Cheapest Auto Insurance Quote

Finding the cheapest auto insurance quote is a top priority for many drivers, as it can significantly impact their financial well-being. With a plethora of insurance providers and policies available, it can be a daunting task to navigate the market and identify the most cost-effective option. This article aims to provide a comprehensive guide to securing the most affordable auto insurance quote while maintaining adequate coverage. We'll delve into the factors that influence insurance costs, explore strategies to reduce premiums, and offer insights into the best practices for comparing quotes.

Understanding the Cost Factors

The cost of auto insurance is influenced by a multitude of factors, each playing a role in determining the overall premium. These factors can be broadly categorized into two groups: those that the driver has control over and those that are beyond their influence.

Driver-Controlled Factors

- Driving Record: A clean driving record with no recent accidents or violations is crucial. Insurance companies reward safe drivers with lower premiums, as they pose a lower risk. On the other hand, a history of accidents or traffic violations can significantly increase insurance costs.

- Credit Score: Believe it or not, your credit score can impact your insurance rates. Many insurance providers consider credit as an indicator of responsibility, and those with higher scores often enjoy lower premiums.

- Vehicle Choice: The type of vehicle you drive matters. Certain makes and models are more expensive to insure due to their repair costs, theft rates, or safety features. Opting for a safer, more economical vehicle can lead to reduced insurance premiums.

- Coverage Limits: The level of coverage you choose directly affects your premium. Higher coverage limits generally result in higher costs, so it’s essential to strike a balance between adequate protection and affordability.

Factors Beyond Driver Control

- Location: Where you live and work can influence your insurance rates. Urban areas with higher population densities and traffic congestion often have higher premiums due to the increased risk of accidents. Similarly, areas with a higher crime rate may also see elevated insurance costs.

- Age and Gender: Age and gender are factors that insurance companies use to assess risk. Younger drivers, especially males, are often considered higher-risk and face higher premiums. As drivers age and gain more experience, insurance costs typically decrease.

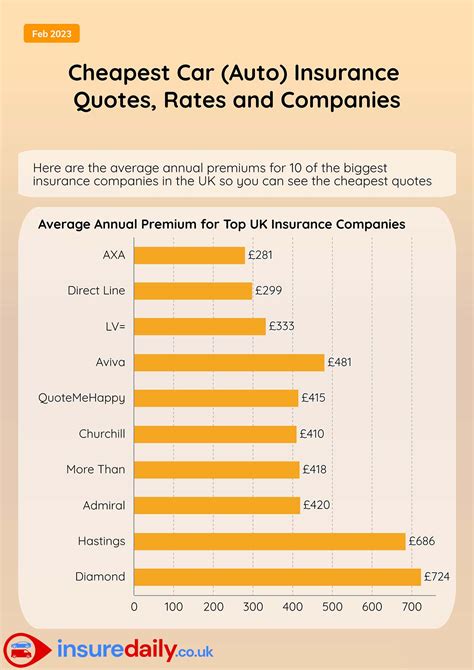

- Insurance Provider: Different insurance companies have varying pricing structures and target different demographics. It’s crucial to shop around and compare quotes from multiple providers to find the most competitive rates.

Strategies to Reduce Premiums

Securing the cheapest auto insurance quote requires a combination of strategic planning and a thorough understanding of the market. Here are some effective strategies to consider:

Shop Around

Comparing quotes from multiple insurance providers is crucial. Each company has its own rating system and pricing structure, so getting quotes from at least three to five different insurers can help you identify the most competitive rates.

Bundle Policies

If you have multiple insurance needs, such as auto, home, or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who choose to bundle their coverage, which can result in significant savings.

Increase Deductibles

Opting for a higher deductible can reduce your insurance premium. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a higher deductible, you’re essentially assuming more financial responsibility, which can lead to lower premiums.

Explore Discounts

Insurance companies offer a variety of discounts to attract and retain customers. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and loyalty discounts. Make sure to inquire about available discounts and take advantage of those that apply to your situation.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep insurance costs low. Avoid accidents and violations, and maintain a safe driving habit. Over time, a good driving record can lead to significant savings on your insurance premiums.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that bases premiums on your actual driving behavior. By installing a device in your vehicle or using a smartphone app, insurance companies can monitor your driving habits and offer personalized rates. This option can be particularly beneficial for safe, low-mileage drivers.

Comparing Quotes: A Step-by-Step Guide

Now that we’ve explored the cost factors and strategies to reduce premiums, let’s delve into the process of comparing quotes to secure the cheapest auto insurance:

- Identify Your Needs: Before comparing quotes, it's essential to understand your insurance needs. Consider the level of coverage you require, any additional drivers or vehicles to be insured, and any specific requirements or exclusions.

- Research Insurance Providers: Start by researching reputable insurance companies in your area. Look for providers with a strong financial standing, positive customer reviews, and a good track record of claim handling.

- Obtain Quotes: Reach out to the selected insurance providers and request quotes. Provide accurate and detailed information about your driving history, vehicle details, and coverage preferences. Be sure to ask about any available discounts.

- Compare Apples to Apples: When comparing quotes, ensure you're comparing similar coverage levels and policy terms. Look at the specific coverage limits, deductibles, and any additional features or endorsements included in the policy.

- Analyze Provider Reputation: While cost is a significant factor, it's crucial to consider the reputation and financial stability of the insurance provider. A low premium from an unknown or financially unstable company may not provide the security and support you need in the event of a claim.

- Read the Fine Print: Don't be swayed solely by the cheapest quote. Carefully review the policy details, exclusions, and limitations. Understand the terms and conditions to ensure the policy meets your needs and provides adequate protection.

- Consider Customer Service: Customer service can be a critical factor in the event of a claim. Research the provider's claim handling process, response times, and customer satisfaction ratings. A company with excellent customer service can provide peace of mind and make the claims process less stressful.

- Seek Expert Advice: If you're unsure about the best policy for your needs, consider consulting an independent insurance agent or broker. They can provide impartial advice and help you navigate the complex world of auto insurance, ensuring you get the best value for your money.

The Impact of Technology on Auto Insurance

Advancements in technology have revolutionized the auto insurance industry, offering new opportunities for drivers to save on their premiums. Here’s how technology is shaping the insurance landscape:

Telematics and Usage-Based Insurance

As mentioned earlier, usage-based insurance leverages technology to monitor driving behavior and offer personalized rates. Telematics devices or smartphone apps collect data on driving habits, such as speed, acceleration, braking, and mileage. This data is then used to calculate premiums, rewarding safe drivers with lower rates.

Online Quotes and Comparison Tools

The internet has made it easier than ever to compare auto insurance quotes. Online comparison tools and insurance provider websites allow drivers to quickly and conveniently obtain multiple quotes in a matter of minutes. This level of accessibility and transparency empowers drivers to make informed decisions about their insurance coverage.

Data Analytics and Risk Assessment

Insurance companies are utilizing advanced data analytics to assess risk more accurately. By analyzing vast amounts of data, including driving behavior, vehicle usage, and historical claims data, insurers can better predict the likelihood of accidents and adjust premiums accordingly. This data-driven approach ensures more precise pricing and can lead to lower costs for drivers who pose a lower risk.

Future Trends in Auto Insurance

The auto insurance industry is continuously evolving, and several trends are shaping its future. Here’s a glimpse into what we can expect:

Increased Personalization

As technology advances, insurance providers are moving towards more personalized coverage. By leveraging data analytics and telematics, insurers can offer policies tailored to individual driving habits and preferences. This level of personalization can result in more accurate pricing and better value for customers.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles is expected to have a significant impact on auto insurance. As self-driving cars become more prevalent, insurance providers will need to adapt their policies and pricing structures. The reduced risk of human error may lead to lower insurance premiums for autonomous vehicles, but the industry is still exploring the complex liability and coverage issues associated with this emerging technology.

Focus on Customer Experience

Insurance companies are increasingly prioritizing customer experience. This includes streamlining the quote and claims processes, offering convenient online and mobile tools, and providing personalized support. By enhancing customer satisfaction, insurers can build long-lasting relationships and retain customers more effectively.

| Cheapest Auto Insurance Providers | Average Annual Premium |

|---|---|

| Geico | $1,100 |

| State Farm | $1,200 |

| Progressive | $1,250 |

| Allstate | $1,350 |

| Liberty Mutual | $1,400 |

How often should I review my auto insurance policy and quotes?

+It’s recommended to review your auto insurance policy and obtain new quotes annually or whenever your life circumstances change significantly. This could include a new vehicle purchase, a move to a different location, a change in marital status, or the addition of a teen driver to your policy. Regularly reviewing your coverage ensures that you’re always getting the best value and adequate protection.

Can I switch insurance providers mid-policy if I find a better deal?

+Yes, you can switch insurance providers at any time, even mid-policy. However, it’s important to ensure that you have continuous coverage to avoid any gaps. Notify your current provider that you’re switching and provide them with the effective date of the new policy. This way, you can take advantage of better rates without compromising your coverage.

What are some common mistakes to avoid when comparing auto insurance quotes?

+Some common mistakes to avoid include comparing quotes without considering the reputation and financial stability of the provider, overlooking the fine print and policy exclusions, and failing to bundle policies to take advantage of potential discounts. Additionally, be cautious of quotes that seem too good to be true, as they may not provide the coverage you need.