Compare Car Insurance Rates

Finding the best car insurance rates is a crucial aspect of owning a vehicle. With countless insurance providers offering a wide range of policies, it can be challenging to navigate the complex world of car insurance. This article aims to provide an in-depth analysis and comparison of car insurance rates, helping you make informed decisions and potentially save money on your automotive coverage.

Understanding Car Insurance Rates

Car insurance rates, also known as premiums, are the amount you pay to an insurance company for coverage. These rates are influenced by various factors, and understanding them is essential to securing the best deal.

Factors Affecting Insurance Rates

The insurance industry uses a multitude of criteria to assess risk and determine rates. Here are some key factors that influence car insurance premiums:

- Age and Gender: Younger drivers, particularly males under the age of 25, often face higher premiums due to their perceived higher risk of accidents. Insurance rates generally decrease with age and experience.

- Vehicle Type: The make, model, and year of your vehicle play a significant role. Sports cars and luxury vehicles, for instance, are often more expensive to insure due to their higher repair costs.

- Driving Record: A clean driving record with no accidents or violations is favorable and can lead to lower rates. On the other hand, a history of accidents or traffic violations may result in higher premiums.

- Location: The area where you reside and drive influences rates. Urban areas with higher traffic and crime rates often have higher insurance costs.

- Coverage Level: The level of coverage you choose affects your premium. Comprehensive and collision coverage, for example, provide more protection but also increase the cost.

- Usage: How you use your vehicle matters. Commuting long distances or using your car for business purposes may result in higher rates compared to occasional driving.

- Credit Score: In many states, insurance companies consider your credit score when determining rates. A higher credit score can lead to lower premiums.

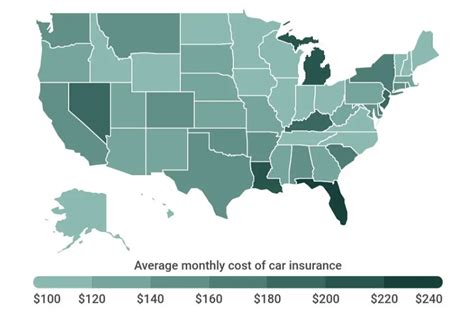

Average Car Insurance Rates

According to recent data, the average annual cost of car insurance in the United States is approximately 1,674</strong>. However, this figure can vary significantly based on individual factors and the state you reside in.</p> <table> <tr> <th>State</th> <th>Average Annual Premium</th> </tr> <tr> <td>Louisiana</td> <td>2,559 Michigan 2,489</td> </tr> <tr> <td>Florida</td> <td>2,296 Rhode Island 1,988</td> </tr> <tr> <td>New Jersey</td> <td>1,876

Comparing Insurance Providers

With numerous insurance companies vying for your business, it’s essential to compare their offerings to find the best value. Here’s a comprehensive breakdown of some top providers and their features.

State Farm

State Farm is one of the largest and most recognizable insurance providers in the United States. They offer a wide range of coverage options and are known for their strong customer service and claims handling.

- Coverage Options: State Farm provides standard coverage such as liability, collision, and comprehensive, along with additional options like rental car coverage and roadside assistance.

- Discounts: They offer various discounts, including a good driving record, multiple-policy discounts, and student discounts for good grades.

- Average Premium: The average annual premium for State Farm customers is around $1,450, making it a competitive option.

Geico

Geico, known for its catchy advertisements, is another leading insurance provider. They cater to a wide range of drivers and offer convenient online services.

- Coverage Options: Geico provides standard coverage and additional options like personal injury protection (PIP) and medical payments coverage.

- Discounts: They offer discounts for safe driving, military personnel, and federal employees, among others.

- Average Premium: Geico’s average annual premium is approximately $1,400, positioning it as a cost-effective choice.

Progressive

Progressive is a well-known insurer known for its innovative approaches and competitive rates. They offer a wide array of coverage options and tools to help customers save.

- Coverage Options: Progressive provides standard coverage and unique options like custom equipment coverage and pet injury coverage.

- Discounts: They offer discounts for safe driving, multiple policies, and snapshot programs that track driving behavior to adjust rates.

- Average Premium: Progressive’s average annual premium is around $1,550, making it a balanced option.

Allstate

Allstate is a trusted insurer with a focus on providing comprehensive coverage and excellent customer service.

- Coverage Options: Allstate offers standard coverage and specialized options like rental reimbursement and sound system coverage.

- Discounts: They provide discounts for safe driving, good students, and multiple policies.

- Average Premium: Allstate’s average annual premium is approximately $1,650, slightly higher than some competitors.

USAA

USAA is a unique insurer that caters specifically to military members, veterans, and their families. They are known for their exceptional customer service and competitive rates.

- Coverage Options: USAA provides standard coverage and additional options like rental car coverage and roadside assistance.

- Discounts: They offer discounts for safe driving, loyalty, and multiple policies.

- Average Premium: USAA’s average annual premium is around $1,300, making it an excellent value for eligible customers.

Tips for Lowering Your Insurance Rates

While insurance rates are influenced by various factors, there are strategies you can employ to potentially lower your premiums.

Improve Your Driving Record

A clean driving record is one of the most effective ways to reduce insurance rates. Avoid accidents and traffic violations, and consider taking a defensive driving course to demonstrate your commitment to safe driving.

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Take the time to compare rates from multiple providers. Online tools and insurance brokers can make this process more efficient.

Bundle Your Policies

If you have multiple insurance needs, such as home and auto, consider bundling your policies with the same provider. Many insurers offer discounts for bundling, which can lead to significant savings.

Consider Higher Deductibles

Opting for a higher deductible can lower your premiums. However, ensure you can afford the deductible in the event of a claim.

Explore Discounts

Insurance companies offer a variety of discounts. Some common discounts include good student, safe driver, and loyalty discounts. Ask your insurer about the discounts they provide and ensure you’re taking advantage of all eligible options.

Frequently Asked Questions

How often should I compare car insurance rates?

+It’s a good practice to compare rates annually, especially if your circumstances have changed. However, you can also compare rates whenever you receive a renewal notice or after a major life event like a move or a new vehicle purchase.

Can I switch insurance providers at any time?

+Yes, you can switch insurance providers at any time. However, be sure to coordinate the switch so that you don’t have a gap in coverage.

How can I get the most accurate insurance quotes?

+Provide accurate and detailed information when requesting quotes. Be honest about your driving record and vehicle usage to ensure you receive precise quotes.

What factors can I control to lower my insurance rates?

+You can control factors like your driving record, vehicle usage, and the coverage options you choose. Maintaining a clean driving record and opting for higher deductibles can lead to lower rates.

Are there any online tools to help me compare insurance rates?

+Yes, there are several online comparison tools available. These tools allow you to input your information once and receive quotes from multiple providers, making the comparison process more efficient.