Cheap Liability Insurance For Cars

Ensuring your vehicle with the right coverage is essential, and many drivers seek affordable options to protect themselves financially without breaking the bank. In this comprehensive guide, we delve into the world of cheap liability insurance for cars, exploring the factors that influence pricing, the coverage options available, and the strategies to secure the best deals. Whether you're a seasoned driver or a newcomer to the road, understanding how to navigate the insurance landscape can lead to significant savings.

Understanding Liability Insurance for Vehicles

Liability insurance is a fundamental component of any vehicle insurance policy, designed to safeguard policyholders from financial losses arising from accidents or incidents where they are deemed at fault. This coverage is especially crucial as it protects drivers from potentially devastating financial consequences that could result from lawsuits or medical expenses incurred by others involved in an accident.

Liability insurance typically consists of two main components: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and lost wages for individuals injured in an accident caused by the policyholder, while property damage liability covers the cost of repairing or replacing property damaged in the accident, such as the other driver's vehicle or any other damaged property.

The level of liability coverage required varies by state and can be influenced by factors such as the driver's age, the type of vehicle, and the driver's history. For instance, states with a no-fault system often require drivers to carry higher levels of personal injury protection (PIP) coverage, while states with a tort system may place more emphasis on bodily injury liability.

Factors Affecting Liability Insurance Costs

The cost of liability insurance for cars can vary significantly depending on several factors. Understanding these influences can help drivers make informed choices when seeking affordable coverage.

Driver Profile

Insurance providers carefully assess a driver’s profile to determine the level of risk they pose. Key factors include age, gender, driving history, and location. Younger drivers, particularly those under 25, often face higher premiums due to their perceived higher risk of accidents. Similarly, drivers with a history of accidents or traffic violations may also be considered higher risk.

The driver's location also plays a significant role. Insurance rates can vary widely between different states and even between different neighborhoods within a city. This is because factors such as traffic density, crime rates, and the likelihood of natural disasters can all influence the risk of an accident.

Vehicle Type and Usage

The type of vehicle insured and how it’s used can significantly impact insurance costs. Generally, sports cars and high-performance vehicles attract higher premiums due to their association with higher speeds and a perceived increased risk of accidents. On the other hand, sedans and hybrids, often considered more economical and safer, may attract lower premiums.

The vehicle's primary usage also matters. For instance, a car primarily used for commuting to work may attract different rates compared to a vehicle used for business purposes or a car primarily driven by a teenager.

Coverage Level and Deductibles

The level of liability coverage chosen directly impacts insurance costs. Higher coverage limits usually result in higher premiums. However, it’s important to strike a balance between affordable coverage and adequate protection. Choosing too low a coverage limit could leave a driver exposed to significant out-of-pocket expenses in the event of an accident.

Deductibles also play a role in insurance costs. A higher deductible (the amount the policyholder pays out of pocket before the insurance coverage kicks in) usually results in lower premiums. This trade-off can be a strategic way to reduce insurance costs, especially for drivers with a clean record and a low risk of accidents.

Strategies for Securing Cheap Liability Insurance

While the cost of liability insurance is influenced by various factors, there are strategies drivers can employ to secure more affordable coverage.

Compare Quotes

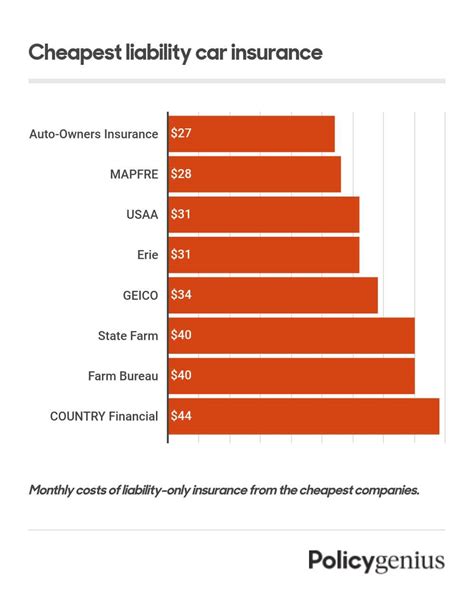

One of the most effective ways to find cheap liability insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so getting quotes from at least three to five providers can help drivers identify the most competitive rates.

Online comparison tools and insurance marketplaces can streamline this process, allowing drivers to quickly get multiple quotes in one place. These platforms often provide a comprehensive view of the market, helping drivers make more informed choices.

Utilize Discounts

Insurance providers offer a range of discounts that can significantly reduce the cost of liability insurance. Common discounts include safe driver discounts, multi-policy discounts (for bundling car insurance with other policies like home or renters insurance), and loyalty discounts for long-term customers.

Some providers also offer discounts for vehicles equipped with safety features such as anti-lock brakes, air bags, or theft-deterrent systems. Additionally, certain professional affiliations or memberships, such as those with alumni associations or professional organizations, may qualify drivers for discounted rates.

Improve Your Driving Record

A clean driving record is one of the most influential factors in securing cheap liability insurance. Insurance providers closely scrutinize driving histories, and a record free of accidents and violations can lead to significant savings. Conversely, a history marred by accidents or traffic violations can result in higher premiums or even difficulty in securing coverage.

For drivers with a less-than-perfect record, it's important to maintain a clean slate moving forward. Over time, a clean driving record can help reduce insurance costs, as most violations and accidents will eventually drop off the record after a certain period.

Consider Higher Deductibles

Choosing a higher deductible can be a strategic way to reduce insurance costs. While this means the policyholder will need to pay more out of pocket in the event of a claim, it can significantly lower monthly premiums. This strategy is particularly effective for drivers with a clean record and a low risk of accidents.

However, it's important to ensure the chosen deductible is manageable. If the deductible is too high, it could strain financial resources in the event of an accident, defeating the purpose of insurance protection.

Bundle Policies

Bundling multiple insurance policies, such as auto and home insurance, can often lead to significant savings. Many insurance providers offer multi-policy discounts, which can reduce the overall cost of insurance. Additionally, bundling policies can simplify insurance management, as all policies are managed through a single provider.

Choosing the Right Liability Coverage

While cheap liability insurance is important, it’s equally crucial to ensure the chosen coverage meets the necessary requirements and provides adequate protection. Here are some key considerations when choosing liability coverage.

State Minimum Requirements

Every state has its own minimum liability insurance requirements that drivers must meet to legally operate a vehicle. These requirements typically specify the minimum levels of bodily injury and property damage liability coverage that must be carried. While meeting these minimums is essential, it’s often recommended to carry higher levels of coverage to provide more robust protection.

Assessing Personal Needs

Each driver’s needs are unique, and it’s important to tailor liability coverage to personal circumstances. Factors to consider include the driver’s financial situation, the value of their vehicle, and their tolerance for risk. For instance, a driver with significant assets may want to carry higher levels of coverage to protect those assets in the event of a serious accident.

Additionally, drivers should consider their personal tolerance for risk. While choosing higher deductibles can reduce premiums, it's important to ensure the deductible amount is manageable. Similarly, while lower coverage limits may be cheaper, they may not provide adequate protection in the event of a serious accident.

Performance Analysis of Cheap Liability Insurance Policies

To gain a deeper understanding of the value and effectiveness of cheap liability insurance policies, it’s beneficial to analyze their performance in real-world scenarios. This analysis can help drivers make more informed choices and ensure they’re getting the coverage they need at a price they can afford.

Claim Handling and Customer Satisfaction

One key aspect of insurance performance is how claims are handled. Efficient and effective claim handling can make a significant difference in the overall customer experience. A provider that promptly processes claims and provides fair settlements can greatly enhance customer satisfaction.

Online reviews and customer feedback can offer valuable insights into a provider's claim handling processes. Drivers can use these resources to gauge the provider's reputation and identify potential issues or areas of excellence.

Financial Strength and Stability

The financial strength and stability of an insurance provider are critical factors to consider. A financially strong provider is more likely to have the resources to pay out claims promptly and fairly. Conversely, a provider with financial difficulties may struggle to meet its obligations, potentially leading to delayed or reduced payouts.

Ratings from independent agencies like AM Best, Standard & Poor's, and Moody's can provide valuable insights into an insurance provider's financial health. These ratings assess the provider's ability to meet its financial obligations, including paying out claims.

Evidence-Based Future Implications

As the insurance landscape continues to evolve, it’s important to consider the future implications of cheap liability insurance policies. Several key trends and developments are likely to shape the future of this market.

Technological Advancements

Advancements in technology are likely to play a significant role in the future of liability insurance. Telematics, for instance, which uses data from vehicle sensors to assess driving behavior, could provide more accurate risk assessments. This could lead to more tailored insurance policies and potentially reduce costs for safe drivers.

Additionally, the rise of autonomous vehicles is likely to have a significant impact on liability insurance. As these vehicles become more prevalent, the nature of accidents and liability could shift, potentially reducing the need for certain types of coverage.

Regulatory Changes

Changes in regulatory environments can also influence the cost and availability of liability insurance. For instance, shifts in state laws regarding minimum coverage requirements or the introduction of new regulations, such as those related to autonomous vehicles, could impact insurance costs and the types of coverage available.

Market Competition

The level of competition in the insurance market is a key factor influencing insurance costs. A highly competitive market often leads to more affordable options and better coverage for consumers. As the insurance market continues to evolve, new entrants and changing dynamics could drive increased competition, potentially benefiting consumers.

Conclusion

Securing cheap liability insurance for cars is a complex process that requires a careful balance between cost and coverage. By understanding the factors that influence insurance costs and employing strategic approaches to reduce premiums, drivers can find affordable coverage that meets their needs. Additionally, by staying informed about the performance and future implications of liability insurance policies, drivers can make more confident choices when selecting their coverage.

As the insurance landscape continues to evolve, staying proactive and informed is key to ensuring drivers get the best value for their insurance dollar.

How much liability insurance do I need for my car?

+The amount of liability insurance you need depends on several factors, including your state’s minimum requirements, your personal assets, and your tolerance for risk. While meeting your state’s minimum requirements is essential, many experts recommend carrying higher levels of coverage to provide more robust protection.

Can I reduce my liability insurance costs by choosing a higher deductible?

+Yes, choosing a higher deductible can be a strategic way to reduce liability insurance costs. However, it’s important to ensure the chosen deductible is manageable. If the deductible is too high, it could strain financial resources in the event of a claim, defeating the purpose of insurance protection.

What discounts are available for liability insurance?

+Insurance providers offer a range of discounts that can significantly reduce the cost of liability insurance. Common discounts include safe driver discounts, multi-policy discounts (for bundling car insurance with other policies like home or renters insurance), and loyalty discounts for long-term customers. Some providers also offer discounts for vehicles equipped with safety features or for certain professional affiliations.