Colorado Insurance Exchange

Colorado Insurance Exchange: Unlocking Access to Affordable Healthcare

In the vibrant state of Colorado, the Colorado Insurance Exchange has emerged as a crucial platform, empowering residents to navigate the complexities of healthcare coverage and make informed choices about their insurance plans. This comprehensive insurance marketplace, established with a mission to enhance accessibility and transparency, has played a pivotal role in reshaping the healthcare landscape for Coloradans.

With a deep understanding of the unique healthcare needs and preferences of the state's diverse population, the Colorado Insurance Exchange offers a user-friendly and accessible platform, making it easier than ever for individuals and families to secure the coverage they need. By aggregating a wide array of insurance plans from various providers, the exchange provides a one-stop shop for consumers, streamlining the often daunting process of comparing and selecting healthcare plans.

This article delves into the intricacies of the Colorado Insurance Exchange, exploring its key features, benefits, and impact on the healthcare landscape of the state. We will uncover how this innovative platform is revolutionizing access to healthcare, empowering consumers with choice and control over their insurance decisions.

The Evolution of the Colorado Insurance Exchange

The Colorado Insurance Exchange traces its origins back to the Affordable Care Act (ACA), also known as Obamacare, which was signed into law in 2010. This landmark legislation aimed to reform the healthcare system in the United States, with a key focus on increasing access to affordable healthcare coverage for all Americans. As part of the ACA, states were given the option to establish their own insurance marketplaces, or exchanges, to facilitate the purchase of health insurance plans.

Colorado was among the states that recognized the potential of an insurance exchange to improve healthcare accessibility and embraced the opportunity to create a robust platform tailored to the needs of its residents. In 2013, the Connect for Health Colorado (CFHC) was launched, marking a significant milestone in the state's journey towards a more equitable and accessible healthcare system.

Since its inception, the Colorado Insurance Exchange has undergone continuous refinement and expansion. It has adapted to the evolving healthcare landscape, incorporating feedback from consumers, healthcare providers, and insurance carriers to enhance its functionality and responsiveness. This iterative approach has positioned the exchange as a dynamic and adaptable platform, capable of meeting the diverse and ever-changing needs of Coloradans.

Key Features and Benefits of the Colorado Insurance Exchange

1. A Wide Array of Insurance Options

One of the standout features of the Colorado Insurance Exchange is its extensive selection of insurance plans. The exchange serves as a marketplace, aggregating a diverse range of healthcare coverage options from various insurance carriers. This aggregation provides consumers with a comprehensive view of the available plans, enabling them to make informed comparisons and choose the option that best aligns with their unique healthcare needs and financial circumstances.

The exchange offers a variety of plan types, including bronze, silver, gold, and platinum plans, each with its own level of coverage and associated costs. Additionally, consumers can explore catastrophic plans and dental and vision plans, ensuring that they can secure the specific coverage they require.

| Plan Type | Coverage Level | Cost |

|---|---|---|

| Bronze | Lower coverage, higher out-of-pocket costs | Lower premiums |

| Silver | Moderate coverage, balanced costs | Moderate premiums |

| Gold | Higher coverage, lower out-of-pocket costs | Higher premiums |

| Platinum | Comprehensive coverage, lowest out-of-pocket costs | Highest premiums |

2. Simplified Enrollment Process

The Colorado Insurance Exchange is designed with a user-friendly interface, making the enrollment process straightforward and accessible. Consumers can create an account, input their personal details, and search for insurance plans that match their needs. The exchange's intuitive platform guides users through the enrollment process, ensuring a seamless and stress-free experience.

Furthermore, the exchange provides real-time eligibility determination, allowing users to instantly understand their coverage options and potential costs. This transparency helps consumers make timely decisions and ensures a smooth transition into their chosen insurance plan.

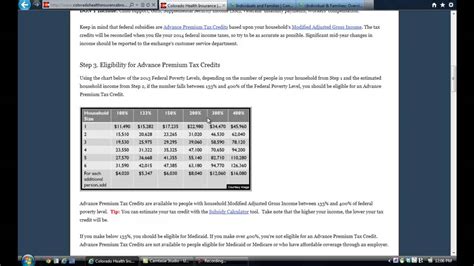

3. Premium Tax Credits and Cost-Saving Opportunities

The Colorado Insurance Exchange plays a crucial role in helping eligible residents access premium tax credits and other cost-saving measures. These credits, which are based on income and family size, can significantly reduce the cost of monthly premiums, making healthcare coverage more affordable for many Coloradans.

In addition to premium tax credits, the exchange offers a range of cost-saving opportunities, including special enrollment periods and reduced cost-sharing options. These features ensure that individuals and families have access to affordable healthcare, regardless of their financial situation.

4. Access to Local and National Carriers

The Colorado Insurance Exchange aggregates insurance plans from both local and national carriers, providing consumers with a diverse range of options. This aggregation includes plans from well-known national carriers, as well as regional and local providers, ensuring that Coloradans have access to a variety of coverage options tailored to their specific needs and preferences.

By partnering with a wide range of insurance carriers, the exchange promotes competition and choice, driving down costs and improving the overall quality of healthcare coverage available to residents.

5. Consumer Education and Support

Beyond its role as a marketplace, the Colorado Insurance Exchange is committed to empowering consumers with knowledge and support. The exchange offers a wealth of educational resources, including articles, guides, and webinars, to help residents understand their healthcare options, navigate the enrollment process, and make informed decisions about their coverage.

Additionally, the exchange provides a dedicated customer support team, available via phone, email, and live chat, to assist consumers with any questions or concerns they may have throughout the enrollment process and beyond. This comprehensive support system ensures that Coloradans have the guidance they need to make the most of their healthcare coverage.

Impact and Success Stories

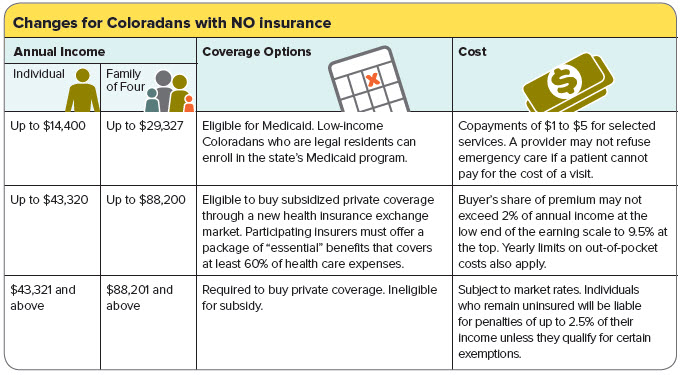

Increased Healthcare Access

The establishment of the Colorado Insurance Exchange has had a profound impact on the state's healthcare landscape. By providing a centralized platform for comparing and enrolling in insurance plans, the exchange has made healthcare coverage more accessible to a broader range of residents. This has led to a significant increase in the number of Coloradans with healthcare coverage, narrowing the gap in access to essential medical services.

According to a recent study conducted by the Colorado Health Institute, the percentage of uninsured residents in Colorado has decreased significantly since the launch of the exchange. This reduction in the uninsured rate is a testament to the exchange's success in connecting residents with affordable and comprehensive healthcare coverage.

Empowering Consumers with Choice

The Colorado Insurance Exchange has empowered consumers by giving them a choice in their healthcare coverage. The wide array of insurance plans available on the exchange allows individuals and families to select the option that best suits their unique needs, whether it's a focus on comprehensive coverage, cost-effectiveness, or a combination of both.

This choice extends beyond the type of plan, as consumers can also select their preferred healthcare providers and facilities. By providing this level of flexibility, the exchange enables Coloradans to take control of their healthcare decisions, ensuring they receive the care they need from trusted providers.

Success Stories: Real-Life Impact

The Colorado Insurance Exchange has had a tangible impact on the lives of many Coloradans, providing them with access to essential healthcare services and peace of mind. Here are a few success stories that showcase the exchange's transformative power:

- Single Mother's Peace of Mind: A single mother, struggling to make ends meet, was able to secure affordable healthcare coverage for herself and her children through the Colorado Insurance Exchange. The exchange's premium tax credits and cost-saving options made healthcare coverage an achievable reality, ensuring that her family had access to the medical care they needed without financial strain.

- Small Business Owner's Relief: A small business owner, faced with rising healthcare costs, found relief through the Colorado Insurance Exchange. By comparing plans on the exchange, he was able to identify a cost-effective option that provided comprehensive coverage for his employees. This not only helped him manage his business expenses but also ensured that his team had access to quality healthcare, fostering a healthier and more productive workforce.

- Senior Citizen's Comprehensive Coverage: A senior citizen, concerned about the rising costs of healthcare, turned to the Colorado Insurance Exchange for a solution. The exchange's wide array of plans allowed her to find a gold-level plan that provided comprehensive coverage at a reasonable cost. This enabled her to access the medical services she needed without compromising her financial security, ensuring her health and well-being into her golden years.

Looking Ahead: The Future of the Colorado Insurance Exchange

As the healthcare landscape continues to evolve, the Colorado Insurance Exchange remains committed to its mission of enhancing accessibility and transparency in healthcare coverage. The exchange is continually refining its platform, incorporating feedback from stakeholders and adapting to the changing needs of Coloradans.

Looking ahead, the exchange aims to further expand its reach and impact. This includes exploring innovative technologies to enhance the user experience, such as mobile-friendly interfaces and personalized recommendation engines. By leveraging technology, the exchange can make healthcare coverage even more accessible and tailored to the unique needs of each consumer.

Additionally, the exchange is dedicated to fostering a collaborative environment, bringing together insurance carriers, healthcare providers, and community organizations to address the evolving healthcare needs of Coloradans. Through these partnerships, the exchange aims to drive innovation, improve the quality of care, and ensure that residents have access to the latest advancements in healthcare.

The future of the Colorado Insurance Exchange is bright, as it continues to play a pivotal role in shaping a more equitable and accessible healthcare system for the state. By empowering residents with choice, transparency, and affordability, the exchange is transforming the way Coloradans access and experience healthcare coverage.

What is the purpose of the Colorado Insurance Exchange?

+

The Colorado Insurance Exchange, also known as Connect for Health Colorado, is a state-based marketplace created to provide Coloradans with a platform to compare and purchase health insurance plans. Its primary purpose is to increase access to affordable healthcare coverage and empower residents to make informed decisions about their insurance.

How does the Colorado Insurance Exchange benefit consumers?

+

The exchange benefits consumers by offering a wide range of insurance plans from various carriers, making it easier to find and compare coverage options. It also provides premium tax credits and cost-saving measures, ensuring that healthcare coverage is more affordable. Additionally, the exchange offers educational resources and customer support to assist consumers throughout the enrollment process.

What types of insurance plans are available on the Colorado Insurance Exchange?

+

The Colorado Insurance Exchange offers a variety of plan types, including bronze, silver, gold, and platinum plans, each with different coverage levels and costs. Additionally, consumers can explore catastrophic plans and dental and vision plans to meet their specific healthcare needs.

Is enrollment in the Colorado Insurance Exchange mandatory for all residents?

+

No, enrollment in the Colorado Insurance Exchange is not mandatory for all residents. However, it is highly recommended for those seeking affordable healthcare coverage. The exchange provides a convenient and accessible platform to compare and enroll in insurance plans, ensuring individuals and families have the coverage they need.

How can I access the Colorado Insurance Exchange to explore insurance options?

+

To access the Colorado Insurance Exchange, you can visit the official website at https://www.connectforhealthco.com. There, you can create an account, browse available insurance plans, and enroll in the plan that best suits your needs. The website provides a user-friendly interface and comprehensive resources to guide you through the process.