Cheap Ny Auto Insurance

Are you a New Yorker seeking affordable auto insurance options? Look no further! In this comprehensive guide, we'll explore the factors that influence car insurance costs in New York and provide you with expert insights to secure the best coverage at the most economical rates. From understanding the unique challenges of insuring a vehicle in the Big Apple to discovering cost-saving strategies, we've got you covered.

Understanding the Cost of Auto Insurance in New York

The cost of auto insurance in New York can vary significantly depending on various factors. Understanding these influences is crucial to making informed decisions and securing the most suitable coverage. Let’s delve into the key aspects that impact insurance rates in the Empire State.

Factors Affecting Insurance Premiums

New York, with its bustling cities and diverse population, presents a unique set of circumstances that can affect insurance costs. Here are some of the primary factors that influence auto insurance premiums in the state:

- Location: The area where you reside and drive plays a significant role in determining insurance rates. Urban areas like New York City often have higher premiums due to increased traffic, congestion, and the potential for accidents. Suburban and rural areas, on the other hand, may offer more affordable options.

- Driving History: Your driving record is a crucial factor in insurance pricing. A clean driving history with no accidents or violations can lead to lower premiums. Conversely, a history of accidents or traffic violations may result in higher rates.

- Vehicle Type: The make, model, and year of your vehicle can impact insurance costs. Sports cars and luxury vehicles, for instance, may require more expensive coverage due to their higher repair costs and theft risks. On the other hand, economical and safe vehicles can lead to more affordable insurance options.

- Coverage and Deductibles: The level of coverage you choose and the deductibles you select can significantly affect your premium. Comprehensive and collision coverage, while offering more protection, can increase your costs. Higher deductibles, on the other hand, can lower your premium but may require a larger out-of-pocket expense in the event of a claim.

- Age and Gender: Insurance companies often consider age and gender when calculating premiums. Younger drivers, especially males under the age of 25, are statistically more likely to be involved in accidents, leading to higher insurance costs. As you age and gain more driving experience, insurance rates typically decrease.

- Credit Score: In many states, including New York, insurance companies may consider your credit score when determining your premium. A good credit score can lead to lower insurance rates, while a poor credit score may result in higher costs.

Average Auto Insurance Costs in New York

According to recent data, the average cost of auto insurance in New York is approximately 1,700 per year. However, this average can vary significantly based on the factors mentioned above. Urban areas like New York City and its surrounding boroughs often have higher average premiums due to the increased risk of accidents and theft.</p> <p>Here's a table showcasing the average annual insurance premiums in New York for various vehicle types:</p> <table> <tr> <th>Vehicle Type</th> <th>Average Annual Premium</th> </tr> <tr> <td>Sedan</td> <td>1,500 SUV 1,800</td> </tr> <tr> <td>Sports Car</td> <td>2,200 Electric Vehicle $1,650

Strategies for Securing Cheap Auto Insurance in New York

While the cost of auto insurance in New York can be higher than in other states, there are strategies you can employ to secure more affordable coverage. Here are some expert tips to help you find the best deals on car insurance in the Empire State:

Shop Around and Compare Quotes

One of the most effective ways to find cheap auto insurance is to compare quotes from multiple providers. Insurance companies in New York offer a wide range of rates and coverage options, so it’s essential to shop around. Obtain quotes from at least three to five reputable insurers to get a sense of the market and identify the most competitive rates.

Utilize online quote comparison tools or seek assistance from an independent insurance agent who can provide quotes from various carriers. This process allows you to assess the coverage and pricing offered by different companies, ensuring you make an informed decision.

Explore Discounts and Savings Opportunities

Insurance companies in New York often offer a variety of discounts and savings opportunities to attract and retain customers. These discounts can significantly reduce your insurance premium, so it’s crucial to be aware of them and take advantage of those that apply to your situation.

- Multi-Policy Discounts: Many insurance providers offer discounts when you bundle your auto insurance with other policies, such as homeowners or renters insurance. By consolidating your insurance needs with one carrier, you can save money on your overall premiums.

- Safe Driver Discounts: If you have a clean driving record with no accidents or violations, you may be eligible for safe driver discounts. These discounts reward responsible driving behavior and can lead to significant savings on your insurance premium.

- Student Discounts: Young drivers who are students may be eligible for discounts if they maintain good grades. Many insurance companies offer discounts to students with a certain GPA or honor roll status, encouraging academic achievement and rewarding responsible behavior.

- Payment Method Discounts: Some insurance providers offer discounts for specific payment methods. For example, paying your premium in full annually or setting up automatic payments can sometimes lead to reduced rates.

- Loyalty Discounts: Insurance companies often reward long-term customers with loyalty discounts. If you’ve been with the same insurer for an extended period, it’s worth inquiring about potential discounts or loyalty programs that can lower your premium.

Consider Higher Deductibles and Coverage Adjustments

The deductibles you choose and the level of coverage you select can significantly impact your insurance premium. While it may be tempting to opt for the lowest deductibles and highest coverage limits, this approach can lead to higher costs. Consider adjusting your deductibles and coverage to find a balance that suits your budget and risk tolerance.

For example, increasing your deductible from 500 to 1,000 can lead to a notable reduction in your premium. Similarly, carefully reviewing your coverage needs and removing unnecessary options can also result in cost savings. However, it’s essential to ensure that you maintain adequate coverage to protect yourself and your vehicle in the event of an accident or other unforeseen circumstances.

Maintain a Clean Driving Record

Your driving record is a significant factor in determining your insurance premium. A clean driving history with no accidents or violations can lead to lower insurance rates. On the other hand, a history of accidents or traffic violations can result in higher premiums or even non-renewal of your policy.

To maintain a clean driving record, practice safe and defensive driving habits. Avoid distractions like texting or eating while driving, and always obey traffic laws and speed limits. Additionally, consider taking a defensive driving course, which can not only improve your driving skills but may also qualify you for insurance discounts.

Explore Alternative Insurance Options

If you’re still struggling to find affordable auto insurance in New York, consider exploring alternative insurance options. These options may not be suitable for everyone, but they can provide significant savings for those who qualify.

- Usage-Based Insurance (UBI): Usage-based insurance programs, often referred to as “pay-as-you-drive” or “telematics,” use a device or app to track your driving behavior and habits. Insurance companies then use this data to determine your premium. If you’re a safe and cautious driver, UBI can lead to significant savings on your insurance costs.

- High-Risk Insurance Pools: If you’ve been labeled a high-risk driver due to multiple accidents or violations, you may be eligible for high-risk insurance pools. These pools, often overseen by state governments, provide coverage to drivers who may have difficulty obtaining insurance through traditional means. While premiums may be higher, it ensures you have the necessary coverage.

- Low-Cost Insurance Programs: Some states, including New York, offer low-cost insurance programs for eligible individuals. These programs are typically designed for low-income drivers or those who meet certain financial criteria. While the coverage may be more limited, it can provide a more affordable option for those who qualify.

Conclusion: Finding Affordable Auto Insurance in New York

Securing cheap auto insurance in New York is a multifaceted process that requires a combination of strategies and an understanding of the unique factors that influence insurance costs in the state. By shopping around, exploring discounts, adjusting coverage and deductibles, maintaining a clean driving record, and considering alternative insurance options, you can find the best coverage at the most economical rates.

Remember, finding affordable auto insurance is not just about saving money; it’s about ensuring you have the protection you need on the road. With the right approach and a bit of research, you can navigate the complex world of auto insurance and find a policy that suits your needs and budget.

What is the average cost of auto insurance in New York City?

+The average cost of auto insurance in New York City is approximately $2,000 per year. However, this average can vary significantly based on individual circumstances and the factors mentioned earlier.

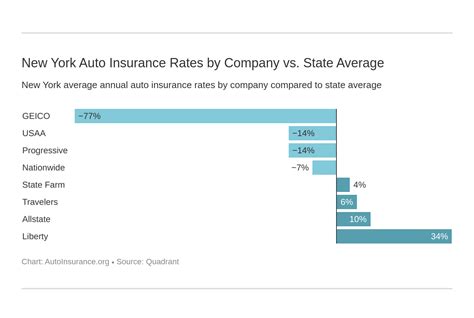

Are there any specific insurance providers that offer cheap rates in New York?

+While specific insurance providers may offer competitive rates in certain areas, it’s essential to shop around and compare quotes. Each insurer has its own rating system and factors that influence premiums. Obtaining quotes from multiple providers will help you identify the most affordable option for your situation.

Can I reduce my insurance premium by bundling my auto insurance with other policies?

+Yes, bundling your auto insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings. Many insurance companies offer multi-policy discounts, so consolidating your insurance needs with one carrier can be a cost-effective strategy.

Are there any resources or programs to help low-income individuals find affordable auto insurance in New York?

+Yes, New York offers a low-cost insurance program called the New York Automobile Insurance Plan (NYAIP). This program provides auto insurance to eligible individuals who may have difficulty obtaining coverage through traditional means. The program is overseen by the New York State Department of Financial Services and offers limited coverage at an affordable rate.