Car Insurance Quote Cheap

Securing an affordable car insurance quote is a priority for many vehicle owners, as it not only protects their investment but also provides financial security in case of unforeseen incidents. With numerous insurance providers offering varying rates and coverage options, it can be challenging to find the best deal. This article aims to guide you through the process of obtaining a cheap car insurance quote, offering insights and strategies to help you save money without compromising on essential coverage.

Understanding the Factors that Influence Car Insurance Quotes

Car insurance quotes are tailored to individual circumstances and are influenced by a multitude of factors. Understanding these factors is crucial to knowing how to navigate the insurance market effectively and secure the best possible deal.

Demographics and Location

Insurance companies consider your age, gender, and marital status when calculating quotes. Statistically, younger drivers tend to pay higher premiums due to their perceived higher risk of accidents. Similarly, your location plays a significant role; areas with higher crime rates or a history of frequent accidents will often result in higher insurance quotes. For instance, in metropolitan areas like New York City, where traffic congestion and parking challenges are common, insurance rates are typically elevated.

Vehicle Type and Usage

The make, model, and year of your vehicle significantly impact your insurance quote. Sports cars and luxury vehicles, known for their higher speeds and costly repairs, often attract higher premiums. Conversely, sedans and compact cars are generally more affordable to insure. The usage of your vehicle also matters; if you primarily use your car for commuting to work, your insurance needs will differ from someone who frequently drives long distances or uses their vehicle for business purposes.

Driving Record and Claims History

Your driving history is a critical factor in determining your insurance quote. A clean driving record, free from accidents and traffic violations, is likely to result in lower premiums. Conversely, a history of accidents or moving violations can lead to increased insurance costs. Insurance companies view drivers with a poor claims history as a higher risk, hence the higher premiums. It's essential to review your driving habits and strive for a safe driving record to maintain affordable insurance.

Credit Score and Insurance Score

Your credit score, a measure of your financial responsibility, can impact your insurance quote. Many insurance companies use credit-based insurance scores to assess the risk of insuring a driver. A higher credit score generally indicates a lower risk, leading to more favorable insurance rates. Maintaining a good credit score is, therefore, beneficial not just for financial health but also for securing affordable car insurance.

| Factor | Impact on Quote |

|---|---|

| Demographics | Age, gender, marital status |

| Location | Crime rates, accident history |

| Vehicle Type | Make, model, year |

| Usage | Commuting, long-distance, business |

| Driving Record | Accidents, violations |

| Credit Score | Financial responsibility |

Strategies to Get the Cheapest Car Insurance Quote

Securing a cheap car insurance quote requires a combination of research, understanding, and smart decision-making. Here are some effective strategies to help you find the most affordable insurance option for your needs.

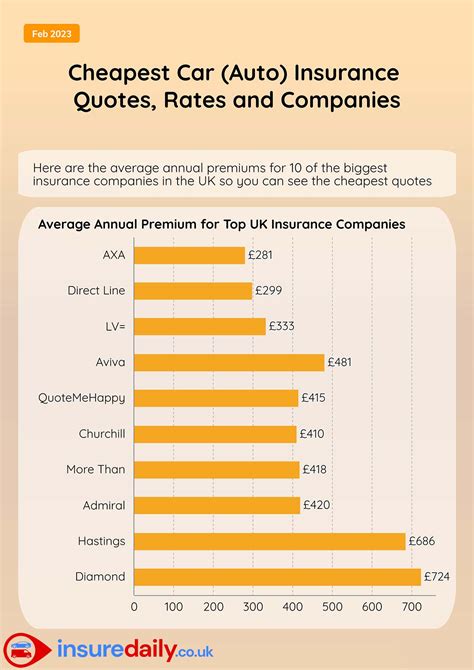

Compare Multiple Insurance Providers

The car insurance market is highly competitive, with numerous providers offering varying rates and coverage options. Comparing quotes from multiple insurers is essential to finding the best deal. Online comparison tools can be particularly useful, allowing you to quickly gather quotes from several companies in one place. However, remember that while these tools are a great starting point, it's important to delve deeper and understand the specific coverage and exclusions offered by each provider.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies together. For instance, if you have homeowners or renters insurance with a particular provider, consider getting your car insurance from the same company. Bundling policies can lead to significant savings, often up to 25% or more. It's a simple strategy that can result in substantial long-term cost reductions.

Choose a Higher Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lead to lower insurance premiums. While this strategy requires you to pay more upfront in the event of an accident, it can result in substantial savings over time, especially if you're a safe driver with a low risk of accidents.

Utilize Discounts and Rewards

Insurance companies offer a variety of discounts and rewards to attract and retain customers. These can include discounts for safe driving, loyalty rewards, and discounts for certain professions or affiliations. Researching and understanding the available discounts can help you take advantage of these savings opportunities. For example, many insurers offer discounts for students with good grades, military personnel, or members of certain professional organizations.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a relatively new concept that offers a unique approach to car insurance. With this type of insurance, your premium is based on your actual driving behavior, rather than general assumptions about your risk profile. This can be beneficial for safe, cautious drivers, as they may be able to secure significantly lower premiums. However, it's important to understand the potential drawbacks, such as increased surveillance and the need for consistent safe driving to maintain affordable rates.

| Strategy | Description |

|---|---|

| Compare Multiple Providers | Gather quotes from various insurers to find the best deal. |

| Bundle Policies | Combine multiple insurance types with one provider for significant savings. |

| Higher Deductible | Opt for a higher deductible to lower your premium. |

| Utilize Discounts | Research and take advantage of available discounts and rewards. |

| Usage-Based Insurance | Consider pay-as-you-drive insurance for potentially lower premiums based on your driving behavior. |

The Future of Affordable Car Insurance

The car insurance landscape is evolving rapidly, driven by technological advancements and changing consumer expectations. These developments are set to transform the way insurance is priced, offered, and consumed, potentially making affordable car insurance more accessible than ever before.

Telematics and Usage-Based Insurance

The use of telematics, which involves the collection and analysis of driving data through GPS and other vehicle sensors, is expected to grow significantly in the coming years. This technology allows insurance companies to offer usage-based insurance policies that tailor premiums to individual driving behavior. For safe drivers, this could mean substantial savings, as their low-risk driving habits are directly reflected in their insurance rates. However, it's important to note that this also means high-risk drivers may face higher premiums.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning technologies are increasingly being employed by insurance companies to streamline processes, enhance fraud detection, and improve risk assessment. AI-powered systems can analyze vast amounts of data, including historical claims data and real-time driving behavior, to more accurately predict and price risk. This could lead to more tailored and potentially more affordable insurance offerings for customers.

Direct-to-Consumer Insurance Models

The rise of digital technology and changing consumer preferences have led to the emergence of direct-to-consumer insurance models. These models, often facilitated by online platforms, cut out the middleman and allow consumers to purchase insurance directly from the provider. This shift is expected to drive down costs and increase transparency, making insurance more affordable and accessible. Additionally, these platforms often offer personalized recommendations and comparisons, empowering consumers to make more informed decisions.

Collaborative Insurance Models

Collaborative insurance models, also known as peer-to-peer or community-based insurance, are gaining traction as an alternative to traditional insurance models. These models are typically facilitated by blockchain technology and involve a community of individuals pooling their resources to provide insurance coverage to each other. While still in their infancy, these models have the potential to offer more affordable coverage, particularly for niche markets or high-risk individuals who may struggle to find traditional insurance.

| Future Trend | Impact on Affordable Insurance |

|---|---|

| Telematics and Usage-Based Insurance | Potential for substantial savings for safe drivers. |

| AI and Machine Learning | Improved risk assessment leading to more tailored and potentially cheaper insurance. |

| Direct-to-Consumer Models | Lower costs and increased transparency, making insurance more affordable. |

| Collaborative Insurance Models | Alternative coverage options, particularly for high-risk individuals. |

Conclusion: Securing an Affordable Car Insurance Quote

Obtaining a cheap car insurance quote is a balancing act between finding the lowest premium and ensuring adequate coverage. By understanding the factors that influence quotes and employing strategic approaches, you can navigate the insurance market effectively and find the best deal for your needs. Whether it's through comparing providers, bundling policies, or embracing new insurance models, there are numerous avenues to explore in your quest for affordable car insurance.

As the car insurance landscape continues to evolve, staying informed and adaptable is key. With technological advancements and changing consumer preferences, the future of car insurance looks promising, offering increased accessibility and affordability. Keep an eye on these developments and leverage them to your advantage to secure the best insurance deal possible.

Frequently Asked Questions

How can I lower my car insurance premium if I’m a young driver with a high-risk profile?

+

For young drivers, maintaining a clean driving record and taking defensive driving courses can help lower insurance premiums. Additionally, opting for a higher deductible and exploring usage-based insurance policies can lead to savings. It’s also worth comparing quotes from various insurers, as rates can vary significantly.

Are there any disadvantages to usage-based insurance?

+

While usage-based insurance can offer significant savings for safe drivers, it’s important to consider potential drawbacks. These policies may require constant monitoring of your driving behavior and can lead to higher premiums if you’re involved in an accident or exhibit risky driving habits. Additionally, some drivers may feel their privacy is invaded by the constant tracking of their vehicle.

What are some common car insurance discounts I should look for?

+

Common car insurance discounts include safe driver discounts, loyalty rewards, multi-policy discounts, and discounts for certain professions or affiliations. Some insurers also offer discounts for students with good grades, vehicle safety features, and low-mileage usage. It’s worth exploring these options to maximize your savings.