Compare Cheap Car Insurance

Finding the best car insurance coverage at an affordable price is a priority for many vehicle owners. With numerous insurance providers offering a wide range of policies, it can be a daunting task to navigate the market and identify the most cost-effective option without compromising on quality. This comprehensive guide aims to provide an in-depth analysis of cheap car insurance, helping you make an informed decision while securing the best value for your money.

Understanding Cheap Car Insurance

Cheap car insurance, or budget car insurance, refers to policies that offer essential coverage at a lower cost. These policies are designed for those seeking affordable protection for their vehicles without the need for extensive additional benefits. While the term “cheap” might suggest a lack of quality, it’s important to understand that these policies provide the necessary coverage to comply with legal requirements and protect your vehicle from common risks.

Key Considerations for Choosing Cheap Car Insurance

When searching for cheap car insurance, there are several critical factors to consider. Firstly, ensure that the policy covers the basic legal requirements for your state or country. This typically includes liability coverage, which protects you from claims resulting from accidents you cause. Secondly, consider the level of personal injury and property damage coverage you need. While it might be tempting to opt for the minimum required by law, it’s essential to assess your personal financial situation and choose a level of coverage that provides adequate protection.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers claims made against you for bodily injury or property damage caused by your vehicle. |

| Personal Injury Protection (PIP) | Provides coverage for medical expenses and lost wages for you and your passengers, regardless of fault. |

| Collision Coverage | Covers damage to your vehicle resulting from a collision, regardless of fault. |

| Comprehensive Coverage | Protects against damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters. |

Top Providers of Cheap Car Insurance

Several insurance companies specialize in offering budget-friendly car insurance policies. Here’s a breakdown of some of the top providers in the market, along with their unique features and offerings:

State Farm

State Farm is a leading insurance provider known for its competitive rates and comprehensive coverage options. Their cheap car insurance policies are tailored to offer essential protection at affordable prices. State Farm provides liability coverage, personal injury protection (PIP), and medical payments coverage to ensure you’re protected in various situations.

Progressive

Progressive is renowned for its innovative approach to insurance, offering a range of digital tools and resources to enhance the customer experience. Their Snapshot program, for instance, allows drivers to save on insurance by tracking their driving habits. Progressive’s cheap car insurance policies provide liability coverage, collision coverage, and comprehensive coverage, with the option to customize based on individual needs.

Geico

Geico is another prominent insurance provider that focuses on affordability without compromising on quality. Their cheap car insurance policies include liability coverage, personal injury protection, and medical payments coverage. Geico also offers additional benefits like roadside assistance and rental car coverage, making their policies a comprehensive and cost-effective choice.

Esurance

Esurance is a tech-forward insurance company that leverages digital tools to simplify the insurance process. Their cheap car insurance policies offer liability coverage, collision coverage, and comprehensive coverage. Esurance also provides unique benefits like claims tracking, repair shop recommendations, and online policy management, making them a convenient and affordable option.

Liberty Mutual

Liberty Mutual is a well-established insurance provider known for its wide range of coverage options and personalized policies. Their cheap car insurance plans provide liability coverage, collision coverage, and comprehensive coverage. Liberty Mutual also offers additional benefits like rental car coverage, gap insurance, and accident forgiveness, making their policies a competitive choice for those seeking comprehensive protection at an affordable price.

Tips for Getting the Best Deal on Cheap Car Insurance

While cheap car insurance policies offer a more affordable option, there are strategies you can employ to further reduce your insurance costs. Here are some tips to help you get the best deal:

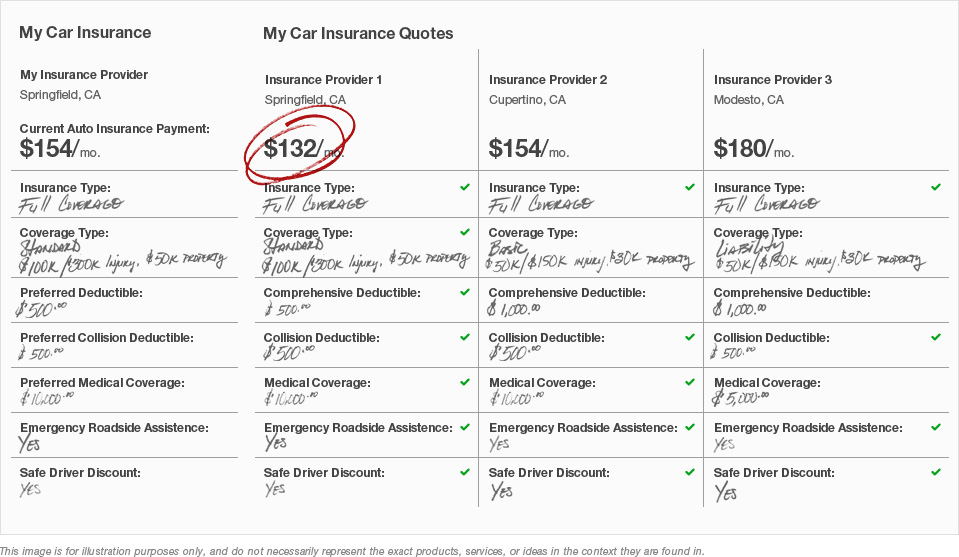

- Compare quotes from multiple providers: Get quotes from at least three insurance companies to understand the range of prices and coverage options available. This will help you identify the most cost-effective policy for your needs.

- Consider bundling policies: Many insurance providers offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. Bundling can result in significant savings and simplify your insurance management.

- Maintain a good driving record: Insurance providers often reward drivers with clean driving records by offering lower premiums. Avoid accidents and violations to keep your insurance costs down.

- Raise your deductible: Increasing your deductible, the amount you pay out of pocket before your insurance kicks in, can lower your insurance premiums. However, ensure that you can afford the higher deductible in case of an accident.

- Explore discounts: Many insurance providers offer discounts for various reasons, such as good student discounts, safe driver discounts, or discounts for installing anti-theft devices. Ask your insurance provider about available discounts and how you can qualify.

The Future of Cheap Car Insurance

The insurance industry is continuously evolving, and cheap car insurance is no exception. As technology advances and driving behaviors change, we can expect to see several developments in the market. Here are some insights into the future of cheap car insurance:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is already being utilized by some insurance providers to offer usage-based insurance policies. These policies adjust premiums based on individual driving habits, rewarding safe drivers with lower rates. As this technology becomes more advanced and widespread, we can expect usage-based insurance to become a more prominent feature of cheap car insurance policies.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles is likely to have a significant impact on the insurance industry. With self-driving cars, the risk of human error is reduced, potentially leading to fewer accidents and lower insurance costs. However, the legal and liability aspects of autonomous vehicles are still being navigated, and it remains to be seen how insurance providers will adapt their policies to accommodate this new technology.

Digital Transformation

The digital transformation of the insurance industry is already underway, with many providers leveraging technology to enhance customer experiences and streamline processes. This includes the use of digital tools for policy management, claims processing, and customer support. As more insurance providers adopt digital strategies, we can expect to see increased convenience, faster response times, and potentially lower costs for consumers.

Data Analytics and Personalized Insurance

Advanced data analytics is enabling insurance providers to offer more personalized policies. By analyzing vast amounts of data, insurers can identify specific risk factors and tailor policies to individual needs. This level of personalization can result in more accurate pricing and better coverage options for consumers, ultimately leading to more affordable and tailored cheap car insurance policies.

Frequently Asked Questions

What is the average cost of cheap car insurance?

+The average cost of cheap car insurance can vary significantly depending on factors such as location, driving history, and the level of coverage desired. On average, cheap car insurance policies can range from $500 to $1,500 per year, but these prices can be higher or lower depending on individual circumstances.

Do cheap car insurance policies cover rental cars?

+It depends on the specific policy and the insurance provider. Some cheap car insurance policies may include rental car coverage as an optional add-on, while others may not offer this benefit at all. It’s essential to review the policy details and speak with your insurance provider to understand the extent of your coverage.

Can I switch to cheap car insurance if I already have a policy?

+Yes, you can switch to a cheap car insurance policy at any time. However, it’s important to carefully review the new policy to ensure it meets your coverage needs. Additionally, consider any potential penalties or fees associated with canceling your existing policy before making the switch.

By understanding the landscape of cheap car insurance, comparing providers, and employing cost-saving strategies, you can secure affordable coverage that meets your needs. Stay informed about industry developments and leverage technology to ensure you’re getting the best value for your insurance dollar.