Car Insurance Quotes In Florida

Welcome to our comprehensive guide on Car Insurance Quotes in Florida, designed to provide you with an in-depth understanding of the insurance landscape in the Sunshine State. Florida, known for its vibrant culture, diverse communities, and, of course, its beautiful beaches, also presents unique considerations when it comes to automotive insurance.

In this article, we'll delve into the specific factors that influence car insurance rates in Florida, explore the average costs and coverage options available, and offer expert insights to help you navigate the process of obtaining the best insurance quote for your needs. Whether you're a long-time resident or new to the state, this guide will equip you with the knowledge to make informed decisions about your car insurance.

Understanding Florida’s Unique Insurance Environment

Florida stands out among US states for its distinct car insurance regulations and requirements. The state operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, each driver’s insurance company is initially responsible for covering their medical expenses and a portion of other damages.

This system, known as Personal Injury Protection (PIP), requires all Florida drivers to carry a minimum of $10,000 in PIP coverage. However, the unique nature of Florida's insurance environment also means that rates can vary significantly based on a multitude of factors, making it crucial for drivers to understand what influences their insurance quotes.

Factors Influencing Car Insurance Quotes in Florida

When it comes to car insurance quotes in Florida, a multitude of factors come into play, each contributing to the unique pricing landscape in the state. Understanding these factors is key to navigating the insurance market effectively.

- Location: Florida's diverse geography and population density play a significant role in insurance rates. Urban areas like Miami and Tampa often have higher premiums due to increased traffic and the potential for more accidents. On the other hand, rural areas may offer lower rates but could have longer response times in the event of an accident.

- Driving Record: Your personal driving history is a critical factor. A clean record can lead to significant savings, while violations, accidents, and DUIs can drive up your insurance costs. In Florida, a single DUI conviction can result in a 200% increase in insurance rates on average.

- Age and Gender: In many cases, younger drivers and males tend to pay higher premiums due to statistical risk factors. However, this can vary based on individual circumstances and the insurance company's policies.

- Vehicle Type: The make, model, and year of your vehicle matter. High-performance cars, luxury vehicles, and those with a history of frequent accidents or theft can increase your insurance costs. Additionally, newer cars with advanced safety features might qualify for discounts.

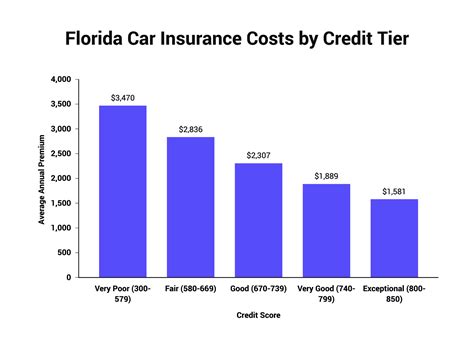

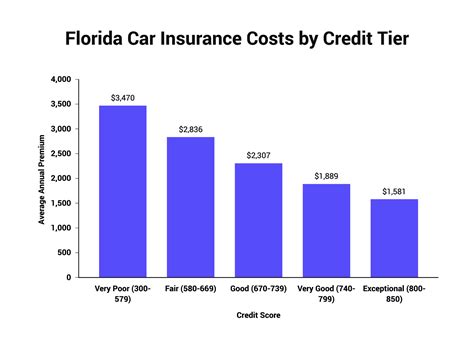

- Credit Score: Believe it or not, your credit history can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, and a higher credit score often correlates with lower premiums.

- Insurance Company and Policy Type: Different insurance companies offer varying levels of coverage and pricing. Additionally, the type of policy you choose (e.g., liability-only vs. full coverage) will significantly impact your quote.

By understanding these factors and their potential impact on your insurance quote, you can make more informed decisions when shopping for car insurance in Florida.

Average Car Insurance Costs in Florida

Understanding the average costs of car insurance in Florida can provide a valuable benchmark for drivers seeking insurance quotes. While rates can vary significantly based on individual circumstances, it’s essential to have a general idea of what to expect when shopping for insurance in the Sunshine State.

According to recent data, the average cost of car insurance in Florida is approximately $2,150 per year, or roughly $180 per month. However, this figure can vary widely depending on the specific factors mentioned earlier, such as location, driving record, and vehicle type.

| Coverage Type | Average Annual Cost |

|---|---|

| Minimum Liability Coverage | $1,200 |

| Full Coverage (Including Comprehensive and Collision) | $2,800 |

| Average Monthly Cost | $180 |

It's important to note that these averages are just a starting point. By shopping around and comparing quotes from multiple insurance providers, you can often find rates that are significantly lower or higher than these averages, depending on your unique circumstances.

Comparing Insurance Quotes in Florida

When comparing insurance quotes in Florida, it’s essential to consider not just the price but also the coverage and reputation of the insurance company. Here are some key factors to keep in mind when evaluating quotes:

- Coverage Options: Ensure that the quote you're considering provides the level of coverage you need. This includes not just the state-mandated minimums but also additional coverage options like comprehensive and collision.

- Reputation and Financial Stability: Research the insurance company's reputation and financial health. You want to ensure that the company is reputable, financially stable, and has a good track record of paying claims promptly.

- Customer Service and Claims Process: Consider the insurance company's customer service ratings and the ease of their claims process. A company with excellent customer service can make a significant difference if you ever need to file a claim.

- Discounts and Special Offers: Many insurance companies offer discounts for various reasons, such as safe driving records, vehicle safety features, or bundling multiple policies. Be sure to inquire about these discounts when requesting quotes.

Remember, while price is important, it's not the only factor to consider when choosing car insurance. By taking the time to compare quotes and evaluate the coverage and reputation of the insurance providers, you can find the best value for your insurance needs in Florida.

Expert Tips for Obtaining the Best Car Insurance Quote in Florida

Navigating the car insurance landscape in Florida can be challenging, but with the right approach and expert guidance, you can secure the best insurance quote for your needs. Here are some valuable tips to help you on your journey:

Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Take the time to shop around and compare quotes from multiple insurance providers. This can help you identify the best rates and coverage options available. Utilize online quote comparison tools and speak with independent insurance agents to get a comprehensive view of the market.

Understand Your Coverage Needs

Before requesting quotes, take the time to understand your specific coverage needs. Consider factors such as the value of your vehicle, your personal assets, and your tolerance for risk. This will help you determine the right level of coverage, whether it’s liability-only or full comprehensive coverage.

Explore Discounts and Savings Opportunities

Insurance companies offer a variety of discounts that can significantly reduce your premiums. Some common discounts include safe driver discounts, multi-policy discounts (for bundling car insurance with other types of insurance), and loyalty discounts for long-term customers. Be sure to inquire about these discounts when comparing quotes.

Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you assume more financial responsibility in the event of an accident, which can lead to lower monthly premiums.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to keep your insurance rates low. Avoid violations, accidents, and DUIs, as these can significantly increase your insurance premiums. If you have a less-than-perfect driving record, consider taking a defensive driving course, which may help reduce your rates.

Explore Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs can offer significant savings for safe drivers. These programs use data from your driving habits to determine your insurance rate. By demonstrating safe driving behavior, you can potentially lower your premiums.

Stay Informed and Monitor Your Rates

The insurance landscape in Florida is constantly evolving, with rates and coverage options changing over time. Stay informed about changes in the market and periodically review your insurance policy to ensure you’re still getting the best value. Don’t hesitate to shop around and switch providers if you find a better deal.

The Future of Car Insurance in Florida

The car insurance industry in Florida is undergoing significant changes and innovations, driven by technological advancements and evolving consumer expectations. As we look ahead, several key trends and developments are likely to shape the future of car insurance in the Sunshine State.

Advancements in Telematics and Usage-Based Insurance

Telematics and usage-based insurance programs are expected to become increasingly prevalent in Florida. These programs use advanced technologies, such as GPS tracking and smartphone apps, to monitor driving behavior and offer personalized insurance rates based on actual driving habits. This shift towards usage-based insurance can benefit safe drivers by offering more accurate and potentially lower premiums.

The Rise of Autonomous Vehicles

The advent of autonomous vehicles (AVs) and advanced driver-assistance systems (ADAS) is poised to revolutionize the car insurance industry. As AV technology matures and becomes more widely adopted, it could lead to a significant reduction in accidents and, consequently, lower insurance premiums. However, the transition period as AVs integrate into the existing vehicle fleet may present unique challenges and considerations for insurers.

Increased Focus on Data Analytics and Personalization

Insurance companies are increasingly leveraging data analytics and machine learning to personalize insurance offerings and improve risk assessment. By analyzing vast amounts of data, insurers can better understand individual driving behaviors, vehicle performance, and other factors that influence risk. This level of personalization can lead to more accurate and competitive insurance rates for consumers.

Enhanced Claims Management and Customer Service

The future of car insurance in Florida is likely to see continued improvements in claims management and customer service. Insurance companies are investing in technologies and processes to streamline claims handling, reduce processing times, and improve overall customer satisfaction. This includes the adoption of digital tools, such as mobile apps and chatbots, to enhance the claims experience and provide customers with real-time updates and assistance.

Expanding Insurance Options and Coverage

As the insurance market in Florida becomes more competitive, insurance providers are likely to introduce a wider range of coverage options and specialized products. This could include expanded offerings for specific driver demographics, such as young drivers or senior citizens, as well as innovative coverage options for emerging technologies like electric vehicles and ride-sharing services.

Conclusion

The car insurance landscape in Florida is dynamic and ever-evolving, presenting both challenges and opportunities for drivers and insurance providers alike. By staying informed about the latest trends and innovations, Florida drivers can make more informed decisions when it comes to their car insurance needs. Whether it’s embracing usage-based insurance, staying abreast of AV technology, or exploring personalized coverage options, the future of car insurance in Florida promises to be exciting and transformative.

What is the minimum car insurance coverage required in Florida?

+

Florida requires drivers to carry a minimum of 10,000 in Personal Injury Protection (PIP) coverage and 10,000 in Property Damage Liability (PDL) coverage.

How can I lower my car insurance premiums in Florida?

+

You can lower your premiums by maintaining a clean driving record, exploring discounts, increasing your deductible, and shopping around for the best rates.

Are there any unique insurance considerations for electric vehicles in Florida?

+

Yes, some insurance providers offer specialized coverage for electric vehicles, including unique discounts and benefits. It’s worth shopping around to find the best coverage for your EV.