Christian Insurance Companies

In the realm of insurance, Christian-affiliated companies stand as unique entities, offering not just financial protection but also aligning their services with religious values and principles. These companies have carved a niche in the industry, catering to individuals and businesses seeking insurance coverage that resonates with their faith-based beliefs.

The Foundation of Christian Insurance

The concept of Christian insurance stems from the desire to integrate faith and business. These companies are founded on the principles of biblical teachings, aiming to provide financial security while upholding values of integrity, compassion, and service. They often operate with a mission to serve their policyholders, not only by offering competitive insurance products but also by actively supporting Christian communities and causes.

Key Principles and Practices

Christian insurance companies adhere to several core principles. They prioritize honesty and transparency in their dealings, reflecting the biblical value of integrity. Many of these firms allocate a portion of their profits to charitable initiatives, reflecting the Christian principle of giving back to the community. Additionally, they strive to treat their customers with compassion and respect, reflecting the biblical teachings on love and service.

| Company | Charitable Initiatives |

|---|---|

| Good Samaritan Insurance | Supports local food banks and provides scholarships for Christian education. |

| Faithful Finance | Offers grants to churches for community development projects. |

| Providence Protection | Partners with global charities to provide aid and education in developing countries. |

Product Offerings and Customization

Christian insurance companies provide a range of standard insurance products, including health, life, property, and casualty insurance. However, what sets them apart is their ability to customize these products to align with the specific needs and values of their policyholders.

Health Insurance with a Difference

In the realm of health insurance, Christian companies often offer plans that exclude services conflicting with religious beliefs, such as certain contraceptive methods or abortion-related procedures. They may also provide additional coverage for spiritual or holistic health practices, reflecting the holistic approach to health often embraced by Christians.

Life Insurance with a Purpose

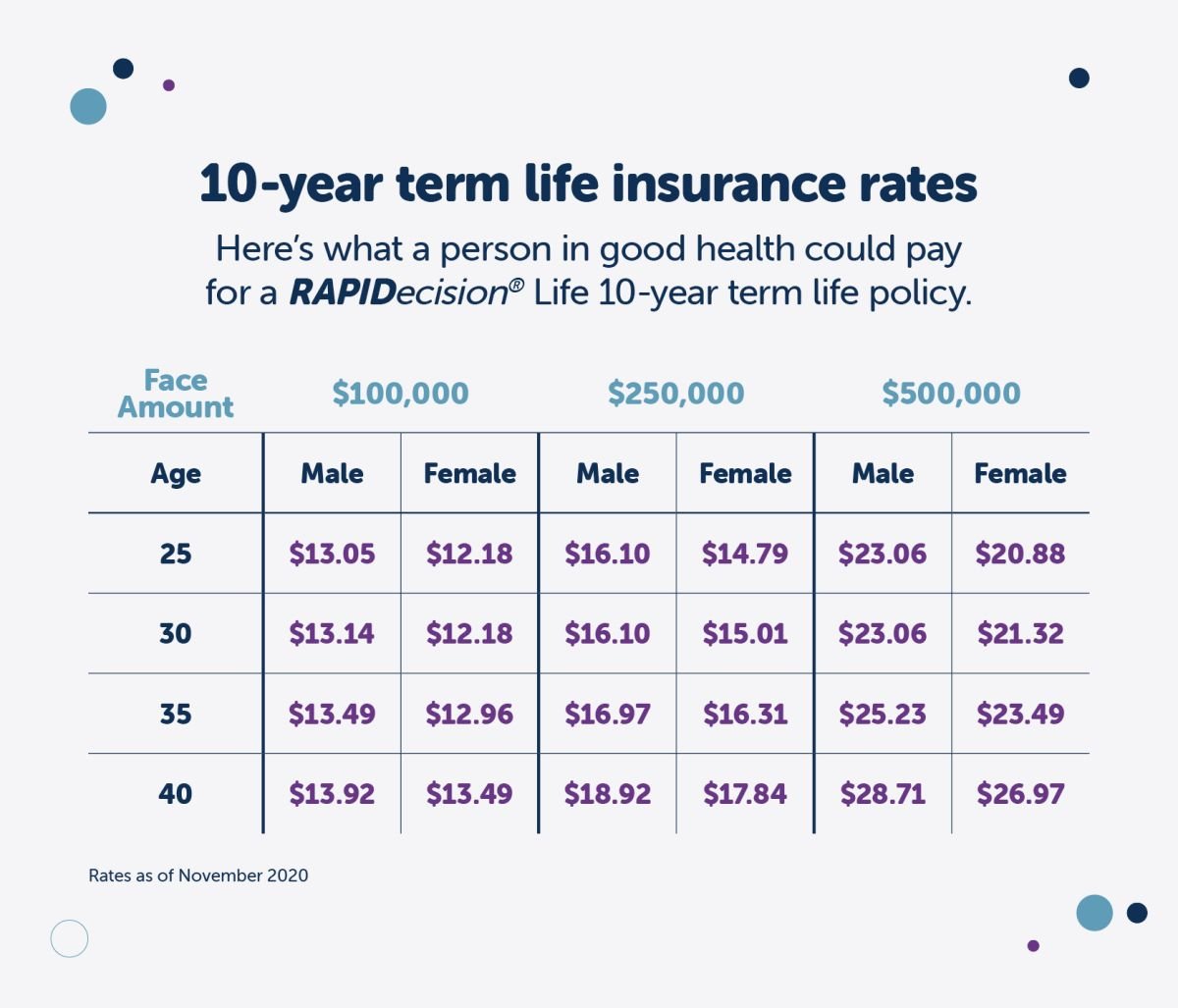

Life insurance policies from Christian companies often come with an added sense of purpose. These policies can include provisions for charitable donations upon the policyholder’s death, ensuring their legacy continues to support Christian causes. Some companies also offer life insurance policies with accelerated benefit riders, allowing policyholders to access a portion of their death benefit while still alive to cover long-term care or end-of-life expenses.

Property and Casualty Insurance

For property and casualty insurance, Christian companies offer standard coverage, but they also provide additional options tailored to the needs of religious institutions and leaders. This can include coverage for church buildings, religious schools, and even specialized policies for clergy, ensuring their personal belongings and liabilities are adequately insured.

Community Engagement and Support

Beyond providing insurance products, Christian insurance companies actively engage with and support their communities. They often sponsor and participate in local events, such as church fairs, youth camps, and community outreach programs. Many companies also provide educational resources and workshops to help individuals and families better understand insurance and financial planning, reflecting their commitment to service and empowerment.

Sponsorships and Partnerships

Christian insurance companies frequently partner with religious organizations and charities. These partnerships can involve joint initiatives to provide insurance coverage to underserved communities, support for mission trips, or the development of specialized insurance products to meet the unique needs of religious groups.

Challenges and Opportunities

While Christian insurance companies offer unique value propositions, they also face distinct challenges. One of the primary challenges is balancing their mission-driven focus with the need to remain financially sustainable in a highly competitive industry. Additionally, as the insurance landscape evolves with technological advancements and changing consumer preferences, these companies must adapt while staying true to their faith-based principles.

Embracing Technology and Innovation

To stay competitive, Christian insurance companies are increasingly adopting digital technologies. This includes online platforms for policy management, claims submission, and customer support. By embracing innovation, these companies can enhance their efficiency and customer service, while also reaching a wider audience, including younger generations who are more comfortable with digital interactions.

Conclusion: The Future of Christian Insurance

Christian insurance companies have established a strong presence in the industry, offering a unique blend of financial protection and faith-based values. As they continue to evolve, these companies are poised to leverage technological advancements and innovative business strategies to better serve their policyholders and support Christian communities. The future of Christian insurance looks promising, with a focus on continued growth, adaptation, and service to others.

What sets Christian insurance companies apart from traditional insurers?

+Christian insurance companies differentiate themselves by aligning their business practices and insurance products with biblical principles. This often involves a focus on integrity, compassion, and charitable giving. They also offer customized insurance solutions that cater to the unique needs and values of their faith-based clientele.

Do Christian insurance companies only serve Christians?

+While Christian insurance companies are rooted in faith, they typically serve a diverse range of individuals and businesses. Their products and services are often attractive to those who value integrity, transparency, and a commitment to community service, regardless of their religious affiliation.

How do Christian insurance companies ensure their profitability while supporting charitable causes?

+Christian insurance companies achieve profitability through a balanced approach. They focus on efficient operations, competitive pricing, and a commitment to underwriting discipline. Simultaneously, they allocate a portion of their profits to charitable initiatives, ensuring they can both support their communities and maintain financial sustainability.

Are there any unique risks or challenges associated with Christian insurance companies?

+One of the primary challenges faced by Christian insurance companies is balancing their mission-driven focus with the need to remain financially viable. They must also navigate potential conflicts between their religious principles and changing social norms, ensuring their products remain relevant and attractive to their target market.