Cheap Same Day Car Insurance

In today's fast-paced world, the demand for immediate solutions is higher than ever, and this extends to the realm of car insurance. The concept of cheap same-day car insurance has emerged as a convenient and flexible option for drivers who need coverage quickly and cost-effectively. This type of insurance policy provides an excellent solution for those facing unexpected situations, such as needing to borrow a friend's car or requiring temporary coverage for a rental vehicle. In this comprehensive guide, we will delve into the world of cheap same-day car insurance, exploring its benefits, how it works, and the key factors to consider when choosing such a policy.

Understanding Cheap Same-Day Car Insurance

Cheap same-day car insurance, as the name suggests, is a type of auto insurance policy that can be obtained and activated on the same day. This insurance option is designed to cater to individuals who require short-term coverage or need to insure a vehicle temporarily. It offers a quick and convenient solution, often at a lower cost compared to traditional long-term insurance policies.

This type of insurance is particularly beneficial for drivers who:

- Need to borrow a friend's or family member's car for a day or two.

- Are planning a road trip and want to ensure their rental car is covered.

- Have recently purchased a new vehicle and require immediate insurance.

- Are in between insurance policies and need temporary coverage.

Key Advantages of Cheap Same-Day Car Insurance

The appeal of cheap same-day car insurance lies in its flexibility and affordability. Here are some of the key advantages:

- Quick Coverage: The ability to obtain insurance within hours allows for immediate peace of mind.

- Cost-Effectiveness: These policies are often more affordable than traditional ones, making them ideal for short-term needs.

- Convenience: Drivers can easily manage their insurance needs without long-term commitments.

- Flexibility: Policies can be tailored to specific needs, such as covering only certain days or providing coverage for specific vehicles.

How Does Cheap Same-Day Car Insurance Work?

The process of acquiring cheap same-day car insurance is straightforward and typically involves the following steps:

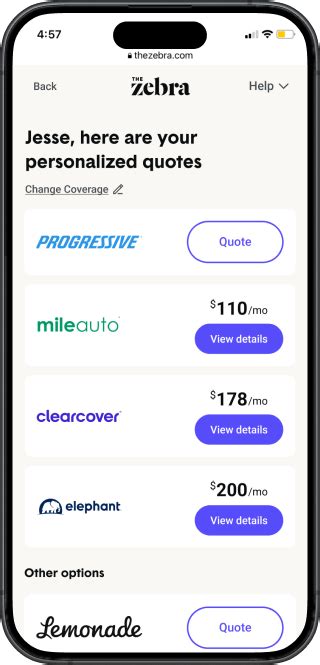

Step 1: Research and Compare

Start by researching insurance providers that offer same-day car insurance. Compare prices, coverage options, and customer reviews to find the best fit for your needs.

Step 2: Obtain Quotes

Request quotes from multiple providers. Provide accurate information about the vehicle, the driver’s details, and the desired coverage period. This step is crucial to getting an accurate quote.

Step 3: Choose the Right Policy

Review the quotes and choose the policy that offers the best coverage at the most affordable price. Consider factors like deductibles, liability limits, and any additional coverage options.

Step 4: Purchase and Activate

Once you’ve decided on a policy, proceed with the purchase. You’ll typically need to provide payment details and confirm the coverage period. After payment, the insurance will be activated immediately, providing you with the necessary coverage.

| Insurance Provider | Average Cost (per day) | Coverage Options |

|---|---|---|

| Provider A | $25 | Liability, Collision, Comprehensive |

| Provider B | $30 | Liability, Medical Payments |

| Provider C | $28 | Liability, Uninsured Motorist |

Factors to Consider When Choosing Cheap Same-Day Car Insurance

While cheap same-day car insurance offers convenience, it’s essential to make an informed decision. Here are some factors to keep in mind:

Coverage Options

Different providers offer varying coverage options. Ensure that the policy covers your specific needs, whether it’s liability-only coverage or more comprehensive protection.

Cost and Budget

Compare prices and consider your budget. While these policies are generally affordable, rates can vary based on factors like the vehicle, driver’s age, and location.

Reputation and Reviews

Research the reputation of the insurance provider. Read customer reviews and ratings to ensure the company is reliable and offers good customer service.

Policy Limitations

Understand any limitations or restrictions of the policy. For instance, some policies may have mileage limits or specific restrictions on the use of the insured vehicle.

Renewal Options

Inquire about renewal options. If you find that you need coverage for a longer period, it’s beneficial to know if and how you can extend the policy.

The Benefits of Cheap Same-Day Car Insurance for Different Scenarios

Cheap same-day car insurance can be a lifesaver in various situations. Here’s how it can benefit different types of drivers:

For Road Trips and Rentals

If you’re planning a road trip and want to rent a car, cheap same-day insurance can provide coverage for the duration of your trip. This ensures you’re protected in case of accidents or other unforeseen events.

Borrowing a Friend’s Car

Imagine a friend offers to lend you their car for a day. With cheap same-day insurance, you can insure the vehicle temporarily, giving you the freedom to drive without worrying about unforeseen expenses.

Temporary Coverage for New Cars

If you’ve recently purchased a new car and are waiting for your long-term insurance to take effect, same-day insurance can bridge the gap, ensuring your new vehicle is protected during this transition period.

Gap Coverage Between Policies

In cases where you’re changing insurance providers or have a lapse in coverage, same-day insurance can fill the gap, ensuring you’re not driving uninsured.

FAQs

Can I purchase cheap same-day car insurance for multiple days at once?

+

Yes, many providers offer the option to purchase coverage for multiple days or even weeks. This allows for flexibility and can often result in a more cost-effective rate per day.

Are there any age restrictions for cheap same-day car insurance?

+

Age restrictions can vary between providers. Some may have minimum age requirements, while others might charge higher rates for younger drivers due to their higher risk profile.

What happens if I need to make a claim under my cheap same-day insurance policy?

+

The claims process for same-day insurance is similar to that of traditional policies. You’ll need to contact your provider, provide details of the incident, and follow their claims procedures. Keep in mind that the extent of coverage will depend on your chosen policy.