Cheap Insurance Quotes Online

In today's digital age, obtaining cheap insurance quotes online has become an increasingly popular and convenient way for individuals to explore their coverage options. With just a few clicks, one can compare various insurance policies, tailor them to their specific needs, and potentially save a significant amount of money. This article aims to delve into the world of online insurance quotes, providing an in-depth analysis of how to navigate this process effectively, the benefits it offers, and the key considerations to make when seeking affordable insurance coverage.

Unraveling the Process: How to Get Cheap Insurance Quotes Online

Securing cheap insurance quotes online is a straightforward process that begins with a thorough understanding of your insurance needs. This involves assessing your current coverage, identifying any gaps, and determining the level of protection you require. Once you have a clear idea of your insurance needs, you can proceed to explore online platforms that offer quote comparison services.

These platforms typically request basic information about you, your vehicle (if it's auto insurance), or your property (for home insurance). This information includes personal details like your name, age, and address, as well as specific details about the item being insured. For instance, when getting auto insurance quotes, you might be asked about the make and model of your vehicle, its year of manufacture, and the average number of miles you drive annually.

After providing this information, the platform will generate a list of insurance quotes from various providers. These quotes will often come with a breakdown of coverage, deductibles, and premiums, allowing you to compare different policies side by side. It's important to note that the accuracy of these quotes relies heavily on the information you provide, so it's crucial to be as precise and honest as possible.

One of the key advantages of online insurance quotes is the ability to tailor your coverage. Many platforms offer interactive tools that allow you to adjust variables like deductibles, coverage limits, and additional endorsements. This level of customization ensures that you can find a policy that not only meets your needs but also fits within your budget.

Tips for an Efficient Online Quote Process

- Have Your Information Ready: Before starting the quote process, gather all the necessary details about yourself and the item you wish to insure. This will make the process quicker and more accurate.

- Compare Multiple Quotes: Don't settle for the first quote you receive. Compare quotes from several providers to ensure you're getting the best deal.

- Understand the Coverage: Read through the fine print of each quote to understand the coverage, exclusions, and any additional benefits or perks offered.

- Consider Bundling: If you're in the market for multiple types of insurance (e.g., auto and home), consider bundling them with the same provider. This can often lead to significant savings.

The Benefits of Online Insurance Quotes

Online insurance quotes offer a multitude of advantages over traditional methods of obtaining insurance. Here's a closer look at some of the key benefits:

Convenience and Accessibility

One of the most significant advantages of online insurance quotes is the convenience they offer. You can access these platforms at any time, from the comfort of your home, without the need for appointments or physical visits to insurance offices. This accessibility is particularly beneficial for individuals with busy schedules or those who live in remote areas.

Quick Comparison

Online quote platforms provide an efficient way to compare multiple insurance policies side by side. This feature allows you to quickly identify the best value for your money, ensuring you're not overpaying for coverage.

Personalization and Flexibility

As mentioned earlier, online insurance quotes often come with tools that allow you to customize your coverage. This level of flexibility ensures that you can find a policy that perfectly suits your needs, whether you're looking for extensive coverage or a more budget-friendly option.

Potential for Significant Savings

By comparing quotes online, you can identify the most competitive rates and potentially save a substantial amount on your insurance premiums. This is especially true if you take advantage of discounts offered by various providers, such as those for safe driving records, multi-policy bundles, or loyalty rewards.

| Discount Type | Description |

|---|---|

| Safe Driver Discount | Applies to individuals with clean driving records, free of accidents or violations. |

| Multi-Policy Discount | Offers reduced rates when you bundle multiple insurance policies with the same provider. |

| Loyalty Discount | Rewards long-term customers with reduced premiums over time. |

Key Considerations for Affordable Insurance

While online insurance quotes offer a convenient way to explore coverage options, there are several considerations to keep in mind to ensure you're getting the best deal:

Assessing Your Needs

Before seeking quotes, it's essential to understand your insurance needs. Consider factors like your risk tolerance, the value of the items you're insuring, and any specific coverage requirements. For instance, if you have valuable possessions, you might need additional coverage beyond a standard policy.

Understanding Coverage Limitations

While it's tempting to choose the cheapest option, it's crucial to understand the limitations of such policies. Some providers may offer low premiums by limiting coverage or increasing deductibles. Ensure you read the fine print to understand what's included and excluded from your policy.

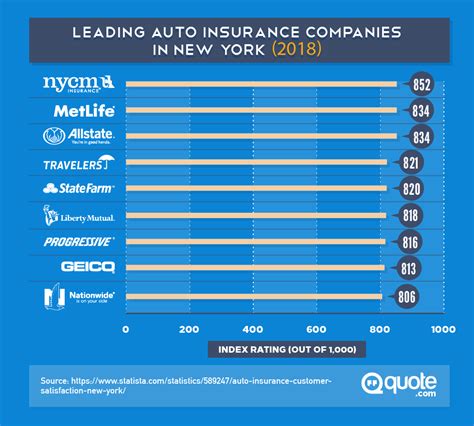

Researching Provider Reputation

In addition to price, it's important to research the reputation and financial stability of the insurance providers you're considering. This ensures that you're not only getting a good deal but also dealing with a reputable company that will be there to support you in the event of a claim.

Regularly Reviewing and Adjusting Your Coverage

Your insurance needs can change over time, so it's beneficial to regularly review your policies. This allows you to adjust your coverage as necessary, ensuring you always have the right amount of protection without overpaying.

💡 Expert Insight: Don't be afraid to negotiate with your insurance provider. Many companies are willing to work with loyal customers to provide the best rates and coverage possible.

The Future of Insurance Quotes: Digital Innovation

The world of insurance is rapidly evolving, driven by digital innovation and changing consumer preferences. Here’s a glimpse into how technology is shaping the future of insurance quotes:

AI-Driven Personalization

Artificial Intelligence (AI) is being increasingly utilized to provide personalized insurance quotes. By analyzing vast amounts of data, AI algorithms can offer tailored recommendations based on an individual’s unique circumstances, potentially leading to more accurate and affordable coverage.

Telematics and Usage-Based Insurance

Telematics technology is transforming the way auto insurance is priced. By installing devices in vehicles that track driving behavior, insurance companies can offer usage-based insurance policies. These policies reward safe driving habits with lower premiums, providing an incentive for safer roads and potentially significant savings for responsible drivers.

Blockchain for Secure and Transparent Transactions

Blockchain technology is set to revolutionize the insurance industry by enhancing security and transparency. By using blockchain, insurance providers can securely store and share customer data, ensuring privacy and trust. Additionally, smart contracts built on blockchain can automate certain insurance processes, such as claims processing, making the entire experience faster and more efficient.

Digital Assistants and Chatbots for Customer Support

The rise of digital assistants and chatbots is improving customer service in the insurance industry. These technologies can provide instant support to customers, answering common queries and guiding them through the insurance quote process. This enhances the overall customer experience, making it more convenient and efficient.

Conclusion

Obtaining cheap insurance quotes online is an accessible and efficient way to explore your coverage options. By understanding your needs, utilizing online comparison tools, and being mindful of key considerations, you can secure affordable insurance that meets your specific requirements. As the insurance industry continues to embrace digital innovation, the process of obtaining insurance quotes is set to become even more streamlined and personalized, offering an even brighter future for consumers.

What is the best way to compare insurance quotes online?

+

To compare insurance quotes effectively online, use reputable comparison websites or directly visit the websites of multiple insurance providers. Ensure you provide accurate information and compare quotes based on similar coverage levels to make an informed decision.

Can I negotiate insurance quotes online?

+

Yes, you can often negotiate insurance quotes, especially if you’re a loyal customer or have a good claim history. Contact the insurance provider directly and inquire about potential discounts or customized rates.

Are there any disadvantages to getting insurance quotes online?

+

While online insurance quotes offer convenience, there are potential drawbacks. You may miss out on personalized advice from an insurance agent, and there’s a risk of providing inaccurate information that could lead to unsuitable coverage. Always verify the information you provide and seek clarification if needed.