Cheapest Auto Insurance Full Coverage

When it comes to auto insurance, finding the cheapest full coverage option can be a challenging task. With a plethora of insurance providers and varying factors that influence premiums, it's crucial to navigate the market wisely. In this comprehensive guide, we will delve into the world of auto insurance, exploring the key considerations, factors that impact costs, and strategies to secure the most affordable full coverage plan tailored to your needs.

Understanding Full Coverage Auto Insurance

Full coverage auto insurance is a comprehensive policy that offers extensive protection for vehicle owners. It typically combines liability coverage, collision coverage, and comprehensive coverage, providing a robust safety net in the event of accidents, natural disasters, or other unforeseen incidents. While it may seem straightforward, the cost of full coverage can vary significantly depending on several factors.

Key Components of Full Coverage

Liability coverage is a fundamental aspect of full coverage. It protects you financially if you are found at fault in an accident, covering the costs of injuries and damages caused to others. Collision coverage, on the other hand, covers the repair or replacement expenses of your own vehicle after an accident, regardless of fault. Comprehensive coverage is the third pillar, safeguarding your vehicle against non-collision incidents such as theft, vandalism, natural disasters, or collisions with animals.

Factors Influencing Auto Insurance Costs

The cost of auto insurance, particularly full coverage, is influenced by a multitude of factors. Understanding these factors is crucial in identifying the most affordable options. Here are some key considerations:

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in determining insurance costs. Luxury cars, sports cars, and newer models often carry higher premiums due to their higher repair and replacement costs. Additionally, the primary purpose of your vehicle, such as personal use, business travel, or leisure activities, can impact insurance rates.

Driving History and Experience

Your driving record and experience are closely scrutinized by insurance providers. A clean driving history with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents, especially those deemed your fault, can significantly increase insurance costs. Young drivers with less driving experience may also face higher premiums due to the perceived higher risk associated with their age group.

Geographic Location

The area where you reside and frequently drive has a substantial impact on insurance rates. Urban areas with higher population densities and traffic volumes often result in increased insurance costs due to the higher risk of accidents. Similarly, regions with a history of severe weather conditions or high crime rates may also contribute to higher premiums.

Insurance Coverage Limits and Deductibles

The level of coverage you choose and the associated deductibles can significantly influence the cost of your insurance. Higher coverage limits, such as increased liability limits or comprehensive coverage, may result in higher premiums. However, it’s essential to strike a balance between affordability and adequate protection. Opting for higher deductibles can lower your monthly premiums, but it’s crucial to ensure you can afford the out-of-pocket expenses in the event of a claim.

| Coverage Type | Average Premium Increase |

|---|---|

| Liability Coverage | Varies based on limits |

| Collision Coverage | 10-30% increase |

| Comprehensive Coverage | 10-20% increase |

Credit History and Other Factors

In some states, insurance providers may consider your credit history when determining premiums. A strong credit score can lead to lower insurance rates, while a poor credit history may result in higher costs. Additionally, other factors such as your marital status, education level, and profession may also be taken into account by certain insurance companies.

Strategies to Find the Cheapest Full Coverage

Securing the cheapest full coverage auto insurance requires a combination of research, comparison, and strategic planning. Here are some effective strategies to help you find the most affordable option:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from multiple providers. Each insurer has its own rating system and pricing structure, so obtaining quotes from at least three to five reputable companies can help you identify the most competitive rates.

Consider Bundling Policies

If you own multiple vehicles or have other insurance needs, such as home or renters insurance, consider bundling your policies with the same insurer. Many insurance companies offer multi-policy discounts, which can significantly reduce your overall insurance costs. Bundling can provide added convenience and potential savings.

Review Your Coverage Annually

Insurance rates are not static and can change over time. It’s essential to review your coverage annually to ensure you’re still receiving the best value. Factors such as improved driving history, changes in vehicle usage, or updates to your geographic location can impact your insurance premiums. Regularly reviewing your policy allows you to make informed decisions and potentially negotiate better rates.

Explore Discounts and Savings

Insurance providers offer various discounts and savings opportunities to attract customers and reward safe driving behavior. Some common discounts include:

- Safe Driver Discount: Recognizes drivers with a clean driving record.

- Multi-Vehicle Discount: Rewards policyholders with multiple insured vehicles.

- Good Student Discount: Offers savings for students with good academic performance.

- Loyalty Discount: Incentivizes long-term customers with loyalty rewards.

- Safety Features Discount: Recognizes vehicles equipped with advanced safety technologies.

Be sure to inquire about these discounts when obtaining quotes or during your annual policy review. Taking advantage of available discounts can significantly reduce your insurance costs.

Opt for Higher Deductibles

Choosing a higher deductible can lead to lower monthly premiums. While it means you’ll have to pay more out-of-pocket in the event of a claim, it can be a cost-effective strategy if you’re confident in your driving skills and have a solid financial cushion. However, it’s essential to carefully assess your financial capabilities and choose a deductible amount that won’t cause undue hardship.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that allows insurers to track your driving behavior and offer personalized premiums. By installing a tracking device or using a smartphone app, insurers can monitor factors such as mileage, driving speed, and braking habits. Safe driving behavior can lead to significant discounts, making this option attractive for cautious drivers.

Maintain a Good Driving Record

One of the most effective ways to keep your insurance costs low is to maintain a clean driving record. Avoid accidents, traffic violations, and other incidents that can lead to insurance claims. A good driving history not only helps you qualify for lower premiums but also demonstrates your responsibility as a driver.

The Impact of Age and Gender on Insurance Costs

Age and gender are two factors that can significantly influence auto insurance costs. Historically, young male drivers, particularly those under 25, have been associated with higher insurance rates due to their perceived higher risk of accidents and violations. However, it’s important to note that insurance providers now use more sophisticated rating systems that take into account a wider range of factors beyond age and gender.

While age and gender still play a role in determining insurance premiums, their impact has decreased over time. Insurance providers now consider a comprehensive range of factors, including driving history, vehicle type, and geographic location, to assess an individual's risk profile more accurately. This shift towards a more holistic approach ensures that insurance rates are based on a broader understanding of an individual's driving behavior and potential risks.

The Future of Auto Insurance: Technological Innovations

The auto insurance industry is continuously evolving, and technological advancements are playing a significant role in shaping the future of coverage. Here are some key technological innovations that are impacting the industry:

Telematics and Connected Cars

Telematics technology, which includes GPS tracking and advanced sensors, is revolutionizing the way insurance providers assess risk and offer personalized premiums. With connected cars, insurers can gather real-time data on driving behavior, vehicle performance, and even road conditions. This data-driven approach allows for more accurate risk assessment and the potential for customized insurance plans.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning algorithms are being utilized by insurance providers to analyze vast amounts of data and make more precise predictions about risk. These technologies can identify patterns, detect anomalies, and improve fraud detection, leading to more efficient underwriting processes and potentially lower insurance costs for policyholders.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, is gaining traction in the insurance industry. It offers a secure and transparent way to store and share data, making it ideal for managing insurance contracts and claims. Blockchain can streamline the claims process, reduce fraud, and provide greater transparency for policyholders and insurers alike.

Smart Devices and Internet of Things (IoT)

The integration of smart devices and the Internet of Things (IoT) is transforming the way we interact with our vehicles and insurance providers. Smart devices, such as dash cams and connected sensors, can provide real-time data on driving behavior and vehicle health, allowing insurers to offer more tailored coverage and potentially reduce premiums for safe drivers.

Conclusion

Securing the cheapest full coverage auto insurance requires a comprehensive understanding of the market, your personal circumstances, and the strategies available to you. By researching and comparing quotes, considering bundling options, and exploring discounts, you can find the most affordable coverage tailored to your needs. Additionally, staying informed about the latest technological advancements in the insurance industry can help you make more informed decisions and potentially benefit from innovative coverage options.

Can I get full coverage auto insurance if I have a poor credit history?

+Yes, it is still possible to obtain full coverage auto insurance with a poor credit history. While credit scores may impact insurance rates in some states, there are insurers who offer specialized policies for individuals with less-than-perfect credit. It’s important to shop around and compare quotes to find an insurer that caters to your specific circumstances.

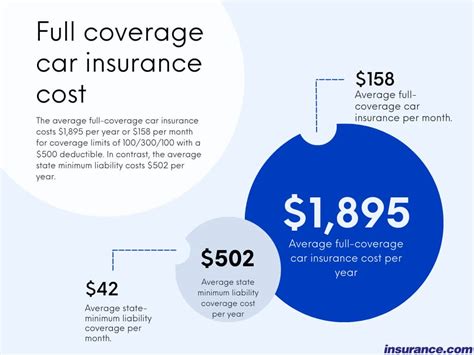

What is the average cost of full coverage auto insurance per month?

+The average cost of full coverage auto insurance per month can vary widely based on numerous factors, including your location, vehicle type, driving history, and coverage limits. As a general estimate, full coverage auto insurance can range from 100 to 200 per month, but it’s essential to obtain personalized quotes to get an accurate idea of your specific costs.

How can I lower my full coverage auto insurance premiums?

+There are several strategies to lower your full coverage auto insurance premiums. These include shopping around for quotes, considering bundling policies, exploring discounts, opting for higher deductibles, and maintaining a clean driving record. Regularly reviewing your coverage and staying informed about technological advancements in the insurance industry can also help you make informed decisions and potentially save money.