Compare Cheap Auto Insurance

Securing affordable car insurance is a top priority for many vehicle owners, especially in today's economic climate. With the cost of living on the rise, finding the best deal on auto insurance without compromising on coverage is essential. This comprehensive guide will delve into the world of cheap auto insurance, exploring various strategies, options, and considerations to help you make informed decisions and potentially save a significant amount on your insurance premiums.

Understanding Cheap Auto Insurance

Cheap auto insurance refers to policies that offer the necessary coverage at competitive rates, often tailored to specific needs and budgets. While the term “cheap” may suggest a lack of quality, this is not necessarily the case. It’s possible to find affordable insurance options that provide adequate protection without sacrificing essential coverage.

Key Factors Affecting Insurance Costs

Several factors influence the cost of auto insurance, and understanding these can help you identify areas where you can potentially reduce your premiums. Here are some of the primary factors:

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how you use it, can significantly impact your insurance rates. Sports cars and luxury vehicles, for instance, often come with higher premiums due to their higher repair costs.

- Driving Record: A clean driving record with no accidents or violations can lead to lower insurance rates. Conversely, a history of accidents or traffic violations may result in higher premiums.

- Location: Insurance rates can vary significantly based on your geographical location. Urban areas with higher traffic density and crime rates often have higher insurance costs.

- Age and Gender: Age and gender are factors that insurance companies consider when determining rates. Young drivers, especially males, tend to be associated with higher risk and thus pay higher premiums.

- Coverage Options: The level of coverage you choose can impact your premiums. Comprehensive and collision coverage, for example, offer more protection but also increase your costs.

Strategies for Finding Cheap Auto Insurance

When it comes to finding cheap auto insurance, there are several effective strategies you can employ. These strategies can help you identify the best deals and potentially save hundreds of dollars on your annual insurance premiums.

Shop Around and Compare Quotes

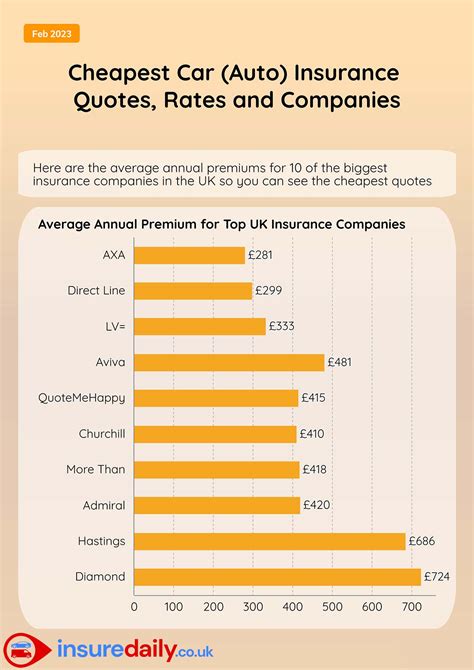

One of the most effective ways to find cheap auto insurance is to compare quotes from multiple providers. Insurance companies often have varying rates and coverage options, so shopping around can reveal significant differences. Use online comparison tools or request quotes directly from insurers to get a clear picture of the market.

When comparing quotes, ensure you're comparing similar coverage levels. Look for policies that offer the same or similar limits for liability, collision, and comprehensive coverage. This ensures you're not sacrificing essential protection for a lower premium.

Take Advantage of Discounts

Insurance companies offer a wide range of discounts that can significantly reduce your premiums. Here are some common discounts you should look out for:

- Safe Driver Discount: Many insurers provide discounts for drivers with a clean driving record. If you've been accident-free and violation-free for a certain period, you may qualify for this discount.

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings. Many insurers offer discounts when you purchase multiple policies from them.

- Good Student Discount: If you have a young driver in your household, encourage them to maintain good grades. Many insurers offer discounts for students with a certain GPA or honor roll status.

- Low Mileage Discount: If you drive less than the average number of miles annually, you may be eligible for a low-mileage discount. This is especially beneficial for retirees or those who work from home.

- Safe Car Discount: Vehicles with advanced safety features, such as anti-lock brakes, air bags, and collision avoidance systems, often qualify for discounts.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach to auto insurance that bases your premiums on your actual driving behavior. This type of insurance uses a device or an app to track your driving habits, such as mileage, acceleration, braking, and time of day driven.

For drivers with safe driving habits, usage-based insurance can result in significant savings. It rewards those who drive fewer miles, avoid aggressive driving, and stick to safer hours. However, it's important to note that this type of insurance may not be suitable for everyone, as it requires a certain level of trust and transparency in data sharing.

Opt for Higher Deductibles

Increasing your deductible, which is the amount you pay out of pocket before your insurance kicks in, can lead to lower premiums. While this strategy may not be suitable for everyone, especially those with limited financial resources, it can be an effective way to reduce your insurance costs.

By opting for a higher deductible, you're essentially accepting more financial responsibility in the event of a claim. This shift in risk from the insurance company to you results in lower premiums. However, it's important to ensure that your chosen deductible is an amount you can comfortably afford in the event of an accident or other insured loss.

Review Your Coverage Annually

Insurance needs can change over time, and it’s important to review your coverage annually to ensure you’re not overinsured or underinsured. Regularly assess your driving habits, vehicle usage, and life changes that may impact your insurance needs.

For instance, if you've recently retired and now drive less frequently, you may be able to reduce your mileage or adjust your coverage accordingly. On the other hand, if you've added a new driver to your policy, such as a teen driver, you'll need to consider the impact on your premiums and coverage.

Cheap Auto Insurance: Tips and Considerations

Finding cheap auto insurance involves more than just comparing quotes and taking advantage of discounts. Here are some additional tips and considerations to keep in mind:

Choose the Right Coverage Levels

While it’s tempting to opt for the cheapest coverage available, it’s crucial to ensure you have adequate protection. Consider your financial situation and the potential risks you may face. For example, if you have significant assets, you may want to opt for higher liability limits to protect your finances in the event of a serious accident.

Similarly, if you own an older vehicle that's paid off, you may consider dropping collision and comprehensive coverage, especially if the cost of these coverages exceeds the value of your vehicle. However, this decision should be made carefully, as it leaves you vulnerable to losses from accidents or natural disasters.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid traffic violations and accidents by practicing defensive driving and being aware of your surroundings. If you have a young driver in your household, consider enrolling them in a defensive driving course, which may also qualify them for insurance discounts.

Consider Bundle Discounts

If you have multiple insurance needs, such as homeowners, renters, or life insurance, consider bundling your policies with the same insurer. Many insurance companies offer significant discounts when you bundle multiple policies, which can result in substantial savings on your auto insurance.

Research and Understand Your Policy

Before finalizing your insurance policy, take the time to thoroughly review and understand the terms and conditions. Ensure you’re aware of any exclusions or limitations that may impact your coverage. Ask your insurance agent or broker to clarify any confusing aspects of the policy.

Explore Telematics Devices

Telematics devices, used in usage-based insurance, can provide valuable insights into your driving behavior. These devices can help you identify areas where you can improve your driving habits, which may lead to safer driving and potentially lower premiums.

The Future of Cheap Auto Insurance

The auto insurance industry is evolving, and the future holds several promising developments that could further enhance the affordability of car insurance. Here’s a glimpse into the future of cheap auto insurance:

Autonomous Vehicles

The rise of autonomous vehicles is expected to revolutionize the auto insurance industry. Self-driving cars are designed to be safer than traditional vehicles, with advanced sensors and artificial intelligence reducing the risk of accidents. As these vehicles become more prevalent, insurance rates are likely to decrease due to the reduced likelihood of claims.

Advanced Safety Features

The automotive industry is rapidly adopting advanced safety features, such as collision avoidance systems, lane departure warnings, and automatic emergency braking. These features significantly reduce the risk of accidents, leading to lower insurance costs. As more vehicles incorporate these safety technologies, we can expect insurance premiums to become more affordable.

Data-Driven Insurance

The use of data analytics and telematics in the insurance industry is already transforming the way insurance is priced and offered. Insurers are leveraging data to assess risk more accurately, which can lead to fairer and more affordable premiums. As data-driven insurance models become more sophisticated, we can expect insurance costs to become more tailored to individual driving behaviors and risk profiles.

Pay-Per-Mile Insurance

Pay-per-mile insurance, a type of usage-based insurance, is gaining traction as a cost-effective option for low-mileage drivers. This model charges premiums based on the actual miles driven, rather than estimating mileage. For individuals who drive infrequently, such as retirees or those who work from home, pay-per-mile insurance can result in significant savings.

Conclusion

Finding cheap auto insurance is not just about getting the lowest premium; it’s about finding the right balance between cost and coverage. By understanding the factors that influence insurance rates, employing effective strategies, and staying informed about the latest industry developments, you can make informed decisions and potentially save a substantial amount on your auto insurance premiums.

Remember, cheap auto insurance doesn't have to mean compromising on quality or protection. With the right approach and a bit of research, you can secure an affordable policy that meets your needs and provides the peace of mind you deserve.

Can I get cheap auto insurance if I have a poor driving record?

+While a poor driving record may lead to higher insurance premiums, it’s still possible to find affordable options. Consider shopping around for insurers that specialize in high-risk drivers or explore usage-based insurance, which may offer more favorable rates based on your current driving habits.

Are there any drawbacks to usage-based insurance?

+Usage-based insurance has the potential to save you money, but it may not be suitable for everyone. It requires sharing your driving data, which some individuals may find intrusive. Additionally, if you have a history of aggressive driving or frequent accidents, you may not see significant savings with this type of insurance.

What factors should I consider when choosing an insurance provider?

+When selecting an insurance provider, consider factors such as financial stability, customer service reputation, and the range of coverage options offered. Look for insurers with a strong financial rating and positive customer reviews. Additionally, ensure the insurer provides the specific coverage you need, such as rental car coverage or roadside assistance.

How can I reduce my insurance costs if I own an expensive car?

+Owning an expensive car can lead to higher insurance premiums due to the cost of repairs and replacement. To reduce costs, consider increasing your deductible, shopping around for insurers that offer discounts for advanced safety features, and exploring usage-based insurance, which may provide savings based on your driving habits.