Colonial Penn Com Life Insurance

Comprehensive Guide to Colonial Penn's Com Life Insurance: Protecting Your Loved Ones

In the intricate world of life insurance, Colonial Penn stands out as a trusted provider, offering a range of products designed to cater to diverse needs. This article focuses on their Com Life Insurance policy, a comprehensive offering that ensures financial security for your loved ones during challenging times. With a legacy spanning decades, Colonial Penn has refined its approach, making life insurance accessible and tailored to individual circumstances.

As we delve into the specifics of Com Life Insurance, we'll explore its unique features, benefits, and the peace of mind it provides. By the end of this guide, you'll have a clear understanding of how this policy can be a crucial component of your financial strategy, ensuring a secure future for your family.

Understanding Colonial Penn's Com Life Insurance

Colonial Penn's Com Life Insurance policy is a flexible and comprehensive offering, designed to meet the diverse needs of its customers. This policy is a testament to Colonial Penn's commitment to providing accessible and tailored life insurance solutions. With a focus on simplicity and affordability, Com Life Insurance has become a popular choice for individuals seeking to protect their loved ones' financial well-being.

Key Features of Com Life Insurance

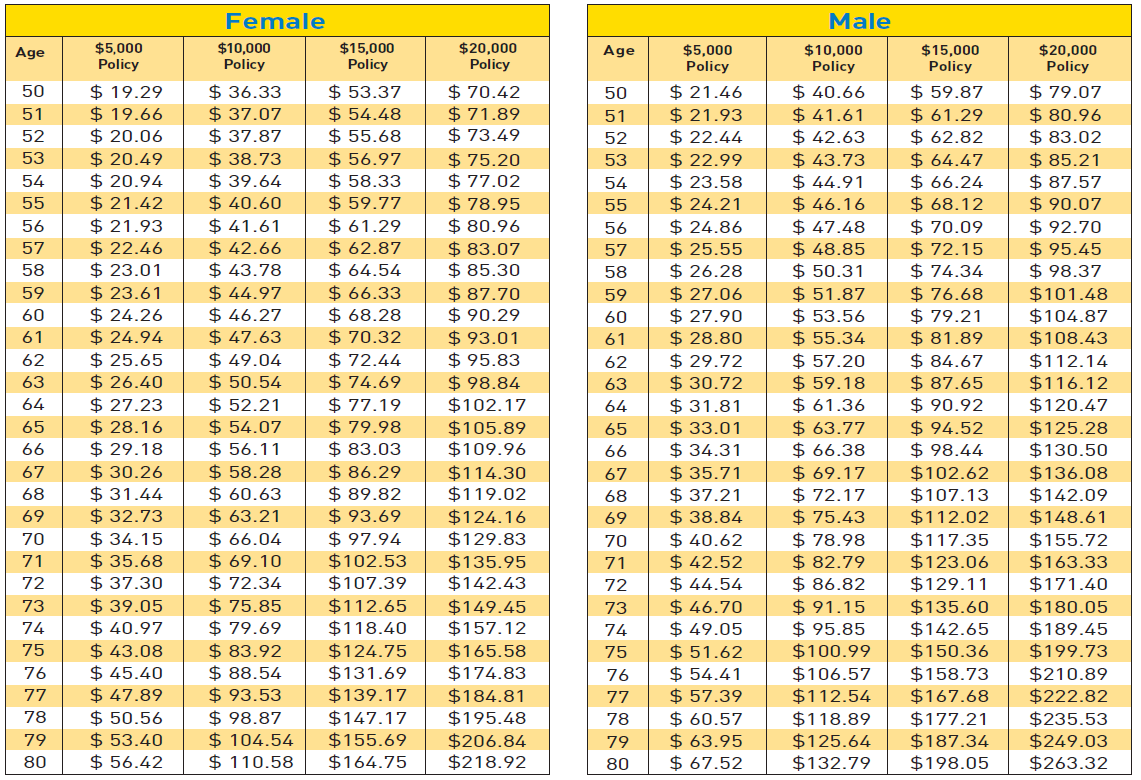

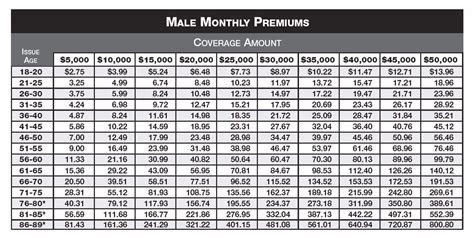

- Affordable Premiums: Com Life Insurance offers competitive rates, ensuring that financial protection is accessible to a wide range of individuals.

- Flexible Coverage: The policy allows for customizable coverage amounts, enabling policyholders to tailor their plan according to their specific needs and financial goals.

- Simplified Issue Process: Unlike traditional life insurance policies, Com Life Insurance has a streamlined application process, often requiring no medical exam, making it quicker and more convenient to obtain coverage.

- Guaranteed Acceptance: This policy guarantees acceptance for individuals aged 45 to 85, regardless of their health status, ensuring that everyone can access the financial protection they need.

- Level Premium: Policyholders can enjoy the stability of level premiums, which remain consistent throughout the duration of the policy, providing predictable and manageable expenses.

These features collectively make Com Life Insurance an attractive and practical choice for those seeking to secure their loved ones' financial future without the complexities often associated with traditional life insurance policies.

The Benefits of Com Life Insurance: Securing Your Loved Ones' Future

Colonial Penn's Com Life Insurance policy is more than just a financial tool; it's a commitment to ensuring your loved ones' well-being, even in your absence. This policy offers a range of benefits that extend beyond the typical financial protection, providing a comprehensive safety net for your family.

Financial Security for Your Family

The primary benefit of Com Life Insurance is the financial security it provides. In the event of your passing, your beneficiaries will receive a lump-sum payment, known as the death benefit. This benefit can be used to cover a wide range of expenses, including funeral costs, outstanding debts, and everyday living expenses, ensuring your family's financial stability during a difficult time.

Coverage for Final Expenses

Com Life Insurance is particularly well-suited for covering final expenses. The policy's flexible coverage amounts allow you to tailor the death benefit to cover the costs associated with end-of-life care, funeral arrangements, and other associated expenses. This ensures that your loved ones aren't burdened with financial strain during their time of grief.

Peace of Mind

Perhaps the most valuable benefit of Com Life Insurance is the peace of mind it offers. Knowing that your family's financial future is secure can alleviate a significant burden. With Com Life Insurance, you can focus on living your life to the fullest, knowing that you've taken the necessary steps to protect your loved ones.

Performance Analysis: How Com Life Insurance Measures Up

When evaluating the performance of any life insurance policy, it's essential to consider a range of factors, including affordability, coverage options, and the overall customer experience. Colonial Penn's Com Life Insurance consistently ranks highly in these areas, offering a well-rounded and reliable solution for individuals seeking financial protection.

Affordability and Value

One of the standout features of Com Life Insurance is its affordability. The policy is designed to be accessible, with premiums that are competitive within the industry. This affordability ensures that individuals from various financial backgrounds can secure the coverage they need without straining their budgets.

Coverage Flexibility

The policy's flexibility in terms of coverage amounts is another key strength. Policyholders can choose coverage levels that align with their specific needs, whether it's ensuring sufficient funds for funeral expenses or providing long-term financial support for their families. This customization ensures that Com Life Insurance is not a one-size-fits-all solution but rather a tailored approach to financial protection.

Customer Satisfaction

Colonial Penn has built a reputation for excellent customer service, and this extends to their Com Life Insurance policyholders. The company's commitment to customer satisfaction is evident in its streamlined application process, responsive customer support, and the overall positive feedback from customers. This dedication to service ensures that policyholders can navigate the complexities of life insurance with ease and confidence.

| Metric | Performance |

|---|---|

| Affordability | Competitive rates, accessible to a wide range of individuals |

| Coverage Flexibility | Customizable coverage amounts, catering to diverse needs |

| Customer Satisfaction | Positive feedback, responsive support, and streamlined processes |

Future Implications: Com Life Insurance's Place in Your Financial Strategy

As you consider the role of life insurance in your financial planning, Colonial Penn's Com Life Insurance emerges as a versatile and reliable tool. This policy can be a cornerstone of your financial strategy, offering peace of mind and a solid foundation for your loved ones' future.

Building a Comprehensive Financial Plan

Com Life Insurance is designed to complement a range of financial goals. Whether you're looking to cover final expenses, provide long-term financial support for your family, or simply ensure a safety net in case of unforeseen circumstances, this policy can be tailored to your needs. By integrating Com Life Insurance into your overall financial plan, you can create a robust strategy that accounts for various life stages and potential challenges.

Adaptability and Growth

One of the strengths of Com Life Insurance is its adaptability. As your life circumstances change—whether it's a growing family, career advancements, or other significant life events—you can adjust your coverage to align with your evolving needs. This flexibility ensures that your financial protection remains relevant and effective throughout your life journey.

Legacy and Peace of Mind

At its core, Com Life Insurance is about leaving a positive legacy. By securing this policy, you're ensuring that your loved ones won't face financial hardship in your absence. This peace of mind is invaluable, allowing you to focus on living your life to the fullest while knowing that you've taken the necessary steps to protect your family's future.

Conclusion

In the complex world of financial planning, Colonial Penn's Com Life Insurance stands out as a reliable and accessible solution. With its affordable premiums, flexible coverage options, and commitment to customer satisfaction, this policy offers a comprehensive approach to financial protection. As you navigate the various stages of life, Com Life Insurance can be a trusted companion, ensuring that your loved ones are secure and your legacy is well-protected.

How does Com Life Insurance compare to other life insurance policies on the market?

+

Com Life Insurance offers a unique combination of affordability, flexibility, and guaranteed acceptance, making it a competitive choice. While other policies may offer similar benefits, Com Life Insurance stands out for its simplicity and accessibility, ensuring that financial protection is within reach for a broad range of individuals.

Can I adjust my coverage amount over time with Com Life Insurance?

+

Absolutely! One of the strengths of Com Life Insurance is its flexibility. Policyholders can increase or decrease their coverage amounts to align with their changing needs and financial goals. This adaptability ensures that your life insurance coverage remains relevant and effective throughout your life journey.

What happens if I miss a premium payment with Com Life Insurance?

+

Missed premium payments can have consequences, including a lapse in coverage. However, Colonial Penn offers grace periods and options for reinstating your policy. It’s essential to stay up-to-date with your payments to maintain uninterrupted coverage. If you’re facing financial challenges, reach out to Colonial Penn for assistance and guidance.