Cheap Private Medical Insurance

Private medical insurance, often referred to as health insurance, is a valuable asset for individuals seeking timely access to medical care and personalized healthcare experiences. In today's fast-paced world, where waiting times for appointments and treatments can be extensive, private medical insurance offers an attractive solution. However, the cost of such insurance is a significant concern for many. In this comprehensive guide, we delve into the realm of affordable private medical insurance, exploring its benefits, coverage options, and strategies to obtain quality healthcare without breaking the bank.

Understanding the Benefits of Private Medical Insurance

Private medical insurance provides individuals with numerous advantages over public healthcare systems. Firstly, it offers speed and convenience by allowing policyholders to bypass lengthy waiting lists, ensuring quicker access to medical professionals and treatments. This is particularly beneficial for those requiring immediate attention for acute conditions or facing long wait times in the public system.

Secondly, private medical insurance provides choice and control over healthcare decisions. Policyholders can select their preferred doctors and hospitals, choose their treatment plans, and even opt for alternative therapies not commonly covered by public healthcare. This level of autonomy is invaluable for those seeking personalized healthcare experiences.

Lastly, private medical insurance often includes additional benefits such as wellness programs, dental and optical coverage, and mental health support. These comprehensive benefits enhance overall well-being and provide a more holistic approach to healthcare.

Exploring Affordable Private Medical Insurance Options

Contrary to common misconceptions, private medical insurance is not exclusively for the wealthy. With careful consideration and strategic planning, individuals can access affordable private medical insurance options tailored to their specific needs and budgets.

1. Comparative Shopping

The first step towards affordable private medical insurance is comparative shopping. Different insurance providers offer a range of plans with varying coverage and premium costs. By comparing these plans, individuals can identify the most cost-effective option that aligns with their healthcare requirements. Online platforms and insurance brokers can simplify this process, providing comprehensive comparisons and personalized recommendations.

When comparing plans, consider the following factors:

- Coverage Limits: Assess the extent of coverage provided by each plan, including hospital stays, outpatient treatments, and specialist consultations.

- Exclusions and Excess Charges: Be aware of any exclusions or excess charges that may apply, as these can significantly impact out-of-pocket expenses.

- Waiting Periods: Understand the waiting periods for different treatments, as longer waiting periods can mean lower premiums.

- Network of Providers: Check if your preferred doctors and hospitals are within the insurance provider's network, as this can influence your treatment options and costs.

2. Utilizing Government Schemes and Subsidies

Many governments offer schemes and subsidies to make private medical insurance more accessible to their citizens. These initiatives aim to reduce the financial burden of healthcare and encourage wider coverage. By understanding and leveraging these schemes, individuals can significantly reduce their insurance costs.

For instance, the National Health Insurance Scheme in the United Kingdom provides financial assistance to low-income earners, helping them afford private medical insurance. Similarly, the Medicare program in the United States offers subsidies to individuals aged 65 and above, making private insurance more affordable for this demographic.

3. Group Insurance Plans

Group insurance plans, often offered through employers or professional associations, can provide significant cost savings compared to individual plans. These plans leverage the principle of risk pooling, where a larger group shares the overall risk and cost of insurance, resulting in lower premiums for each individual.

Employer-sponsored group insurance plans are particularly advantageous as they may offer comprehensive coverage at a fraction of the cost of individual plans. Additionally, some employers may subsidize a portion of the premium, further reducing the financial burden on employees.

4. Telemedicine and Virtual Care

The rise of telemedicine and virtual care has revolutionized the healthcare industry, offering convenience and cost-effectiveness to patients. Many private medical insurance providers now incorporate telemedicine services into their plans, allowing policyholders to consult with healthcare professionals remotely.

Telemedicine is particularly beneficial for minor illnesses, follow-up consultations, and mental health support, as it eliminates the need for physical visits and associated travel costs. This integration of technology into healthcare not only reduces insurance premiums but also provides a more flexible and accessible healthcare experience.

Maximizing Your Private Medical Insurance Coverage

Once you have secured an affordable private medical insurance plan, it’s essential to understand how to maximize its benefits and ensure you receive the most value for your investment.

1. Understanding Your Policy

Familiarize yourself with the terms and conditions of your insurance policy. This includes knowing the coverage limits, any exclusions or restrictions, and the process for making claims. Being well-informed about your policy can help you make better healthcare decisions and avoid unexpected costs.

Pay close attention to the annual limits and benefit periods outlined in your policy. These limits may apply to specific treatments or overall healthcare expenses, so understanding them is crucial to managing your healthcare budget effectively.

2. Preventive Care and Wellness Programs

Many private medical insurance plans include preventive care and wellness programs as part of their benefits. These programs focus on maintaining good health and preventing illnesses, often covering annual check-ups, vaccinations, and health screenings. By actively participating in these programs, you can reduce your risk of developing costly medical conditions and maximize the value of your insurance.

Additionally, some insurance providers offer incentives or discounts for maintaining a healthy lifestyle. This may include reduced premiums for non-smokers, weight management programs, or rewards for achieving certain health goals. Taking advantage of these initiatives can not only improve your overall well-being but also provide financial benefits.

3. Exploring Alternative Therapies

Private medical insurance plans often provide coverage for a range of alternative therapies such as acupuncture, chiropractic care, and massage therapy. These therapies can complement traditional medical treatments and provide holistic approaches to healthcare.

When considering alternative therapies, ensure that your insurance plan covers them and understand any limitations or requirements for coverage. Some plans may require a referral from a primary care physician or may only cover a certain number of sessions per year. By understanding these details, you can effectively utilize these benefits and improve your overall healthcare experience.

Performance Analysis and Real-World Examples

To illustrate the effectiveness of affordable private medical insurance, let’s examine a few real-world examples:

Case Study 1: John’s Experience with Private Insurance

John, a 35-year-old professional, decided to explore private medical insurance options due to his concerns about long wait times in the public healthcare system. After comparing various plans, he opted for a mid-range policy that offered comprehensive coverage, including specialist consultations and dental care. With his new insurance, John was able to schedule an appointment with a dermatologist within a week, receiving timely treatment for a concerning skin condition. The insurance covered the majority of the costs, and John appreciated the peace of mind and efficient care he received.

Case Study 2: Sarah’s Group Insurance Advantage

Sarah, a 28-year-old employee at a tech startup, was enrolled in her company’s group insurance plan. This plan, negotiated by the company, provided extensive coverage at a significantly reduced premium. Sarah, who had recently been diagnosed with a chronic condition, found the insurance invaluable. She was able to consult with specialists, access advanced treatments, and manage her condition effectively without incurring substantial out-of-pocket expenses. The group insurance plan not only provided financial relief but also offered Sarah the support and resources she needed to maintain her health.

Case Study 3: Telemedicine Revolutionizes Tom’s Healthcare

Tom, a 45-year-old father of two, opted for a private medical insurance plan that included telemedicine services. When his daughter developed a minor illness, he was able to consult with a pediatrician via video call, avoiding the need for a physical visit and the associated costs. The telemedicine service not only saved Tom time and money but also provided convenient and efficient care for his family. Tom found the experience empowering, knowing he had access to quality healthcare without the hassle of waiting rooms or travel.

Evidence-Based Future Implications

The trend towards affordable private medical insurance is poised to have significant implications for the healthcare industry and individuals’ well-being. As more people gain access to private insurance, it can lead to a reduction in public healthcare system strain, improving overall efficiency and wait times. Additionally, the increased competition among insurance providers may drive innovation and further cost-cutting measures, benefiting policyholders.

Furthermore, the integration of technology into healthcare, as seen with telemedicine, is expected to continue shaping the industry. This digital transformation can enhance accessibility, convenience, and cost-effectiveness, particularly for individuals in remote areas or with limited mobility. As private medical insurance plans adapt to incorporate these technological advancements, they will become even more appealing and accessible to a wider range of individuals.

Conclusion

Affordable private medical insurance is not an unattainable luxury but a realistic option for individuals seeking timely, personalized healthcare. By understanding the benefits, exploring various coverage options, and maximizing their insurance plans, individuals can access quality healthcare without compromising their financial stability. As the healthcare industry continues to evolve, private medical insurance will play a pivotal role in empowering individuals to take control of their health and well-being.

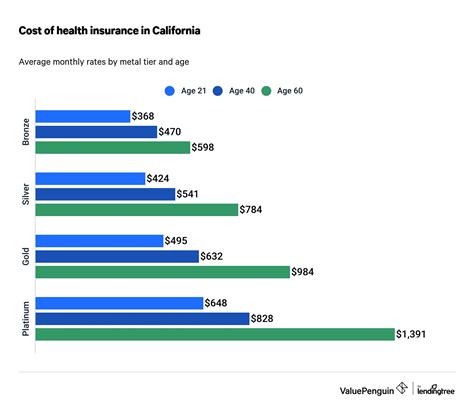

How much does private medical insurance typically cost per month?

+The cost of private medical insurance varies widely depending on factors such as age, location, and the level of coverage desired. On average, basic individual plans can range from £150 to £300 per month, while more comprehensive plans may exceed £500 per month. Group insurance plans, often offered through employers, can be significantly more affordable, sometimes starting as low as £50 per month.

What factors determine the cost of private medical insurance premiums?

+Several factors influence the cost of private medical insurance premiums, including age, gender, location, and the level of coverage desired. Older individuals and those with pre-existing conditions may pay higher premiums, as they are considered higher risk. Additionally, the choice of excess (the amount you pay towards each claim) can impact premiums, with higher excess amounts typically resulting in lower premiums.

Can I switch my private medical insurance provider if I find a better deal?

+Absolutely! It’s essential to review your insurance options regularly to ensure you are getting the best value for your money. When switching providers, be mindful of any waiting periods or exclusions that may apply to pre-existing conditions. It’s advisable to consult with an insurance broker or advisor to navigate the switching process effectively and ensure you don’t miss out on any crucial benefits.