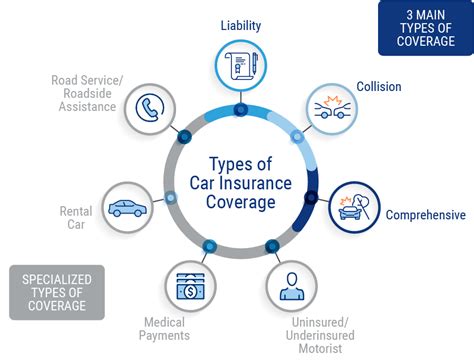

Car Insurance Types Of Coverage

When it comes to car insurance, understanding the different types of coverage available is crucial to ensuring you have the right protection for your vehicle and yourself. Car insurance is designed to provide financial security and peace of mind in various situations, ranging from minor fender benders to major accidents. The type of coverage you choose can significantly impact your coverage, liability, and overall experience in the event of a claim. In this comprehensive guide, we will explore the various car insurance coverage options, their benefits, and how they can safeguard your interests on the road.

Liability Coverage

Liability coverage is a fundamental component of car insurance and is often required by law in most states. This coverage type protects you financially if you are found at fault in an accident that results in property damage or bodily injury to others. Here’s a breakdown of the two main forms of liability coverage:

Bodily Injury Liability

Bodily injury liability coverage ensures that the medical expenses, lost wages, and pain and suffering of individuals injured in an accident you caused are covered. This coverage is essential as it provides a financial safety net, protecting you from potentially devastating financial consequences. It’s important to note that bodily injury liability coverage typically has a limit, which is the maximum amount the insurer will pay per person and per accident. It’s crucial to choose limits that align with your financial situation and the level of protection you desire.

| Coverage Type | Limit |

|---|---|

| Per Person | $50,000 - $100,000 |

| Per Accident | $100,000 - $300,000 |

Property Damage Liability

Property damage liability coverage is designed to cover the cost of repairing or replacing property damaged in an accident for which you are at fault. This can include damage to other vehicles, structures, fences, and even personal belongings inside the vehicle. Like bodily injury liability, property damage liability also has coverage limits. These limits specify the maximum amount the insurer will pay per accident.

| Coverage Type | Limit |

|---|---|

| Per Accident | $25,000 - $50,000 |

Comprehensive and Collision Coverage

While liability coverage is essential for protecting others, comprehensive and collision coverage focuses on safeguarding your own vehicle. These coverages are optional but highly recommended, especially if you have a loan or lease on your vehicle.

Comprehensive Coverage

Comprehensive coverage, often referred to as “Other Than Collision” coverage, provides protection against damage to your vehicle caused by events other than collisions. This can include:

- Vandalism: If your car is damaged by vandals, comprehensive coverage can help cover the repairs.

- Theft: In the unfortunate event of your vehicle being stolen, comprehensive coverage can provide financial assistance.

- Natural Disasters: Damage caused by floods, hurricanes, or other natural disasters is typically covered under comprehensive coverage.

- Animal Collisions: Hitting an animal on the road is often covered by comprehensive insurance.

- Falling Objects: Damage from falling tree branches, debris, or even space rocks is included in comprehensive coverage.

Collision Coverage

Collision coverage, as the name suggests, provides protection for your vehicle in the event of a collision with another vehicle, object, or even a rollover. This coverage pays for the repairs or replacement of your vehicle, regardless of who is at fault in the accident. It’s particularly beneficial if you have a newer or more valuable vehicle, as the cost of repairs can be substantial.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal injury protection (PIP) and medical payments coverage are designed to provide medical and related benefits to the insured driver and passengers, regardless of fault. These coverages are essential for ensuring that you and your passengers receive the necessary medical care and financial support after an accident.

Personal Injury Protection (PIP)

PIP coverage, often mandatory in no-fault states, provides a wide range of benefits, including:

- Medical Expenses: Covers the cost of medical treatment for the insured and their passengers, including hospital stays, surgeries, and rehabilitation.

- Lost Wages: Reimburses a portion of the insured's income if they are unable to work due to injuries sustained in the accident.

- Funeral Expenses: Provides financial assistance for funeral costs in the unfortunate event of a fatality.

- Child Care: Covers the cost of child care services if the insured is unable to provide care due to injuries.

- Essential Services: Pays for essential services, such as house cleaning or lawn care, if the insured is temporarily unable to perform these tasks.

Medical Payments Coverage

Medical payments coverage, often referred to as “MedPay,” is similar to PIP but typically has a more limited scope. It provides coverage for medical expenses incurred by the insured and their passengers, regardless of fault. MedPay coverage is generally less comprehensive than PIP but can still be a valuable addition to your insurance policy, offering quick and straightforward reimbursement for medical bills.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is an essential protection against the financial consequences of being involved in an accident with a driver who has no insurance or insufficient insurance. This coverage provides compensation for your injuries and property damage when the at-fault driver lacks adequate coverage to fully compensate you.

Uninsured Motorist Coverage

Uninsured motorist coverage steps in when you are involved in an accident with a driver who has no insurance. It covers your medical expenses, lost wages, and other related costs up to the limits of your policy. This coverage is particularly important as it ensures that you are not left financially vulnerable in the event of an accident caused by an uninsured driver.

Underinsured Motorist Coverage

Underinsured motorist coverage comes into play when the at-fault driver’s insurance coverage is insufficient to cover all your damages. It provides additional compensation to cover the gap between the at-fault driver’s coverage and the full extent of your losses. This coverage is crucial in ensuring that you receive fair compensation, even when dealing with an underinsured driver.

Additional Coverages and Optional Add-Ons

In addition to the standard coverage types, car insurance policies often offer a range of optional add-ons and additional coverages that can enhance your protection and provide specialized benefits.

Rental Car Coverage

Rental car coverage, also known as loss of use coverage, provides reimbursement for the cost of renting a vehicle while your insured car is being repaired or replaced after an accident. This coverage can be particularly valuable if you rely heavily on your vehicle for daily transportation or business purposes.

Gap Insurance

Gap insurance, or guaranteed asset protection (GAP), is designed to cover the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease. It’s especially beneficial if you have a loan or lease and your vehicle is totaled or stolen. Gap insurance ensures that you are not left with a financial gap, as it covers the outstanding balance on your loan or lease.

Roadside Assistance

Roadside assistance coverage provides emergency services such as towing, flat tire changes, jump-starts, and fuel delivery. This coverage can be a lifesaver in unexpected situations, ensuring that you receive prompt assistance when your vehicle breaks down or becomes disabled.

Custom Parts and Equipment Coverage

If you have customized your vehicle with unique parts or equipment, this coverage ensures that the value of those additions is covered in the event of an accident or theft. It’s particularly relevant for vehicles with custom paint jobs, audio systems, or performance upgrades.

Accident Forgiveness

Accident forgiveness is an optional add-on that protects your driving record and prevents your premiums from increasing after your first at-fault accident. This coverage can be a valuable investment, especially for drivers with a clean driving history, as it provides peace of mind and helps maintain affordable insurance rates.

Understanding Coverage Limits and Deductibles

When selecting car insurance coverage, it’s essential to understand coverage limits and deductibles. Coverage limits define the maximum amount your insurer will pay for a covered claim, while deductibles are the portion of the claim that you must pay out of pocket before your insurance coverage kicks in.

Coverage Limits

Coverage limits vary depending on the type of coverage and your chosen policy. It’s crucial to choose limits that align with your financial situation and the level of protection you desire. Higher limits generally provide more extensive coverage but may result in slightly higher premiums. It’s recommended to review your limits periodically and adjust them as your financial circumstances change.

Deductibles

Deductibles are the amount you agree to pay before your insurance coverage takes effect. Choosing a higher deductible can lower your premiums, as you assume more financial responsibility in the event of a claim. However, it’s essential to strike a balance, as a higher deductible may make it more challenging to afford out-of-pocket expenses in the event of an accident.

The Importance of Tailoring Your Coverage

Car insurance coverage is not one-size-fits-all. It’s essential to tailor your coverage to your specific needs, taking into account factors such as the value of your vehicle, your driving habits, and your financial situation. By carefully selecting the right combination of coverage types and limits, you can ensure that you have the protection you need without paying for coverage you don’t require.

Conclusion

Understanding the various types of car insurance coverage is a crucial step in ensuring you have the right protection for your vehicle and yourself. From liability coverage to comprehensive and collision protection, each type of coverage serves a specific purpose, providing financial security and peace of mind. By carefully selecting the appropriate coverage types and limits, you can drive with confidence, knowing that you are adequately protected in a wide range of situations.

Frequently Asked Questions (FAQ)

What is the difference between comprehensive and collision coverage?

+

Comprehensive coverage provides protection against non-collision events, such as theft, vandalism, and natural disasters, while collision coverage specifically covers damage caused by collisions with other vehicles or objects.

Do I need uninsured/underinsured motorist coverage?

+

Uninsured/underinsured motorist coverage is highly recommended, as it protects you financially if you are involved in an accident with a driver who has no insurance or insufficient insurance. It ensures you receive fair compensation for your injuries and property damage.

How do I choose the right coverage limits and deductibles?

+

Choosing the right coverage limits and deductibles involves assessing your financial situation and risk tolerance. Higher limits provide more extensive coverage but may result in higher premiums. Similarly, a higher deductible can lower premiums but requires you to pay more out of pocket in the event of a claim. It’s essential to find a balance that aligns with your financial capabilities and comfort level.

Can I customize my car insurance policy with additional coverages?

+

Absolutely! Car insurance policies offer a range of optional add-ons and additional coverages, such as rental car coverage, gap insurance, roadside assistance, and more. These coverages can be customized to your specific needs, providing specialized protection for unique situations.