Cheap Car Insurance Michigan

Finding affordable car insurance in Michigan can be a challenging task, as the state has some of the highest insurance rates in the nation. The average cost of car insurance in Michigan is significantly higher compared to the national average, making it crucial for drivers to explore ways to secure more affordable coverage. This article aims to provide an in-depth guide to obtaining cheap car insurance in Michigan, covering various strategies and factors that can impact insurance costs.

Understanding the Cost of Car Insurance in Michigan

The cost of car insurance in Michigan is influenced by a multitude of factors, including individual driving records, the type of vehicle insured, and the coverage limits chosen. Additionally, Michigan’s unique no-fault insurance system plays a significant role in determining insurance rates. Here’s a breakdown of the key factors that impact insurance costs in the state:

No-Fault Insurance System

Michigan operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, each driver’s insurance company pays for their own medical expenses and other related costs. This system is designed to streamline the claims process and ensure faster compensation for injured parties. However, it also contributes to the higher insurance rates in the state.

Personal Injury Protection (PIP) Coverage

One of the most expensive components of car insurance in Michigan is Personal Injury Protection (PIP) coverage. PIP covers medical expenses, wage loss, and other related costs incurred due to an auto accident. Michigan requires drivers to carry unlimited PIP coverage, which can significantly impact insurance premiums.

High Accident and Claim Rates

Michigan has a higher-than-average rate of accidents and insurance claims, which can lead to increased insurance costs. Factors such as busy urban areas, harsh winters, and a high population density contribute to the state’s elevated accident rates.

Vehicle Choice and Usage

The type of vehicle you drive and how you use it can also impact your insurance rates. Sports cars, luxury vehicles, and SUVs often have higher insurance premiums due to their potential for higher repair costs and increased risk of theft or damage. Additionally, if you use your vehicle for business purposes or commute long distances, your insurance rates may be affected.

Strategies for Securing Cheap Car Insurance in Michigan

Despite the unique challenges presented by Michigan’s insurance landscape, there are several strategies drivers can employ to find more affordable car insurance. Here are some key tactics to consider:

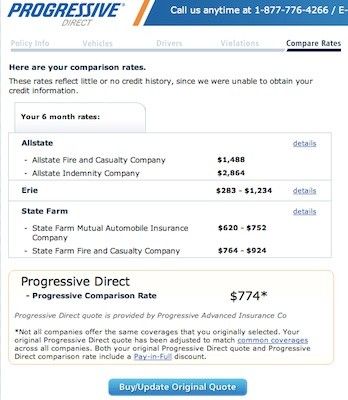

Compare Insurance Providers

Insurance rates can vary significantly between providers, so it’s essential to compare quotes from multiple companies. By obtaining quotes from at least three different insurers, you can identify the most competitive rates for your specific circumstances.

Opt for Higher Deductibles

Increasing your deductible can lead to lower insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you accept more financial responsibility in the event of an accident, which can result in reduced insurance costs.

Review Coverage Limits

Reviewing your coverage limits and adjusting them as needed can help reduce insurance costs. While it’s important to maintain adequate coverage, you may be able to lower your premiums by slightly reducing certain coverage limits, such as collision or comprehensive coverage.

Take Advantage of Discounts

Many insurance providers offer a variety of discounts that can lower your insurance premiums. Some common discounts include safe driver discounts, multi-policy discounts (bundling your auto insurance with other policies such as homeowners or renters insurance), and loyalty discounts for long-term customers.

Maintain a Clean Driving Record

Your driving record is a significant factor in determining your insurance rates. Maintaining a clean driving record by avoiding accidents and traffic violations can help keep your insurance premiums low. Additionally, some insurance companies offer discounts for completing defensive driving courses or other safe driving programs.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an option for drivers who may not drive frequently or who have safe driving habits. These programs use telematics devices to track your driving behavior, such as mileage, time of day, and driving style. If you drive less or have safer driving habits, you may be eligible for lower insurance rates.

Explore Group or Association Discounts

Certain professional associations, alumni groups, or membership organizations may offer group discounts on car insurance. These discounts can provide significant savings, so it’s worth exploring if you are a member of any such groups.

Understanding Your Insurance Policy

When shopping for car insurance in Michigan, it’s crucial to understand the different types of coverage available and how they can impact your overall insurance costs. Here’s a breakdown of the key coverage types and their importance:

Liability Coverage

Liability coverage is mandatory in Michigan and is designed to protect you financially if you are found at fault in an accident. It covers the costs associated with injuries or property damage caused to others. The minimum liability coverage limits in Michigan are 20,000 for bodily injury per person, 40,000 for bodily injury per accident, and $10,000 for property damage.

Personal Injury Protection (PIP) Coverage

As mentioned earlier, PIP coverage is a crucial component of car insurance in Michigan. It covers a wide range of expenses related to injuries sustained in an auto accident, including medical bills, lost wages, and replacement services. Michigan requires drivers to carry unlimited PIP coverage, but you can opt for a lower limit if you have other health insurance coverage.

Collision and Comprehensive Coverage

Collision coverage pays for damages to your vehicle if you are involved in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damages to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. While these coverages are optional, they are highly recommended to protect your vehicle and minimize out-of-pocket expenses.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you in the event of an accident with a driver who has no insurance or insufficient insurance to cover the costs of the accident. This coverage is especially important in Michigan, where the rate of uninsured drivers is relatively high.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, provides additional coverage for medical expenses incurred in an auto accident. It can help cover co-pays, deductibles, and other medical costs not covered by your PIP or health insurance.

Additional Coverages

Depending on your specific needs and circumstances, you may also want to consider other optional coverages, such as rental car reimbursement, gap insurance, or custom parts and equipment coverage. These coverages can provide added protection and peace of mind.

The Impact of Credit Score on Insurance Rates

In Michigan, as in many other states, your credit score can have a significant impact on your insurance rates. Insurance companies often use credit-based insurance scores to assess the risk associated with insuring a particular individual. Here’s how your credit score can affect your insurance costs:

The Role of Credit Score in Insurance Rates

Insurance companies believe that individuals with higher credit scores are less likely to file insurance claims. As a result, they may offer lower insurance rates to drivers with good credit scores. Conversely, drivers with lower credit scores may be seen as higher-risk and face higher insurance premiums.

Improving Your Credit Score for Lower Rates

If you have a lower credit score and are looking to reduce your insurance costs, improving your credit score can be a long-term strategy. Here are some tips to help boost your credit score:

- Pay your bills on time: Late payments can have a significant negative impact on your credit score. Make sure to pay your bills, including credit card and loan payments, on time each month.

- Reduce your credit card balances: High credit card balances can negatively affect your credit score. Aim to keep your credit card balances below 30% of your credit limit.

- Check your credit report for errors: Review your credit report regularly and dispute any inaccuracies you find. Errors on your credit report can lower your credit score unnecessarily.

- Consider a credit-builder loan: A credit-builder loan can help establish or rebuild your credit history. These loans typically involve borrowing a small amount of money and making regular payments until the loan is repaid.

Final Thoughts

Finding cheap car insurance in Michigan can be a complex task, but with a thorough understanding of the factors that influence insurance rates and the strategies outlined above, you can make more informed decisions. Remember to compare quotes from multiple providers, review your coverage limits and deductibles, and take advantage of any applicable discounts. Additionally, maintaining a clean driving record and keeping your credit score in good standing can also contribute to lower insurance costs over time.

Frequently Asked Questions

What is the average cost of car insurance in Michigan?

+The average cost of car insurance in Michigan is higher compared to the national average. According to recent data, the average annual premium in Michigan is around 2,500, which is significantly above the national average of approximately 1,674.

Why is car insurance so expensive in Michigan?

+The high cost of car insurance in Michigan can be attributed to several factors, including the state’s no-fault insurance system, which requires drivers to carry unlimited Personal Injury Protection (PIP) coverage. Additionally, Michigan has a higher rate of accidents and insurance claims, which can drive up insurance costs.

How can I lower my car insurance rates in Michigan?

+There are several strategies you can employ to lower your car insurance rates in Michigan. These include comparing quotes from multiple providers, opting for higher deductibles, reviewing coverage limits, taking advantage of discounts, maintaining a clean driving record, and considering usage-based insurance programs.

What factors influence car insurance rates in Michigan?

+Several factors influence car insurance rates in Michigan, including your driving record, the type of vehicle you drive, your coverage limits, and your credit score. Additionally, the state’s no-fault insurance system and high accident rates also contribute to insurance costs.

Can I bundle my car insurance with other policies to save money?

+Yes, bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings. Many insurance providers offer multi-policy discounts, so it’s worth exploring this option to reduce your overall insurance costs.