City Of New York Health Insurance

The city of New York, known for its vibrant culture, diverse population, and bustling urban life, also prides itself on offering comprehensive health insurance options to its residents. Navigating the complex world of health insurance can be daunting, but understanding the available plans and their benefits is crucial for making informed decisions. In this comprehensive guide, we delve into the realm of health insurance in New York City, exploring the various options, their coverage, and how they cater to the unique needs of the city's inhabitants.

The Importance of Health Insurance in New York City

New York City, with its large and diverse population, presents a unique set of healthcare challenges and opportunities. The city’s fast-paced lifestyle, coupled with its dense population, means that access to quality healthcare is essential. Health insurance serves as a crucial safety net, ensuring that residents can receive the medical care they need without facing financial hardship.

Furthermore, the city's reputation as a global hub for business and innovation means that many residents are self-employed or work for small businesses. In such cases, health insurance becomes even more critical, as it provides a vital layer of protection for individuals and their families.

Understanding New York’s Health Insurance Landscape

The health insurance landscape in New York City is diverse and complex, offering a range of plans to cater to different needs and budgets. Understanding the key players and the options available is the first step towards making an informed choice.

Private Health Insurance Providers

New York City is home to numerous private health insurance providers, each offering a unique set of plans and benefits. These providers cater to a wide range of individuals, from young professionals to families and seniors. Some of the prominent private insurers in the city include:

- Aetna: Known for its comprehensive coverage and a wide network of healthcare providers, Aetna offers various plans, including HMO, PPO, and EPO options. Their plans often include additional benefits like vision and dental coverage.

- UnitedHealthcare: UnitedHealthcare provides a range of affordable plans, making healthcare accessible to a broad spectrum of New Yorkers. Their plans often feature flexible coverage options and tools to help members manage their healthcare costs.

- Empire BlueCross BlueShield: As one of the largest insurers in the state, Empire BlueCross BlueShield offers a robust network of healthcare providers and a variety of plan options, including HMO and PPO plans. They also provide specialized plans for small businesses and individuals.

Public Health Insurance Programs

In addition to private insurers, New York City residents also have access to public health insurance programs. These programs are designed to provide coverage to those who may not be able to afford private insurance or who have specific healthcare needs.

- Medicaid: Medicaid is a joint federal and state program that provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. In New York, Medicaid is administered by the state and offers comprehensive coverage, including doctor visits, hospital stays, and prescription medications.

- Child Health Plus: This program provides low-cost health insurance for children and teens up to age 19 who are not eligible for Medicaid. Child Health Plus offers comprehensive coverage, including doctor visits, immunizations, and dental care.

- Medicare: Medicare is a federal health insurance program primarily for people aged 65 or older, as well as some younger people with disabilities. In New York, Medicare offers various plans, including Original Medicare (Parts A and B) and Medicare Advantage (Part C) plans, which often include additional benefits like prescription drug coverage.

Essential Plan

The Essential Plan is a unique offering in New York State, designed to provide affordable health insurance coverage to individuals and families who do not qualify for Medicaid but cannot afford private insurance. This plan offers comprehensive benefits, including doctor visits, hospital care, and prescription drug coverage. The Essential Plan is particularly beneficial for those with limited incomes or who are between jobs.

Key Considerations When Choosing a Health Insurance Plan

With so many options available, choosing the right health insurance plan can be a complex decision. Here are some key factors to consider when evaluating the available plans:

Coverage and Benefits

Examine the scope of coverage offered by each plan. Consider your specific healthcare needs, including regular doctor visits, prescription medications, specialized treatments, or chronic condition management. Ensure that the plan covers these essential aspects and provides adequate benefits.

| Plan Type | Coverage Highlights |

|---|---|

| HMO Plans | Typically offer lower premiums and comprehensive coverage within a network of healthcare providers. May require referrals for specialist visits. |

| PPO Plans | Provide more flexibility, allowing you to choose providers both in and out of network. Often have higher premiums but offer greater convenience. |

| EPO Plans | Similar to PPOs, but with a more limited network. EPO plans offer lower premiums and focus on keeping care within a specific network. |

Network of Healthcare Providers

The network of healthcare providers associated with a plan is crucial. Ensure that your preferred doctors, hospitals, and specialists are included in the plan’s network. This is especially important if you have established relationships with certain healthcare professionals.

Cost and Premiums

Consider the overall cost of the plan, including premiums, deductibles, copayments, and coinsurance. Evaluate your budget and assess whether the plan’s cost aligns with your financial capabilities. Keep in mind that lower premiums may result in higher out-of-pocket expenses when receiving care.

Prescription Drug Coverage

If you rely on prescription medications, ensure that the plan offers adequate coverage for your specific needs. Some plans have preferred drug lists or may require prior authorization for certain medications. Understanding these details is crucial to avoid unexpected costs.

Additional Benefits and Services

Look for plans that offer additional benefits, such as vision and dental coverage, mental health services, or wellness programs. These added benefits can enhance your overall healthcare experience and provide greater value.

Navigating the Enrollment Process

Enrolling in a health insurance plan in New York City is a straightforward process, but it requires attention to detail. Here’s a step-by-step guide to help you navigate the enrollment process smoothly:

Step 1: Determine Your Eligibility

Begin by assessing your eligibility for different plans. Consider your income, family size, and any existing health conditions. This will help you narrow down the options and focus on plans that are most suitable for your situation.

Step 2: Compare Plans

Utilize online tools and resources provided by the New York State of Health website to compare plans side by side. Evaluate the coverage, benefits, costs, and network of providers for each plan. Consider your specific healthcare needs and choose a plan that aligns with your priorities.

Step 3: Gather Required Documentation

Before applying, ensure you have all the necessary documentation ready. This may include proof of identity, income verification, and residency documents. Having these documents readily available will streamline the application process.

Step 4: Apply Online or In-Person

You can apply for health insurance through the New York State of Health website or by visiting an enrollment center in person. Online applications are convenient and can be completed at your own pace. In-person enrollment allows you to receive assistance from trained navigators who can guide you through the process.

Step 5: Review and Finalize Your Choice

Once you’ve applied, carefully review the plan details and coverage summary. Ensure that the plan you’ve chosen meets your needs and expectations. If you have any questions or concerns, reach out to the insurance provider or the New York State of Health for clarification.

Understanding Your Rights and Responsibilities

As a health insurance holder in New York City, it’s essential to understand your rights and responsibilities. This knowledge empowers you to make the most of your coverage and ensures that you receive the care you deserve.

Your Rights

New York State law guarantees certain rights to all health insurance policyholders, including:

- The right to appeal coverage decisions, such as denied claims or restricted access to care.

- Protection from discrimination based on pre-existing conditions or health status.

- Access to emergency services without prior authorization.

- Timely access to healthcare providers and timely resolution of grievances.

Your Responsibilities

While your health insurance plan provides coverage, there are certain responsibilities that fall on your shoulders as well:

- Paying your premiums on time to maintain continuous coverage.

- Understanding your plan's benefits and limitations to make informed healthcare decisions.

- Keeping your personal information, including address and contact details, up to date with your insurance provider.

- Notifying your insurance company of any changes in your circumstances, such as a new job, marriage, or birth of a child, which may affect your coverage.

Staying Informed and Engaged

Health insurance is a dynamic field, and staying informed about changes and updates is crucial. Here are some ways to stay engaged and ensure you’re making the most of your coverage:

Review Your Plan Regularly

Health insurance plans can evolve, and it’s essential to review your plan annually to ensure it still meets your needs. Changes in your health status, family size, or income may warrant a different plan or coverage level.

Utilize Online Resources

The New York State of Health website offers a wealth of resources, including a plan finder tool, educational materials, and updates on healthcare-related legislation. Stay connected to these resources to stay informed about your options and rights.

Attend Community Events

Community health fairs, workshops, and educational sessions are excellent opportunities to learn more about health insurance, ask questions, and connect with healthcare providers and insurance representatives.

Conclusion

Navigating the complex world of health insurance in New York City requires knowledge, diligence, and a commitment to staying informed. By understanding the options available, considering your specific needs, and staying engaged, you can make the most of your health insurance coverage and access the care you deserve. Remember, health insurance is not just a financial investment; it’s an essential tool for safeguarding your well-being and the well-being of your loved ones.

How often should I review my health insurance plan?

+It’s a good practice to review your health insurance plan annually or whenever there are significant changes in your life, such as a new job, marriage, or birth of a child. Regular reviews ensure that your coverage aligns with your current needs and circumstances.

What should I do if I have a dispute with my insurance provider?

+If you have a dispute or disagreement with your insurance provider, it’s important to first review your policy and understand your rights. Many insurance companies have grievance processes in place, and you can start by filing a formal complaint. If the issue persists, you can seek assistance from the New York State Department of Financial Services or the New York State Department of Health.

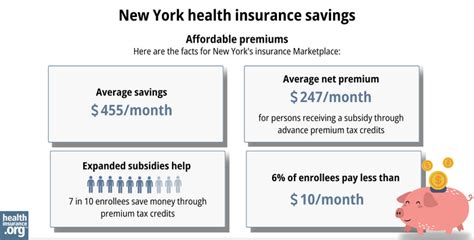

Are there any discounts or subsidies available for health insurance in New York City?

+Yes, New York City offers various programs and subsidies to make health insurance more affordable. The Essential Plan, for instance, provides low-cost coverage for individuals and families who don’t qualify for Medicaid. Additionally, the New York State of Health website provides information on tax credits and subsidies available through the Affordable Care Act.