Car Insurance Quotes Florida

Obtaining car insurance quotes in Florida is an essential process for residents and drivers in the state. With its unique geographical features and diverse driving conditions, Florida presents a specific set of considerations when it comes to auto insurance. This comprehensive guide aims to provide an in-depth analysis of the car insurance landscape in Florida, offering expert insights and valuable information to help you navigate the process effectively.

Understanding Car Insurance in Florida

Florida is known for its beautiful beaches, vibrant cities, and, unfortunately, its high rates of car accidents. These factors contribute to the complexity of the car insurance market in the state. It is crucial to understand the specific requirements and regulations that govern car insurance in Florida to make informed decisions and ensure adequate coverage.

Florida’s No-Fault Insurance System

One distinctive aspect of car insurance in Florida is its no-fault insurance system. This means that, in the event of an accident, your own insurance policy typically covers your medical expenses and lost wages, regardless of who is at fault. This system aims to streamline the claims process and reduce litigation. However, it also has certain implications for policyholders, which we will explore further.

| Key Coverage in Florida | Description |

|---|---|

| Personal Injury Protection (PIP) | Required coverage that pays for medical expenses and lost wages up to the policy limit. |

| Property Damage Liability | Covers damage to other vehicles or property caused by the policyholder. |

| Bodily Injury Liability | Provides coverage for injuries caused to others in an accident. |

Understanding these basic coverages is crucial, as they form the foundation of any car insurance policy in Florida. However, it is equally important to explore additional coverages to ensure comprehensive protection.

Additional Coverages to Consider

While the no-fault system provides a baseline of coverage, there are several additional options to enhance your car insurance policy in Florida. These coverages can offer peace of mind and financial protection in various scenarios.

- Uninsured/Underinsured Motorist Coverage: Protects you if an at-fault driver lacks sufficient insurance to cover your damages.

- Collision Coverage: Covers the cost of repairing or replacing your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Provides protection against damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Rental Car Reimbursement: Offers coverage for rental car expenses while your vehicle is being repaired after an insured incident.

By carefully considering these additional coverages, you can tailor your car insurance policy to meet your specific needs and ensure adequate protection.

Factors Influencing Car Insurance Quotes in Florida

Car insurance quotes in Florida are influenced by a multitude of factors. Understanding these factors can help you make more informed choices and potentially lower your insurance premiums.

Location-Specific Considerations

Florida’s diverse geography and climate play a significant role in car insurance rates. Coastal regions, for instance, may face higher premiums due to the risk of hurricanes and coastal storms. Similarly, densely populated urban areas often have higher rates of accidents and theft, leading to increased insurance costs.

Demographic Factors

Demographic characteristics such as age, gender, and marital status can impact insurance quotes. Younger drivers, especially those under 25, often face higher premiums due to their perceived higher risk of accidents. Additionally, your driving history, including any previous accidents or traffic violations, can significantly influence your insurance rates.

Vehicle-Related Factors

The type of vehicle you drive and its safety features can affect your insurance quotes. Newer, high-performance vehicles or those with advanced safety systems may qualify for lower premiums. On the other hand, older vehicles or those with a higher likelihood of theft or accident damage may result in higher insurance costs.

Usage and Driving Behavior

The way you use your vehicle and your driving behavior can also influence insurance quotes. Those who drive frequently, especially in high-risk areas, may face higher premiums. Additionally, safe driving practices, such as avoiding accidents and maintaining a clean driving record, can lead to more favorable insurance rates over time.

Comparing Car Insurance Quotes in Florida

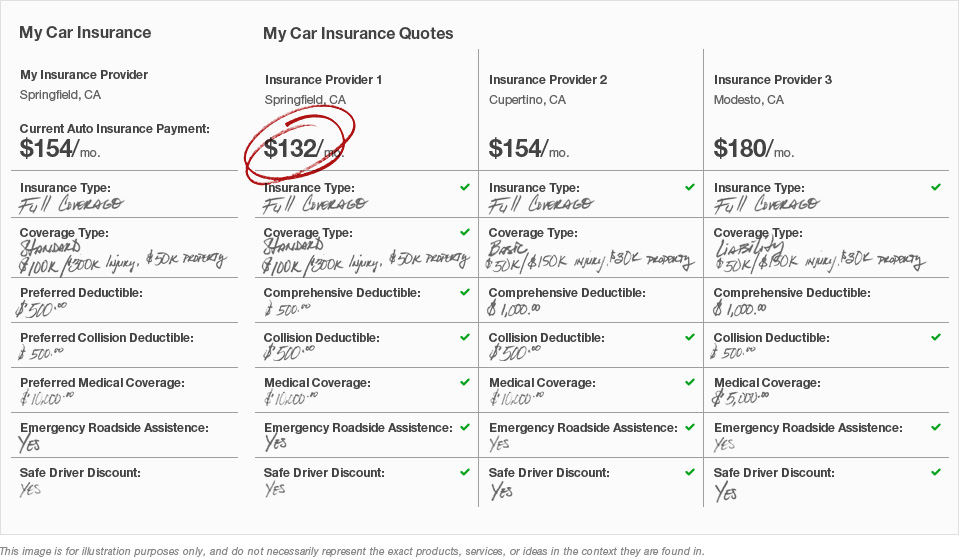

Comparing car insurance quotes is a crucial step in finding the best coverage and value for your needs. With numerous insurance providers operating in Florida, it is essential to shop around and evaluate multiple options.

Online Quote Comparison Tools

Online quote comparison tools have revolutionized the insurance shopping experience. These platforms allow you to enter your information once and receive multiple quotes from different insurers. This simplifies the comparison process and saves you time and effort.

Working with an Insurance Broker

Engaging the services of an insurance broker can be beneficial, especially if you require specialized coverage or have complex insurance needs. Brokers have access to a wide range of insurance providers and can provide personalized recommendations based on your specific circumstances.

Understanding Insurance Provider Reputation

When comparing insurance providers, it is crucial to consider their reputation and financial stability. Researching customer reviews and ratings can provide valuable insights into the provider’s reliability and claim-handling processes. Additionally, checking their financial strength ratings from reputable agencies can give you confidence in their ability to pay claims.

Tips for Lowering Car Insurance Costs in Florida

While car insurance is a necessary expense, there are strategies you can employ to potentially lower your insurance costs in Florida.

Bundling Policies

Consider bundling your car insurance with other insurance policies, such as homeowners or renters insurance. Many insurance providers offer discounts when you combine multiple policies, resulting in significant savings.

Safe Driving Practices

Maintaining a clean driving record and practicing safe driving habits can lead to lower insurance premiums over time. Avoid traffic violations and accidents, and consider taking defensive driving courses, which may qualify you for discounts.

Choosing Higher Deductibles

Opting for a higher deductible can reduce your insurance premiums. However, it’s essential to choose a deductible amount that you can comfortably afford in the event of a claim. This strategy can be particularly effective for those with a history of safe driving and few claims.

Exploring Discounts

Insurance providers often offer a variety of discounts to attract customers. These discounts can be based on factors such as good student status, safe driving programs, anti-theft devices, and loyalty rewards. Researching and taking advantage of these discounts can help lower your insurance costs.

Future Trends in Car Insurance in Florida

The car insurance landscape in Florida is constantly evolving, influenced by technological advancements, changing regulations, and shifting consumer needs. Staying informed about these trends can help you make more strategic insurance decisions.

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior through devices installed in vehicles, is gaining traction in the insurance industry. Usage-based insurance programs utilize telematics data to offer personalized insurance rates based on an individual’s driving habits. This technology has the potential to revolutionize the way insurance rates are determined and may lead to more tailored and affordable coverage options.

Increased Focus on Cybersecurity

With the growing reliance on digital technologies in the insurance industry, cybersecurity has become a critical concern. Insurance providers are investing in robust cybersecurity measures to protect customer data and prevent fraudulent activities. As a result, insurers are likely to prioritize data security and implement stricter protocols to safeguard customer information.

Advancements in Claims Processing

The insurance industry is continuously exploring ways to streamline and expedite the claims process. Technological innovations, such as artificial intelligence and machine learning, are being leveraged to automate certain aspects of claims handling, leading to faster and more efficient resolution of claims. Additionally, the increasing use of drones and satellite imagery is enhancing the accuracy of damage assessments, further improving the claims experience.

Conclusion

Obtaining car insurance quotes in Florida requires a comprehensive understanding of the state’s unique insurance landscape. By considering the various factors that influence insurance rates and exploring multiple coverage options, you can make informed decisions and find the best value for your insurance needs. Remember to stay informed about the latest trends and advancements in the insurance industry to stay ahead of the curve.

How much does car insurance typically cost in Florida?

+

The cost of car insurance in Florida varies based on numerous factors, including the coverage limits, deductibles, and the specific circumstances of the policyholder. On average, drivers in Florida can expect to pay between 1,500 and 2,000 per year for car insurance. However, it’s important to note that this is just an estimate, and actual costs can vary significantly based on individual circumstances.

What are the minimum insurance requirements in Florida?

+

Florida has a minimum insurance requirement known as the 10/20/10 rule. This means that drivers must carry at least 10,000 in Personal Injury Protection (PIP) coverage, 10,000 in Property Damage Liability coverage, and $20,000 in Bodily Injury Liability coverage per person. However, it is important to note that these minimum requirements may not provide sufficient coverage in the event of a serious accident. It is recommended to explore additional coverages to ensure comprehensive protection.

Can I get a discount on my car insurance in Florida if I have a clean driving record?

+

Absolutely! Many insurance providers in Florida offer discounts to drivers with a clean driving record. These discounts can significantly reduce your insurance premiums. It’s always a good idea to inquire about safe driver discounts and explore other potential savings opportunities when shopping for car insurance.

What is the best way to compare car insurance quotes in Florida?

+

Using online quote comparison tools is an efficient way to compare car insurance quotes in Florida. These tools allow you to input your information once and receive multiple quotes from different insurers. Additionally, working with an insurance broker can provide personalized recommendations based on your specific needs. By combining online research with professional guidance, you can make an informed decision about your car insurance coverage.

Are there any unique challenges or considerations for drivers in specific regions of Florida?

+

Yes, Florida’s diverse geography and climate can present unique challenges for drivers in certain regions. Coastal areas, for example, may face higher insurance rates due to the risk of hurricanes and coastal storms. Similarly, densely populated urban areas often have higher rates of accidents and theft, which can impact insurance costs. It’s important to consider these location-specific factors when obtaining car insurance quotes in Florida.