Cheap Insurance Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other unforeseen events. While it is crucial to have adequate coverage, many drivers are often concerned about the cost of insurance policies. In this comprehensive guide, we will explore the world of cheap car insurance, uncovering the factors that influence pricing, strategies to reduce premiums, and the trade-offs one might encounter when opting for a more affordable policy.

Understanding the Factors that Affect Car Insurance Costs

The price of car insurance is influenced by a multitude of factors, each playing a significant role in determining the overall cost. These factors can be broadly categorized into personal, vehicle-related, and geographical aspects. Let’s delve into each category to gain a deeper understanding.

Personal Factors

Insurance providers consider an individual’s personal characteristics when calculating premiums. Some key personal factors include:

- Age and Gender: Younger drivers, especially males, often face higher insurance rates due to their perceived higher risk of accidents. As individuals age, their insurance rates generally decrease.

- Driving Record: A clean driving record with no accidents or violations can lead to lower premiums. On the other hand, a history of accidents or traffic violations may result in higher insurance costs.

- Credit Score: Believe it or not, your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, with higher scores often resulting in lower premiums.

- Marital Status: Married individuals are often considered less risky and may enjoy slightly lower insurance rates compared to single drivers.

Vehicle-Related Factors

The type of vehicle you drive and its specifications can also influence insurance costs. Here are some key vehicle-related factors:

- Vehicle Make and Model: Some car models are statistically more prone to accidents or theft, leading to higher insurance premiums. Luxury vehicles and sports cars, for instance, often attract higher insurance costs.

- Vehicle Age and Condition: Older vehicles with higher mileage may have lower insurance costs compared to newer models. However, the condition of the vehicle also plays a role, as well-maintained cars might be eligible for better rates.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems may qualify for discounts, as these features reduce the risk of accidents and injuries.

- Usage: How you use your vehicle also matters. Drivers who use their cars for commuting to work or long-distance travel may pay higher premiums compared to those who primarily use their vehicles for local errands.

Geographical Factors

Where you live and drive can significantly impact your insurance costs. Geographical factors considered by insurance providers include:

- Location: Urban areas often have higher insurance rates compared to rural regions due to increased traffic, congestion, and higher risks of accidents and theft.

- Weather and Road Conditions: Regions prone to severe weather conditions like hurricanes, tornadoes, or heavy snowfall may have higher insurance rates. Poor road conditions and frequent accidents can also influence insurance costs.

- Theft and Crime Rates: Areas with higher rates of vehicle theft or crime may result in increased insurance premiums to cover the risk.

Strategies to Find Cheap Car Insurance

Now that we understand the factors influencing car insurance costs, let’s explore some strategies to secure cheap car insurance without compromising on essential coverage.

Shop Around and Compare Quotes

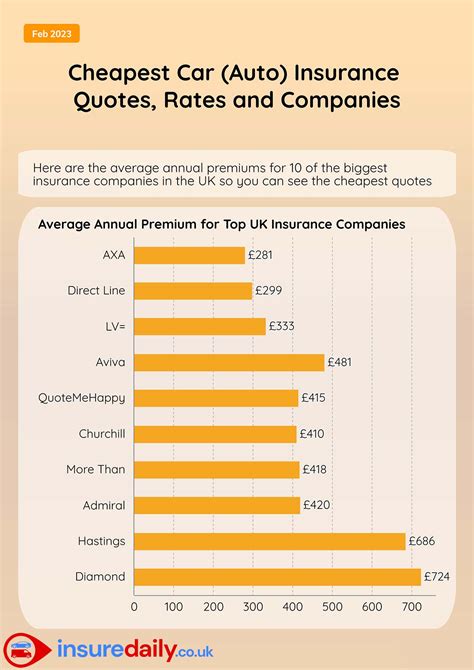

One of the most effective ways to find cheap car insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, even for the same level of coverage. Use online tools and insurance comparison websites to gather quotes from various insurers. Make sure to compare not only the price but also the coverage details to ensure you’re getting the best value.

Understand Your Coverage Needs

Before purchasing insurance, it’s crucial to understand your specific coverage needs. Assess your financial situation and determine the level of coverage that is right for you. While it may be tempting to opt for the cheapest option, ensure that the policy provides adequate protection for your vehicle and your liabilities. Consider factors like the value of your car, the risk of accidents in your area, and your personal financial ability to cover potential costs.

Explore Discounts and Special Programs

Many insurance companies offer discounts and special programs to attract and retain customers. These discounts can significantly reduce your insurance premiums. Some common discounts include:

- Safe Driver Discount: If you have a clean driving record, you may be eligible for a safe driver discount. This discount rewards drivers who have avoided accidents and violations for a certain period.

- Multi-Policy Discount: Insurers often provide discounts when you bundle multiple policies, such as car insurance with home or renters’ insurance.

- Loyalty Discount: Some companies offer loyalty discounts to long-term customers who have maintained their policies without interruptions.

- Student Discounts: If you’re a student or have a young driver in your household, inquire about student discounts. Many insurers offer reduced rates for good grades or driver training programs.

- Safety Feature Discounts: As mentioned earlier, vehicles equipped with advanced safety features may qualify for discounts. Check with your insurer to see if they offer such incentives.

Consider Higher Deductibles

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can significantly reduce your insurance premiums. However, it’s important to select a deductible amount that you can afford to pay in the event of a claim. While a higher deductible means lower monthly premiums, it also means you’ll have to pay more out of pocket if you need to make a claim.

Maintain a Good Driving Record

Your driving record plays a significant role in determining your insurance rates. Maintaining a clean driving record by avoiding accidents and traffic violations can lead to lower premiums over time. Insurance companies often reward safe drivers with reduced rates, so it’s important to practice defensive driving and adhere to traffic laws.

Choose a Suitable Coverage Level

While it’s tempting to opt for the cheapest insurance option, it’s essential to choose a coverage level that aligns with your needs. Consider the value of your vehicle, your personal liability, and the potential risks you may face on the road. Insufficient coverage can leave you financially vulnerable in the event of an accident or other unforeseen circumstances. Assess your specific circumstances and select a policy that provides adequate protection without breaking the bank.

The Trade-Offs of Cheap Car Insurance

While seeking cheap car insurance is a prudent financial decision, it’s important to be aware of the potential trade-offs and limitations associated with lower-cost policies. Here are some key considerations:

Limited Coverage

Cheap insurance policies often come with limited coverage options. This means that in the event of an accident or other insured event, you may not receive the same level of financial protection as you would with a more comprehensive policy. It’s crucial to carefully review the coverage limits and exclusions in your policy to understand what is and isn’t covered.

Higher Deductibles and Out-of-Pocket Costs

As mentioned earlier, choosing a higher deductible can reduce your insurance premiums. However, this also means that you’ll have to pay more out of pocket if you need to make a claim. In the event of an accident or other insured event, you’ll be responsible for paying the agreed-upon deductible amount before your insurance coverage takes effect. Consider whether you have the financial means to cover these costs before opting for a policy with a high deductible.

Restricted Policy Features and Add-Ons

Cheap insurance policies may have fewer policy features and add-ons compared to more expensive options. This can include limitations on rental car coverage, roadside assistance, or other optional benefits. While these features may not be essential for everyone, they can provide valuable peace of mind and additional protection in certain situations. Assess your specific needs and priorities to determine whether these add-ons are worth the extra cost.

Potential for Increased Premiums Over Time

While cheap insurance policies may offer attractive initial rates, it’s important to consider the potential for premium increases over time. Insurance companies regularly review and adjust their rates based on various factors, including claim frequency, inflation, and changing market conditions. As a result, your insurance premiums may increase in subsequent years, even if you maintain a clean driving record. Be prepared for potential rate adjustments and factor them into your long-term insurance planning.

Conclusion: Balancing Cost and Coverage

Finding cheap car insurance is a balancing act between cost and coverage. While it’s tempting to opt for the lowest premium, it’s crucial to ensure that you have adequate protection for your vehicle and liabilities. By understanding the factors that influence insurance costs and employing strategic approaches to reduce premiums, you can secure affordable coverage without compromising on essential safeguards.

Remember, the goal is to find a policy that provides the right balance of coverage and cost, ensuring you’re financially protected while also managing your insurance expenses effectively. Stay informed, compare quotes, and make informed decisions to navigate the world of car insurance with confidence and peace of mind.

Can I find cheap car insurance with a bad driving record?

+Yes, it is possible to find affordable car insurance even with a less-than-perfect driving record. While a bad driving record may lead to higher premiums, there are still options to reduce costs. Consider shopping around for quotes from multiple insurers, as rates can vary significantly. Additionally, explore specialized programs or insurers that cater to high-risk drivers. Some companies offer accident forgiveness or other incentives to help offset the impact of a poor driving history. It’s important to be transparent about your record when obtaining quotes to ensure accurate pricing.

Are there any disadvantages to choosing a higher deductible?

+Choosing a higher deductible can indeed have some drawbacks. While it may lead to lower monthly premiums, it also means you’ll have to pay a larger amount out of pocket in the event of a claim. This can be a financial burden if you’re not prepared for it. Additionally, some insurance companies may require a higher deductible for certain coverage types, which may not be suitable for everyone. It’s essential to carefully assess your financial situation and consider the potential risks before opting for a higher deductible.

How often should I review my car insurance policy?

+It’s a good practice to review your car insurance policy at least once a year. Insurance rates and coverage options can change, and your personal circumstances may also evolve. By regularly reviewing your policy, you can ensure that you’re still getting the best value and that your coverage aligns with your current needs. Additionally, insurance companies may offer new discounts or programs that you can take advantage of. Staying informed and proactive can help you optimize your insurance coverage and potentially save money.