Cheapest Auto Insurance Quotes

Finding the cheapest auto insurance quotes can be a challenging task, especially with the multitude of insurance providers and the numerous factors that influence premiums. However, it is possible to secure affordable coverage by understanding the key factors that affect insurance costs and by utilizing effective strategies to compare quotes. This comprehensive guide will delve into the intricacies of obtaining the most cost-effective auto insurance quotes, providing valuable insights and practical tips to help you make informed decisions.

Understanding the Factors that Influence Auto Insurance Costs

The cost of auto insurance is determined by a complex interplay of various factors, each playing a significant role in shaping the final premium. By familiarizing yourself with these factors, you can better understand how insurance providers calculate risks and set prices. This knowledge will empower you to make more strategic choices when shopping for auto insurance, potentially leading to substantial savings.

Demographic Factors

Your demographic profile, including your age, gender, marital status, and location, can significantly impact your auto insurance rates. Insurance providers often categorize individuals based on these factors, as statistical data suggests certain demographics are more likely to be involved in accidents. For instance, young drivers, especially males, tend to have higher insurance premiums due to their perceived higher risk of accidents. Similarly, individuals living in urban areas with higher crime rates may face elevated insurance costs.

| Demographic Factor | Impact on Premium |

|---|---|

| Age | Younger drivers (under 25) and senior drivers (over 65) often face higher premiums. |

| Gender | Statistically, males, especially young males, are often charged higher premiums. |

| Marital Status | Married individuals may enjoy lower premiums, as they are generally considered lower-risk drivers. |

| Location | Urban areas with high crime rates or frequent accidents can lead to higher insurance costs. |

Driving Record and History

Your driving record is a critical factor in determining your insurance premium. Insurance providers scrutinize your driving history to assess your risk level. A clean driving record with no accidents or violations typically leads to lower premiums, as it indicates a lower risk of future accidents. Conversely, a history of accidents, especially those deemed your fault, can significantly increase your insurance costs.

| Driving Record | Impact on Premium |

|---|---|

| Clean Record | No accidents or violations lead to lower premiums. |

| At-Fault Accidents | Being at fault in accidents can significantly increase your insurance costs. |

| Traffic Violations | Speeding tickets, DUI/DWI convictions, and other violations can lead to higher premiums. |

Vehicle Type and Usage

The type of vehicle you drive and how you use it also influence your insurance premium. Insurance providers consider factors such as the make, model, year, and value of your vehicle, as well as your annual mileage. Vehicles that are more expensive to repair or replace, or those that are frequently targeted by thieves, may result in higher insurance costs. Additionally, if you use your vehicle for business purposes or regularly drive long distances, your insurance premiums may increase.

| Vehicle Type and Usage | Impact on Premium |

|---|---|

| Vehicle Make and Model | Some makes and models are more expensive to insure due to repair costs or theft rates. |

| Vehicle Value | Higher-value vehicles generally require more expensive insurance coverage. |

| Annual Mileage | High mileage may indicate a higher risk of accidents, leading to increased premiums. |

Insurance Coverage and Deductibles

The level of insurance coverage you choose and the deductibles you opt for can significantly impact your premium. Comprehensive and collision coverage, while providing broader protection, typically come with higher premiums. On the other hand, opting for higher deductibles can lower your premium, as you agree to pay more out-of-pocket in the event of a claim. However, it’s essential to strike a balance, ensuring you have adequate coverage while keeping costs manageable.

| Insurance Coverage | Impact on Premium |

|---|---|

| Comprehensive and Collision Coverage | These coverages provide broader protection but come with higher premiums. |

| Deductibles | Higher deductibles can lower your premium, but you pay more out-of-pocket for claims. |

Strategies to Compare and Secure the Cheapest Auto Insurance Quotes

Now that we’ve explored the key factors influencing auto insurance costs, let’s delve into effective strategies to compare quotes and secure the most affordable coverage. By following these steps, you can make informed decisions and potentially save a significant amount on your auto insurance.

Research Multiple Insurance Providers

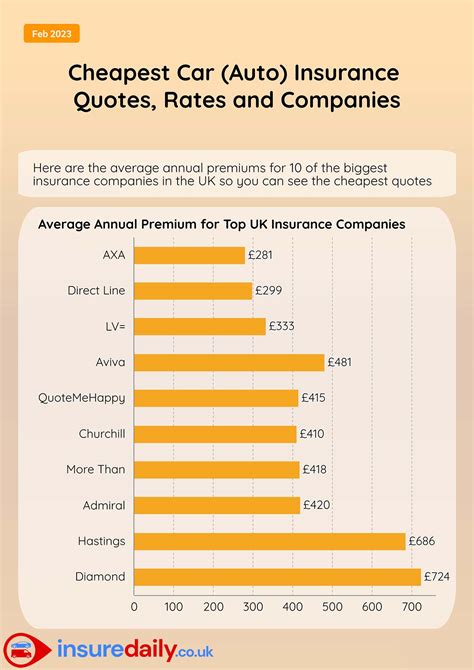

The auto insurance market is highly competitive, with numerous providers offering a wide range of policies. To find the cheapest quotes, it’s essential to research and compare offers from multiple insurance companies. Online platforms and insurance comparison websites can be invaluable tools for this task, allowing you to quickly and easily gather quotes from various providers. By obtaining quotes from at least three to five different insurers, you can get a good overview of the market and identify the most cost-effective options.

Evaluate Coverage Options and Customization

When comparing quotes, it’s crucial to evaluate not only the price but also the coverage offered. Different insurance providers may offer unique coverage options and customizable plans. For instance, some insurers may specialize in offering lower rates for specific groups, such as seniors or students, while others may provide discounts for certain safety features in your vehicle. By understanding these nuances, you can tailor your coverage to your specific needs and potentially secure more affordable rates.

Explore Discounts and Bundle Options

Insurance providers often offer a variety of discounts to attract and retain customers. These discounts can significantly reduce your insurance premium. Common discounts include those for safe driving, multi-policy bundles (such as bundling auto and home insurance), and loyalty rewards. Additionally, some insurers offer discounts for specific professions, educational achievements, or vehicle safety features. By researching and understanding the discounts available, you can strategically choose an insurer that offers the most relevant and beneficial discounts for your situation.

Utilize Online Quote Tools and Comparison Websites

Online quote tools and comparison websites have revolutionized the process of shopping for auto insurance. These platforms allow you to quickly and easily gather quotes from multiple insurers, often within minutes. By providing your personal and vehicle information, these tools generate tailored quotes based on your specific needs. This not only saves you time but also gives you a comprehensive overview of the market, making it easier to identify the most affordable options. Additionally, many of these platforms provide educational resources and articles to help you better understand the insurance landscape and make more informed choices.

Negotiate and Leverage Competition

While insurance providers may not openly advertise it, negotiating your insurance premium is often possible. If you’ve been a loyal customer with a clean driving record and a history of timely payments, you may have leverage to negotiate a lower premium. Contact your insurer and explain your situation, highlighting your positive track record and any recent improvements in your driving history or vehicle safety features. By doing so, you may be able to secure a better rate, especially if you threaten to switch providers. Remember, insurance companies value long-term customers, and they may be willing to match or beat competitors’ offers to retain your business.

Maintain a Good Credit Score

Your credit score is often a significant factor in determining your auto insurance premium. Insurance providers view individuals with higher credit scores as more responsible and less likely to file claims. As a result, they may offer lower premiums to these individuals. Therefore, maintaining a good credit score is crucial when seeking affordable auto insurance. Regularly check your credit report for errors and disputes, and take steps to improve your score if needed. This can include paying bills on time, reducing outstanding debt, and avoiding excessive credit inquiries.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that tailors your insurance premium to your actual driving behavior. This type of insurance uses telematics devices or smartphone apps to track your driving habits, such as miles driven, driving speed, and time of day. Insurers then use this data to calculate your premium, potentially offering significant savings to safe drivers. If you have a clean driving record and typically drive fewer miles, usage-based insurance could be a cost-effective option.

Future Trends and Innovations in Auto Insurance

The auto insurance industry is continually evolving, with technological advancements and changing consumer preferences driving significant innovations. Staying abreast of these trends can help you make more informed decisions when shopping for insurance and potentially access more affordable options. Here’s a glimpse into the future of auto insurance.

Telematics and Connected Car Technology

Telematics and connected car technology are transforming the auto insurance landscape. These technologies allow insurers to gather real-time data on driving behavior, vehicle performance, and even road conditions. By leveraging this data, insurers can offer more personalized and accurate insurance premiums. For instance, insurers may provide discounts to drivers who consistently drive safely or offer incentives for adopting eco-friendly driving habits. Additionally, connected car technology can enhance claims processing by providing detailed accident data, potentially leading to faster and more efficient resolution.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are increasingly being used by insurance providers to streamline processes and enhance decision-making. These technologies can analyze vast amounts of data, including driving behavior, weather patterns, and traffic conditions, to identify patterns and make more accurate predictions. For instance, AI can be used to detect fraud, automate claims processing, and even provide personalized insurance recommendations based on individual driving patterns. As these technologies continue to evolve, they are likely to play an even more significant role in shaping the auto insurance industry.

Digitalization and Paperless Processes

The digital transformation is sweeping through the auto insurance industry, with many providers embracing paperless processes and digital interactions. This shift not only enhances efficiency and convenience but also has the potential to reduce costs. By digitizing policies, claims, and other administrative processes, insurers can streamline operations and reduce overhead costs. Additionally, digital tools and apps are making it easier for customers to manage their policies, file claims, and access support, further enhancing the customer experience. As more insurers adopt these digital solutions, customers can expect more affordable and accessible insurance options.

Shared Mobility and Autonomous Vehicles

The rise of shared mobility services, such as ride-sharing and car-sharing platforms, is challenging traditional auto insurance models. These services often require specialized insurance coverage, as vehicles are used by multiple drivers and for various purposes. As a result, insurers are developing new products and services to cater to this emerging market. Similarly, the advent of autonomous vehicles is also prompting insurers to rethink their approaches. While autonomous vehicles are expected to significantly reduce accidents, the potential for new types of claims, such as software or system failures, is prompting insurers to adapt their coverage and pricing models.

Conclusion

Securing the cheapest auto insurance quotes requires a combination of knowledge, strategy, and effective research. By understanding the factors that influence insurance costs and utilizing the strategies outlined in this guide, you can make informed decisions and potentially save a significant amount on your auto insurance. Remember, it’s not just about finding the lowest price; it’s about finding the right coverage at the best value. As the auto insurance industry continues to evolve, staying informed about the latest trends and innovations will further empower you to make the most of your insurance choices.

How often should I review my auto insurance policy and quotes?

+

It’s recommended to review your auto insurance policy and quotes annually or whenever you experience significant life changes, such as getting married, buying a new car, or moving to a new location. Regular reviews ensure you have adequate coverage and are getting the best rates available.

What factors can I control to lower my auto insurance premium?

+

You can take several steps to lower your auto insurance premium, including maintaining a clean driving record, increasing your deductible, taking advantage of discounts (such as safe driver or multi-policy discounts), and exploring usage-based insurance options.

How can I improve my chances of getting cheaper auto insurance quotes?

+

To improve your chances of getting cheaper quotes, focus on improving your driving record, maintaining a good credit score, shopping around for multiple quotes, and exploring discounts and bundle options. Additionally, consider new technologies like telematics and usage-based insurance, which may offer more personalized and affordable coverage.