Cheap Auto Insurance For New Drivers

Navigating the world of auto insurance as a new driver can be daunting, especially when you're looking for affordable coverage. The cost of insurance for new drivers is often significantly higher due to the perceived risk associated with inexperience. However, there are strategies and options available to help you find cheap auto insurance, allowing you to protect yourself and your vehicle without breaking the bank.

Understanding the Factors That Affect Insurance Costs for New Drivers

Several key factors contribute to the higher insurance premiums that new drivers typically face. Understanding these factors is essential for devising strategies to mitigate costs. One of the primary considerations is age. Insurance companies often classify drivers under the age of 25 as high-risk, resulting in higher premiums. This is because younger drivers are statistically more likely to be involved in accidents.

Another critical factor is driving history. A clean driving record can help reduce insurance costs, but for new drivers who have not yet established a history, insurance companies rely on other data points to assess risk. This includes factors like the make and model of your vehicle, your annual mileage, and even your gender and marital status.

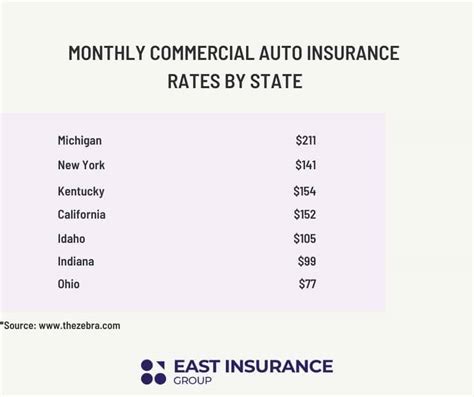

The location where you reside and drive also plays a significant role. Insurance rates can vary significantly between states and even between different cities within the same state. Urban areas often have higher insurance costs due to increased traffic and the higher likelihood of accidents and car theft.

Lastly, the type of coverage you choose can impact your insurance premiums. While comprehensive coverage offers more protection, it also tends to be more expensive. Balancing your need for coverage with your budget is essential when selecting an insurance plan.

Strategies to Find Cheap Auto Insurance as a New Driver

Despite the challenges, there are several strategies that new drivers can employ to find affordable auto insurance. One of the most effective methods is to shop around and compare quotes from multiple insurance providers. Each insurer has its own unique rating system, so the premiums they offer can vary significantly.

When comparing quotes, it's important to ensure that you're comparing apples to apples. This means that the coverage levels and deductibles should be consistent across all quotes. By obtaining multiple quotes, you can identify the insurance provider that offers the best combination of coverage and cost for your specific circumstances.

Another strategy is to take advantage of discounts. Many insurance companies offer discounts for a variety of reasons, such as good grades, safe driving records, and even certain professional affiliations. By understanding the discounts available, you can ensure that you're getting the best possible rate.

Additionally, consider bundling your insurance policies. Many insurers offer discounts when you bundle multiple policies, such as auto and home insurance, or auto and life insurance. Bundling can be a cost-effective way to save on your insurance premiums.

Furthermore, investing in driver training can help reduce your insurance costs. Some insurance companies offer discounts to drivers who have completed approved driver training courses. These courses can help you become a safer, more confident driver, which in turn reduces your risk profile and can lead to lower insurance premiums.

Finally, consider the make and model of your vehicle. Insurance costs can vary significantly depending on the vehicle you drive. Some vehicles are more expensive to insure due to their higher repair costs or because they are more frequently targeted by thieves. Opting for a vehicle that is known for its safety features and lower insurance costs can help keep your premiums down.

The Role of Technology in Affordable Auto Insurance for New Drivers

Advancements in technology have played a significant role in making auto insurance more affordable for new drivers. Telematics, for instance, is a technology that allows insurance companies to monitor driving behavior in real-time. By installing a small device in your vehicle or using a smartphone app, insurers can track your driving habits, such as acceleration, braking, and mileage. This data is then used to offer personalized insurance rates, often resulting in lower premiums for safe drivers.

Additionally, online quotes and comparisons have made it easier than ever to shop for insurance. Online platforms and comparison websites allow you to quickly and conveniently obtain multiple quotes from different insurers, making it simple to find the best deal. These platforms often provide additional tools and resources, such as guides and articles, to help you understand the insurance process and make informed decisions.

Furthermore, the rise of usage-based insurance (UBI) has introduced a new paradigm in auto insurance. With UBI, insurance premiums are based on how much and how you drive. This means that if you drive less or exhibit safe driving behaviors, you could potentially pay lower premiums. UBI is particularly advantageous for new drivers who may not have an established driving record but can demonstrate safe driving habits.

The Future of Auto Insurance for New Drivers

The landscape of auto insurance is continually evolving, and several trends are shaping the future of insurance for new drivers. One significant trend is the increasing focus on data-driven underwriting. Insurance companies are leveraging advanced analytics and machine learning to more accurately assess risk and price insurance policies. This shift is expected to lead to more personalized insurance rates, with premiums reflecting an individual’s specific risk profile rather than broad demographic categories.

Another trend is the integration of autonomous and connected vehicle technologies. As self-driving cars become more prevalent, the role of the driver in accident causation will shift, potentially leading to a significant reduction in accidents. This, in turn, could result in lower insurance premiums for all drivers, including new ones. Additionally, connected vehicle technologies that enable real-time vehicle diagnostics and predictive maintenance could further reduce the likelihood of accidents and associated insurance claims.

The rise of pay-as-you-drive (PAYD) insurance models is also a notable trend. PAYD policies charge premiums based on actual vehicle usage, typically measured by mileage. This model is particularly beneficial for new drivers who may have lower annual mileage, as they can pay premiums that reflect their actual driving habits rather than broad averages. PAYD models are expected to become more prevalent as usage-based insurance gains traction and as vehicle technology continues to advance.

How can I improve my chances of getting cheap auto insurance as a new driver?

+To increase your chances of finding affordable auto insurance, consider factors like your driving record, vehicle choice, and insurance coverage options. Shop around for quotes from multiple insurers, and take advantage of discounts for good grades, safe driving, or professional affiliations. Additionally, consider adding a more experienced driver to your policy as a named driver, as this can help lower your premiums.

What is the average cost of auto insurance for new drivers?

+The average cost of auto insurance for new drivers can vary significantly based on a range of factors, including age, location, driving history, and the type of vehicle being insured. Generally, new drivers can expect to pay higher premiums compared to more experienced drivers. On average, new drivers may pay anywhere from 1,500 to 3,000 per year for insurance, although this can vary widely.

Are there any specific insurance companies that offer cheaper rates for new drivers?

+While specific insurance companies that consistently offer the cheapest rates for new drivers can vary based on location and other factors, some insurers are known for their competitive rates and discounts. These may include State Farm, GEICO, Progressive, and USAA (for eligible military members and their families). It’s always a good idea to get quotes from multiple insurers to find the best rate for your specific circumstances.

How can I lower my auto insurance premiums over time as a new driver?

+To lower your auto insurance premiums over time, focus on maintaining a clean driving record and taking advantage of any available discounts. As you gain more driving experience and establish a safe driving history, your insurance premiums are likely to decrease. Additionally, consider shopping around for quotes every year to ensure you’re getting the best rate available.