Check My Insurance

In today's fast-paced world, ensuring comprehensive insurance coverage is more crucial than ever. From unexpected medical emergencies to unforeseen property damages, the right insurance policy can provide the necessary financial protection and peace of mind. However, with numerous insurance options available, it's essential to thoroughly evaluate and understand your existing policies to ensure they meet your specific needs. This guide aims to provide a comprehensive analysis of the steps you should take to review your insurance coverage, highlighting the key considerations and potential pitfalls to avoid.

Assessing Your Insurance Needs: A Comprehensive Review

Conducting a regular review of your insurance portfolio is an essential practice to ensure that your policies remain aligned with your current lifestyle, assets, and potential risks. This process involves a detailed examination of each policy, understanding its coverage limits, deductibles, and any exclusions that may impact your protection. By taking a proactive approach, you can identify gaps in your coverage and make informed decisions to enhance your financial security.

Step 1: Gather Your Insurance Policies

The first step in reviewing your insurance coverage is to collect all your existing policies. This includes health insurance, life insurance, property insurance (such as home or rental insurance), auto insurance, and any other relevant policies. If you have multiple policies with different providers, ensure you have all the necessary documents readily available.

It’s important to note that each policy document contains crucial information about the coverage, including the scope, limits, and any specific exclusions. By thoroughly examining these details, you can identify potential gaps or areas where your coverage may be insufficient.

Step 2: Understand Your Current Lifestyle and Assets

Your insurance needs are closely tied to your lifestyle and the assets you own. As your life circumstances change, so do your insurance requirements. For instance, if you recently purchased a new home, upgraded your vehicle, or started a family, your insurance needs will likely have evolved as well. Understanding these changes is crucial to ensure your insurance coverage keeps pace with your life.

Consider the following aspects when evaluating your current lifestyle and assets:

- Property Value: Have you made any significant improvements to your home or property? Ensure your insurance coverage reflects the current value, as underinsurance can lead to financial strain in the event of a claim.

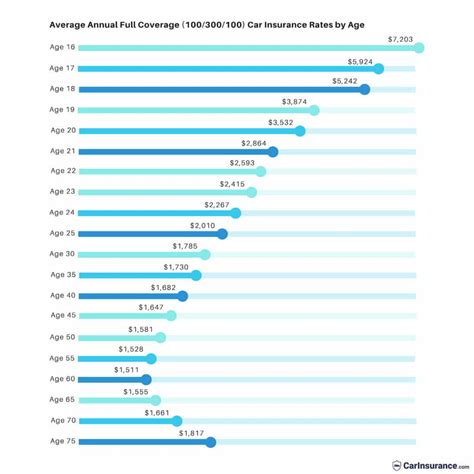

- Vehicle Upgrades: If you’ve recently upgraded your vehicle or added modifications, verify that your auto insurance policy covers these changes adequately.

- Health Changes: Any changes in your health status, such as the development of a chronic condition or the need for ongoing medical treatment, may impact your health insurance coverage and out-of-pocket expenses.

- Financial Responsibilities: Evaluate your financial obligations, such as mortgages, loans, or other debt. Ensure your life insurance policy provides sufficient coverage to protect your loved ones in the event of your untimely passing.

Step 3: Evaluate Your Coverage Limits and Deductibles

Insurance policies often come with coverage limits, which specify the maximum amount the insurer will pay for a covered loss. It’s essential to review these limits to ensure they are adequate for your needs. For instance, if you have a high-value home, the coverage limit on your homeowner’s insurance should reflect its actual replacement cost.

Similarly, deductibles play a crucial role in insurance policies. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but it’s important to strike a balance that suits your financial situation and risk tolerance.

Consider the following when evaluating your coverage limits and deductibles:

- Coverage Limits: Review the limits for each type of coverage, such as liability, property damage, or medical expenses. Ensure they align with your potential risks and financial capabilities.

- Deductible Considerations: Assess whether your current deductible amounts are suitable for your budget. Higher deductibles can lead to significant out-of-pocket expenses in the event of a claim, so choose an amount you can comfortably afford.

Step 4: Identify Potential Gaps and Areas for Improvement

During your insurance review, it’s crucial to identify any gaps in your coverage. Gaps can leave you vulnerable to financial losses in the event of an unexpected incident. Common gaps include insufficient coverage for specific assets, inadequate liability protection, or a lack of coverage for certain types of risks.

Consider the following when identifying potential gaps:

- Asset Coverage: Review your property insurance policies to ensure all your assets, including high-value items like jewelry or artwork, are adequately covered. Consider adding endorsements or riders to extend coverage for valuable possessions.

- Liability Protection: Evaluate your liability coverage, especially if you own rental properties, have a home-based business, or engage in activities that could expose you to liability risks. Ensure your policy provides sufficient protection against potential lawsuits.

- Risk-Specific Coverage: Assess your insurance needs based on your lifestyle and potential risks. For instance, if you frequently travel abroad, consider purchasing travel insurance to cover medical emergencies, trip cancellations, or lost luggage.

Step 5: Compare Your Options and Seek Professional Advice

Once you’ve identified areas where your insurance coverage may be lacking, it’s time to explore your options. Research and compare different insurance providers to find policies that offer the coverage you need at competitive rates. Consider seeking professional advice from an insurance broker or financial advisor who can provide expert guidance tailored to your specific circumstances.

When comparing insurance options, pay attention to the following factors:

- Coverage Options: Ensure the policies you’re considering offer the specific coverage you require, such as comprehensive auto insurance, replacement cost coverage for your home, or adequate life insurance benefits.

- Provider Reputation: Research the reputation and financial stability of the insurance companies you’re considering. Choose reputable providers who have a track record of prompt claim settlements and excellent customer service.

- Premium Costs: Compare the premiums offered by different providers. While cost is an important factor, it shouldn’t be the sole consideration. Balance the cost of premiums with the coverage provided to find the best value for your money.

Step 6: Make Informed Decisions and Adjust Your Coverage

Based on your thorough insurance review, make informed decisions about your coverage. If you’ve identified gaps or areas where your coverage is insufficient, take the necessary steps to enhance your protection. This may involve increasing coverage limits, adjusting deductibles, or adding additional policies to fill the gaps.

Consider the following when adjusting your coverage:

- Increase Coverage Limits: If your assets or liability risks have increased, consider raising the coverage limits on your policies to ensure adequate protection.

- Adjust Deductibles: Evaluate your financial situation and risk tolerance. If you can afford a higher deductible, consider increasing it to reduce your premium costs while maintaining sufficient coverage.

- Add Supplemental Policies: Depending on your needs, you may need to purchase additional policies, such as umbrella insurance for enhanced liability protection or specialized coverage for unique risks like cyber liability or identity theft.

Step 7: Regularly Review and Stay Informed

Insurance needs are not static; they evolve over time as your life circumstances change. Therefore, it’s crucial to make insurance reviews a regular part of your financial planning. Aim to review your insurance coverage annually or whenever significant life changes occur, such as a move, a new addition to the family, or a career change.

Stay informed about insurance trends and changes in the market. Keep an eye on industry news and developments that may impact your coverage. Additionally, maintain open communication with your insurance provider to address any concerns or questions you may have about your policies.

| Insurance Type | Key Considerations |

|---|---|

| Health Insurance | Review coverage limits, deductibles, and out-of-pocket maximums. Ensure your policy covers essential health services and prescriptions. |

| Life Insurance | Assess your coverage amount and beneficiary designations. Consider adding riders for additional protection, such as accidental death or disability coverage. |

| Property Insurance | Verify your policy covers the full replacement cost of your home or rental property. Consider adding coverage for specific risks, like flood or earthquake protection. |

| Auto Insurance | Evaluate liability limits, comprehensive and collision coverage, and any additional coverage for rental cars or roadside assistance. |

FAQ

How often should I review my insurance policies?

+

It’s recommended to review your insurance policies annually or whenever significant life changes occur, such as a move, marriage, or the birth of a child. Regular reviews ensure your coverage remains up-to-date and aligned with your evolving needs.

What happens if I don’t review my insurance coverage regularly?

+

Failing to review your insurance coverage regularly can lead to inadequate protection. Your insurance needs may change over time, and without regular reviews, you may be exposed to financial risks that your current policies don’t cover adequately.

Can I adjust my insurance coverage mid-policy term?

+

Yes, you can typically adjust your insurance coverage mid-term, but it may depend on the insurer and the type of policy. Contact your insurance provider to discuss your options and any potential fees or adjustments to your premiums.

What should I do if I find gaps in my insurance coverage during a review?

+

If you identify gaps in your insurance coverage, take immediate action to address them. Contact your insurance provider to discuss your options, such as adding riders or endorsements to your existing policies or purchasing additional coverage to fill the gaps.

Are there any resources available to help me understand my insurance policies better?

+

Yes, there are various resources available to help you understand your insurance policies. Your insurance provider may offer educational materials or online resources. Additionally, insurance brokers and financial advisors can provide expert guidance tailored to your specific needs.