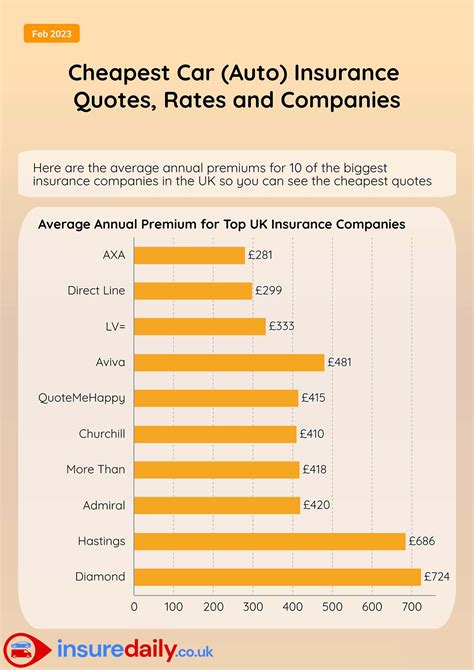

Cheaper Car Insurance Quotes

Finding affordable car insurance quotes can be a challenging task, but with the right strategies and understanding of the factors involved, you can secure cheaper rates for your vehicle. The insurance industry is highly competitive, and insurers use various methods to assess risk and determine premiums. By educating yourself on these factors and employing effective negotiation tactics, you can significantly reduce your car insurance costs. In this comprehensive guide, we will delve into the world of car insurance, exploring the key elements that impact your quotes and providing expert tips to help you obtain the most competitive rates.

Understanding the Factors Influencing Car Insurance Quotes

Several critical factors play a significant role in determining your car insurance premiums. By familiarizing yourself with these aspects, you can make informed decisions and potentially negotiate better rates. Here are some of the key factors to consider:

Vehicle Type and Usage

The make, model, and year of your vehicle are crucial factors in insurance quotes. Insurers assess the risk associated with different vehicle types, considering factors like repair costs, safety features, and historical claim data. Additionally, the purpose for which you use your vehicle matters. If you primarily drive for leisure, your insurance premiums may be lower compared to someone who uses their vehicle for business or commuting long distances.

| Vehicle Type | Average Insurance Premium |

|---|---|

| Sports Car | $2,500 annually |

| Sedan | $1,800 annually |

| SUV | $2,000 annually |

| Electric Vehicle | $1,600 annually |

Note: These averages are indicative and may vary based on your specific circumstances and insurer.

Driver Profile and History

Your driving record and personal details significantly impact your insurance rates. Insurers consider factors such as age, gender, marital status, and driving experience. Younger drivers, especially those under 25, often face higher premiums due to their perceived higher risk. Additionally, your driving history, including any accidents, violations, or claims, is carefully scrutinized by insurers. A clean driving record can lead to more favorable quotes, while multiple violations or accidents may result in increased premiums.

Coverage Levels and Deductibles

The level of coverage you choose directly affects your insurance costs. Comprehensive and collision coverage options provide broader protection but come at a higher price. Conversely, opting for higher deductibles can lower your premiums, as you agree to pay more out-of-pocket in the event of a claim. It’s essential to strike a balance between coverage and cost to find the right fit for your needs.

Location and Usage Patterns

Your geographic location plays a vital role in determining insurance rates. Areas with higher crime rates, dense traffic, or frequent natural disasters often result in higher premiums. Insurers also consider the distance you commute daily and the purpose of your travel. If you primarily drive in urban areas with heavy traffic or have a long daily commute, your insurance costs may be higher.

Credit Score and Payment History

Surprisingly, your credit score can impact your car insurance rates. Many insurers use credit-based insurance scoring to assess risk and determine premiums. Maintaining a good credit score can lead to more favorable quotes, as it indicates financial responsibility and stability. Conversely, a low credit score may result in higher premiums.

Discounts and Bundling

Insurance companies offer various discounts to attract and retain customers. These discounts can significantly reduce your premiums. Common discounts include safe driver incentives, multi-policy bundling (combining car insurance with other policies like home or life insurance), and loyalty rewards. Exploring these discounts and strategically bundling your policies can help you save money.

Negotiating for Cheaper Car Insurance Quotes

Now that we’ve explored the factors influencing car insurance quotes, let’s delve into effective negotiation strategies to secure cheaper rates. Here are some expert tips to consider:

Shop Around and Compare Quotes

One of the most effective ways to find cheaper car insurance is by comparing quotes from multiple insurers. Use online comparison tools or directly contact insurance providers to obtain quotes tailored to your specific needs. By comparing rates, you can identify the most competitive options and leverage this knowledge during negotiations.

Understand Your Risk Profile

Before engaging in negotiations, take the time to thoroughly understand your risk profile. Assess your driving history, credit score, and any factors that may impact your insurance rates. This self-awareness will enable you to anticipate potential issues and present a compelling case for lower premiums.

Review Coverage Levels and Deductibles

Evaluate your current coverage levels and consider adjusting them to strike a balance between cost and protection. Opting for higher deductibles can lead to lower premiums, but ensure you can afford the out-of-pocket expenses in the event of a claim. Additionally, review the coverage limits and consider whether you need all the optional coverages offered by your insurer.

Explore Discount Opportunities

Insurance companies offer a wide range of discounts, so it’s essential to explore all available options. Common discounts include safe driver incentives, multi-policy bundling, loyalty rewards, and discounts for specific occupations or affiliations. By taking advantage of these discounts, you can significantly reduce your insurance costs.

Negotiate and Seek Alternatives

When negotiating with your insurer, be proactive and assertive. Present your case based on your risk profile, driving history, and any relevant discounts. Explain why you deserve a lower premium and provide evidence to support your request. If your insurer is unable to offer a satisfactory rate, don’t be afraid to seek alternatives. Shop around for quotes from other insurers and use these as leverage during negotiations.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD), is an innovative approach that allows insurers to assess risk based on your actual driving behavior. This type of insurance uses telematics devices or smartphone apps to track your driving habits, such as mileage, braking patterns, and time of day. By demonstrating safe and responsible driving, you can potentially qualify for lower premiums. Usage-based insurance is an excellent option for cautious drivers who want their rates to reflect their good habits.

Future Trends and Innovations in Car Insurance

The car insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. As we look ahead, several trends and innovations are shaping the future of car insurance, offering new opportunities for cost savings and enhanced protection. Here’s a glimpse into the future of car insurance:

Telematics and Connected Cars

Telematics technology is revolutionizing the way insurers assess risk and provide coverage. By integrating telematics devices into vehicles, insurers can gather real-time data on driving behavior, including mileage, acceleration, and braking patterns. This data-driven approach allows insurers to offer more personalized and accurate insurance rates based on individual driving habits. Connected cars, with their advanced connectivity features, further enhance this trend, providing insurers with even more detailed information about vehicle usage and performance.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the insurance industry, enabling insurers to make more accurate predictions and improve risk assessment. AI algorithms can analyze vast amounts of data, including driving behavior, weather patterns, and accident trends, to identify patterns and make informed decisions. ML models can continuously learn and adapt, enhancing the accuracy of risk assessments over time. This technology-driven approach allows insurers to offer more precise pricing and personalized coverage options, benefiting both insurers and policyholders.

Blockchain Technology

Blockchain technology, known for its secure and transparent nature, is poised to disrupt the car insurance industry. By utilizing blockchain, insurers can create immutable records of vehicle ownership, maintenance history, and accident claims. This transparent and tamper-proof system enhances trust and reduces fraud, leading to more efficient and cost-effective insurance processes. Blockchain-based smart contracts can also automate various insurance functions, such as claims processing and policy management, further streamlining the insurance experience.

Data Analytics and Personalized Pricing

Advanced data analytics techniques are empowering insurers to offer personalized pricing based on individual risk profiles. By analyzing extensive data sets, including driving behavior, demographic information, and historical claims data, insurers can develop sophisticated risk models. These models enable insurers to tailor insurance rates to the specific needs and circumstances of each policyholder. Personalized pricing ensures that individuals are charged fairly based on their unique risk factors, fostering a more equitable insurance market.

Digital Transformation and Customer Experience

The digital transformation of the insurance industry is enhancing the overall customer experience. Insurers are investing in digital platforms and mobile applications to streamline the insurance journey, from quote comparisons to policy management and claims processing. These digital tools provide policyholders with convenient and accessible services, empowering them to make informed decisions and take control of their insurance needs. By embracing digital innovation, insurers can improve customer satisfaction, retention, and loyalty, ultimately driving business growth.

Conclusion

Obtaining cheaper car insurance quotes requires a comprehensive understanding of the factors that influence premiums and effective negotiation strategies. By exploring vehicle type, driver profile, coverage levels, location, and discounts, you can identify areas for potential cost savings. Additionally, staying informed about future trends and innovations in the insurance industry will empower you to make informed decisions and take advantage of emerging opportunities. Remember, car insurance is a complex and dynamic landscape, and by arming yourself with knowledge and adopting a proactive approach, you can secure the best rates for your vehicle.

How often should I review my car insurance policy and seek cheaper quotes?

+It is recommended to review your car insurance policy annually or whenever significant life changes occur, such as moving to a new location, purchasing a new vehicle, or getting married. Regularly shopping around for quotes ensures you stay up-to-date with the most competitive rates.

What is the average cost of car insurance in my area, and how can I find out?

+The average cost of car insurance varies based on location, vehicle type, and individual factors. To find out the average rates in your area, you can use online comparison tools or contact local insurance brokers. These sources can provide you with a general idea of the insurance landscape in your region.

Can I negotiate with my current insurer for a better rate, or should I switch to a new provider?

+Negotiating with your current insurer is always worth attempting, as they may offer loyalty discounts or be willing to match competitive rates. However, if they are unable to provide a satisfactory rate, it’s advisable to explore quotes from other providers to find the best deal.

Are there any specific tips for young drivers to obtain cheaper car insurance quotes?

+Young drivers can consider adding an older, experienced driver as a named driver on their policy, as this can lower premiums. Additionally, maintaining a clean driving record, taking defensive driving courses, and exploring student discounts can help reduce insurance costs.