Cheap Auto Insurance Quotes

Securing affordable auto insurance is a top priority for many vehicle owners, as it provides essential financial protection in the event of accidents or mishaps on the road. The good news is that with a bit of research and savvy negotiating, it's entirely possible to find cheap auto insurance quotes that offer the coverage you need without breaking the bank. This comprehensive guide will take you through the steps to finding the best deals on auto insurance, ensuring you get the right coverage at the most competitive rates.

Understanding Your Auto Insurance Needs

Before embarking on your quest for cheap auto insurance quotes, it’s crucial to have a clear understanding of your specific insurance needs. Different drivers and vehicles will require varying levels of coverage. Factors such as your driving history, the make and model of your car, and your state’s legal requirements will all play a role in determining the right insurance policy for you.

Assessing Your Coverage Requirements

Start by evaluating your personal circumstances and identifying the minimum level of coverage required by your state. This typically includes liability insurance, which covers damages to other people’s property or injuries they sustain in an accident you cause. However, you may also want to consider additional coverage types, such as:

- Collision coverage: This pays for repairs to your own vehicle after an accident, regardless of fault.

- Comprehensive coverage: Covers damage to your vehicle caused by non-collision events like theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: Protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance.

- Medical payments coverage: Helps cover medical expenses for you and your passengers after an accident.

It's essential to strike a balance between the coverage you need and what you can afford. While comprehensive coverage offers the most protection, it also tends to be more expensive. Consider your budget and the value of your vehicle when deciding on the appropriate level of coverage.

Factors Influencing Your Premiums

The cost of your auto insurance, or your premium, is determined by several factors. These include:

- Age and Gender: Younger drivers and males tend to pay higher premiums due to their perceived higher risk of accidents.

- Driving Record: A clean driving record with no recent accidents or violations can result in lower premiums.

- Vehicle Type: The make, model, and year of your car, as well as its safety and anti-theft features, can impact your premium.

- Credit Score: In many states, your credit history can be a factor in determining your insurance rates.

- Location: The area where you live and drive can affect your rates, with urban areas and high-crime neighborhoods typically resulting in higher premiums.

- Mileage: The more you drive, the higher your risk of being in an accident, which can lead to increased premiums.

Understanding these factors can help you anticipate the potential costs of your auto insurance and make informed decisions when comparing quotes.

Shopping Around for Cheap Auto Insurance Quotes

Now that you have a better understanding of your insurance needs and the factors that influence your premiums, it’s time to start shopping around for cheap auto insurance quotes. This process involves researching different insurance providers, comparing their rates and coverage options, and negotiating the best deal for your circumstances.

Researching Insurance Providers

There are numerous insurance companies offering auto insurance policies, each with its own unique features and pricing structures. It’s essential to research and compare these providers to find the one that best fits your needs and budget.

- Start by making a list of reputable insurance companies, both local and national, that offer auto insurance in your state.

- Check online reviews and ratings to get an idea of each company’s customer service, claim handling, and overall satisfaction levels.

- Consider the financial stability and rating of the insurance companies. A financially stable company is more likely to be able to pay out claims in the event of an accident.

- Research the coverage options and discounts offered by each provider. Some companies may specialize in certain types of coverage or offer unique benefits that could be advantageous for your situation.

By thoroughly researching insurance providers, you can identify the companies that are most likely to offer competitive rates and suitable coverage for your needs.

Comparing Quotes and Coverage Options

Once you’ve narrowed down your list of potential insurance providers, it’s time to start comparing quotes and coverage options. This is a crucial step in ensuring you get the best value for your money.

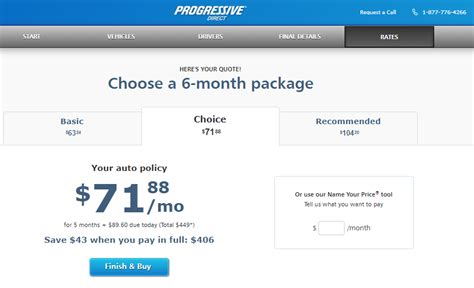

- Use online quote comparison tools to get initial estimates from multiple providers. These tools allow you to input your details once and receive multiple quotes, making the comparison process quicker and easier.

- Pay close attention to the coverage limits and deductibles offered in each quote. Ensure that the coverage limits are sufficient for your needs and that the deductibles are affordable for you.

- Look for any additional benefits or perks that may be included with the policy, such as roadside assistance, rental car coverage, or accident forgiveness.

- Consider the reputation and financial stability of the insurance company offering the quote. While a low premium may be tempting, it’s important to ensure the company is reliable and able to provide the coverage you need.

Comparing quotes and coverage options will help you identify the policies that offer the best combination of affordability and comprehensive coverage.

Negotiating for the Best Deal

Negotiating with insurance providers can be a powerful way to secure the best deal on your auto insurance. Many providers are willing to negotiate on pricing, especially if you have a strong understanding of your needs and the market.

- When negotiating, be prepared to provide detailed information about your driving history, the make and model of your vehicle, and any safety features it may have.

- Highlight any low-risk factors that could potentially reduce your premiums, such as a clean driving record, a low-mileage policy, or a vehicle with advanced safety features.

- Discuss any discounts you may be eligible for, such as those for safe driving, multiple policies, or membership in certain organizations.

- Don’t be afraid to ask for a better rate. Insurance companies often have some flexibility in their pricing, and they may be willing to match or beat a competitor’s quote to secure your business.

By negotiating effectively, you can often secure significant savings on your auto insurance premiums while still maintaining the coverage you need.

Maximizing Savings with Discounts and Special Programs

In addition to negotiating directly with insurance providers, there are several other strategies you can employ to maximize your savings on auto insurance. These include taking advantage of discounts and special programs offered by insurance companies, as well as exploring alternative insurance options.

Discounts and Special Programs

Insurance companies offer a wide range of discounts and special programs that can significantly reduce your premiums. Some common discounts include:

- Multi-policy discounts: If you bundle your auto insurance with other policies, such as home or renters insurance, you may be eligible for a discount.

- Good driver discounts: Many insurance companies offer reduced rates for drivers with a clean driving record, free of accidents or serious violations.

- Student discounts: Students who maintain good grades or are enrolled in certain educational programs may qualify for discounted rates.

- Low-mileage discounts: If you drive fewer miles than the average driver, you may be eligible for a low-mileage discount.

- Safety feature discounts: Having certain safety features in your vehicle, such as anti-lock brakes, air bags, or a theft prevention system, can result in lower premiums.

Be sure to inquire about all available discounts when speaking with insurance providers. You may also want to explore special programs, such as pay-as-you-drive insurance, which can offer significant savings for low-mileage drivers.

Alternative Insurance Options

If traditional insurance providers are still offering rates that are too high for your budget, consider exploring alternative insurance options. These may include:

- Usage-based insurance: Also known as pay-as-you-drive or pay-per-mile insurance, this type of policy bases your premium on your actual driving habits, rather than demographic factors. This can be especially advantageous for low-mileage drivers.

- Peer-to-peer insurance: This relatively new insurance model allows drivers to share insurance policies and premiums, often resulting in lower costs.

- State-run insurance programs: Some states offer their own auto insurance programs, which can be a more affordable option for high-risk drivers who may struggle to find coverage elsewhere.

While alternative insurance options may not be suitable for everyone, they can provide significant savings for those who meet the necessary criteria.

Maintaining Affordable Auto Insurance Over Time

Finding cheap auto insurance quotes is just the first step in ensuring you maintain affordable coverage over the long term. It’s important to regularly review your policy and make adjustments as needed to keep your premiums as low as possible.

Regularly Reviewing and Adjusting Your Policy

Your insurance needs and circumstances can change over time, so it’s essential to periodically review your auto insurance policy to ensure it still meets your requirements. This could involve making adjustments to your coverage limits, deductibles, or other policy features.

- If your vehicle’s value has decreased significantly, you may be able to reduce your coverage limits or remove certain coverages, such as collision or comprehensive, to lower your premiums.

- If you’ve added safety features to your vehicle or improved your driving record, you may be eligible for additional discounts.

- Review your policy’s deductibles. While higher deductibles can result in lower premiums, they also mean you’ll have to pay more out of pocket in the event of a claim. Consider whether a higher deductible is still the right choice for your financial situation.

Regularly reviewing and adjusting your policy ensures that your coverage remains adequate and your premiums remain as low as possible.

Exploring Loyalty and Renewal Discounts

Insurance companies often reward loyal customers with loyalty or renewal discounts. These discounts can help keep your premiums low over time, so it’s worth exploring the options available to you.

- Inquire about loyalty discounts when renewing your policy. Many insurance companies offer reduced rates for long-term customers.

- Consider switching providers if you’ve been a loyal customer for several years but are not receiving significant loyalty discounts. Shopping around for new quotes every few years can help you identify more affordable options.

- Explore multi-year policies, which can sometimes offer discounts for committing to a longer-term policy.

By exploring loyalty and renewal discounts, you can maintain affordable auto insurance coverage for the long term.

Conclusion

Securing cheap auto insurance quotes is a process that requires research, comparison, and negotiation. By understanding your insurance needs, shopping around for the best deals, and maximizing your savings through discounts and special programs, you can find affordable coverage that meets your requirements. Additionally, regularly reviewing and adjusting your policy, as well as exploring loyalty and renewal discounts, can help you maintain affordable auto insurance over time.

What is the average cost of auto insurance in the United States?

+

The average cost of auto insurance in the U.S. varies widely depending on factors such as location, driving history, and the type of vehicle insured. As of 2021, the national average cost for a full coverage policy is around 1,674 per year, or approximately 139 per month. However, this average can be significantly higher or lower depending on individual circumstances.

How can I get the cheapest auto insurance quotes?

+

To get the cheapest auto insurance quotes, you should shop around and compare rates from multiple providers. Research insurance companies that offer competitive rates and discounts, and use online quote comparison tools to quickly get estimates from several insurers. Additionally, consider adjusting your coverage limits and deductibles to find the right balance between affordability and adequate protection.

Are there any tips for negotiating lower auto insurance rates?

+

Yes, there are several strategies you can use to negotiate lower auto insurance rates. First, ensure you have a complete understanding of your coverage needs and the factors that influence your premiums. When negotiating, highlight your low-risk factors, such as a clean driving record or advanced safety features in your vehicle. Also, inquire about all available discounts and special programs, and don’t hesitate to ask for a better rate, especially if you’re a loyal customer or have a strong negotiating position.