Cheapest Online Insurance

In today's digital age, finding the cheapest online insurance options has become an essential task for many individuals and businesses alike. With the vast array of insurance providers and policies available, it can be challenging to navigate the market and identify the most cost-effective solutions. This comprehensive guide aims to shed light on the world of online insurance, providing insights into how to secure the best deals and make informed decisions regarding your coverage needs.

Understanding the Online Insurance Landscape

The insurance industry has undergone a significant transformation with the advent of online platforms, making it easier than ever to compare policies, prices, and providers. Online insurance, in essence, refers to insurance policies that can be purchased and managed entirely online, without the need for physical interactions or paperwork. This shift has brought about increased convenience, allowing consumers to shop for insurance from the comfort of their homes and often at more competitive rates.

However, with this convenience comes a need for diligence and a thorough understanding of the market. Online insurance brokers and providers often offer a wide range of coverage options, from auto and health insurance to more specialized policies like cyber liability or equipment breakdown coverage. It's crucial to recognize that the cheapest policy might not always be the best fit for your specific needs, and vice versa. Therefore, striking a balance between affordability and comprehensive coverage is key.

Key Factors Influencing Insurance Costs

Several factors come into play when determining the cost of insurance policies. These include the type of coverage (e.g., auto, health, home), the level of coverage (e.g., comprehensive vs. basic), and the insured’s risk profile. Risk assessment plays a pivotal role in insurance pricing. For instance, younger drivers or those with a history of accidents may face higher auto insurance premiums, while homeowners in areas prone to natural disasters might pay more for home insurance.

Additionally, personal details such as age, gender, occupation, and even credit score can influence insurance costs. For example, certain professions might be considered higher-risk, leading to increased insurance premiums. Understanding these factors can help individuals and businesses make more informed choices when seeking out the cheapest online insurance options.

| Insurance Type | Average Cost |

|---|---|

| Auto Insurance | $500 - $1500 annually |

| Health Insurance | Varies widely based on coverage and demographics |

| Home Insurance | $300 - $1000 annually (for average homes) |

| Life Insurance | $200 - $1000 annually (term life) |

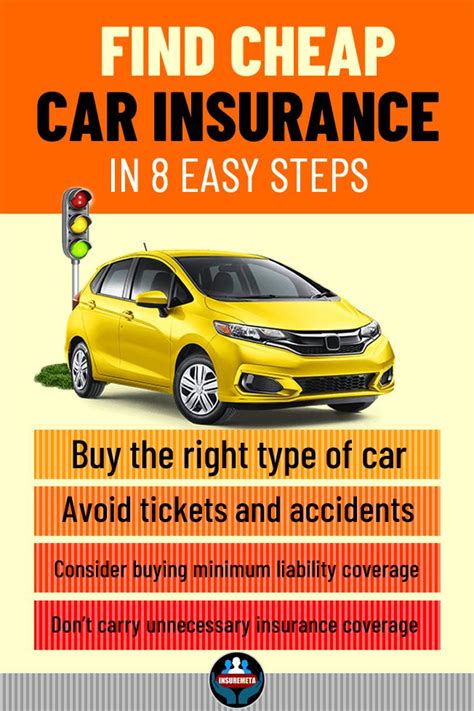

Strategies for Finding the Cheapest Online Insurance

Securing the cheapest online insurance involves a combination of research, comparison, and understanding your specific needs. Here are some expert-backed strategies to help you navigate the online insurance landscape effectively.

1. Compare Multiple Quotes

One of the most effective ways to find the cheapest online insurance is to compare quotes from various providers. Online insurance comparison platforms are an excellent resource for this. These platforms allow you to input your details once and receive multiple quotes, making it easier to identify the most cost-effective options.

For instance, consider a scenario where you're seeking auto insurance. By inputting your vehicle details, driving history, and desired coverage levels into an online comparison tool, you can quickly generate quotes from multiple insurers. This process not only saves time but also ensures you're getting a competitive rate.

2. Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies with them. For example, if you have auto and home insurance, consider combining them with one provider. This strategy can lead to significant savings, as insurers often reward loyalty and the convenience of managing multiple policies under one roof.

Let's take the example of a homeowner who also owns a classic car. By bundling their home and auto insurance policies, they might be eligible for a multi-policy discount, reducing their overall insurance costs.

3. Utilize Online Discounts and Promotions

Online insurance providers frequently offer discounts and promotions to attract new customers. These discounts can range from a percentage off your premium to waived fees for the first year. Keeping an eye out for such offers can help you snag a more affordable insurance policy.

For instance, some insurers might offer a discount for policyholders who pay their premiums annually rather than monthly. This strategy not only saves you money on premium payments but also eliminates the administrative fees associated with monthly payments.

4. Assess Your Coverage Needs Regularly

Insurance needs can change over time, so it’s crucial to review your coverage regularly. As your life circumstances evolve, your insurance requirements may also change. For example, if you recently purchased a new car, you might need to update your auto insurance policy to reflect the new vehicle’s value.

Similarly, if you've made significant home improvements, your home insurance policy might need to be adjusted to ensure adequate coverage. Regularly assessing your coverage needs ensures that you're not overpaying for unnecessary coverage or underinsured for your current circumstances.

5. Understand Policy Terms and Conditions

When comparing insurance policies, it’s essential to delve beyond the price tag. Different policies may have varying terms and conditions, which can significantly impact your overall experience and out-of-pocket costs.

For example, some health insurance policies might have lower premiums but higher deductibles, meaning you'll pay more out of pocket before your insurance coverage kicks in. On the other hand, policies with higher premiums might offer more comprehensive coverage with lower deductibles. Understanding these nuances is crucial for making an informed decision.

The Future of Online Insurance

The online insurance market is continually evolving, driven by technological advancements and changing consumer preferences. As more individuals embrace digital solutions, the demand for convenient, cost-effective online insurance options is likely to grow.

Looking ahead, we can expect to see further innovations in the online insurance space. Insurers are increasingly leveraging data analytics and artificial intelligence to offer more personalized and targeted insurance products. This shift towards data-driven insurance could lead to more accurate risk assessments and potentially lower premiums for policyholders.

Additionally, the rise of InsurTech startups is disrupting the traditional insurance industry, offering innovative solutions and challenging established players. These startups often focus on niche markets or specialized coverage, providing unique alternatives for consumers seeking tailored insurance solutions.

Key Trends in Online Insurance

Several trends are shaping the future of online insurance:

- Digital Onboarding and Claims Processing: Insurers are investing in digital tools to streamline the onboarding process and claims management. This shift towards digital processes enhances efficiency and reduces administrative costs, which can be passed on to consumers in the form of lower premiums.

- Telematics and Usage-Based Insurance: Telematics technology, which tracks driving behavior, is gaining traction in auto insurance. This data-driven approach allows insurers to offer usage-based insurance, where premiums are determined by actual driving habits rather than traditional risk factors. This trend has the potential to reward safe drivers with lower premiums.

- Parametric Insurance: Parametric insurance is an innovative concept where payouts are triggered by specific parameters, such as natural disasters or extreme weather events. This type of insurance is particularly relevant in the context of climate change, offering a more efficient and predictable way to manage risk.

The Impact of Technological Advancements

Technological advancements are set to play a pivotal role in shaping the future of online insurance. The integration of artificial intelligence and machine learning algorithms will enable insurers to make more accurate predictions and offer more tailored insurance products. Additionally, the Internet of Things (IoT) will likely enhance risk assessment and monitoring, especially in areas like home and auto insurance.

For instance, smart home devices can provide real-time data on factors like temperature, humidity, and energy usage, allowing insurers to offer more precise home insurance policies. Similarly, connected car technologies can provide detailed driving data, enabling insurers to offer usage-based auto insurance policies that reward safe driving behaviors.

Conclusion

Finding the cheapest online insurance involves a blend of research, comparison, and an understanding of your unique needs and risk profile. By leveraging the power of online comparison tools, bundling policies, and staying informed about market trends and technological advancements, you can secure the most cost-effective insurance coverage for your circumstances.

As the insurance industry continues to innovate, the future of online insurance looks promising. With a focus on data-driven solutions and personalized coverage, insurers are poised to offer more efficient and tailored insurance products. Embracing these advancements can lead to significant savings and a more seamless insurance experience.

Frequently Asked Questions

How can I save money on my auto insurance policy?

+

There are several strategies to reduce your auto insurance premiums. These include comparing quotes from multiple insurers, maintaining a clean driving record, increasing your deductible, and considering usage-based insurance if available in your area.

Are online insurance policies as reliable as traditional ones?

+

Online insurance policies are just as reliable as traditional ones, as they are backed by the same insurance providers. The key difference lies in the convenience and ease of purchasing and managing policies online.

What factors determine the cost of health insurance?

+

Health insurance costs can vary widely based on factors such as age, location, coverage level (e.g., bronze, silver, gold), and the number of people covered under the policy. It’s essential to compare plans and understand the out-of-pocket costs to find the most cost-effective option for your needs.

Can I get insurance for my small business online?

+

Absolutely! Many insurance providers offer online platforms specifically tailored for small businesses. These platforms allow you to compare quotes and purchase policies for various types of business insurance, including general liability, professional liability, and property insurance.

How often should I review my insurance policies?

+

It’s recommended to review your insurance policies annually or whenever your life circumstances change significantly. This ensures that your coverage remains adequate and cost-effective for your current needs.