Cheapest Automotive Insurance

In the vast landscape of automotive insurance, finding the cheapest coverage can be a challenging yet crucial endeavor. This comprehensive guide will delve into the factors that influence insurance costs, provide strategies to minimize expenses, and offer insights into how to secure the best value for your money. Understanding the intricacies of automotive insurance is key to making informed decisions and potentially saving a significant amount on your policy.

Understanding the Cost Dynamics of Automotive Insurance

The price of automotive insurance is a multifaceted equation, influenced by a myriad of variables. These include your personal details, such as age, gender, and marital status, as well as your driving history, encompassing the number of years you’ve been on the road and any past accidents or traffic violations. The type of vehicle you own also plays a pivotal role, with certain makes and models considered riskier to insure due to their propensity for theft or high repair costs.

Furthermore, the coverage options you choose significantly impact the overall cost. Comprehensive and collision coverage, while offering broader protection, tend to be more expensive. Conversely, liability-only coverage, though cheaper, provides a more limited scope of protection. The deductible amount you select also influences the premium, with higher deductibles typically resulting in lower monthly payments.

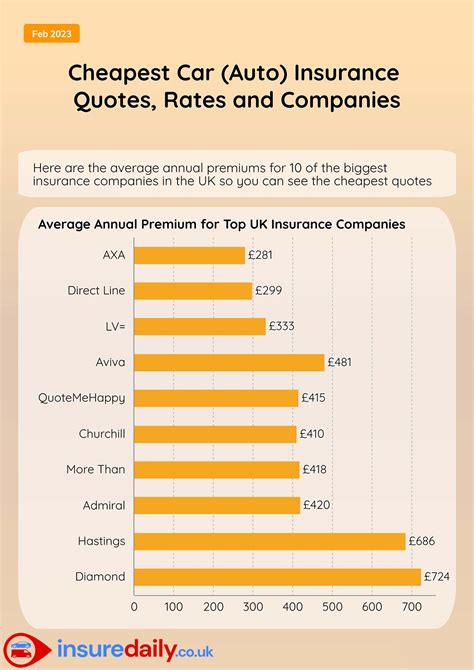

The location where you reside or park your vehicle frequently can affect insurance rates. Areas with higher incidences of theft or natural disasters may command higher premiums. Additionally, the insurance company you choose can make a substantial difference. Different insurers have varying risk assessment methodologies and pricing structures, so it's crucial to shop around for the best deal.

Strategies to Obtain the Cheapest Automotive Insurance

Securing the cheapest automotive insurance requires a strategic approach. Here are some practical steps to help you achieve this goal:

Compare Multiple Quotes

Obtaining multiple quotes is the cornerstone of finding the best insurance deal. Compare prices from at least three reputable insurers to understand the market rate for your specific circumstances. This process can be streamlined by using online comparison tools, which often provide a comprehensive view of available options.

Opt for Higher Deductibles

Increasing your deductible can lead to substantial savings on your insurance premium. While this means you’ll have to pay more out of pocket if you file a claim, it can significantly reduce your monthly or annual insurance costs. However, it’s essential to choose a deductible amount that you’re comfortable paying in the event of an accident or other covered incident.

Consider Package Deals

Many insurance companies offer package deals or discounts when you bundle multiple policies, such as automotive and homeowners or renters insurance. These bundles can result in significant savings, so it’s worth exploring these options if you’re in the market for multiple types of insurance.

Maintain a Clean Driving Record

A clean driving record is a powerful tool in your quest for cheaper insurance. Insurance companies view drivers with a history of accidents or traffic violations as higher risk, leading to higher premiums. By maintaining a spotless driving record, you can potentially qualify for lower rates.

Explore Discounts

Insurance companies often offer a variety of discounts to attract customers. These can include discounts for safe driving, loyalty rewards, good student status, or even for taking defensive driving courses. Always inquire about available discounts when obtaining quotes, as these can significantly reduce your insurance costs.

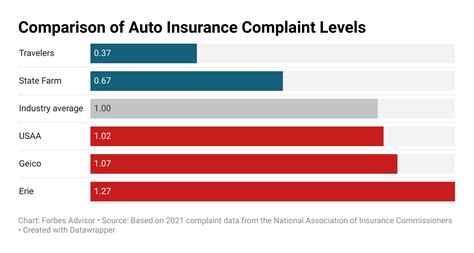

Research Provider Reputation

While cost is a significant factor in choosing an insurance provider, it’s not the only consideration. The financial stability and reputation of the insurer are crucial, as they directly impact the company’s ability to pay out claims. Researching provider reputation through customer reviews and financial rating agencies can help ensure you’re choosing a reliable insurer.

Analyzing Real-World Examples

To illustrate the strategies outlined above, let’s examine a hypothetical scenario. Consider two individuals, Sarah and David, both seeking automotive insurance. Sarah is a 30-year-old female with a clean driving record, living in a suburban area. David, on the other hand, is a 22-year-old male with a recent speeding ticket, residing in an urban center.

By comparing quotes from multiple insurers, Sarah finds that her average premium for liability-only coverage is approximately $800 annually. However, by increasing her deductible and opting for a package deal that includes her renters insurance, she can reduce this cost to $650. David, with his less favorable circumstances, starts with an average premium of $1,200 for the same coverage. By taking a defensive driving course and applying for available discounts, he manages to bring this down to $1,050.

These examples highlight the significance of shopping around and employing various strategies to obtain the cheapest automotive insurance.

| Insurer | Premium (Annual) | Deductible | Coverage |

|---|---|---|---|

| Company A | $850 | $500 | Liability |

| Company B | $780 | $1,000 | Liability |

| Company C | $920 | $500 | Comprehensive |

In the table above, we can see the different quotes Sarah received from three insurance companies. While Company B offers the lowest premium with a higher deductible, Company A provides a competitive rate with a standard deductible, and Company C offers comprehensive coverage for a slightly higher price.

The Future of Automotive Insurance

The automotive insurance landscape is evolving rapidly, driven by technological advancements and changing consumer expectations. The emergence of telematics and usage-based insurance models is one notable trend. These models use real-time data, often collected through GPS tracking or smartphone apps, to monitor driving behavior and adjust insurance premiums accordingly. This shift towards a more personalized pricing model is expected to continue, offering drivers the opportunity to directly influence their insurance costs through their driving habits.

Additionally, the increasing adoption of autonomous vehicles is poised to have a significant impact on automotive insurance. As these vehicles become more prevalent, insurance providers will need to adapt their risk assessment models and coverage offerings. This could potentially lead to lower insurance premiums as autonomous vehicles are generally considered safer than human-driven cars. However, the legal and liability issues surrounding autonomous vehicles are still being worked out, which may introduce new complexities to the insurance landscape.

Conclusion

Finding the cheapest automotive insurance is a journey that requires research, strategy, and an understanding of the various factors at play. By comparing quotes, optimizing your coverage choices, and leveraging discounts, you can significantly reduce your insurance costs. As the industry continues to evolve, staying informed about emerging trends and technologies will be key to making the most informed insurance decisions.

How can I get the cheapest insurance if I have a less than perfect driving record?

+If you have a less than perfect driving record, your insurance options may be more limited and premiums may be higher. However, there are still strategies you can employ to reduce costs. Consider increasing your deductible, comparing quotes from multiple insurers, and exploring package deals or discounts. Additionally, taking a defensive driving course can sometimes lead to reduced premiums, as it demonstrates a commitment to improving your driving skills and reducing the likelihood of future accidents.

Are there any online tools to help me compare insurance quotes?

+Yes, there are numerous online comparison tools available that can help you compare insurance quotes from multiple providers. These tools typically require you to input your personal and vehicle details, and they provide a list of quotes from various insurers based on your information. This can be a convenient way to quickly see a range of options and find the best deal for your needs.

What is the difference between liability-only coverage and comprehensive coverage?

+Liability-only coverage, also known as liability insurance, covers the cost of damage you cause to others in an accident. This includes property damage and bodily injury. It does not cover damage to your own vehicle, unless you are found to be not at fault. Comprehensive coverage, on the other hand, provides a more comprehensive level of protection. It covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, and animal collisions. It also includes liability coverage.