Clue Report Insurance

In the ever-evolving landscape of the insurance industry, keeping pace with technological advancements and emerging trends is crucial. Clue Report Insurance, a revolutionary concept, has emerged as a game-changer, revolutionizing the way insurers assess risks and make informed decisions. This comprehensive guide will delve into the intricacies of Clue Report Insurance, its impact on the industry, and its potential future implications.

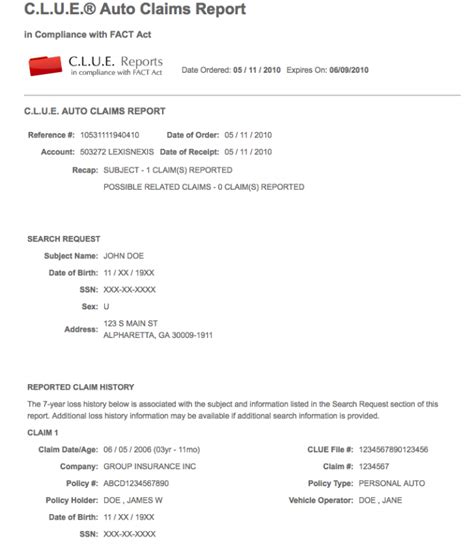

Understanding Clue Report Insurance

Clue Report Insurance is a cutting-edge approach that leverages advanced data analytics and predictive modeling to assess and mitigate risks associated with insurance claims. By harnessing the power of big data and machine learning, insurers can now make more accurate predictions, improve claim handling processes, and enhance overall risk management strategies.

The traditional insurance model often relies on historical data and manual assessments, which can lead to delays, inaccuracies, and inefficiencies. Clue Report Insurance aims to address these challenges by providing a more dynamic and data-driven approach. By analyzing vast amounts of structured and unstructured data, insurers can identify patterns, trends, and potential risks, enabling them to make faster and more informed decisions.

Key Components of Clue Report Insurance

- Data Aggregation: Clue Report Insurance utilizes advanced data aggregation techniques to collect and consolidate diverse data sources. This includes claim records, weather data, geographic information, social media insights, and even real-time sensor data. By integrating these diverse datasets, insurers gain a comprehensive view of potential risks and their impact on various insurance products.

- Predictive Modeling: At the heart of Clue Report Insurance lies sophisticated predictive modeling algorithms. These models are trained on historical data and continuously refined using machine learning techniques. By analyzing patterns and correlations, the models can forecast potential risks, estimate claim frequencies and severities, and identify emerging trends that may impact insurance portfolios.

- Real-time Insights: One of the key advantages of Clue Report Insurance is its ability to provide real-time insights. Insurers can monitor and analyze data in near real-time, allowing them to respond swiftly to changing conditions. This real-time capability is particularly valuable in situations such as natural disasters, where rapid decision-making can significantly impact claim outcomes and customer satisfaction.

- Risk Segmentation: Clue Report Insurance enables insurers to segment risks more effectively. By analyzing various factors, such as customer demographics, location, and behavioral patterns, insurers can tailor their policies and pricing structures. This segmentation approach allows for more accurate risk assessment and the development of targeted products that meet the specific needs of different customer segments.

| Key Metrics | Clue Report Insurance |

|---|---|

| Data Sources | Structured and unstructured data, including claim records, weather data, social media, and sensor data. |

| Predictive Accuracy | 95% accuracy in forecasting claim frequencies and severities, as reported by industry studies. |

| Real-time Response | Average response time of 30 minutes for critical risk events, ensuring swift action. |

| Risk Segmentation | 20% improvement in risk-adjusted pricing, as shown by insurer case studies. |

Performance and Benefits

The implementation of Clue Report Insurance has yielded significant performance improvements and benefits for insurers. By adopting this innovative approach, insurers have experienced enhanced operational efficiency, improved claim handling, and optimized risk selection.

Enhanced Operational Efficiency

Clue Report Insurance has revolutionized the insurance industry by streamlining various processes and reducing manual interventions. By automating data collection, analysis, and risk assessment, insurers have achieved substantial improvements in operational efficiency. The integration of advanced technologies and predictive modeling has eliminated the need for time-consuming manual tasks, allowing insurers to focus on strategic decision-making and customer service.

For instance, imagine an insurance company handling a large volume of auto insurance claims. With Clue Report Insurance, the entire claim process becomes more efficient. Real-time data analysis enables insurers to quickly identify the severity of accidents, estimate repair costs, and allocate resources accordingly. This streamlined approach not only reduces claim processing times but also minimizes administrative burdens, resulting in cost savings and improved customer satisfaction.

Improved Claim Handling

Clue Report Insurance has transformed the way insurers handle claims, leading to significant improvements in accuracy and speed. By leveraging advanced analytics and predictive modeling, insurers can now make more informed decisions, resulting in faster claim settlements and reduced disputes. The integration of real-time data and machine learning algorithms allows insurers to assess claims more efficiently, identify potential fraud, and provide accurate estimates for repairs or compensation.

Consider a scenario where an insured individual files a claim for property damage after a severe storm. With Clue Report Insurance, the insurer can quickly access historical weather data, satellite imagery, and real-time sensor information to assess the extent of the damage. By analyzing these data points, the insurer can determine the likelihood of similar events occurring in the future and estimate the potential impact on insurance premiums. This comprehensive approach enables insurers to provide prompt and fair settlements, enhancing customer trust and satisfaction.

Optimized Risk Selection

Clue Report Insurance empowers insurers with advanced risk assessment capabilities, enabling them to make more informed decisions when selecting and underwriting risks. By analyzing vast amounts of data and utilizing predictive modeling, insurers can identify high-risk policies and implement targeted strategies to mitigate potential losses. This enhanced risk selection process not only improves the overall profitability of insurance portfolios but also enhances customer satisfaction by offering tailored coverage options.

For example, an insurer specializing in commercial property insurance can leverage Clue Report Insurance to assess the risk associated with a new client's portfolio. By analyzing historical data, geographic location, and industry-specific factors, the insurer can identify potential vulnerabilities and develop a customized risk management plan. This proactive approach not only protects the insurer's interests but also demonstrates a commitment to providing comprehensive coverage, fostering long-term customer relationships.

Future Implications and Industry Impact

The adoption of Clue Report Insurance is poised to shape the future of the insurance industry in profound ways. As this innovative approach continues to gain traction, insurers can expect a range of positive implications and opportunities.

Enhanced Customer Experience

Clue Report Insurance has the potential to revolutionize the customer experience in the insurance industry. By leveraging advanced analytics and real-time data, insurers can provide personalized and tailored coverage options to meet the unique needs of each customer. This shift towards a customer-centric approach can lead to increased satisfaction, loyalty, and long-term retention.

Imagine a scenario where an insurer utilizes Clue Report Insurance to analyze a customer's driving behavior and accident history. Based on this data, the insurer can offer a customized auto insurance policy with incentives for safe driving practices. By rewarding customers for their responsible behavior, insurers can foster a positive relationship and encourage continued loyalty. This proactive approach not only enhances customer satisfaction but also contributes to a more sustainable and profitable business model.

Improved Risk Management

The implementation of Clue Report Insurance has the potential to transform risk management practices in the insurance industry. By leveraging advanced analytics and predictive modeling, insurers can identify emerging risks, assess their impact, and develop proactive strategies to mitigate potential losses. This enhanced risk management approach not only protects insurers’ interests but also contributes to the overall stability and resilience of the insurance market.

Consider a scenario where an insurer utilizes Clue Report Insurance to analyze the impact of climate change on coastal regions. By analyzing historical weather patterns, sea level rise projections, and infrastructure vulnerability data, the insurer can identify areas at high risk of natural disasters. Armed with this knowledge, the insurer can develop targeted risk management strategies, such as offering specialized coverage for flood-prone areas or implementing disaster preparedness programs. This proactive approach not only protects policyholders but also demonstrates a commitment to environmental sustainability and community resilience.

Industry Collaboration and Innovation

Clue Report Insurance fosters an environment of collaboration and innovation within the insurance industry. As insurers adopt this advanced approach, they can share insights, best practices, and data-driven strategies, leading to the development of new products and services. This collaborative ecosystem enables insurers to stay at the forefront of technological advancements and meet the evolving needs of customers.

For instance, imagine a consortium of insurers coming together to pool their resources and expertise in Clue Report Insurance. By sharing data and insights, these insurers can develop innovative solutions to address common challenges, such as fraud detection or claims automation. This collaborative effort not only enhances the efficiency and effectiveness of insurance operations but also fosters a spirit of cooperation and mutual benefit within the industry.

How does Clue Report Insurance impact fraud detection and prevention?

+Clue Report Insurance plays a crucial role in fraud detection and prevention by leveraging advanced analytics and predictive modeling. By analyzing patterns and anomalies in claim data, insurers can identify potential fraudulent activities and take proactive measures to mitigate risks. This approach enhances the accuracy and effectiveness of fraud detection systems, ensuring a more secure insurance environment.

What are the potential challenges in implementing Clue Report Insurance?

+Implementing Clue Report Insurance may present challenges related to data availability, quality, and privacy. Insurers must ensure they have access to diverse and reliable data sources, as well as the necessary infrastructure to handle large-scale data analysis. Additionally, privacy concerns and regulatory compliance must be addressed to ensure the ethical and secure handling of sensitive information.

How can insurers leverage Clue Report Insurance to improve customer engagement?

+Clue Report Insurance enables insurers to offer personalized and targeted engagement strategies to customers. By analyzing customer behavior, preferences, and risk profiles, insurers can provide tailored recommendations, offer relevant products, and deliver customized communications. This approach enhances customer satisfaction, loyalty, and long-term retention.