Commercial Motor Insurance Quote Online

In today's fast-paced world, businesses are seeking efficient and convenient ways to secure insurance coverage. The ability to obtain a commercial motor insurance quote online has become a valuable tool for business owners, offering them a quick and accessible way to explore their insurance options. This article delves into the process, benefits, and considerations of obtaining a commercial motor insurance quote online, shedding light on the digital transformation of the insurance industry.

Understanding Commercial Motor Insurance

Commercial motor insurance is a critical aspect of business operations, particularly for companies that rely on vehicles for their day-to-day activities. This type of insurance provides coverage for a range of vehicles, including trucks, vans, and cars, ensuring protection against various risks such as accidents, theft, and liability claims.

The importance of commercial motor insurance lies in its ability to safeguard businesses from potentially devastating financial losses. For instance, imagine a delivery company that experiences a major accident involving one of its trucks. Without adequate insurance coverage, the company could face significant financial burdens, including repair costs, legal fees, and potential compensation for injured parties. Commercial motor insurance acts as a safety net, helping businesses navigate such challenging situations.

The Rise of Online Quoting

The traditional method of obtaining insurance quotes often involved lengthy meetings with insurance agents, filling out extensive paperwork, and waiting for days or even weeks to receive a quote. However, the digital age has brought about a revolution, making the process of obtaining a commercial motor insurance quote online more efficient and accessible than ever before.

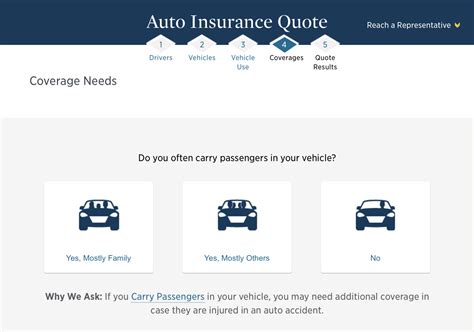

Online quoting platforms have emerged as a convenient alternative, offering business owners the ability to compare quotes from multiple insurance providers with just a few clicks. These platforms utilize advanced algorithms to assess risk factors and provide tailored quotes based on the specific needs and characteristics of the business. As a result, business owners can save valuable time and effort, allowing them to focus on their core operations.

The Benefits of Online Commercial Motor Insurance Quotes

Convenience and Accessibility

One of the most significant advantages of obtaining a commercial motor insurance quote online is the convenience it offers. Business owners can access these platforms from anywhere at any time, eliminating the need for physical appointments or lengthy phone calls. This accessibility is particularly beneficial for busy entrepreneurs who value their time and appreciate the flexibility to manage their insurance needs on their own schedule.

For instance, consider a small business owner who operates a fleet of delivery vans. With an online quoting platform, they can quickly input their vehicle details, select the desired coverage options, and instantly receive multiple quotes. This process not only saves time but also provides them with the flexibility to make informed decisions without disrupting their daily operations.

Quick Turnaround Times

Online quoting platforms are designed to provide swift responses, often generating quotes within minutes. This rapid turnaround time is a stark contrast to traditional methods, where waiting for quotes could extend to days or even weeks. The instant nature of online quotes allows business owners to make prompt decisions, ensuring they can secure the necessary coverage without unnecessary delays.

Furthermore, the speed of online quotes can be especially crucial during urgent situations. For example, if a business experiences a sudden increase in vehicle fleet size due to unexpected demand, they can quickly obtain quotes to ensure their new vehicles are adequately insured. This agility helps businesses maintain compliance and mitigate potential risks promptly.

Transparency and Comparison

Online commercial motor insurance quotes offer unparalleled transparency, allowing business owners to compare various options side by side. These platforms often provide detailed breakdowns of coverage, deductibles, and premium costs, enabling informed decision-making. Business owners can easily identify the most suitable insurance provider based on their specific needs and budget constraints.

Additionally, the comparison feature of online quoting platforms encourages healthy competition among insurance providers. As business owners can quickly assess multiple quotes, insurance companies are incentivized to offer competitive rates and comprehensive coverage to stand out. This competitive environment benefits businesses, ensuring they receive the best value for their insurance premiums.

Factors to Consider When Obtaining an Online Quote

Assessing Your Business Needs

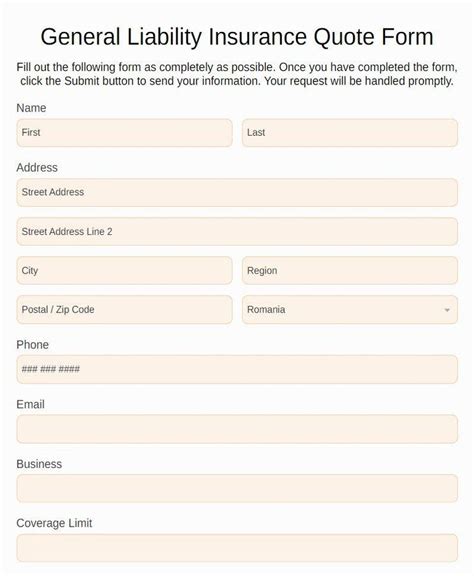

Before obtaining an online commercial motor insurance quote, it’s crucial to thoroughly assess your business’s unique needs. Consider factors such as the type of vehicles you operate, the nature of your business operations, and the potential risks associated with your industry. By understanding your specific requirements, you can tailor your insurance coverage accordingly.

For example, if your business involves hauling hazardous materials, you'll need to ensure your insurance policy provides adequate coverage for such operations. Similarly, if your vehicles frequently travel long distances, you may require additional coverage for road hazards or breakdown assistance.

Researching Insurance Providers

While online quoting platforms offer a convenient way to compare quotes, it’s essential to conduct additional research on the insurance providers themselves. Look for reputable companies with a strong track record of claims handling and customer satisfaction. Read reviews, check ratings, and consider the financial stability of the insurance providers to ensure they can fulfill their obligations in the event of a claim.

Additionally, consider the range of services and additional benefits offered by different insurance providers. Some companies may provide specialized coverage for unique business needs, while others might offer discounts for safety programs or loyalty rewards. Understanding these nuances can help you choose an insurance provider that aligns with your business goals and values.

Understanding Policy Details

When reviewing online quotes, pay close attention to the policy details. Ensure that you understand the coverage limits, deductibles, and any exclusions or limitations included in the policy. Misunderstanding these details can lead to unexpected out-of-pocket expenses or inadequate coverage during a claim.

For instance, if your policy has a high deductible, you'll need to be prepared to pay a substantial amount out of pocket in the event of a claim. Similarly, certain policies may have exclusions for specific types of accidents or damage, so it's crucial to review these thoroughly to ensure your business is adequately protected.

The Future of Commercial Motor Insurance

The rise of online commercial motor insurance quotes is a testament to the evolving nature of the insurance industry. As technology continues to advance, we can expect further innovations in this space. The integration of artificial intelligence and machine learning may enhance the accuracy and speed of risk assessments, leading to even more efficient quoting processes.

Additionally, the concept of usage-based insurance, where premiums are determined by actual driving behavior, is gaining traction. This data-driven approach could revolutionize commercial motor insurance, offering businesses more personalized and cost-effective coverage options. As the industry embraces these technological advancements, business owners can look forward to even greater flexibility and control over their insurance needs.

Conclusion

Obtaining a commercial motor insurance quote online has revolutionized the way businesses approach insurance coverage. The convenience, speed, and transparency offered by online quoting platforms have empowered business owners to make informed decisions efficiently. By understanding their unique needs, researching insurance providers, and thoroughly reviewing policy details, businesses can secure the right coverage to protect their operations and assets.

As the insurance industry continues to evolve, the future of commercial motor insurance looks promising. With ongoing technological advancements, business owners can expect even more innovative solutions, ensuring they can navigate the complex world of insurance with confidence and ease.

How accurate are online commercial motor insurance quotes?

+Online quotes are generated based on the information provided by the business owner. While they offer a good estimate, it’s important to note that the final policy may have slight variations. Factors such as additional endorsements or specific business requirements might impact the final premium.

Can I negotiate the premium after receiving an online quote?

+Negotiating premiums is possible, especially if you have a strong relationship with your insurance provider. However, it’s important to remember that online quotes are typically based on standardized rates. Discussing your specific needs and circumstances with your insurer may lead to alternative coverage options or potential discounts.

What happens if I need to make changes to my policy after purchasing it online?

+Most insurance providers offer the flexibility to make policy changes online or over the phone. Common changes include adding or removing vehicles, adjusting coverage limits, or updating contact information. It’s important to notify your insurer promptly to ensure your coverage remains up-to-date.