College Student Insurance

Navigating the complexities of adult life often begins with one crucial decision: securing adequate insurance coverage. For college students, this step is especially pivotal, as it not only safeguards their health and well-being but also provides a foundation for financial stability and peace of mind during a pivotal life stage. This comprehensive guide delves into the world of college student insurance, offering an insightful look at the types, benefits, and considerations that make this an essential aspect of student life.

Understanding the Basics: College Student Insurance

College student insurance, a specialized form of coverage, is tailored to meet the unique needs and circumstances of students. It encompasses a range of policies, each designed to protect students from various risks and uncertainties they may encounter during their academic journey.

Health Insurance: A Pillar of Student Well-being

Health insurance stands as a cornerstone of any student’s insurance portfolio. With the potential for unforeseen medical emergencies or the need for ongoing healthcare, having adequate coverage is essential. College-provided health insurance plans often offer comprehensive benefits, including coverage for routine check-ups, prescriptions, and emergency care. These plans can be a cost-effective solution for students, providing peace of mind and ensuring access to necessary medical services.

Additionally, for students with pre-existing conditions or those who require specialized care, individual health insurance plans can be a valuable option. These plans, available through private insurers, offer tailored coverage to meet specific healthcare needs. It's important for students to carefully review their options and choose a plan that aligns with their health requirements and budget.

| Plan Type | Coverage Highlights |

|---|---|

| College-Provided Health Insurance | Comprehensive coverage, often including routine check-ups, prescriptions, and emergency care. |

| Individual Health Insurance Plans | Tailored coverage for specific health needs, suitable for students with pre-existing conditions or unique healthcare requirements. |

Renters Insurance: Protecting Student Belongings

For college students living off-campus, renters insurance is a crucial consideration. This type of insurance safeguards personal belongings and provides liability coverage in case of accidents or damage. Whether it’s protecting valuable electronics, furniture, or personal items, renters insurance offers peace of mind and financial protection. It’s especially important for students living in shared accommodations, as it can cover their belongings in the event of theft, fire, or other unforeseen circumstances.

Additionally, renters insurance often includes liability coverage, which can be a lifesaver in the event of an accident or injury caused by the student. This coverage ensures that the student's financial well-being is protected, even in unforeseen circumstances. It's a small investment that can provide significant peace of mind and protection for students during their time away from home.

| Coverage Type | Key Benefits |

|---|---|

| Renters Insurance | Protects personal belongings, offers liability coverage, and provides financial protection for students living off-campus. |

Travel Insurance: Safeguarding Student Adventures

College is often a time of exploration and travel. Whether it’s studying abroad, participating in internships, or simply taking advantage of vacation opportunities, travel insurance is a smart consideration. This type of insurance provides coverage for trip cancellations, medical emergencies while traveling, and lost or delayed luggage. It ensures that students can embark on their adventures with the knowledge that they are protected from potential financial setbacks and unexpected circumstances.

Travel insurance also offers peace of mind for parents and guardians, knowing that their student is protected during their travels. It's a valuable investment that can make the difference between a memorable trip and a stressful experience. With the right travel insurance policy, students can focus on making memories and gaining valuable experiences, secure in the knowledge that they are covered.

| Coverage Highlights | Benefits for Students |

|---|---|

| Trip Cancellation Coverage | Protects against unforeseen circumstances that may lead to trip cancellations. |

| Medical Emergency Coverage | Ensures access to necessary medical care while traveling, providing financial protection. |

| Lost or Delayed Luggage Coverage | Covers the cost of essential items in case of lost or delayed luggage. |

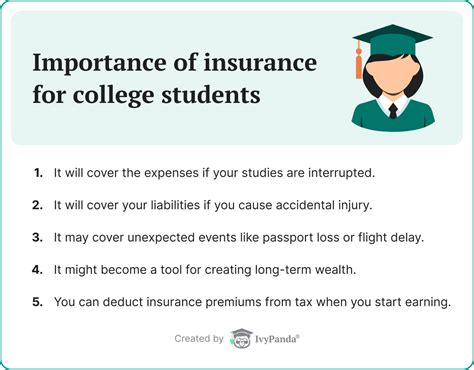

The Importance of Comprehensive Coverage

College student insurance is more than just a requirement; it’s a vital component of a student’s overall well-being and financial security. By understanding the various types of insurance and their benefits, students can make informed decisions to protect themselves and their belongings. Whether it’s health insurance, renters insurance, or travel insurance, each type of coverage plays a unique role in safeguarding students during their academic journey.

Tailoring Insurance to Individual Needs

One of the key advantages of college student insurance is the ability to customize coverage to individual needs. Whether a student requires extensive health coverage due to pre-existing conditions or needs comprehensive renters insurance for valuable belongings, the flexibility of these policies ensures that students can find the right fit. This customization ensures that students receive the protection they need without unnecessary expenses.

Peace of Mind and Financial Protection

The primary goal of insurance is to provide peace of mind and financial protection. For college students, this means having the assurance that they can access necessary medical care, protect their belongings, and navigate unexpected travel situations without financial strain. Insurance policies act as a safety net, allowing students to focus on their studies and personal growth without the worry of potential setbacks.

Long-Term Benefits and Preparation

Beyond the immediate benefits, college student insurance also serves as a valuable preparation for adulthood. By navigating insurance options and understanding the importance of coverage, students develop financial literacy and a sense of responsibility. This knowledge and experience can prove invaluable as they transition into careers and independent living, where insurance becomes an essential aspect of their financial planning.

| Key Takeaways | Benefits of College Student Insurance |

|---|---|

| Comprehensive Coverage | Protects students' health, belongings, and travel experiences. |

| Customization | Allows students to tailor insurance to their unique needs and circumstances. |

| Peace of Mind | Provides financial protection and assurance, allowing students to focus on their studies and personal growth. |

| Long-Term Preparation | Equips students with financial literacy and responsibility, preparing them for future insurance needs and financial planning. |

Conclusion: A Secure Foundation for Academic Success

College student insurance is a critical aspect of a student’s journey, offering a secure foundation for academic success and personal growth. By understanding the types of insurance available and their benefits, students can make informed choices to protect their well-being and financial stability. Whether it’s health insurance, renters insurance, or travel insurance, each policy plays a vital role in ensuring that students can navigate their academic pursuits with confidence and peace of mind.

As students embark on their college careers, the importance of insurance cannot be overstated. It is a key component of their overall preparation for adulthood, providing a safety net and a sense of security during this transformative life stage. With the right insurance coverage, students can focus on their studies, pursue their passions, and embrace the opportunities that college life offers, knowing they are protected and prepared for whatever lies ahead.

What are the main types of insurance for college students?

+College students typically need health insurance, renters insurance (if living off-campus), and travel insurance for study abroad or other trips. These types of insurance provide comprehensive coverage for their well-being, belongings, and travel experiences.

How can I choose the right health insurance plan as a college student?

+Review your options carefully, considering factors like pre-existing conditions, prescription needs, and the cost of premiums and deductibles. For students with unique health needs, individual health insurance plans can offer tailored coverage.

Is renters insurance necessary for college students living on campus?

+While it’s not typically required for on-campus students, renters insurance is still a wise investment. It protects your belongings and provides liability coverage, offering peace of mind and financial protection in case of accidents or damage.

What should I consider when choosing travel insurance for a study abroad program?

+Look for policies that cover trip cancellations, medical emergencies, and lost or delayed luggage. Ensure the policy includes coverage for your destination and any specific activities you plan to participate in during your study abroad experience.