Classic Vehicle Insurance Companies

The Allure of Classic Cars: Unveiling the World of Classic Vehicle Insurance Companies

In the realm of automotive enthusiasts, classic cars hold a special place. These timeless machines, with their unique designs and rich histories, evoke a sense of nostalgia and admiration. However, owning and maintaining a classic vehicle comes with its own set of challenges, one of the most crucial being the need for specialized insurance coverage.

Classic vehicle insurance companies play a pivotal role in ensuring that these vintage treasures are protected against potential risks. With their extensive knowledge and tailored policies, they offer a safety net for collectors, restorers, and enthusiasts alike. In this comprehensive guide, we delve into the world of classic vehicle insurance, exploring the companies that cater to this niche market, the unique coverage they provide, and the factors that influence the insurance landscape for classic cars.

Understanding the Classic Car Insurance Landscape

The insurance landscape for classic cars differs significantly from that of modern vehicles. Classic cars, often defined as vehicles over 20 years old, present a unique set of risks and considerations. While modern cars are designed for everyday use and are expected to depreciate over time, classic cars are typically collector's items, carefully maintained and preserved for their historical and aesthetic value.

Classic vehicle insurance companies recognize these differences and tailor their policies accordingly. They understand that classic car owners have distinct needs and priorities, such as ensuring the preservation of the vehicle's originality, protecting against potential damage during shows or events, and providing coverage for valuable parts and accessories.

Key Features of Classic Car Insurance Policies

- Agreed Value Coverage: One of the hallmark features of classic car insurance is the agreed value coverage. Unlike standard auto insurance policies that provide coverage based on the vehicle's actual cash value, agreed value policies ensure that the insured receives the full agreed-upon value of the car in the event of a total loss. This protection is particularly crucial for classic cars, as their value often increases over time.

- Limited Mileage and Storage: Classic car insurance policies typically cater to the limited use nature of these vehicles. They offer coverage for occasional pleasure driving and participation in car shows, but may restrict mileage to ensure the vehicle's longevity. Additionally, these policies often accommodate storage, understanding that classic cars may be kept in secure facilities or garages for extended periods.

- Parts and Accessories Coverage: Classic cars often require specialized parts and accessories, which can be expensive and difficult to source. Classic vehicle insurance companies offer coverage for these items, ensuring that owners can replace or repair unique components without incurring significant financial burden.

- Event Coverage: Many classic car owners participate in car shows, rallies, and other events. Classic car insurance policies often provide coverage for damage or accidents that occur during these events, giving owners the confidence to display their vehicles without worry.

Leading Classic Vehicle Insurance Companies

The market for classic vehicle insurance is niche but diverse, with several specialized companies offering tailored coverage. Here's an overview of some of the leading classic car insurance providers:

Hagerty Classic Car Insurance

Hagerty is a renowned name in the classic car insurance industry, known for its passion for automotive history and its commitment to preserving the legacy of classic vehicles. With a range of coverage options, Hagerty caters to various needs, offering agreed value policies, comprehensive coverage for mechanical breakdowns, and protection for valuable parts and accessories.

Key Features:

- Agreed Value Coverage: Hagerty specializes in providing agreed value policies, ensuring that the insured receives the full value of their classic car in the event of a total loss.

- Flexible Coverage Options: Hagerty offers coverage for various classic car uses, including daily driving, participation in events, and storage.

- Vehicle Valuation Services: They provide vehicle valuation services, helping owners determine the accurate value of their classic cars for insurance purposes.

Grundy Classic Car Insurance

Grundy is another prominent player in the classic car insurance market, offering specialized coverage for a range of vintage and collector vehicles. With a focus on customer service and tailored policies, Grundy ensures that classic car owners receive the protection they need.

Key Features:

- Agreed Value Coverage: Grundy provides agreed value policies, ensuring that classic car owners receive the full value of their vehicle in the event of a total loss.

- Comprehensive Coverage: They offer comprehensive coverage, including liability, collision, and comprehensive protection, tailored to the unique needs of classic car owners.

- Flexible Mileage Options: Grundy understands the varied usage patterns of classic cars and offers flexible mileage options to accommodate different driving habits.

American Collectors Insurance

American Collectors Insurance is dedicated to serving the needs of classic car enthusiasts, offering a range of coverage options specifically designed for collector vehicles. With a focus on customer satisfaction and competitive rates, they have become a trusted choice for many classic car owners.

Key Features:

- Agreed Value Coverage: American Collectors Insurance provides agreed value policies, ensuring that the insured receives the full agreed-upon value of their classic car in the event of a total loss.

- Parts and Accessories Coverage: They offer coverage for valuable parts and accessories, understanding that classic cars often require specialized components.

- Event Coverage: American Collectors Insurance provides coverage for car shows, rallies, and other events, giving owners peace of mind while displaying their vehicles.

Factors Influencing Classic Car Insurance Rates

The cost of classic car insurance can vary significantly, influenced by a multitude of factors. Here's an overview of some key considerations that impact insurance rates for classic vehicles:

Vehicle Age and Value

The age and value of the classic car are primary factors in determining insurance rates. Older vehicles, particularly those with historical significance or unique features, may command higher insurance premiums due to their increased value and potential rarity.

Usage and Mileage

Classic car insurance policies often take into account the vehicle's intended usage and mileage. Cars that are driven frequently or used for daily commuting may attract higher premiums compared to those that are only driven occasionally or kept in storage for most of the year.

Driver Profile and Experience

The driver's profile and experience also play a role in determining insurance rates. Classic car insurance companies may consider factors such as the driver's age, driving record, and experience with classic vehicles. Younger drivers or those with a history of accidents may face higher premiums.

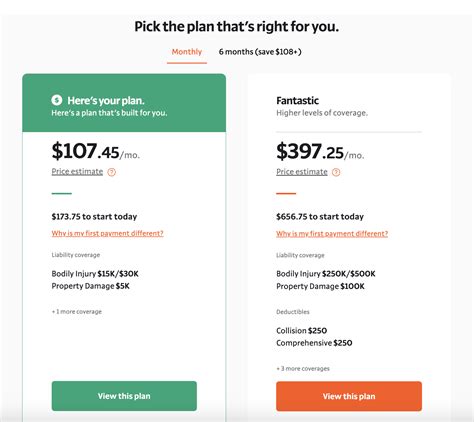

Coverage Options and Deductibles

The chosen coverage options and deductibles can significantly impact insurance rates. Opting for higher levels of coverage or selecting lower deductibles may result in increased premiums. Classic car owners should carefully assess their coverage needs and financial considerations to strike the right balance.

The Benefits of Classic Vehicle Insurance

Investing in classic vehicle insurance offers a range of benefits that extend beyond basic protection. Here's a closer look at some of the advantages:

Preserving Your Investment

Classic cars are often significant investments, both financially and emotionally. Classic vehicle insurance policies provide a safety net, ensuring that owners can protect their investment against potential risks, including accidents, theft, or natural disasters. With the right coverage, owners can have peace of mind knowing their cherished vehicles are safeguarded.

Customized Coverage for Unique Needs

Classic vehicle insurance companies understand the unique needs of classic car owners. They offer customized coverage options, catering to specific requirements such as agreed value coverage, limited mileage policies, and protection for valuable parts and accessories. This level of customization ensures that classic car owners receive the tailored protection they need.

Access to a Community of Enthusiasts

Many classic vehicle insurance companies go beyond providing insurance coverage. They often foster a community of like-minded enthusiasts, offering resources, events, and opportunities for classic car owners to connect and share their passion. This sense of community can enhance the overall experience of owning a classic vehicle.

The Future of Classic Car Insurance

As the classic car market continues to evolve, so too does the landscape of classic car insurance. With an increasing number of enthusiasts and a growing appreciation for vintage vehicles, the demand for specialized insurance coverage is expected to rise. Here's a glimpse into the future of classic car insurance:

Digital Transformation

The insurance industry, including classic car insurance, is undergoing a digital transformation. Insurers are embracing technology to enhance the customer experience, streamline processes, and offer more efficient and personalized coverage. From online policy management to digital claims processing, the future of classic car insurance is likely to be characterized by increased convenience and accessibility.

Expanded Coverage Options

As the classic car market diversifies, so too will the range of coverage options available. Insurers are likely to develop new policies that cater to emerging trends, such as electric classic cars or restored vehicles with modern upgrades. This expansion of coverage options will ensure that classic car owners can find tailored protection that aligns with their specific needs.

Data-Driven Risk Assessment

With advancements in data analytics and machine learning, classic car insurance companies will have access to more sophisticated tools for risk assessment. By leveraging data-driven insights, insurers can more accurately assess the risks associated with classic vehicles, leading to more precise pricing and coverage options. This data-driven approach will benefit both insurers and classic car owners, promoting fair and accurate insurance rates.

Frequently Asked Questions

What is the difference between classic car insurance and standard auto insurance?

+

Classic car insurance is specifically designed for collector vehicles, offering features like agreed value coverage, limited mileage policies, and protection for valuable parts. Standard auto insurance, on the other hand, is typically geared towards everyday vehicles and provides coverage based on the vehicle’s actual cash value.

How do classic car insurance companies determine the value of my vehicle?

+

Classic car insurance companies often use a combination of factors to determine the value of your vehicle, including its make, model, year, condition, and any unique features or modifications. They may also consider market trends and the historical value of similar vehicles.

Can I insure my classic car if it’s not my daily driver?

+

Absolutely! Classic car insurance policies are designed to cater to a range of usage patterns, including occasional pleasure driving and participation in car shows. Many insurers offer flexible coverage options to accommodate the limited use of classic vehicles.

Are there any discounts available for classic car insurance?

+

Yes, classic car insurance companies often offer discounts for various reasons. These may include multi-policy discounts (if you have other insurance policies with the same company), low-mileage discounts, and even discounts for belonging to certain car clubs or organizations.

How do I choose the right classic car insurance company?

+

Choosing the right classic car insurance company involves researching and comparing different providers. Consider factors such as their reputation, the range of coverage options they offer, their claims process, and customer reviews. It’s also beneficial to consult with other classic car owners and seek recommendations.