Cheapest Condo Insurance

Finding the cheapest condo insurance can be a challenging task, as the cost of insurance policies can vary significantly based on various factors such as location, coverage limits, and individual provider rates. However, by understanding these factors and taking the right approach, it's possible to secure an affordable policy that provides adequate protection for your condominium.

Understanding Condo Insurance and Its Costs

Condo insurance, also known as HO-6 insurance, is designed to protect condominium owners from financial losses due to unexpected events. Unlike homeowners’ insurance, which typically covers the entire structure and its contents, condo insurance is more specialized and tailored to the unique needs of condo owners.

The cost of condo insurance is influenced by several key factors:

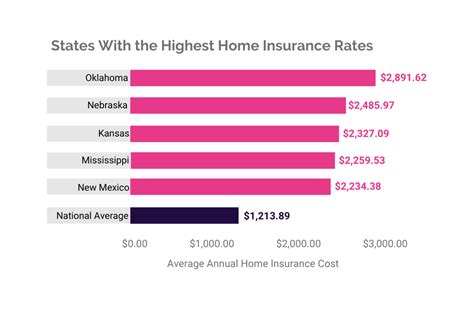

- Location: Insurance rates can vary significantly based on where your condo is located. Factors such as crime rates, weather patterns, and proximity to fire stations can all impact insurance costs.

- Coverage Limits: The amount of coverage you require will influence your insurance premium. Higher coverage limits generally result in higher premiums, so it's important to strike a balance between adequate protection and affordability.

- Provider Rates: Insurance providers set their own rates based on various risk assessments. Shopping around and comparing quotes from multiple providers is essential to finding the best deal.

Tips to Find the Cheapest Condo Insurance

To secure the cheapest condo insurance, consider the following strategies:

Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Compare rates from multiple insurance providers to find the best deal. Online insurance marketplaces can be a great starting point to quickly gather multiple quotes in one place.

Understand Your Coverage Needs

Before requesting quotes, take the time to understand your coverage needs. Consider the value of your personal property, any upgrades or renovations you’ve made to your unit, and any additional coverage you may require, such as liability protection or coverage for high-value items.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies together. If you already have an auto insurance policy with a particular provider, inquire about potential discounts for adding a condo insurance policy. Bundling can often result in significant savings.

Increase Your Deductible

Opting for a higher deductible can lower your insurance premium. However, it’s important to choose a deductible amount that you’re comfortable paying out of pocket in the event of a claim. A higher deductible may not be suitable for everyone, so carefully consider your financial situation before making this decision.

Explore Discounts

Insurance providers offer various discounts to attract and retain customers. Common discounts include those for loyalty, safety features (such as smoke detectors or security systems), and for being claims-free for a certain period. Ask your insurance provider about the discounts they offer and take advantage of any that apply to you.

Consider Policy Add-Ons Strategically

While it’s important to have adequate coverage, be mindful of adding unnecessary policy add-ons. Review your policy carefully and only include add-ons that are essential for your specific needs. This can help keep your insurance costs down.

Maintain a Good Credit Score

Insurance providers often consider your credit score when calculating your insurance premium. Maintaining a good credit score can help you secure more favorable rates. If your credit score is less than ideal, consider taking steps to improve it before shopping for insurance.

Real-Life Examples of Condo Insurance Costs

To provide some context, here are a few real-life examples of condo insurance costs based on different scenarios:

| Scenario | Average Annual Premium |

|---|---|

| Basic Coverage for a Standard Condo in a Low-Risk Area | $300 - $500 |

| Enhanced Coverage for a Luxury Condo with High-Value Items | $800 - $1,200 |

| Condo Insurance for a Unit with Extensive Renovations | $600 - $800 |

| Minimum Coverage for a Small Condo in a High-Risk Area | $400 - $600 |

It's important to note that these are just examples, and actual premiums can vary significantly based on individual circumstances. The best way to determine your specific condo insurance cost is to obtain quotes from multiple providers.

The Future of Condo Insurance: Emerging Trends

The condo insurance landscape is evolving, and several emerging trends are worth noting:

Digital Transformation

Insurance providers are increasingly adopting digital technologies to enhance the customer experience. This includes online policy management, mobile apps for claims reporting, and the use of artificial intelligence for faster and more accurate risk assessments. Embracing these digital tools can streamline the insurance process and potentially lead to cost savings.

Personalized Insurance

Insurance providers are moving towards offering more personalized insurance products. By leveraging data analytics and customer insights, they can tailor policies to individual needs, potentially reducing costs for those with lower risk profiles.

Increased Focus on Prevention

There’s a growing emphasis on preventing losses rather than simply providing compensation after a loss occurs. Insurance providers are offering incentives and discounts for condo owners who take proactive measures to reduce risks, such as installing smart home devices or participating in community safety initiatives.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and data analytics to monitor driving behavior, is being applied to home insurance. Usage-based insurance policies could potentially reward condo owners who demonstrate responsible behavior, such as maintaining regular maintenance schedules or implementing energy-efficient practices.

Conclusion

Finding the cheapest condo insurance requires a thoughtful and strategic approach. By understanding the key factors that influence insurance costs and employing the tips outlined above, you can secure an affordable policy that provides the protection you need. Additionally, staying informed about emerging trends in the insurance industry can help you make more informed decisions and potentially benefit from new cost-saving opportunities.

What is the average cost of condo insurance?

+The average cost of condo insurance can vary significantly based on factors such as location, coverage limits, and individual provider rates. However, as a general guideline, you can expect to pay anywhere from 300 to 1,200 annually for condo insurance.

How can I lower my condo insurance premium?

+There are several strategies to lower your condo insurance premium. These include shopping around for quotes, understanding your coverage needs, bundling policies, increasing your deductible, exploring discounts, and being mindful of unnecessary policy add-ons. Additionally, maintaining a good credit score can also lead to more favorable insurance rates.

What should I look for when choosing condo insurance?

+When choosing condo insurance, it’s important to consider your specific needs and the unique features of your condominium. Look for coverage options that provide adequate protection for your personal property, any upgrades or renovations, and liability coverage. Additionally, consider the financial strength and reputation of the insurance provider, as well as their claims handling process.