Cheap Insurance For Apartments

Securing affordable insurance coverage for your apartment is an essential aspect of protecting your home and possessions. In this comprehensive guide, we delve into the world of apartment insurance, offering expert insights and strategies to help you find the best and most cost-effective coverage tailored to your needs.

Understanding Apartment Insurance

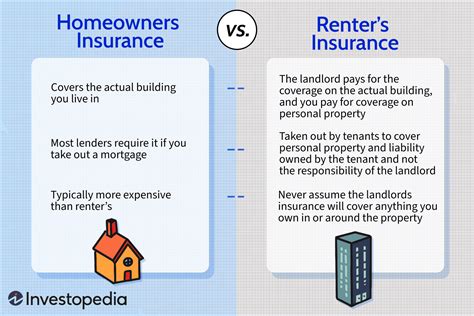

Apartment insurance, also known as renters insurance, is a specialized form of coverage designed specifically for individuals who rent their living space. Unlike homeowners insurance, which caters to property owners, renters insurance focuses on safeguarding your personal belongings and providing liability protection while occupying a rental unit.

The primary purpose of apartment insurance is to offer financial protection against various risks and unforeseen events that could occur within your rental home. These risks include property damage, theft, liability claims, and even medical expenses resulting from accidents that take place within your apartment.

Key Components of Apartment Insurance

To ensure you obtain the right coverage, it’s crucial to understand the key components of apartment insurance policies. Here’s a breakdown of the essential elements:

Personal Property Coverage

This aspect of your policy provides protection for your personal belongings, such as furniture, electronics, clothing, and other valuables. It ensures that if your possessions are damaged, lost, or stolen, you can receive compensation to replace or repair them.

When assessing your personal property coverage, consider the replacement cost of your items. This is especially important if you own expensive electronics, artwork, or other high-value items. You can typically choose the coverage limit that aligns with the total value of your possessions.

Liability Protection

Liability coverage is a vital component of apartment insurance, as it safeguards you against potential legal and financial consequences arising from accidents or injuries that occur within your rental unit.

For instance, if a guest slips and falls in your apartment, causing injury, your liability coverage would step in to cover any medical expenses or legal fees associated with the incident. This protection extends to situations where you might be held responsible for property damage caused to others, ensuring you're not left financially burdened.

Additional Living Expenses

In the event that your apartment becomes uninhabitable due to a covered peril, such as a fire or severe storm damage, your apartment insurance policy may include additional living expenses coverage.

This coverage provides reimbursement for temporary housing, meals, and other necessary expenses incurred while you're unable to reside in your apartment. It ensures that you can maintain your standard of living during the restoration process, offering peace of mind during a challenging time.

Loss of Use Coverage

Similar to additional living expenses, loss of use coverage compensates you for the inconvenience and financial losses incurred when you’re unable to access your rental unit due to a covered event.

For example, if your apartment is damaged by a burst pipe and you need to vacate the premises while repairs are underway, loss of use coverage can reimburse you for the rent you continue to pay during this period, ensuring you're not left paying for a space you cannot occupy.

Factors Influencing Apartment Insurance Costs

The cost of apartment insurance can vary significantly based on several factors. Understanding these factors can help you make informed decisions when shopping for coverage and potentially save on your premiums.

Location and Crime Rates

The location of your apartment plays a significant role in determining your insurance rates. Areas with higher crime rates or a history of frequent natural disasters may result in higher premiums due to the increased risk of theft, vandalism, or property damage.

Researching the crime statistics and disaster history of your neighborhood can provide valuable insights into potential risks and help you anticipate the associated costs.

Deductibles and Coverage Limits

Your chosen deductibles and coverage limits can significantly impact your insurance premiums. Opting for a higher deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can lead to lower monthly premiums.

However, it's essential to strike a balance between affordability and adequate protection. A higher deductible may save you money in the short term, but it could result in a larger financial burden if you need to file a claim.

Discounts and Bundling

Insurance providers often offer discounts to policyholders who take certain safety precautions or bundle multiple insurance policies together. Common discounts include:

- Safety Discounts: These are offered for installing security systems, smoke detectors, or other safety measures in your apartment.

- Multi-Policy Discounts: By bundling your apartment insurance with other policies, such as auto insurance, you may qualify for significant savings.

- Loyalty Discounts: Some insurers reward long-term customers with loyalty discounts, encouraging policyholders to maintain their coverage over time.

Comparing Quotes and Choosing the Right Provider

When shopping for apartment insurance, it’s crucial to compare quotes from multiple providers to ensure you’re getting the best coverage at the most competitive price.

Online Quote Comparison Tools

Utilizing online quote comparison tools can streamline the process and provide a quick overview of various insurance options. These tools allow you to input your details and receive multiple quotes from different insurers, making it easier to identify the most cost-effective coverage.

However, it's essential to carefully review the coverage details and policy terms to ensure you're comparing apples to apples. Pay close attention to the coverage limits, deductibles, and any exclusions or limitations outlined in the policy.

Working with an Insurance Broker

An insurance broker can be a valuable asset when navigating the complex world of apartment insurance. Brokers have extensive knowledge of the industry and can provide personalized recommendations based on your specific needs and circumstances.

They can shop around on your behalf, negotiating with multiple insurers to secure the best coverage and rates. Additionally, brokers can offer ongoing support and guidance, ensuring you have the necessary protection as your needs evolve over time.

Maximizing Your Savings

Apart from comparing quotes and utilizing discounts, there are additional strategies you can employ to maximize your savings on apartment insurance:

Review Your Policy Annually

Insurance policies and rates can change over time. Conducting an annual review of your apartment insurance policy can help you identify potential savings opportunities or areas where you may need to adjust your coverage.

During your review, consider your changing circumstances, such as acquiring new possessions or experiencing life events that may impact your insurance needs. By staying proactive, you can ensure your coverage remains up-to-date and cost-effective.

Increase Your Deductible

As mentioned earlier, increasing your deductible can lead to lower premiums. However, it’s crucial to ensure that you can afford the increased deductible in the event of a claim. Assess your financial situation and choose a deductible that aligns with your comfort level and ability to pay.

Bundle Your Policies

Bundling your apartment insurance with other policies, such as auto insurance or homeowners insurance (if you own other properties), can result in significant savings. Most insurance providers offer multi-policy discounts, so combining your coverage can be a cost-effective strategy.

Practice Preventive Measures

Implementing preventive measures to reduce the risk of accidents or damage in your apartment can not only enhance your safety but also lower your insurance premiums.

For instance, installing smoke detectors, maintaining your plumbing system to prevent leaks, and regularly inspecting your appliances can all contribute to a safer living environment and potentially lower your insurance costs.

Filing an Apartment Insurance Claim

Should the unfortunate event of a covered loss occur, knowing how to navigate the claims process is essential. Here’s a step-by-step guide to filing an apartment insurance claim:

- Contact Your Insurance Provider: Immediately notify your insurance company or agent about the incident. Provide as much detail as possible, including the date, time, and circumstances of the loss.

- Document the Damage: Take photos or videos of the damage and any affected personal belongings. These visual records can serve as valuable evidence when filing your claim.

- Create an Inventory: Compile a detailed list of damaged or lost items, including their brand, model, purchase date, and original value. This inventory will help assess the extent of your loss and determine the appropriate compensation.

- Review Your Policy: Familiarize yourself with your apartment insurance policy to understand the coverage limits, deductibles, and any exclusions or limitations. This knowledge will help you manage your expectations and ensure a smooth claims process.

- Submit Your Claim: Follow the instructions provided by your insurance company to submit your claim. This typically involves filling out a claim form and providing supporting documentation, such as receipts or repair estimates.

- Cooperate with the Adjuster: Your insurance provider will assign an adjuster to investigate and assess your claim. Cooperate fully with the adjuster, providing any additional information or documentation they may request. Their role is to evaluate the extent of the loss and determine the appropriate compensation.

- Receive Your Settlement: Once the adjuster has completed their assessment, you will receive a settlement offer. Carefully review the offer to ensure it aligns with your expectations and covers the full extent of your loss. If you disagree with the settlement, you can negotiate or seek further assistance from your insurance provider or an insurance advocate.

Future Outlook and Industry Trends

The apartment insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Here are some key trends and insights to consider:

Digitalization and Online Services

The insurance industry is embracing digitalization, with many providers offering online platforms and mobile apps for policy management, claim submissions, and communication. This trend enhances convenience and accessibility, allowing renters to access their insurance information and file claims more efficiently.

Personalized Coverage Options

Insurance providers are increasingly recognizing the diverse needs of renters and offering personalized coverage options. From specialized coverage for high-value items to flexible policy terms, insurers are tailoring their offerings to cater to a wider range of rental scenarios.

Data-Driven Risk Assessment

Advanced data analytics and risk assessment tools are transforming the way insurance companies evaluate risks and determine premiums. By leveraging data-driven insights, insurers can more accurately assess the likelihood of losses and offer competitive rates based on individual risk profiles.

Collaborative Partnerships

Insurers are forming partnerships with technology companies and property management firms to enhance risk mitigation and provide better services to renters. These collaborations can result in innovative solutions, such as integrated smart home systems that improve safety and security while potentially reducing insurance costs.

Conclusion

Securing cheap insurance for your apartment is not only possible but also essential for safeguarding your financial well-being. By understanding the key components of apartment insurance, comparing quotes, and implementing cost-saving strategies, you can find the right coverage at a price that fits your budget.

Stay proactive, review your policy regularly, and take advantage of discounts and bundling opportunities. With the right apartment insurance, you can enjoy peace of mind knowing that your home and possessions are protected, even in the face of unforeseen events.

What is the average cost of apartment insurance per month?

+The average monthly cost of apartment insurance can vary widely depending on factors such as location, coverage limits, and deductibles. However, as a general guideline, you can expect to pay anywhere from 15 to 30 per month for basic renters insurance. It’s important to note that premiums can be higher or lower based on your specific circumstances and the level of coverage you choose.

Does apartment insurance cover damage caused by roommates?

+Yes, apartment insurance typically provides coverage for damage caused by roommates or other individuals residing in your rental unit. This coverage extends to situations where a roommate’s actions result in property damage or personal liability claims. However, it’s crucial to review your policy’s specific terms and conditions to understand any exclusions or limitations that may apply.

Can I bundle my apartment insurance with other policies to save money?

+Absolutely! Bundling your apartment insurance with other policies, such as auto insurance or homeowners insurance, can result in significant savings. Many insurance providers offer multi-policy discounts, allowing you to consolidate your coverage and enjoy lower premiums. It’s a cost-effective strategy to consider when managing your insurance needs.