Comp Auto Insurance

The auto insurance industry is a vital part of the global economy, providing financial protection to millions of vehicle owners and drivers. In the United States, auto insurance is a legal requirement in most states, and it plays a crucial role in ensuring road safety and compensating victims of accidents. One of the key players in this industry is Comp Auto Insurance, a company known for its comprehensive coverage and innovative approach to vehicle protection.

A Brief History of Comp Auto Insurance

Comp Auto Insurance has a rich history that spans several decades. Founded in 1972 by a group of visionary entrepreneurs, the company set out to revolutionize the auto insurance landscape by offering tailored policies that catered to the unique needs of drivers. Over the years, Comp Auto Insurance has grown into a leading provider, renowned for its customer-centric approach and commitment to delivering exceptional service.

The company's early success can be attributed to its innovative underwriting practices and a deep understanding of the diverse needs of its customers. Comp Auto Insurance recognized the importance of personalized coverage and worked tirelessly to develop policies that offered flexibility and value. This approach not only attracted a loyal customer base but also positioned the company as an industry leader in customer satisfaction.

Comprehensive Coverage Options

Comp Auto Insurance is widely recognized for its extensive range of coverage options, ensuring that every driver can find a policy that suits their specific needs. Here are some of the key coverage types offered by the company:

Liability Coverage

Liability coverage is a fundamental aspect of auto insurance, protecting policyholders from financial losses arising from accidents they cause. Comp Auto Insurance offers multiple liability coverage options, including bodily injury liability and property damage liability. These coverages ensure that policyholders are protected in the event of an at-fault accident, providing peace of mind and financial security.

Collision and Comprehensive Coverage

For drivers seeking additional protection, Comp Auto Insurance provides collision and comprehensive coverage. Collision coverage helps cover the cost of repairing or replacing a vehicle after an accident, regardless of fault. On the other hand, comprehensive coverage offers protection against non-collision incidents such as theft, vandalism, natural disasters, and animal-related accidents. By combining these coverages, policyholders can enjoy comprehensive protection for their vehicles.

Uninsured/Underinsured Motorist Coverage

Comp Auto Insurance understands the importance of protecting its policyholders from the financial risks posed by uninsured or underinsured drivers. Uninsured/underinsured motorist coverage helps cover medical expenses and property damage costs when an at-fault driver lacks sufficient insurance coverage. This coverage ensures that policyholders are not left bearing the financial burden of such incidents.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a crucial coverage option that provides medical and rehabilitation benefits to policyholders and their passengers after an accident. PIP coverage ensures that injured individuals receive the necessary medical treatment and financial support, regardless of fault. This coverage is especially valuable in states with no-fault insurance laws, where PIP becomes a vital component of an auto insurance policy.

Medical Payments Coverage

Medical Payments coverage, often referred to as MedPay, is designed to cover medical expenses for policyholders and their passengers after an accident. This coverage is an essential addition to an auto insurance policy, as it provides quick and efficient payment for medical bills, allowing policyholders to focus on their recovery rather than financial concerns.

Rental Car Reimbursement

Comp Auto Insurance recognizes the inconvenience and added expense of renting a vehicle while one’s own car is being repaired or replaced. To address this, the company offers rental car reimbursement coverage, which helps cover the cost of renting a temporary vehicle during the repair or replacement process. This coverage ensures that policyholders can maintain their mobility and avoid the financial burden of extended rental periods.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects policyholders from financial losses due to accidents they cause. |

| Collision Coverage | Covers repair or replacement costs after an accident, regardless of fault. |

| Comprehensive Coverage | Protects against non-collision incidents such as theft and natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides financial protection when an at-fault driver lacks sufficient insurance. |

| Personal Injury Protection (PIP) | Covers medical and rehabilitation expenses, regardless of fault. |

| Medical Payments Coverage (MedPay) | Quickly pays for medical expenses after an accident. |

| Rental Car Reimbursement | Helps cover the cost of renting a temporary vehicle during repairs. |

Innovative Features and Benefits

Comp Auto Insurance is not just about offering a wide range of coverage options; the company is also known for its innovative features and benefits that enhance the overall customer experience.

Digital Claims Processing

In today’s digital age, Comp Auto Insurance understands the importance of streamlined processes. The company has implemented a state-of-the-art digital claims processing system, allowing policyholders to report and track their claims online or through a mobile app. This efficient and user-friendly system ensures a swift and convenient claims experience, reducing the stress and hassle often associated with insurance claims.

Telematics-Based Discounts

Comp Auto Insurance is at the forefront of using telematics technology to reward safe driving behaviors. Policyholders can opt into a telematics program, where a small device installed in their vehicle tracks driving habits such as speeding, harsh braking, and acceleration. Safe driving behaviors can lead to significant discounts on insurance premiums, providing an incentive for policyholders to adopt safer driving practices.

Roadside Assistance

Breakdowns and emergencies can happen at any time, and Comp Auto Insurance offers 24⁄7 roadside assistance to its policyholders. This service includes towing, battery jump-starts, flat tire changes, and even fuel delivery in case of an empty tank. By providing this comprehensive roadside assistance, Comp Auto Insurance ensures that its policyholders have peace of mind and reliable support when they need it most.

Usage-Based Insurance (UBI)

Comp Auto Insurance recognizes that not all drivers have the same risk profiles. To address this, the company offers Usage-Based Insurance (UBI) programs, which tailor insurance premiums based on an individual’s actual driving behavior. By analyzing factors such as mileage, time of day, and driving habits, UBI programs provide fair and accurate pricing, rewarding low-risk drivers with lower premiums.

Accident Forgiveness

Accidents happen, and Comp Auto Insurance understands the importance of second chances. The company offers accident forgiveness as an add-on to its policies, ensuring that policyholders’ rates remain unaffected by their first at-fault accident. This feature provides a safety net for policyholders, allowing them to maintain their insurance coverage and avoid rate increases after an unfortunate incident.

Enhanced Rental Car Coverage

For policyholders who frequently rent vehicles, Comp Auto Insurance offers enhanced rental car coverage. This coverage provides additional protection beyond the basic rental car reimbursement, including collision damage waiver and liability coverage for the rental vehicle. By adding this coverage, policyholders can enjoy added peace of mind when renting a car, knowing they are fully protected.

Customer Satisfaction and Industry Recognition

Comp Auto Insurance’s commitment to customer satisfaction and innovative approach has earned the company numerous accolades and industry recognition.

In a recent survey conducted by an independent research firm, Comp Auto Insurance ranked among the top auto insurance providers in terms of customer satisfaction. The survey highlighted the company's exceptional claims handling, responsive customer service, and competitive pricing as key factors contributing to its high customer satisfaction ratings.

Additionally, Comp Auto Insurance has been recognized by industry experts for its forward-thinking approach to insurance. The company's use of telematics and UBI programs has been praised for its ability to accurately assess risk and provide fair pricing. This recognition not only validates Comp Auto Insurance's innovative strategies but also reinforces its position as an industry leader.

Future Outlook and Industry Impact

As the auto insurance industry continues to evolve, Comp Auto Insurance is poised to play a significant role in shaping the future of vehicle protection. With its focus on innovation and customer-centric approach, the company is well-positioned to meet the changing needs of drivers and adapt to emerging trends.

One area where Comp Auto Insurance is expected to make a substantial impact is in the realm of autonomous vehicles. As self-driving cars become more prevalent, the insurance landscape will need to adapt to this new reality. Comp Auto Insurance is actively researching and developing insurance products tailored to autonomous vehicles, ensuring that policyholders can obtain adequate coverage for this emerging technology.

Furthermore, Comp Auto Insurance's commitment to sustainability and environmental responsibility is set to influence the industry. The company has already taken steps to reduce its carbon footprint by encouraging the use of electric vehicles and offering incentives for policyholders who adopt eco-friendly driving practices. By promoting sustainable transportation, Comp Auto Insurance is contributing to a greener future and setting an example for other insurance providers.

In conclusion, Comp Auto Insurance stands as a shining example of an innovative and customer-centric auto insurance provider. With its comprehensive coverage options, industry-leading features, and unwavering commitment to customer satisfaction, the company has established itself as a trusted partner for vehicle owners. As the industry continues to evolve, Comp Auto Insurance is well-equipped to navigate the changing landscape and deliver exceptional value to its policyholders.

How can I get a quote from Comp Auto Insurance?

+Getting a quote from Comp Auto Insurance is simple and convenient. You can start by visiting their official website and using the online quote tool. Alternatively, you can call their customer service hotline and speak to a representative who can guide you through the quoting process. Comp Auto Insurance aims to provide quick and accurate quotes to help you find the right coverage for your needs.

What factors determine my auto insurance premium with Comp Auto Insurance?

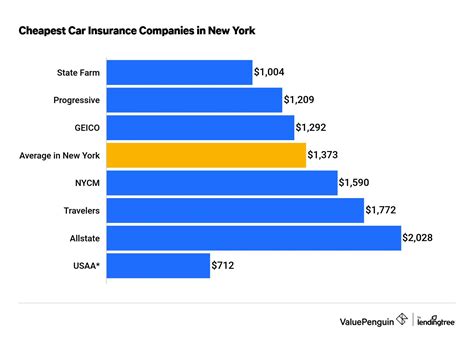

+Several factors influence your auto insurance premium with Comp Auto Insurance. These include your driving history, the make and model of your vehicle, your age and gender, the coverage options you choose, and your location. Comp Auto Insurance also considers your credit score and any additional discounts or programs you may be eligible for. It’s important to discuss these factors with a representative to get an accurate quote tailored to your circumstances.

Does Comp Auto Insurance offer discounts for multiple policies?

+Yes, Comp Auto Insurance recognizes the value of bundling multiple policies and offers significant discounts for customers who combine their auto insurance with other insurance products, such as homeowners or renters insurance. By bundling your policies, you can enjoy cost savings and streamlined coverage management.