Compare Auto Insurance Quotes

When it comes to choosing the right auto insurance policy, getting multiple quotes is a crucial step to ensure you're not only getting the coverage you need but also the best value for your money. Comparing auto insurance quotes is an essential practice that empowers you to make an informed decision, saving you time and money in the long run. In this comprehensive guide, we will delve into the world of auto insurance quotes, exploring the key factors that influence rates, the steps to obtain accurate quotes, and the strategies to compare them effectively. By the end of this article, you'll have the knowledge and tools to navigate the auto insurance landscape with confidence, finding the perfect policy that meets your unique needs.

Understanding the Factors that Impact Auto Insurance Quotes

Before diving into the comparison process, it’s essential to grasp the factors that insurance providers consider when calculating your auto insurance quote. These factors play a significant role in determining the cost of your policy and can vary depending on your location, personal circumstances, and driving history.

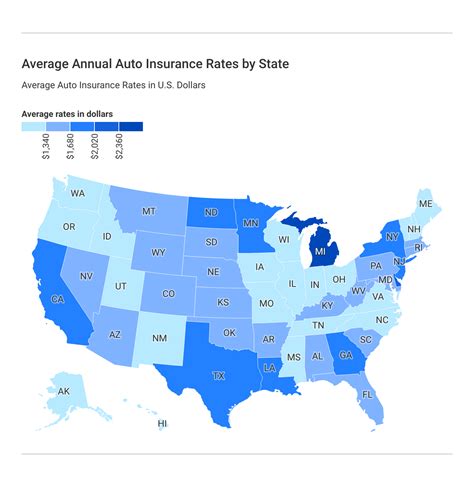

Location-Specific Considerations

One of the primary factors influencing auto insurance rates is your geographic location. Insurance companies analyze data specific to your region, taking into account factors such as traffic density, crime rates, and weather conditions. For instance, urban areas with higher population densities and increased traffic may result in higher insurance premiums due to the elevated risk of accidents and vehicle theft.

Additionally, states or regions with a history of severe weather events, such as hurricanes or tornadoes, may also see higher insurance rates. These events can lead to increased claims, affecting the overall cost of insurance in that area.

| Region | Average Annual Premium |

|---|---|

| Urban City Centers | $1,200 - $1,800 |

| Suburban Areas | $800 - $1,200 |

| Rural Communities | $600 - $900 |

Personal Factors and Driving History

Your personal characteristics and driving history are key considerations when insurance providers assess your risk profile. Factors such as age, gender, marital status, and credit score can influence your insurance rates. For example, younger drivers, especially those under 25, often face higher premiums due to their lack of driving experience and higher risk of accidents.

Additionally, your driving record plays a crucial role. Insurance companies examine your history of accidents, traffic violations, and claims. A clean driving record can lead to more affordable insurance rates, while multiple accidents or violations may result in higher premiums or even policy denial.

Vehicle Type and Usage

The type of vehicle you drive and how you use it also impact your insurance rates. Insurance companies consider factors such as the make, model, and year of your vehicle, as well as its safety features and repair costs. Vehicles with advanced safety features or those that are less prone to accidents may qualify for lower insurance rates.

Furthermore, the purpose for which you use your vehicle matters. If you primarily use your car for commuting to work, your insurance rates may be different from someone who uses their vehicle for business purposes or long-distance travel. The frequency and distance of your drives can influence your insurance premium.

Obtaining Accurate Auto Insurance Quotes

Now that we understand the factors that influence auto insurance quotes, let’s explore the steps to obtain accurate and reliable quotes from insurance providers.

Research and Compare Insurance Companies

Begin by researching and comparing multiple insurance companies. Different providers offer varying coverage options and pricing structures. Consider factors such as their financial stability, customer satisfaction ratings, and the range of coverage options they provide. Online reviews and industry rankings can offer valuable insights into the reputation and reliability of these companies.

Explore the websites of reputable insurance companies to get a sense of their offerings. Many providers offer online quote tools that allow you to input your information and receive an estimate of your premium. These tools can provide a quick and convenient way to compare initial quotes.

Gather Essential Information

To obtain accurate quotes, gather all the necessary information beforehand. This includes details about your vehicle, such as make, model, year, and VIN number. Additionally, have your personal information ready, including your name, address, date of birth, and driver’s license number.

If you have a current insurance policy, collect details about your coverage limits, deductibles, and any discounts you currently receive. This information will be useful when comparing quotes and ensuring you're getting a comprehensive and fair comparison.

Provide Accurate Details

When filling out quote forms or speaking with insurance agents, provide accurate and honest information. Misrepresenting your driving history or vehicle details can lead to inaccurate quotes and potential issues down the line. Insurance companies have ways to verify the information you provide, so it’s best to be upfront and transparent.

Consider Additional Coverage Options

While obtaining quotes, explore the additional coverage options offered by insurance providers. Common add-ons include rental car coverage, roadside assistance, and gap insurance. Evaluate your needs and consider whether these additional coverages are worth the extra cost. Remember, while comprehensive coverage is essential, it’s also important to strike a balance between coverage and affordability.

Comparing Auto Insurance Quotes Effectively

With a collection of accurate quotes from different insurance providers, it’s time to delve into the comparison process. Here’s a step-by-step guide to help you make an informed decision.

Assess Coverage Levels

Start by comparing the coverage levels offered by each insurance provider. Ensure that you’re comparing apples to apples by examining the liability limits, comprehensive and collision coverage, and any additional coverages included in the policy. Look for policies that provide adequate coverage for your needs without overspending on unnecessary add-ons.

Consider your personal circumstances and the value of your vehicle when assessing coverage. For instance, if you own an older vehicle with a low market value, you may opt for a policy with higher deductibles and lower coverage limits to save on premiums.

Evaluate Premium Costs

Of course, one of the primary factors in your decision-making process will be the cost of the insurance premium. Compare the annual or monthly premiums offered by each provider, ensuring that you’re considering the same coverage levels. Keep in mind that the cheapest quote may not always be the best option, as it may lack essential coverage.

Look for opportunities to save money through discounts. Many insurance companies offer discounts for safe driving records, multiple policy bundles (e.g., auto and home insurance), and loyalty programs. Inquire about these discounts when obtaining quotes to see if you're eligible for any savings.

Consider Deductibles and Out-of-Pocket Costs

When comparing quotes, pay attention to the deductibles and out-of-pocket costs associated with each policy. Higher deductibles can lead to lower premiums, but they also mean you’ll have to pay more out of pocket in the event of a claim. Weigh the potential savings against the risk of having to pay a higher deductible.

Additionally, consider the overall financial impact of a claim. If you're comfortable with a higher deductible, you may be able to save money on your premium. However, it's important to ensure that you have the financial means to cover the deductible in the event of an accident or other insured event.

Read the Fine Print

Don’t forget to scrutinize the fine print of each policy. Look for exclusions, limitations, and any hidden fees or charges. Some insurance providers may offer seemingly attractive rates but have stringent conditions or exclusions that could impact your coverage in the event of a claim. Understanding these details can help you make a more informed decision.

Customer Service and Claims Handling

Consider the reputation and track record of each insurance provider when it comes to customer service and claims handling. Research online reviews and ratings to gauge the satisfaction levels of existing customers. Prompt and efficient claims handling can make a significant difference when you need to file a claim.

Inquire about the claims process, including the turnaround time for claims approval and payment. A provider with a reputation for quick and fair claims handling can provide peace of mind, especially in times of need.

Strategies to Negotiate and Save on Auto Insurance

While comparing quotes is an essential step, there are additional strategies you can employ to potentially save money on your auto insurance policy.

Shop Around Regularly

Insurance rates can fluctuate over time, so it’s a good practice to shop around for quotes regularly, even if you’re satisfied with your current provider. Rates may change based on market conditions, your driving history, or other factors. By comparing quotes annually or every few years, you can ensure you’re still getting the best deal.

Bundle Policies for Discounts

If you have multiple insurance needs, such as auto, home, or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer significant discounts when you bundle multiple policies, as it simplifies their administrative tasks and reduces the risk of policy cancellations.

Improve Your Driving Record

A clean driving record can lead to lower insurance premiums. If you have a history of accidents or traffic violations, focus on improving your driving habits and maintaining a safe driving record. Over time, a clean driving record can result in significant savings on your insurance policy.

Explore Telematics-Based Insurance

Some insurance providers offer telematics-based insurance programs, where they track your driving behavior through a device installed in your vehicle or an app on your smartphone. These programs reward safe driving habits with discounts. If you’re a cautious and defensive driver, telematics-based insurance could be a cost-effective option.

Review and Adjust Coverage Regularly

As your personal circumstances change, so might your insurance needs. Regularly review your coverage to ensure it aligns with your current situation. For example, if you’ve paid off your vehicle or its value has significantly decreased, you may no longer need comprehensive or collision coverage, which can lead to substantial savings.

Future Trends in Auto Insurance

The auto insurance industry is evolving, and new technologies and trends are shaping the way insurance is offered and consumed. Here’s a glimpse into the future of auto insurance and how it may impact your policy.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles (AVs) is expected to have a significant impact on auto insurance. As AV technology advances, insurance providers will need to adapt their policies to account for the reduced risk of human error in accidents. This could potentially lead to lower insurance premiums for AV owners.

Usage-Based Insurance (UBI)

Usage-based insurance programs, also known as pay-as-you-drive or pay-how-you-drive, are gaining traction. These programs use telematics to track driving behavior and offer customized insurance rates based on actual driving habits. UBI can provide incentives for safe driving and may lead to more personalized and affordable insurance options.

Digitalization and Convenience

The insurance industry is increasingly embracing digitalization, offering more convenient ways to obtain quotes, manage policies, and file claims. Online platforms and mobile apps are becoming common tools for policyholders to interact with their insurance providers. This shift towards digitalization is expected to continue, making the insurance process more accessible and efficient.

Conclusion

Comparing auto insurance quotes is a vital step in ensuring you find the right coverage at the best price. By understanding the factors that influence insurance rates, obtaining accurate quotes, and comparing policies effectively, you can make an informed decision that suits your unique needs. Remember to regularly review and adjust your coverage, explore discounts, and stay updated with industry trends to maximize your savings and protection.

What are the key factors that affect auto insurance quotes?

+

Several factors influence auto insurance quotes, including your location, personal characteristics (age, gender, marital status, credit score), driving history, vehicle type, and usage. These factors are assessed by insurance providers to determine your risk profile and the cost of your policy.

How can I obtain accurate auto insurance quotes?

+

To obtain accurate quotes, research and compare multiple insurance companies, gather essential information (vehicle details, personal details, current insurance policy details), and provide honest and accurate information when filling out quote forms or speaking with agents. Consider additional coverage options and explore discounts to get the best value.

What should I consider when comparing auto insurance quotes?

+

When comparing quotes, assess coverage levels to ensure you’re getting the protection you need. Evaluate premium costs, considering both the annual or monthly premiums and potential discounts. Consider deductibles and out-of-pocket costs, read the fine print for exclusions and limitations, and research customer service and claims handling reputation. Choose a policy that offers a balance of coverage and affordability.

Are there any strategies to negotiate or save on auto insurance?

+

Yes, regularly shop around for quotes to stay updated on the best rates. Bundle your policies with the same provider to access potential discounts. Improve your driving record to potentially lower premiums. Explore telematics-based insurance programs that reward safe driving habits. Finally, regularly review and adjust your coverage to ensure it aligns with your changing needs.

What are some future trends in auto insurance?

+

The future of auto insurance is expected to be influenced by autonomous vehicles, with potential reductions in insurance premiums for AV owners. Usage-based insurance programs (UBI) are gaining popularity, offering customized rates based on driving behavior. Additionally, the industry is embracing digitalization, providing more convenient ways to manage policies and file claims.