Cash Value On Life Insurance

Understanding the cash value of a life insurance policy is crucial for policyholders, as it can provide a financial safety net during their lifetime and ensure financial security for their beneficiaries after their passing. In this comprehensive guide, we will delve into the world of cash value life insurance, exploring its mechanics, benefits, and considerations to help you make informed decisions about your financial future.

Unraveling the Concept of Cash Value Life Insurance

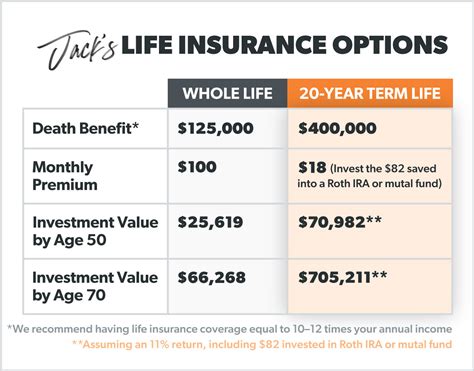

Cash value life insurance, often referred to as permanent life insurance, is a type of policy that offers both a death benefit and a savings component. Unlike term life insurance, which provides coverage for a specified period, cash value life insurance remains in force for the policyholder’s entire life, provided premiums are paid.

The cash value element is a savings account within the policy that accumulates over time. A portion of each premium payment is allocated to this savings account, allowing the policyholder to build a cash reserve. This cash value can be used for various purposes, such as withdrawing funds, taking out loans against the policy, or even surrendering the policy entirely to receive the accumulated cash value.

One of the key advantages of cash value life insurance is its flexibility. Policyholders have the option to adjust their coverage and premiums as their financial needs change. They can also access the cash value to cover unexpected expenses, supplement retirement income, or pay for their children's education. Additionally, the cash value can be used to offset premium payments, making it an attractive option for those seeking long-term financial planning.

How Does Cash Value Grow?

The growth of the cash value within a life insurance policy depends on several factors, including the interest rate credited to the policy, the premium payments, and the policy’s design. Most cash value policies offer a guaranteed minimum interest rate, but the actual rate can be higher, depending on the insurer’s performance.

| Policy Type | Interest Rate |

|---|---|

| Whole Life Insurance | 4% to 5% |

| Universal Life Insurance | Varies, typically 4% to 7% |

The premium payments also impact cash value growth. Policyholders can choose to pay a level premium, which remains constant throughout the policy's term, or a flexible premium, which allows for adjustments based on their financial situation. The more premiums paid, the faster the cash value can grow.

Types of Cash Value Life Insurance

There are two primary types of cash value life insurance: whole life insurance and universal life insurance. Understanding the differences between these policies is essential for choosing the right option.

Whole Life Insurance

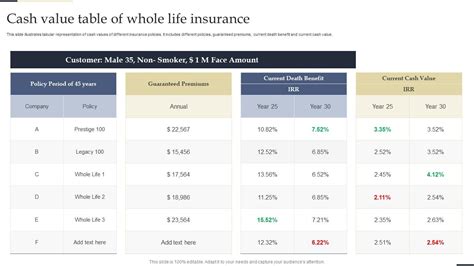

Whole life insurance is a traditional form of cash value life insurance that offers a fixed death benefit and guaranteed cash value growth. Policyholders pay a level premium throughout their lifetime, and the policy remains in force as long as premiums are paid. The cash value grows at a guaranteed rate, providing a predictable savings component.

Whole life insurance is ideal for those seeking long-term financial protection and a guaranteed cash value accumulation. It offers a straightforward and stable option for building wealth and providing a death benefit to beneficiaries.

Universal Life Insurance

Universal life insurance, on the other hand, offers more flexibility and customization. Policyholders can adjust their premiums and death benefit amounts, making it suitable for those with changing financial needs. The cash value within a universal life policy can be used to offset premium payments or increase the death benefit.

One unique feature of universal life insurance is its investment component. Policyholders can choose how their cash value is invested, allowing for potential higher returns. However, this also carries more risk, as the policy's performance depends on the chosen investment options.

Benefits and Considerations of Cash Value Life Insurance

Cash value life insurance offers a range of benefits that make it an appealing choice for many individuals and families. Here are some key advantages to consider:

Financial Security

The primary benefit of cash value life insurance is the financial security it provides. The death benefit ensures that your loved ones are protected financially in the event of your passing. The cash value component adds an extra layer of security, allowing you to access funds during your lifetime for various needs.

Long-Term Wealth Building

Cash value life insurance serves as a long-term wealth-building tool. The guaranteed cash value growth, especially in whole life policies, provides a stable and predictable savings mechanism. Over time, this accumulated cash value can become a significant asset, offering financial flexibility and peace of mind.

Flexibility and Customization

One of the most appealing aspects of cash value life insurance is its flexibility. Policyholders can tailor their coverage and premiums to align with their financial goals and changing circumstances. Whether you need to increase coverage for a growing family or reduce premiums during challenging economic times, cash value life insurance offers options.

Tax Advantages

Cash value life insurance provides certain tax advantages that can be beneficial. The cash value within the policy grows tax-deferred, meaning it is not subject to annual taxation. Additionally, when accessing the cash value through policy loans or withdrawals, the funds are typically tax-free up to the amount of premiums paid.

Estate Planning

Cash value life insurance plays a crucial role in estate planning. The death benefit can provide a significant source of funds for your beneficiaries, helping to cover expenses such as funeral costs, outstanding debts, or even funding a trust. The cash value can also be used to pay estate taxes, ensuring your loved ones receive the full inheritance you intended.

Factors to Consider Before Choosing Cash Value Life Insurance

While cash value life insurance offers numerous advantages, it is essential to consider certain factors before making a decision. Here are some key considerations:

Cost and Premiums

Cash value life insurance policies typically have higher premiums compared to term life insurance. The cost of premiums can vary depending on the policy type, your age, health status, and the amount of coverage you choose. It’s crucial to assess your budget and determine if the premiums are affordable and sustainable over the long term.

Investment Risks

In universal life insurance policies, the investment component carries a certain level of risk. While higher returns are possible, there is also the potential for lower returns or even losses. It’s essential to understand your risk tolerance and consider the impact of market fluctuations on your policy’s performance.

Policy Management

Cash value life insurance policies require active management to ensure they remain in force and perform optimally. Policyholders need to stay informed about their policy’s performance, monitor cash value growth, and make adjustments as needed. Regular reviews with your insurance agent or financial advisor are recommended.

Surrender Charges

When considering cash value life insurance, be aware of surrender charges. These are fees charged by the insurer if you decide to surrender or cancel your policy before a certain period. Surrender charges can significantly impact the cash value you receive, so it’s crucial to understand the terms and conditions before committing to a policy.

Making Informed Decisions: Choosing the Right Policy

Selecting the right cash value life insurance policy involves careful consideration of your financial goals, risk tolerance, and long-term plans. Here are some steps to guide you in making an informed decision:

Define Your Goals

Start by clearly defining your financial objectives. Are you primarily seeking long-term wealth building, or do you need immediate access to funds for specific needs? Understanding your goals will help narrow down the type of policy that aligns with your priorities.

Assess Your Budget

Evaluate your financial situation and determine how much you can afford to allocate towards premiums. Consider your current income, expenses, and any future financial commitments. Ensure that the chosen policy’s premiums fit comfortably within your budget.

Compare Policy Options

Research and compare different cash value life insurance policies. Look at factors such as interest rates, premium flexibility, and the potential for investment growth. Consider consulting with an insurance professional or financial advisor who can provide expert guidance based on your unique circumstances.

Review Policy Details

Before committing to a policy, carefully review the fine print. Understand the terms and conditions, including surrender charges, policy fees, and any limitations on accessing the cash value. Ensure that the policy meets your expectations and aligns with your long-term financial plan.

Conclusion: Navigating Your Financial Future

Cash value life insurance is a powerful financial tool that offers both protection and savings opportunities. By understanding the mechanics, benefits, and considerations of this type of policy, you can make informed decisions that align with your financial goals and provide security for your loved ones. Whether you choose whole life or universal life insurance, the key is to stay informed, manage your policy actively, and adapt it to your changing needs.

How does cash value life insurance differ from term life insurance?

+Cash value life insurance, or permanent life insurance, offers a death benefit and a savings component, while term life insurance provides coverage for a specified period. Term life insurance typically has lower premiums but no cash value accumulation.

Can I access the cash value in my life insurance policy?

+Yes, you can access the cash value through policy loans, withdrawals, or by surrendering the policy. However, it’s important to consider the impact on your coverage and any surrender charges that may apply.

What are the tax implications of cash value life insurance?

+The cash value within a life insurance policy grows tax-deferred, and policy loans or withdrawals up to the amount of premiums paid are typically tax-free. However, there may be tax implications if the cash value exceeds the amount of premiums paid.

Is cash value life insurance suitable for everyone?

+Cash value life insurance can be a valuable tool for long-term financial planning, but it may not be suitable for everyone. Those with limited financial means or short-term needs may find term life insurance more affordable and adequate for their circumstances.