Cheap Insurance For Auto

Finding affordable and reliable auto insurance is a priority for many vehicle owners. With the right coverage, drivers can protect themselves financially in the event of an accident, theft, or other unforeseen circumstances. In this comprehensive guide, we will delve into the world of cheap auto insurance, exploring the factors that influence rates, the best practices for securing the most cost-effective policies, and the options available to those seeking affordable coverage.

Understanding Cheap Auto Insurance

Cheap auto insurance is a relative term, as what may be considered affordable for one driver might not be for another. The cost of insurance can vary significantly based on individual circumstances and the coverage needed. However, generally speaking, cheap auto insurance refers to policies that offer adequate coverage at a price that aligns with the driver’s budget and financial capabilities.

It's important to note that opting for the cheapest insurance option available may not always be the best choice. While cost is a significant factor, it should not be the sole consideration. Drivers must ensure they have sufficient coverage to protect themselves and their assets adequately. Balancing cost and coverage is crucial to finding the right insurance solution.

Factors Influencing Auto Insurance Rates

Auto insurance rates are determined by a complex interplay of factors, including personal details, vehicle characteristics, and driving history. Understanding these factors can help drivers make informed decisions when shopping for cheap insurance.

Personal Factors

- Age and Gender: Younger drivers, especially males, often face higher insurance premiums due to their perceived risk level. However, rates can decrease as drivers gain experience and reach a certain age bracket.

- Marital Status: Married individuals may benefit from lower insurance rates, as they are statistically associated with lower risk profiles.

- Credit Score: Surprisingly, insurance companies often consider credit scores when determining rates. A higher credit score can lead to more affordable insurance options.

- Driving Record: A clean driving record with no accidents or violations is a significant factor in obtaining cheap insurance. Insurance companies view drivers with a history of safe driving as lower risk.

Vehicle Factors

- Vehicle Make and Model: Certain vehicle types are more expensive to insure due to factors like repair costs, theft frequency, and safety ratings. Sports cars and luxury vehicles, for instance, often have higher insurance premiums.

- Vehicle Age: Older vehicles may be cheaper to insure as they typically have lower repair and replacement costs.

- Vehicle Usage: How a vehicle is used can impact insurance rates. Vehicles used for business purposes or frequent long-distance travel may attract higher premiums.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, air bags, and collision avoidance systems may qualify for insurance discounts.

Geographic Factors

The region where a driver resides and operates their vehicle can significantly influence insurance rates. Factors such as traffic density, crime rates, and weather conditions can impact the cost of insurance.

Insurance Coverage Options

The type and level of coverage chosen also play a vital role in determining insurance rates. Different states have varying minimum coverage requirements, but drivers should consider their specific needs and risks when selecting coverage.

Strategies for Securing Cheap Auto Insurance

There are several strategies and best practices that drivers can employ to increase their chances of securing cheap auto insurance:

Shop Around and Compare

One of the most effective ways to find cheap insurance is to compare quotes from multiple providers. Each insurance company uses its own formula to calculate rates, so quotes can vary significantly. By shopping around, drivers can identify the most competitive options available to them.

Bundle Policies

Bundling multiple insurance policies, such as auto and home insurance, can often lead to substantial discounts. Many insurance companies offer package deals or multi-policy discounts, making it more cost-effective to manage multiple policies with a single provider.

Increase Deductibles

Choosing a higher deductible can reduce insurance premiums. A deductible is the amount the driver pays out of pocket before the insurance coverage kicks in. By agreeing to pay a higher deductible, drivers can lower their monthly insurance costs.

Maintain a Clean Driving Record

A clean driving record is one of the most significant factors in securing cheap insurance. Avoiding accidents, violations, and claims can lead to substantial savings over time. Insurance companies reward safe drivers with lower premiums, so it’s crucial to practice defensive driving and maintain a clean record.

Explore Discounts

Insurance companies offer a variety of discounts to attract customers and reward safe driving. Some common discounts include:

- Safe Driver Discounts: For drivers with a clean record and no accidents or violations.

- Good Student Discounts: Available to students who maintain a certain GPA or honor roll status.

- Loyalty Discounts: Offered to long-term customers who have been with the same insurer for an extended period.

- Low Mileage Discounts: For drivers who don't use their vehicles frequently or for long distances.

- Safety Feature Discounts: Given to drivers with vehicles equipped with advanced safety features.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative option that allows drivers to pay insurance premiums based on their actual driving behavior. This type of insurance uses telematics devices to track driving habits, rewarding safe drivers with lower rates.

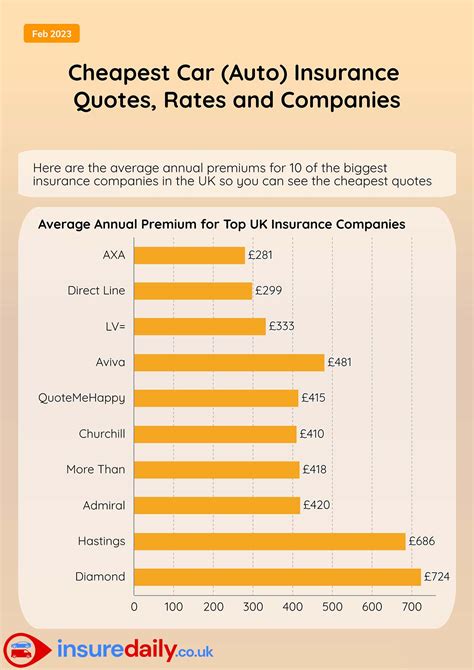

Cheap Insurance Options

There are several insurance providers that specialize in offering affordable coverage to drivers. While the specific options available may vary by region, some of the most well-known providers of cheap auto insurance include:

- Geico: Geico is known for its competitive rates and extensive discounts, making it a popular choice for budget-conscious drivers.

- State Farm: State Farm offers a range of coverage options and discounts, catering to a wide variety of drivers.

- Progressive: Progressive provides customizable coverage and innovative options like usage-based insurance.

- Esurance: Esurance offers online convenience and competitive rates, making it a preferred choice for tech-savvy drivers.

- Allstate: Allstate provides a comprehensive range of coverage options and has a strong reputation for customer service.

The Future of Cheap Auto Insurance

The auto insurance industry is continuously evolving, and the future of cheap insurance looks promising. With advancements in technology and a growing focus on data-driven decisions, insurance providers are better equipped to assess risk and offer more accurate and affordable coverage.

Telematics and usage-based insurance are expected to play a more significant role in the future, providing drivers with greater control over their insurance costs. Additionally, the rise of autonomous vehicles and advanced safety features is likely to impact insurance rates and coverage requirements in the coming years.

Conclusion

Finding cheap auto insurance is a balance between cost and coverage. By understanding the factors that influence rates and employing strategic approaches, drivers can secure affordable insurance that meets their needs. With a competitive market and innovative options, there are more opportunities than ever to find cost-effective coverage.

As the auto insurance landscape continues to evolve, drivers can expect increased transparency, personalized coverage options, and more affordable rates. Staying informed and exploring the available options is key to making the most of these advancements and securing the best insurance deals.

How often should I shop for new insurance quotes?

+

It’s generally recommended to shop for new insurance quotes annually or anytime your circumstances change significantly. Insurance rates can fluctuate, and you may find better deals with different providers over time.

Can I get insurance for a classic car at an affordable rate?

+

Yes, there are specialty insurance providers who offer affordable coverage for classic and vintage cars. These policies typically consider the vehicle’s value and usage differently, making them more cost-effective for classic car owners.

What is the difference between liability and comprehensive insurance?

+

Liability insurance covers damages you cause to others’ property or injuries you cause to others. Comprehensive insurance, on the other hand, covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.