to their higher repair costs or increased likelihood of theft. Additionally, the primary use of your vehicle (commuting, business, pleasure) can influence pricing, as different usage patterns carry varying levels of risk.

- Location and Mileage: Where you live and the number of miles you drive annually are key considerations. Urban areas often have higher insurance rates due to increased traffic congestion and accident rates. Similarly, the more you drive, the higher the risk of being involved in an accident, leading to potentially higher premiums.

By analyzing these factors, insurance companies can assign a risk score to your profile, which forms the basis for calculating your insurance premium.

Market Dynamics: The Broader Insurance Landscape

Beyond individual risk assessment, car insurance pricing is also influenced by broader market dynamics. These factors include:

- Competition: The level of competition among insurance providers in your area can impact pricing. In highly competitive markets, insurers may offer more competitive rates to attract customers, while in less competitive environments, premiums may be higher.

- Regulatory Environment: Government regulations and laws can significantly affect insurance pricing. For instance, mandatory insurance coverage requirements or changes in liability limits can lead to fluctuations in premiums.

- Economic Factors: Economic conditions, such as inflation rates and the cost of living, can influence insurance costs. Increases in the cost of labor, parts, or medical care can lead to higher insurance premiums to cover these rising expenses.

- Catastrophic Events: Natural disasters or major accidents can have a substantial impact on insurance rates. Insurers may need to raise premiums to cover the increased costs associated with these events, particularly if they result in a high volume of claims.

Understanding these market dynamics provides valuable context for the pricing decisions made by insurance companies.

Factors Influencing Car Insurance Prices

Now that we’ve explored the fundamental concepts, let’s dive deeper into the specific factors that can impact the price of your car insurance.

Vehicle-Related Factors

The vehicle you drive is a significant determinant of your insurance costs. Here’s a closer look at some vehicle-related factors:

| Factor | Impact on Insurance Price |

|---|---|

| Vehicle Type | Sports cars, luxury vehicles, and SUVs often attract higher premiums due to their higher repair costs and increased risk of theft or accidents. |

| Vehicle Age | Older vehicles typically have lower insurance costs, as they are generally less expensive to repair and may have lower theft risks. |

| Safety Features | Vehicles equipped with advanced safety features like anti-lock brakes, air bags, or collision avoidance systems may qualify for insurance discounts. |

| Vehicle Usage | Vehicles used primarily for commuting or business purposes may attract higher premiums due to increased mileage and potential exposure to traffic congestion and accidents. |

Driver-Related Factors

Your personal driving history and profile have a significant impact on insurance pricing. Here are some key driver-related factors to consider:

| Factor | Impact on Insurance Price |

|---|---|

| Driving Record | A clean driving record with no accidents or violations is rewarded with lower insurance premiums. Conversely, a history of accidents or traffic violations can lead to significantly higher costs. |

| Age and Experience | Younger drivers, particularly those under 25, are often considered high-risk and may face higher premiums. As you gain more years of driving experience, insurance costs tend to decrease. |

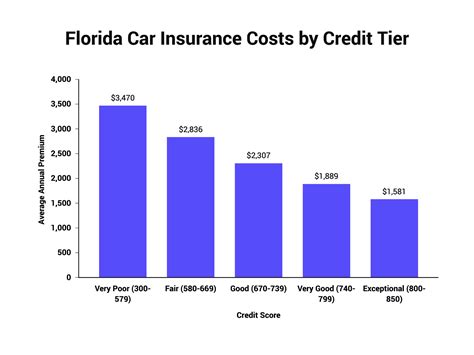

| Credit Score | In many states, insurance companies are allowed to consider your credit score when determining your insurance premium. Generally, a higher credit score is associated with lower insurance costs. |

| Driving Distance and Frequency | The more you drive, the higher the risk of being involved in an accident. As such, those who commute long distances or drive frequently may face higher insurance premiums. |

Location-Related Factors

Where you live and drive your vehicle can have a substantial impact on insurance pricing. Here’s a breakdown of location-related factors:

| Factor | Impact on Insurance Price |

|---|---|

| State Regulations | Different states have varying insurance requirements and regulations, which can influence pricing. For instance, states with mandatory Personal Injury Protection (PIP) coverage may have higher insurance costs. |

| Urban vs. Rural Areas | Insurance costs are generally higher in urban areas due to increased traffic congestion, accident rates, and theft risks. Rural areas often have lower insurance costs due to reduced traffic and lower accident rates. |

| Weather and Natural Disasters | Regions prone to extreme weather conditions or natural disasters may have higher insurance costs due to the increased risk of damage or accidents. |

Other Influencing Factors

Beyond the factors discussed above, several other elements can impact car insurance prices. These include:

- Coverage Types and Limits: The types of coverage you choose (liability, collision, comprehensive) and the limits of coverage can significantly affect your insurance premium. Higher coverage limits generally result in higher premiums.

- Deductibles: Choosing a higher deductible (the amount you pay out of pocket before your insurance kicks in) can lower your insurance premium. However, it's essential to ensure you can afford the deductible in the event of a claim.

- Discounts: Many insurance companies offer discounts for various reasons, such as good driving records, multiple policies with the same insurer, or loyalty rewards. Taking advantage of these discounts can help reduce your insurance costs.

Strategies for Lowering Car Insurance Costs

Now that we’ve explored the factors that influence car insurance prices, let’s discuss some strategies you can employ to potentially reduce your insurance costs.

Improve Your Driving Record

One of the most effective ways to lower your insurance costs is to maintain a clean driving record. Avoid accidents and traffic violations, as these can significantly increase your insurance premiums. Additionally, consider taking defensive driving courses, which may qualify you for insurance discounts and improve your driving skills.

Consider Your Vehicle Choice

When choosing a vehicle, consider its impact on insurance costs. Opting for a safer, more affordable car can lead to lower insurance premiums. Research insurance costs for different vehicles before making a purchase decision. Additionally, vehicles with advanced safety features may qualify for insurance discounts.

Review Your Coverage and Limits

Regularly review your insurance coverage and limits to ensure you have the right amount of protection without paying for unnecessary coverage. Assess your financial situation and risk tolerance to determine the appropriate coverage limits for your needs. Consider increasing your deductible to lower your premium, but ensure you can afford the increased out-of-pocket expense.

Explore Discounts and Rewards

Insurance companies offer a variety of discounts and rewards to attract and retain customers. Some common discounts include:

- Multi-Policy Discounts: Insuring multiple vehicles or combining auto and home insurance policies with the same insurer can result in significant savings.

- Safe Driver Discounts: Maintaining a clean driving record for a certain period may qualify you for a safe driver discount.

- Loyalty Rewards: Many insurance companies offer loyalty discounts to customers who have been with them for a certain number of years.

- Good Student Discounts: Students with a certain GPA or academic standing may be eligible for insurance discounts.

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from multiple insurers to find the best coverage at the most competitive price. Online insurance comparison tools can be a convenient way to quickly compare rates and coverage options.

Maintain a Good Credit Score

In many states, insurance companies are allowed to consider your credit score when determining your insurance premium. Maintaining a good credit score can help keep your insurance costs down. Focus on paying your bills on time, reducing your credit utilization, and regularly monitoring your credit report for any errors or discrepancies.

Conclusion: Navigating the Complex World of Car Insurance Pricing

Car insurance pricing is a multifaceted process influenced by a myriad of factors. By understanding these factors and implementing the strategies outlined above, you can take control of your insurance costs and find the best coverage for your needs. Remember, it’s essential to regularly review your insurance policy, shop around for the best rates, and make informed decisions to ensure you’re getting the most value for your insurance dollar.

How often should I review my car insurance policy and coverage limits?

+It’s a good practice to review your car insurance policy and coverage limits annually, or whenever you experience a significant life change such as a marriage, the birth of a child, or a job change. Regular reviews ensure your coverage remains adequate and aligned with your current needs.

Can I negotiate my car insurance premium with my insurer?

+While insurance premiums are largely determined by standardized factors, you can negotiate certain aspects of your policy with your insurer. Discuss your coverage needs, driving record, and any applicable discounts to potentially secure a better rate.

What are some common car insurance discounts I should be aware of?

+Common car insurance discounts include multi-policy discounts (insuring multiple vehicles or combining auto and home insurance), safe driver discounts, loyalty rewards, and good student discounts. Additionally, some insurers offer discounts for vehicle safety features, low mileage, or completing defensive driving courses.

How can I lower my car insurance premium if I have a poor driving record or a history of accidents?

+If you have a poor driving record or a history of accidents, it can be challenging to lower your insurance premium. However, you can explore options such as increasing your deductible, reviewing your coverage limits to ensure you’re not overinsured, and taking advantage of any available discounts, such as safe driver or loyalty rewards.