Car Repair Insurance

Car repair insurance is a vital aspect of vehicle ownership, offering peace of mind and financial protection to drivers worldwide. In an industry valued at billions, understanding the nuances of this coverage is crucial for making informed decisions. This comprehensive guide will delve into the specifics of car repair insurance, exploring its various facets, benefits, and real-world applications.

Understanding Car Repair Insurance

Car repair insurance, often referred to as automotive repair coverage, is a specialized type of insurance policy designed to cover the costs of repairing or replacing a vehicle after an accident, natural disaster, or mechanical failure. It is a critical component of the broader auto insurance industry, which aims to protect vehicle owners from the financial burdens associated with unexpected vehicle damage.

This form of insurance is particularly beneficial in an era where vehicle repair costs are on the rise. With the advancement of automotive technology, the cost of repairing modern vehicles, especially those equipped with advanced safety features and intricate electronics, can be significantly higher than traditional repairs. Car repair insurance steps in to bridge this financial gap, ensuring that policyholders can afford the necessary repairs without incurring substantial out-of-pocket expenses.

Key Features of Car Repair Insurance

Car repair insurance policies typically include several key features:

- Comprehensive Coverage: This includes repairs for damages caused by natural disasters, vandalism, and theft.

- Collision Coverage: Covers repairs needed after a collision with another vehicle or object.

- Mechanical Breakdown Insurance: Provides coverage for unexpected mechanical failures not covered by the vehicle’s warranty.

- Rental Car Reimbursement: Some policies offer rental car coverage while the insured vehicle is being repaired.

- Roadside Assistance: Includes benefits like towing, flat tire changes, and battery jump-starts.

The exact coverage and benefits offered can vary significantly between insurance providers and policies. It is essential for policyholders to carefully review the terms and conditions of their policy to understand the specific coverages and exclusions.

The Benefits of Car Repair Insurance

Car repair insurance offers a multitude of benefits to vehicle owners. Firstly, it provides financial security by covering the costs of repairs, which can be a significant burden for many individuals. This is especially true for unexpected events like accidents or mechanical failures, where the repair costs can be substantial.

Additionally, car repair insurance promotes peace of mind for policyholders. Knowing that they are covered in the event of an accident or mechanical issue can reduce the stress and anxiety associated with vehicle ownership. It allows drivers to focus on their daily lives without worrying about the financial implications of potential vehicle damage.

Furthermore, car repair insurance can also enhance vehicle resale value. A well-maintained vehicle with a comprehensive repair history can be more appealing to potential buyers, leading to a higher resale price. This is particularly true for vehicles with a history of regular servicing and prompt repairs, as it demonstrates responsible ownership and ensures the vehicle's reliability.

Real-World Applications and Case Studies

To illustrate the practical applications of car repair insurance, let’s explore a few real-world scenarios and case studies:

Case Study 1: Collision Coverage in Action

Imagine a driver, Mr. Johnson, who unfortunately gets into a minor fender bender while commuting to work. His car, a 3-year-old sedan, sustains damage to the front bumper and requires repairs estimated at $2,500. Fortunately, Mr. Johnson has comprehensive car repair insurance coverage, which includes collision coverage.

Thanks to his insurance policy, Mr. Johnson is able to take his vehicle to a trusted repair shop without worrying about the financial burden. The insurance company processes his claim efficiently, and he receives a rental car while his vehicle is being repaired. Within a week, his car is back on the road, looking as good as new, with minimal out-of-pocket expenses.

Case Study 2: Mechanical Breakdown Insurance

Ms. Garcia, a recent college graduate, purchases her first car, a used SUV. Shortly after the purchase, the vehicle’s transmission begins to show signs of failure. The repair estimate is a staggering $4,000, which is well beyond Ms. Garcia’s means.

However, Ms. Garcia had the foresight to purchase mechanical breakdown insurance as part of her car repair coverage. The insurance company assesses the claim and approves the necessary repairs, providing Ms. Garcia with financial relief and ensuring her vehicle is reliable for her daily commute and long-distance travels.

Case Study 3: Comprehensive Coverage for Natural Disasters

In a tragic turn of events, a severe hurricane hits the coastal town where Mr. Williams resides. His car, parked outside his home, is damaged by falling debris and flooding. The repairs are estimated at $3,500, an amount Mr. Williams was not prepared to pay out of pocket.

Mr. Williams, however, had purchased comprehensive car repair insurance, which covers damages caused by natural disasters. His insurance company promptly assesses the damage and authorizes the necessary repairs. With his car back in working condition, Mr. Williams can continue his daily routine without the added financial strain.

Technical Specifications and Performance Analysis

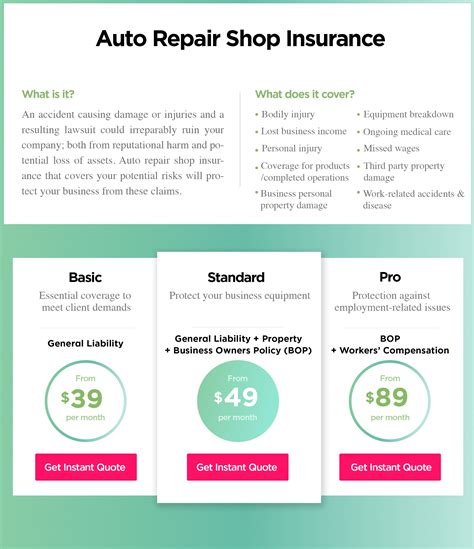

Car repair insurance policies are highly customizable, allowing policyholders to tailor their coverage to their specific needs and budget. Here is a breakdown of some technical specifications and performance metrics:

| Coverage Type | Description | Average Cost |

|---|---|---|

| Comprehensive Coverage | Covers damages from natural disasters, theft, and vandalism. | $200 - $400 annually |

| Collision Coverage | Repairs after collisions with other vehicles or objects. | $300 - $500 annually |

| Mechanical Breakdown Insurance | Covers unexpected mechanical failures. | $150 - $300 annually |

| Rental Car Reimbursement | Provides rental car coverage during repairs. | Varies based on policy |

| Roadside Assistance | Includes towing, tire changes, and battery assistance. | Included in some policies |

It's important to note that these costs can vary significantly based on factors such as the policyholder's location, driving history, and the make and model of their vehicle. Additionally, insurance providers may offer discounts for bundling multiple coverages or for maintaining a clean driving record.

Performance Analysis

The performance of car repair insurance policies can be analyzed based on customer satisfaction, claim processing speed, and the overall financial protection they provide. Here are some key performance metrics:

- Customer Satisfaction: Insurance providers aim for high customer satisfaction rates, with many companies receiving positive reviews for their prompt claim processing and customer support.

- Claim Processing Speed: Efficient claim processing is a critical aspect of car repair insurance. Many providers offer online claim submission and tracking, with claims often being processed within a week.

- Financial Protection: Car repair insurance policies provide significant financial protection, especially for policyholders who experience major accidents or mechanical failures. The coverage can save individuals thousands of dollars in repair costs.

Future Implications and Industry Insights

The car repair insurance industry is evolving, driven by technological advancements and changing consumer needs. Here are some key trends and insights to consider:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is increasingly being used in car repair insurance. This technology allows insurance providers to offer usage-based insurance, where premiums are based on individual driving habits. This approach can encourage safer driving and provide more accurate risk assessments.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles presents new challenges and opportunities for the car repair insurance industry. These vehicles have unique repair needs, and insurance providers are adapting their policies to cover these emerging technologies. As autonomous vehicles become more prevalent, insurance coverage will need to evolve to address potential liabilities and risks.

Data-Driven Insurance

The insurance industry is embracing data-driven approaches, utilizing advanced analytics and machine learning to improve risk assessment and claim management. By analyzing large datasets, insurance providers can identify patterns and trends, leading to more accurate pricing and coverage decisions. This data-driven approach can also help identify potential fraud and improve overall efficiency.

Industry Consolidation

The car repair insurance market is highly competitive, with numerous providers offering a range of policies. However, industry consolidation is a trend to watch, as larger providers acquire smaller companies or merge to gain market share and economies of scale. This consolidation can lead to more standardized policies and pricing, impacting the choices available to consumers.

Regulatory Changes

Regulatory bodies play a crucial role in the car repair insurance industry, setting standards and guidelines for coverage and claims handling. Keeping up-to-date with regulatory changes is essential for both insurance providers and policyholders. Recent regulatory developments, such as changes in collision repair standards and guidelines for autonomous vehicle insurance, can significantly impact the industry.

Conclusion

Car repair insurance is an essential aspect of vehicle ownership, offering financial protection and peace of mind to drivers. By understanding the technical specifications, performance metrics, and future trends, policyholders can make informed decisions to protect their vehicles and themselves. The car repair insurance industry is evolving rapidly, and staying informed is key to navigating this dynamic landscape.

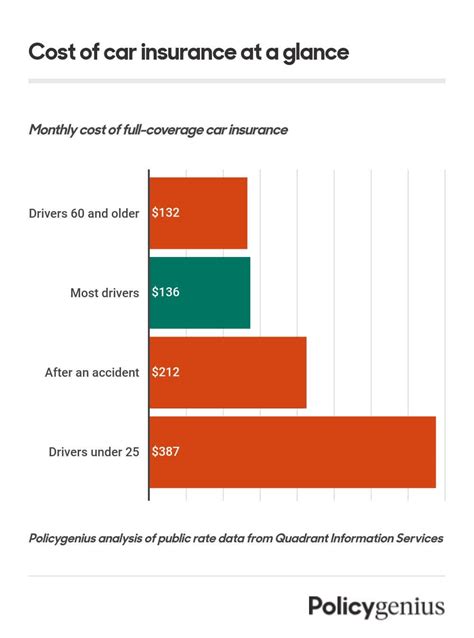

How much does car repair insurance typically cost?

+

The cost of car repair insurance can vary widely depending on several factors, including the policyholder’s location, driving history, and the make and model of their vehicle. On average, comprehensive coverage can range from 200 to 400 annually, collision coverage from 300 to 500 annually, and mechanical breakdown insurance from 150 to 300 annually. It’s important to shop around and compare quotes from different insurance providers to find the best coverage at a competitive price.

What should I look for when choosing a car repair insurance policy?

+

When selecting a car repair insurance policy, consider factors such as the level of coverage (comprehensive, collision, mechanical breakdown), the deductible amount (the amount you pay out of pocket before insurance kicks in), and any additional benefits like rental car reimbursement or roadside assistance. It’s also crucial to review the policy’s exclusions and limitations to ensure you understand what’s covered and what’s not.

Can I customize my car repair insurance policy to my specific needs?

+

Yes, many car repair insurance policies offer customizable options to tailor coverage to your specific needs and budget. You can choose the level of coverage you want, select optional add-ons like rental car reimbursement, and even adjust your deductible to find the right balance between cost and protection. It’s important to work with your insurance provider to find the right coverage for your situation.

How do I file a claim with my car repair insurance policy?

+

To file a claim with your car repair insurance policy, you’ll typically need to contact your insurance provider’s claims department and provide details about the incident, such as the date, location, and any relevant photos or documentation. The claims adjuster will then assess the damage and authorize the necessary repairs. It’s important to follow the specific claim filing process outlined in your policy to ensure a smooth and timely resolution.

What happens if my car is a total loss due to an accident or natural disaster?

+

If your car is deemed a total loss due to an accident or natural disaster, your car repair insurance policy may provide coverage for the actual cash value (ACV) of your vehicle. The ACV is typically calculated based on the vehicle’s make, model, year, and mileage. The insurance company will pay you the ACV, minus your deductible, and you’ll be responsible for any remaining loan or lease balance. It’s important to understand the specifics of your policy’s total loss coverage and any potential limitations.