Commercial Insurance Quote Online

In today's fast-paced business world, obtaining commercial insurance quotes online has become an essential step for businesses of all sizes. This process not only simplifies the task of comparing insurance options but also empowers business owners to make informed decisions regarding their company's protection. By leveraging the power of the internet, businesses can navigate the complex landscape of commercial insurance with ease and efficiency.

Understanding Commercial Insurance Quotes

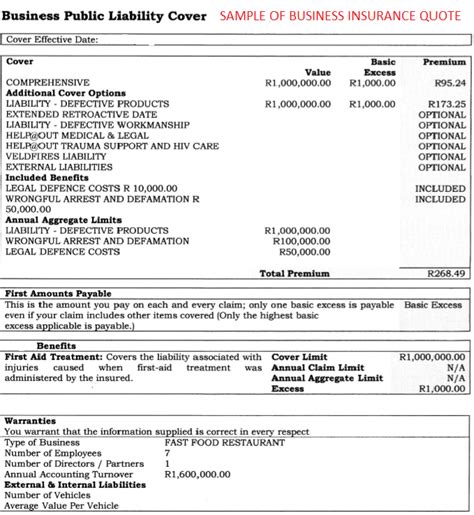

Commercial insurance quotes serve as a vital tool for businesses to assess their insurance needs and compare various coverage options. These quotes provide a comprehensive overview of the potential costs and benefits associated with different insurance policies, allowing businesses to tailor their coverage to specific requirements. Whether it’s protecting against property damage, liability claims, or employee-related risks, commercial insurance quotes offer a customized solution for each unique business venture.

When it comes to obtaining commercial insurance quotes online, the process is straightforward and accessible. Business owners can visit specialized insurance websites or utilize online platforms that aggregate multiple insurance providers. These platforms often feature user-friendly interfaces, enabling users to input their business details and receive personalized quotes based on their specific needs.

The Benefits of Online Commercial Insurance Quotes

The convenience of obtaining commercial insurance quotes online cannot be overstated. Business owners can access these quotes anytime, from anywhere, eliminating the need for in-person meetings or lengthy phone calls. This accessibility saves valuable time and effort, allowing entrepreneurs to focus on their core business activities.

Additionally, online commercial insurance quotes offer a level of transparency that traditional insurance procurement methods may lack. With a few clicks, business owners can compare multiple quotes side by side, gaining a clear understanding of the coverage, premiums, and terms offered by different insurers. This transparency empowers businesses to make informed choices and negotiate better deals, ultimately leading to cost savings and improved coverage.

Moreover, the online quote process often involves a more comprehensive evaluation of a business's unique risks. Advanced algorithms and data analytics enable insurance providers to assess a business's specific needs and tailor quotes accordingly. This level of customization ensures that businesses receive coverage that adequately addresses their potential liabilities, providing peace of mind and financial security.

Navigating the Online Quote Process

To ensure a smooth and successful online quote experience, business owners should follow a few best practices. Firstly, it’s essential to gather all relevant business information before starting the quote process. This includes details such as the nature of the business, number of employees, annual revenue, and any specific coverage requirements.

Secondly, business owners should take the time to thoroughly review and compare the quotes they receive. While cost is an important factor, it's crucial to consider the coverage limits, deductibles, and any exclusions or limitations outlined in the policy. Understanding these nuances can help businesses avoid surprises and ensure they have the right coverage in place.

Lastly, business owners should leverage the expertise of insurance professionals. While online quotes provide a convenient starting point, consulting with insurance agents or brokers can offer valuable insights and guidance. These professionals can help businesses navigate the complex world of commercial insurance, providing tailored advice and ensuring that all potential risks are adequately addressed.

The Role of Technology in Commercial Insurance

The rise of technology has revolutionized the commercial insurance industry, and online quotes are just the tip of the iceberg. Advanced analytics and data-driven insights have enabled insurers to offer more accurate and customized quotes, reflecting the unique risks faced by modern businesses. From cybersecurity threats to natural disasters, technology has enhanced insurers’ ability to assess and mitigate risks, ultimately benefiting businesses seeking comprehensive coverage.

Furthermore, technology has facilitated the development of innovative insurance products tailored to specific industries or business models. Insurers now offer specialized coverage for emerging technologies, such as e-commerce businesses or companies operating in the gig economy. This level of specialization ensures that businesses receive the protection they need to thrive in an ever-changing business landscape.

Case Study: Success Stories of Online Commercial Insurance Quotes

To illustrate the effectiveness of online commercial insurance quotes, let’s explore a few real-world success stories.

Small Business Success: A startup technology company sought commercial insurance to protect its intellectual property and equipment. By obtaining online quotes, the business owner was able to compare various policies and identify a provider that offered comprehensive coverage at a competitive rate. This enabled the company to secure the necessary protection without straining its limited budget.

Expanding Business Needs: As a construction company expanded its operations, the need for comprehensive liability coverage became evident. Through online quotes, the business owner discovered a policy that not only met their expanding liability needs but also included additional coverage for employee injuries, providing a more comprehensive solution for their growing business.

Risk Mitigation for E-commerce: An online retail business faced unique risks associated with their e-commerce platform. By leveraging online quotes, the business owner found an insurance provider that specialized in e-commerce risks. The policy included coverage for data breaches, cyber attacks, and product liability, ensuring the business was protected against the specific challenges of the digital marketplace.

Future Trends in Commercial Insurance

As technology continues to advance, the future of commercial insurance looks increasingly digital and data-driven. Insurers are investing in innovative solutions, such as artificial intelligence and machine learning, to further enhance the accuracy and efficiency of insurance quotes. These advancements will enable insurers to offer even more tailored coverage, reflecting the unique needs and risks of individual businesses.

Additionally, the integration of Internet of Things (IoT) devices and sensors is poised to revolutionize commercial insurance. These technologies will provide insurers with real-time data on business operations, enabling more precise risk assessment and potentially leading to more affordable and comprehensive coverage. The future of commercial insurance is bright, with technology at the forefront of driving innovation and enhancing protection for businesses.

Conclusion

Obtaining commercial insurance quotes online has revolutionized the way businesses protect themselves and their assets. The convenience, transparency, and customization offered by online quotes have empowered business owners to make informed decisions and secure the coverage they need. As technology continues to advance, the commercial insurance landscape will become even more dynamic and responsive to the unique needs of modern businesses.

What information do I need to provide for an online commercial insurance quote?

+When obtaining an online commercial insurance quote, you’ll typically need to provide details about your business, such as the industry, number of employees, annual revenue, and any specific coverage requirements. Having this information ready will streamline the quote process.

How accurate are online commercial insurance quotes?

+Online commercial insurance quotes are generally quite accurate, as they are based on the information you provide and advanced algorithms used by insurance providers. However, it’s important to note that these quotes are estimates and may not reflect the final policy terms or premiums. Consulting with an insurance professional can provide a more precise understanding of your coverage needs.

Can I customize my commercial insurance policy based on the online quote?

+Absolutely! Online commercial insurance quotes often provide a starting point for customization. You can review the quote, assess your specific coverage needs, and work with an insurance professional to tailor the policy to your business’s unique requirements. This ensures you have the right coverage without paying for unnecessary add-ons.