Cheapest Health Insurance California

Health insurance is an essential aspect of healthcare in the United States, providing individuals and families with financial protection and access to necessary medical services. In California, the state's diverse population and unique healthcare landscape offer a range of options for those seeking affordable health coverage. This article delves into the world of health insurance in California, exploring the various plans, programs, and strategies to find the cheapest health insurance options available.

Understanding California’s Health Insurance Market

California boasts one of the most robust and competitive health insurance markets in the nation. With a large population and a strong emphasis on healthcare access, the state has implemented various initiatives to make insurance more affordable and accessible. Understanding the key players and programs in this market is crucial for navigating the options effectively.

The California Department of Insurance oversees the regulation and enforcement of health insurance laws, ensuring compliance and consumer protection. Additionally, the state's Covered California program plays a vital role in providing an online marketplace for individuals and small businesses to compare and enroll in qualified health plans. Covered California also offers financial assistance to eligible residents, making insurance more affordable for those with lower incomes.

Key Features of California’s Health Insurance Market

California’s health insurance market is characterized by its diversity and competitiveness. Here are some key features to consider:

-

Individual Market: Individuals seeking insurance can choose from a wide range of plans offered by various carriers. Covered California serves as a valuable resource for comparing and enrolling in these plans.

-

Employer-Sponsored Plans: Many Californians obtain health insurance through their employers. These plans are typically more cost-effective due to group rates and often include additional benefits.

-

Medicaid and Medi-Cal: California’s Medicaid program, known as Medi-Cal, provides comprehensive health coverage for eligible low-income individuals and families. It serves as a crucial safety net for those who cannot afford private insurance.

-

Medicare: For seniors aged 65 and older, Medicare is the primary source of health insurance. In California, Medicare Advantage plans are particularly popular, offering additional benefits and coordinated care.

-

Short-Term Plans: Short-term health insurance plans offer a temporary solution for those between jobs or in transition. While these plans are generally more affordable, they often come with limitations and may not cover pre-existing conditions.

Finding the Cheapest Health Insurance in California

Securing the cheapest health insurance in California requires a combination of knowledge, research, and strategic planning. Here are some comprehensive steps to help you identify and obtain the most affordable coverage options:

1. Assess Your Eligibility and Needs

Before diving into plan comparisons, it’s crucial to assess your specific needs and eligibility for various programs. Consider the following factors:

-

Income Level: Determine your annual household income, as this will impact your eligibility for financial assistance through Covered California or Medi-Cal.

-

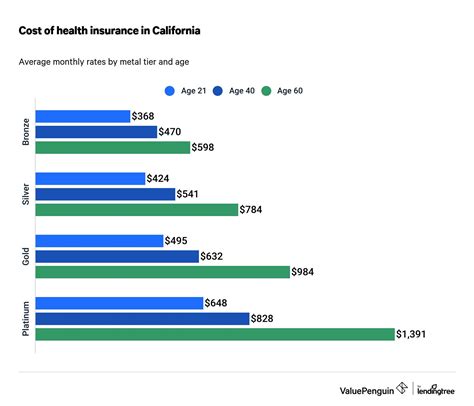

Age and Health Status: Your age and overall health play a significant role in insurance costs. Younger, healthier individuals may opt for plans with higher deductibles and lower premiums, while those with pre-existing conditions may require more comprehensive coverage.

-

Family Size: If you’re covering your family, consider the number of dependents and their ages. Family plans often provide better value and coverage for multiple individuals.

-

Prescription Needs: Evaluate your prescription medication requirements. Some plans offer better coverage for prescription drugs, which can significantly impact your overall costs.

2. Explore Government Programs

California offers several government-sponsored programs to provide affordable health insurance options for its residents. Here’s a closer look at these programs:

-

Covered California: As mentioned earlier, Covered California is the state’s official health insurance marketplace. It allows individuals and families to compare plans, calculate subsidies, and enroll in coverage. The website provides a user-friendly interface and offers assistance for those who need help navigating the process.

-

Medi-Cal: Medi-Cal is California’s Medicaid program, providing no-cost or low-cost health coverage to eligible residents. It covers a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and more. To qualify, your household income must fall below a certain threshold, and you must meet other eligibility criteria.

-

CalFresh: CalFresh, formerly known as Food Stamps, is a program that provides nutrition benefits to supplement the food budget of eligible, low-income individuals and families. While not directly related to health insurance, CalFresh can help ease the financial burden on households, allowing for more disposable income to allocate towards health coverage.

3. Compare Private Insurance Plans

If you’re not eligible for government-sponsored programs or prefer private insurance, comparing plans is essential to finding the cheapest option. Here’s a step-by-step guide to help you navigate this process:

-

Determine Your Coverage Needs: Assess the type and level of coverage you require. Consider factors such as deductibles, copayments, and out-of-pocket maximums. Decide whether you need comprehensive coverage or a more basic plan.

-

Research Carriers and Plans: Explore the major health insurance carriers operating in California, such as Blue Shield of California, Anthem Blue Cross, and Kaiser Permanente. Compare their plan offerings, including HMO, PPO, and EPO options.

-

Use Online Tools: Utilize online resources and comparison websites to quickly compare plans side by side. These tools often provide premium estimates and allow you to filter plans based on your specific needs and preferences.

-

Consider Network Size: Evaluate the network of providers associated with each plan. A larger network can offer more flexibility and potentially lower costs when seeking care. Ensure that your preferred doctors and hospitals are in-network to avoid higher out-of-network charges.

-

Analyze Benefits and Coverage: Carefully review the benefits and coverage details of each plan. Look for plans that cover essential health benefits, including preventive care, mental health services, maternity care, and prescription drugs. Ensure that any pre-existing conditions you have are adequately covered.

-

Compare Premiums and Out-of-Pocket Costs: While premiums are an essential consideration, don’t forget to factor in other out-of-pocket costs, such as deductibles, copayments, and coinsurance. Some plans may have lower premiums but higher out-of-pocket expenses, so strike a balance that aligns with your budget and healthcare needs.

4. Take Advantage of Subsidies and Discounts

To make health insurance more affordable, California offers various subsidies and discounts. Understanding these options can significantly reduce your insurance costs. Here are some key subsidies and discounts to explore:

-

Premium Tax Credits: If you enroll in a Covered California plan and your household income falls within a certain range, you may qualify for premium tax credits. These credits can reduce your monthly premiums, making insurance more affordable. Covered California’s website provides a subsidy calculator to help you estimate your eligibility.

-

Cost-Sharing Reductions: Cost-sharing reductions are available to individuals with lower incomes who enroll in Silver plans through Covered California. These reductions lower your out-of-pocket costs, such as deductibles and copayments, making healthcare more accessible.

-

Health Savings Accounts (HSAs): HSAs are tax-advantaged accounts that allow you to save for qualified medical expenses. If you have a high-deductible health plan, an HSA can be a valuable tool to help cover those costs. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

-

Discounted Plans: Some insurance carriers offer discounted plans or special rates for certain groups. For example, veterans may qualify for reduced rates through the Veterans Administration (VA) health insurance program. Additionally, some employers offer discounted plans as part of their employee benefits packages.

5. Maintain Good Health and Utilize Preventive Care

Staying healthy and utilizing preventive care services can significantly reduce your healthcare costs over time. Here’s how you can take advantage of these strategies:

-

Stay Active and Eat Healthy: Leading a healthy lifestyle can help prevent chronic diseases and reduce your risk of developing costly health conditions. Engage in regular physical activity, eat a balanced diet, and maintain a healthy weight to keep your body in optimal shape.

-

Utilize Preventive Care Services: Many health insurance plans, including those offered through Covered California, cover a range of preventive care services at no additional cost. These services include annual check-ups, immunizations, cancer screenings, and more. Take advantage of these services to detect and address potential health issues early on, which can prevent more costly treatments down the line.

-

Manage Chronic Conditions: If you have a chronic condition, such as diabetes or high blood pressure, work closely with your healthcare provider to manage your condition effectively. Consistent management can prevent complications and reduce the need for more expensive treatments or hospitalizations.

6. Explore Alternative Options

If traditional health insurance plans are still out of reach, consider exploring alternative options. While these options may not provide the same level of coverage as comprehensive plans, they can still offer some financial protection:

-

Short-Term Health Insurance Plans: Short-term plans provide temporary coverage for a limited period, typically up to 364 days. These plans are generally more affordable than traditional plans but often have limited benefits and may not cover pre-existing conditions. They can be a good option for those between jobs or in transition.

-

Discount Medical Plans: Discount medical plans are not insurance, but they can provide savings on certain medical services. These plans offer discounts on services such as doctor visits, prescription drugs, and dental care. While they may not cover all your healthcare needs, they can help reduce out-of-pocket expenses.

-

Health Care Sharing Ministries: Health Care Sharing Ministries are faith-based organizations that provide an alternative to traditional health insurance. Members share medical expenses within the community, often at a lower cost than traditional insurance. However, these plans have certain eligibility requirements and may not cover all medical services.

Future Implications and Considerations

As the healthcare landscape continues to evolve, it’s essential to stay informed about potential changes that may impact the availability and affordability of health insurance in California. Here are some key considerations for the future:

1. Policy Changes and Reforms

The healthcare industry is subject to ongoing policy changes and reforms at both the federal and state levels. Stay updated on any proposed or enacted legislation that may affect insurance coverage, subsidies, or eligibility requirements. Being aware of these changes can help you adapt your insurance strategy accordingly.

2. Market Competition and Innovation

California’s competitive health insurance market drives innovation and encourages carriers to offer more affordable options. Keep an eye on new plans, carriers entering the market, and any advancements in healthcare technology that may impact insurance costs. Being proactive and staying informed can help you identify emerging opportunities for cost-effective coverage.

3. Changing Healthcare Needs

As you age or experience changes in your health status, your insurance needs may evolve. Regularly reassess your coverage to ensure it aligns with your current healthcare requirements. Consider factors such as changes in prescription needs, the emergence of new health conditions, or the addition of dependents to your plan.

4. Financial Planning and Stability

Securing affordable health insurance is not just about finding the cheapest option; it’s also about maintaining financial stability. Develop a comprehensive financial plan that considers not only your insurance premiums but also your overall healthcare costs, including deductibles, copayments, and any out-of-pocket expenses. Building an emergency fund specifically for healthcare can provide peace of mind and ensure you have the necessary resources to cover unexpected medical bills.

Frequently Asked Questions

How do I know if I’m eligible for Medi-Cal in California?

+

To determine your eligibility for Medi-Cal, you can visit the Covered California website or contact the Medi-Cal eligibility hotline. Eligibility is based on various factors, including income level, citizenship status, and certain special circumstances. The website provides a simple eligibility screener tool to help you assess your qualifications.

What happens if I don’t have health insurance in California?

+

In California, there is a state-mandated individual health insurance requirement. If you do not have health insurance, you may face a penalty on your state tax return. Additionally, lacking insurance can result in significant financial strain if you require medical care, as you will be responsible for paying all costs out of pocket.

Can I switch health insurance plans during the year in California?

+

Yes, you can switch health insurance plans outside of the open enrollment period in certain circumstances. These include losing coverage due to a job loss or change in family status, moving to a new area, or qualifying for a special enrollment period due to a change in income or other specific life events. Check with Covered California or your insurance provider to understand your options.