Car Insurance Quotations Online

In today's digital age, obtaining car insurance quotations online has become an increasingly popular and convenient way for drivers to explore their insurance options. With just a few clicks, individuals can compare multiple quotes from different providers, saving time and effort. This comprehensive guide will delve into the world of online car insurance quotations, offering an in-depth analysis of the process, benefits, and considerations to help you make an informed decision about your insurance coverage.

Understanding Online Car Insurance Quotations

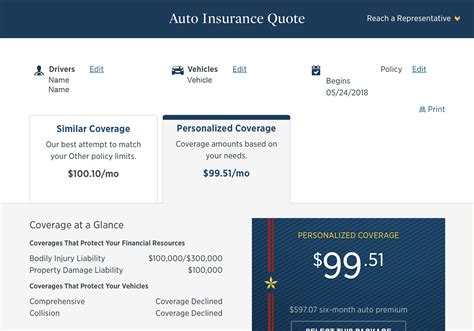

Online car insurance quotations are a modern approach to obtaining estimates for your vehicle’s insurance coverage. This process allows you to input relevant details about your car, driving history, and personal information into an online form, which is then used by insurance providers to generate personalized quotes. These quotes outline the cost and coverage options available to you, providing a convenient way to shop around and compare different policies.

The online quotation process typically involves the following steps:

- Personal Information: You'll start by providing your basic details, including name, date of birth, and contact information.

- Vehicle Information: Here, you'll input details about your car, such as make, model, year, and mileage.

- Driver Information: Insurance providers will want to know about your driving history, including any accidents, claims, or traffic violations.

- Coverage Preferences: You can select the types of coverage you're interested in, such as liability, comprehensive, collision, or additional add-ons.

- Quote Generation: Once you've provided all the necessary information, the online platform will use algorithms to generate quotes from various insurance providers.

Benefits of Online Quotations

Online car insurance quotations offer several advantages over traditional methods:

- Convenience: You can obtain multiple quotes from the comfort of your home, anytime, without the need for appointments or long phone calls.

- Speed: The process is typically quick, with quotes often generated within minutes.

- Comparison: Online platforms allow you to easily compare quotes from different providers side by side, ensuring you find the best deal.

- Personalization: You have control over the coverage options you select, allowing you to tailor your policy to your specific needs.

- Transparency: Online quotes provide clear breakdowns of costs and coverage, making it easier to understand what you're paying for.

Considerations and Best Practices

While online car insurance quotations are a valuable tool, there are a few considerations to keep in mind:

- Accuracy: Ensure you provide accurate and honest information to receive precise quotes. Misrepresenting your details can lead to issues later on.

- Comparison Shopping: Don't settle for the first quote you receive. Take the time to compare multiple quotes to find the best combination of price and coverage.

- Provider Reputation: Research the insurance providers offering quotes to ensure they are reputable and financially stable.

- Read the Fine Print: Pay close attention to the terms and conditions of each quote. Understand what is and isn't covered to avoid surprises.

- Discounts and Add-ons: Explore the various discounts and add-ons available. Some providers offer discounts for safe driving, multiple policies, or specific occupations.

| Provider | Average Quote |

|---|---|

| Provider A | $1,200 annually |

| Provider B | $1,450 annually |

| Provider C | $1,150 annually |

In the above table, you can see a comparison of average quotes from three different providers, highlighting the importance of shopping around for the best deal.

Exploring Coverage Options

When obtaining online car insurance quotations, it’s essential to understand the different types of coverage available and how they can benefit you.

Liability Coverage

Liability coverage is a fundamental component of car insurance, protecting you financially if you’re found at fault in an accident. This coverage pays for the damages and injuries you cause to others, including their medical expenses, property damage, and legal fees. It’s required by law in most states and is typically the minimum coverage you’ll need to drive legally.

Comprehensive and Collision Coverage

Comprehensive and collision coverage provide protection for your own vehicle. Comprehensive coverage covers damages caused by events other than collisions, such as theft, vandalism, natural disasters, or hitting an animal. Collision coverage, on the other hand, covers damages to your vehicle resulting from a collision with another vehicle or object.

Additional Coverages and Add-ons

Beyond the basic coverages, there are various additional options and add-ons available to customize your policy further:

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who doesn't have adequate insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of who is at fault.

- Rental Car Reimbursement: Provides coverage for a rental car if your vehicle is being repaired after an insured incident.

- Gap Insurance: Covers the difference between the actual cash value of your car and the amount you still owe on your loan if your car is totaled.

- Roadside Assistance: Offers emergency services such as towing, flat tire changes, or battery jumps.

Factors Influencing Your Quote

The cost of your car insurance quote is influenced by a variety of factors. Understanding these factors can help you better navigate the quotation process and potentially find ways to lower your insurance costs.

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in determining your insurance quote. Sports cars and luxury vehicles, for instance, often come with higher insurance costs due to their higher repair and replacement costs. Additionally, the purpose for which you use your vehicle can impact your quote. If you use your car for business or frequently drive long distances, your insurance costs may be higher.

Driving History and Record

Your driving history is a critical factor in car insurance quotations. Insurance providers closely examine your record for accidents, traffic violations, and claims. A clean driving record with no recent accidents or violations can lead to lower insurance quotes. On the other hand, multiple accidents or violations within a certain period can significantly increase your insurance costs.

Credit Score and Insurance Score

Your credit score can impact your insurance quote, as insurance providers often use it as an indicator of financial responsibility. A higher credit score may result in lower insurance costs, as it suggests you’re more likely to pay your premiums on time. Additionally, insurance providers may use an “insurance score,” which is a rating based on your credit history and other factors, to assess your risk level.

Age, Gender, and Marital Status

Age, gender, and marital status are factors that insurance providers may consider when calculating your quote. Young drivers, especially males under 25, are often considered higher risk and may face higher insurance costs. Similarly, unmarried individuals may pay more than their married counterparts. However, it’s important to note that these factors are becoming less influential as insurance regulations evolve.

Tips for Lowering Your Insurance Costs

While online car insurance quotations provide a great starting point, there are additional steps you can take to potentially lower your insurance costs:

- Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple providers to find the best deal.

- Bundling Policies: If you have multiple insurance needs, such as home and auto insurance, consider bundling them with the same provider to potentially save money.

- Safe Driving: Maintain a clean driving record by avoiding accidents and traffic violations. Many providers offer discounts for safe driving records.

- Defensive Driving Courses: Taking approved defensive driving courses can lead to insurance discounts, especially for younger drivers.

- Vehicle Safety Features: Cars equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems may qualify for insurance discounts.

- Paying Annually: Instead of monthly payments, paying your insurance premium annually can sometimes result in savings.

Conclusion: Navigating the Online Quotation Process

Online car insurance quotations offer a convenient and efficient way to explore your insurance options. By understanding the process, considering the various coverage options, and being aware of the factors influencing your quote, you can make informed decisions about your insurance coverage. Remember to compare quotes from multiple providers, explore discounts, and tailor your policy to your specific needs. With the right approach, you can find a car insurance policy that offers the best combination of coverage and cost.

How often should I compare car insurance quotes?

+It’s a good practice to compare car insurance quotes annually or whenever your policy renews. Insurance rates can change based on various factors, so regularly reviewing your options can help you identify potential savings.

Can I get an online quote if I have a poor driving record?

+Yes, you can still obtain online quotes with a poor driving record. However, you may find that your insurance options are more limited, and the quotes may be higher. It’s important to be honest about your driving history to avoid issues later on.

What if I don’t own a car but need insurance for a rental?

+If you don’t own a car but need insurance for a rental, you can often purchase short-term rental car insurance through your regular insurance provider or directly from the rental company. Ensure you understand the coverage limits and any exclusions before renting.

Can I get an online quote for a classic car or collectible vehicle?

+Yes, you can obtain online quotes for classic or collectible vehicles. However, the process may be slightly different as these vehicles often require specialized coverage. Some insurance providers offer specific policies for classic cars, so be sure to explore these options.