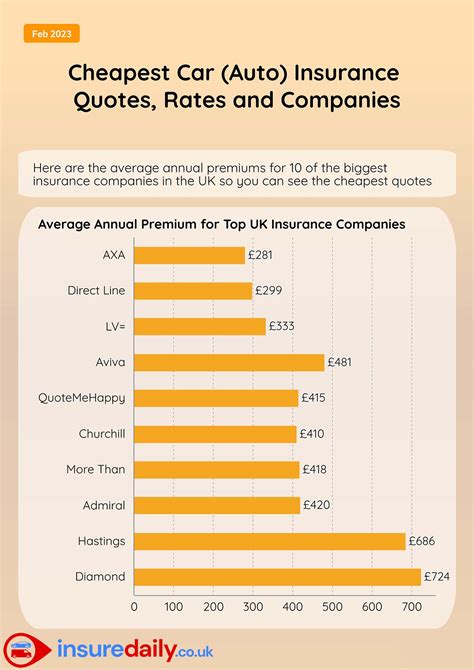

Cheap Car Motor Insurance

In today's fast-paced world, having a car is often a necessity for many people, especially those living in suburban or rural areas. However, with rising costs and the ever-increasing need for financial prudence, finding affordable car insurance can be a daunting task. This article aims to guide you through the process of securing cheap car motor insurance, offering expert insights and practical tips to help you make informed decisions while saving money.

Understanding Car Motor Insurance

Car motor insurance, also known as auto insurance or vehicle insurance, is a form of financial protection for your vehicle. It provides coverage for various risks and liabilities associated with owning and operating a motor vehicle, including damage to your car, injury to yourself or others, and theft or vandalism. Having adequate car insurance is not just a financial decision; it's a responsibility that ensures your safety and the safety of others on the road.

The cost of car insurance can vary significantly depending on several factors, such as your location, the make and model of your vehicle, your driving history, and the level of coverage you choose. This variation in cost can be a challenge, especially for those on a tight budget. However, with the right knowledge and strategy, it is possible to find affordable car insurance without compromising on essential coverage.

Factors Affecting Car Insurance Premiums

Understanding the factors that influence car insurance premiums is crucial for making informed choices. Here are some key considerations:

- Vehicle Type and Age: The make, model, and age of your vehicle play a significant role in determining insurance costs. Newer, high-performance cars or luxury vehicles often come with higher insurance premiums due to their replacement value and the cost of repairs.

- Driving History: Your driving record is a major factor. Insurers consider factors like accident claims, traffic violations, and the number of years you've been driving. A clean driving record can lead to lower premiums, while multiple claims or violations may result in higher costs.

- Location: The area where you live and park your car can impact insurance rates. Urban areas often have higher rates due to increased traffic and the risk of accidents or theft. Rural areas may offer lower rates, but it's important to note that emergency response times can also influence insurance costs.

- Coverage Options: The level of coverage you choose will directly affect your insurance premiums. Comprehensive coverage, which includes protection against damage, theft, and natural disasters, typically costs more than basic liability coverage, which only covers damage to other vehicles or property.

- Deductibles: Choosing a higher deductible (the amount you pay out of pocket before insurance coverage kicks in) can lower your monthly premiums. However, it's important to consider your financial situation and ensure you can afford the deductible in case of an accident or claim.

By understanding these factors, you can tailor your insurance choices to fit your needs and budget. It's important to strike a balance between cost and coverage, ensuring you have adequate protection without paying for unnecessary features.

Strategies for Finding Cheap Car Motor Insurance

Securing cheap car motor insurance requires a combination of research, comparison, and understanding your options. Here are some expert strategies to help you find the best deals:

Shop Around and Compare

One of the most effective ways to find cheap car insurance is to compare quotes from multiple insurers. Each insurer has its own rating system and pricing structure, so getting quotes from several companies can help you identify the most affordable option. Online comparison tools can be particularly useful for this, allowing you to quickly and easily view and compare quotes.

When comparing quotes, pay attention to the coverage details. Ensure that the policies you're comparing offer similar levels of coverage to make an accurate assessment of value. Additionally, consider the reputation and financial stability of the insurers. While cost is important, you also want to ensure you're dealing with a reputable company that will be there to support you in case of an accident or claim.

Understand Your Coverage Needs

Not all car insurance policies are created equal, and understanding your specific coverage needs is essential. Consider your vehicle's value, your driving habits, and the level of risk you're comfortable with. For example, if you have an older vehicle with low resale value, you may not need comprehensive coverage, which can save you money on premiums.

Additionally, assess your personal financial situation and determine how much coverage you can afford. Remember, the goal is to find a balance between affordable premiums and adequate protection. Consider factors like your savings, income, and the potential impact of an accident or claim on your finances.

Explore Discounts and Savings

Many insurers offer discounts and incentives to attract and retain customers. Some common discounts include:

- Multi-Policy Discounts: If you bundle your car insurance with other policies, such as home or life insurance, you may be eligible for a discount.

- Safe Driver Discounts: Insurers often reward drivers with clean records by offering discounts. This can be especially beneficial if you've had no accidents or traffic violations for a certain period.

- Pay-in-Full Discounts: Some insurers offer a discount if you pay your premium in full for the entire policy period instead of making monthly payments.

- Low Mileage Discounts: If you drive fewer miles annually, you may qualify for a low-mileage discount. This is especially beneficial for retirees, stay-at-home parents, or those who work from home.

- Loyalty Discounts: Staying with the same insurer for an extended period can result in loyalty discounts. It's worth inquiring about these discounts to ensure you're getting the best rate.

By exploring these discounts and understanding your eligibility, you can potentially reduce your insurance premiums significantly.

Improve Your Driving Record

Your driving record is a major factor in determining insurance costs. Maintaining a clean driving record can lead to lower premiums. If you have a history of accidents or violations, consider taking defensive driving courses or enrolling in safe driver programs. These courses can help improve your driving skills and may even qualify you for insurance discounts.

Additionally, be mindful of your driving habits. Avoid aggressive driving, speeding, and other risky behaviors that can lead to accidents or traffic violations. By driving safely and responsibly, you not only reduce the risk of accidents but also keep your insurance costs down.

Consider Usage-Based Insurance

Usage-based insurance, also known as telematics insurance, is a relatively new concept that uses technology to track your driving behavior. Insurers offer these policies based on your actual driving habits, which can result in significant savings for safe drivers.

With usage-based insurance, your driving is monitored through a device installed in your vehicle or an app on your smartphone. The system collects data on factors like mileage, speed, and braking habits. If your driving is considered safe, you may be eligible for lower premiums. This type of insurance is particularly beneficial for cautious drivers who want their insurance costs to reflect their safe driving practices.

Performance Analysis and Tips

Finding cheap car motor insurance requires a strategic approach and a thorough understanding of the market. Here are some additional tips and insights to help you make the most of your insurance journey:

Understand the Different Types of Coverage

Car insurance policies typically offer a range of coverage options, each with its own benefits and limitations. Understanding these options can help you make informed decisions about your coverage needs:

- Liability Coverage: This is the most basic form of car insurance, covering damages to other people's property and injuries caused by you in an accident. It's legally required in most states, but the minimum coverage limits may not be sufficient to cover all potential damages.

- Collision Coverage: This coverage pays for repairs to your vehicle if you're involved in an accident, regardless of who is at fault. It's particularly beneficial for newer or more expensive vehicles, as it can cover the cost of repairs or even the replacement of your vehicle.

- Comprehensive Coverage: This type of coverage protects against damage caused by events other than collisions, such as theft, vandalism, natural disasters, or collisions with animals. It's an important consideration if you live in an area prone to natural disasters or have a vehicle with a high replacement value.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have sufficient coverage to cover the damages. It's a valuable addition to your policy, especially in areas with a high incidence of uninsured drivers.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers after an accident, regardless of who is at fault. It's a crucial component of your insurance policy, ensuring that you're covered for medical costs resulting from an accident.

By understanding these coverage options, you can tailor your policy to your specific needs, ensuring you have the right balance of protection and affordability.

Consider Your Deductible Wisely

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly premiums, but it's important to select a deductible that you can afford in case of an accident or claim.

For example, if you have a $1,000 deductible and you're involved in an accident that causes $5,000 worth of damage, you'll pay the first $1,000, and your insurance will cover the remaining $4,000. If you choose a lower deductible, like $500, you'll pay less out of pocket in this scenario, but your monthly premiums will be higher.

It's a trade-off between upfront costs and long-term savings. Consider your financial situation and the likelihood of an accident when deciding on your deductible. If you're a safe driver and don't anticipate frequent claims, a higher deductible can be a cost-effective choice.

Bundle Your Policies

If you have multiple insurance needs, such as car, home, or renters insurance, consider bundling your policies with the same insurer. Many insurers offer multi-policy discounts, which can significantly reduce your overall insurance costs.

For example, if you have a home insurance policy with an insurer and also need car insurance, you may be eligible for a discount on your car insurance by bundling the two policies. This not only saves you money but also simplifies your insurance management, as you'll have a single insurer to deal with for all your coverage needs.

Maintain a Good Credit Score

Believe it or not, your credit score can impact your car insurance rates. Insurers often use credit-based insurance scores to assess your financial responsibility and predict your likelihood of filing claims. A higher credit score can lead to lower insurance premiums, as it indicates a lower risk to the insurer.

If you have a low credit score, improving it can potentially result in lower insurance costs. Focus on paying your bills on time, reducing your debt, and maintaining a healthy credit history. While improving your credit score takes time and effort, it can have positive impacts on various aspects of your financial life, including insurance costs.

Explore Group or Association Discounts

Many insurers offer discounts to members of specific groups or associations. These can include professional organizations, alumni associations, or even certain employee groups. If you're a member of such a group, inquire about potential insurance discounts. You may be eligible for significant savings on your car insurance policy.

For example, if you're a member of a professional association related to your occupation, such as a teachers' association or a medical society, you may find that insurers offer discounted rates to members. It's always worth exploring these options to see if you can take advantage of group discounts.

Review Your Policy Regularly

Insurance needs and costs can change over time. It's important to review your car insurance policy periodically, especially after significant life events or changes in your circumstances. For instance, if you've recently purchased a new car, gotten married, or moved to a new location, your insurance needs and costs may have shifted.

Regular policy reviews allow you to ensure you have the right coverage and that you're not paying for unnecessary features. It's also an opportunity to explore new discounts or coverage options that may have become available. By staying informed and proactive, you can make adjustments to your policy as needed, keeping your insurance costs optimized.

Evidence-Based Future Implications

As the insurance industry continues to evolve, several trends and developments are shaping the future of car motor insurance. Here's a look at some key implications that could impact your insurance journey in the coming years:

Autonomous Vehicles and Safety Technologies

The rise of autonomous vehicles and advanced safety technologies is expected to significantly reduce the number of accidents on the road. With features like collision avoidance systems, lane departure warnings, and automatic emergency braking becoming standard in many new vehicles, the risk of accidents is expected to decline.

This reduction in accidents could lead to lower insurance costs over time. Insurers may adjust their premiums to reflect the decreased risk, offering more affordable rates to policyholders. Additionally, as autonomous vehicles become more prevalent, the insurance industry may need to adapt its policies and coverage to accommodate these new technologies.

Telematics and Usage-Based Insurance

Usage-based insurance, or telematics, is gaining popularity as a way to offer personalized insurance rates based on an individual's driving behavior. This technology allows insurers to track factors like mileage, speed, and braking habits, rewarding safe drivers with lower premiums.

As this technology becomes more advanced and widespread, it's likely to play an even bigger role in insurance pricing. Safe drivers may see significant savings, while those with risky driving habits may face higher premiums. This shift towards usage-based insurance could encourage safer driving practices and lead to a more personalized insurance experience.

Digitalization and Online Insurance

The insurance industry is increasingly embracing digitalization, with many insurers offering online policy management and claim processes. This shift towards online insurance not only provides convenience for policyholders but also reduces administrative costs for insurers.

As more insurers adopt digital platforms, it's likely that online insurance will become even more accessible and cost-effective. Policyholders can expect streamlined processes, easier comparisons, and potentially lower premiums as insurers pass on some of the cost savings from digital operations.

Regulatory Changes and Industry Standards

The insurance industry is subject to various regulations and standards, and changes in these regulations can impact insurance costs and coverage. For example, changes in state laws regarding mandatory coverage or the introduction of new safety standards for vehicles could influence insurance policies and premiums.

It's important to stay informed about regulatory changes that may affect your insurance. Understanding these changes can help you make informed decisions about your coverage and ensure you're compliant with any new requirements.

Emerging Technologies and Risk Assessment

Advancements in technology are also shaping the way insurers assess risk. For instance, the use of big data analytics and artificial intelligence can help insurers more accurately predict and manage risks, potentially leading to more precise pricing and coverage options.

As these technologies continue to evolve, insurers may be able to offer more tailored and affordable insurance policies. Policyholders can benefit from more accurate risk assessments, which could result in lower premiums for those who present a lower risk to the insurer.

FAQ

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies widely based on factors like location, driving record, and coverage options. According to recent data, the national average annual premium for car insurance is around 1,674, but this can range from under 1,000 in some states to over $2,000 in others.

Can I get car insurance if I have a poor credit score?

+Yes, you can still obtain car insurance with a poor credit score, but it may result in higher premiums. Insurers often use credit-based insurance scores to assess financial responsibility, so a lower credit score may indicate a higher risk to the insurer. However, shopping around and comparing quotes can help you find more affordable options.

Are there any car insurance companies that specialize in providing cheap insurance for young drivers?

+While it can be challenging for young drivers to find affordable car insurance due to their lack of driving experience, there are insurers that cater specifically to this demographic. These companies may offer discounts for good grades, driver training courses, or even telematics-based insurance policies that reward