Compare Dental Insurance Plans

Dental health is an essential aspect of overall well-being, and many individuals seek affordable and comprehensive dental insurance plans to ensure access to quality dental care. With a multitude of options available, choosing the right dental insurance plan can be a daunting task. This comprehensive guide aims to provide an in-depth analysis and comparison of various dental insurance plans, empowering readers to make informed decisions regarding their oral health coverage.

Understanding Dental Insurance Plans

Dental insurance plans are designed to help individuals manage the costs associated with dental care, from routine check-ups and cleanings to more complex procedures. These plans typically cover a range of services, with varying levels of coverage and out-of-pocket expenses. Understanding the key components of dental insurance is crucial for selecting a plan that aligns with your specific needs and budget.

Types of Dental Insurance Plans

Dental insurance plans can be categorized into several types, each offering unique features and coverage options. The most common types include:

- Indemnity Plans: These traditional plans allow you to choose any dentist you prefer, providing reimbursement for covered services based on a fee schedule. You have the flexibility to visit any dentist, but you may incur higher out-of-pocket costs.

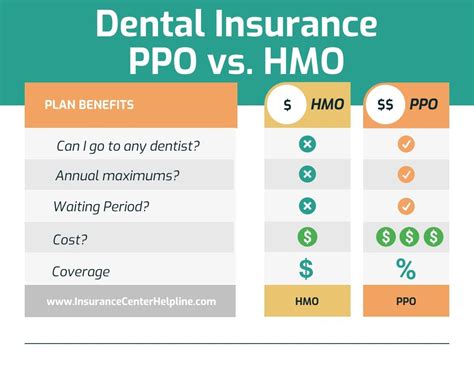

- Preferred Provider Organization (PPO) Plans: PPO plans offer a network of preferred dentists, providing greater savings when you choose an in-network provider. You have the freedom to visit out-of-network dentists, but at a higher cost.

- Dental Health Maintenance Organization (DHMO) Plans: DHMO plans require you to choose a primary care dentist within their network and follow a specific treatment plan. While costs are typically lower, you have less flexibility in choosing providers.

- Dental Discount Plans: Instead of insurance coverage, these plans offer discounted rates on dental services when you use participating dentists. There are no insurance claims or reimbursements, but you save on the overall cost of dental care.

Key Considerations for Plan Selection

When comparing dental insurance plans, several factors should be carefully considered to ensure you choose the right plan for your circumstances:

- Network of Dentists: Determine whether you prefer the flexibility of choosing any dentist or if you’re comfortable with a limited network. Consider the location and accessibility of in-network dentists.

- Coverage and Benefits: Review the plan’s coverage for various dental procedures, including preventive care, basic services, major treatments, and orthodontic care. Ensure the plan aligns with your current and future dental needs.

- Cost and Out-of-Pocket Expenses: Evaluate the monthly premiums, deductibles, copayments, and maximum out-of-pocket limits. Consider your budget and expected dental expenses to find a plan that offers the best value.

- Waiting Periods: Some plans may have waiting periods before certain procedures are covered. If you have immediate dental needs, choose a plan with minimal or no waiting periods.

- Additional Benefits: Look for plans that offer additional benefits such as alternative treatments, dental emergencies, or vision care coverage.

Analyzing Popular Dental Insurance Plans

Now, let’s delve into a detailed comparison of some of the most popular dental insurance plans available, highlighting their unique features, coverage, and suitability for different individuals.

Plan A: Bright Dental Insurance

Bright Dental Insurance is a comprehensive PPO plan known for its extensive network of dentists and flexible coverage options. This plan offers:

- Network: A nationwide network of over 150,000 dentists, ensuring easy access to quality care.

- Coverage: 100% coverage for preventive care, 80% for basic services, and 50% for major treatments. Orthodontic coverage is available with an additional premium.

- Cost: Monthly premiums range from 35 to 50, with a $50 annual deductible and 20% copayment for in-network services.

- Benefits: Includes coverage for emergency dental care, alternative treatments like acupuncture, and a discount program for vision care.

- Suitable for: Individuals and families seeking a balance between flexibility and cost-effectiveness. The extensive network and reasonable premiums make it a popular choice.

Plan B: SmilesFirst Dental Plan

SmilesFirst is a DHMO plan that focuses on providing affordable dental care with a network of trusted dentists. Here’s what it offers:

- Network: A limited network of highly skilled dentists, ensuring personalized care and convenience.

- Coverage: 100% coverage for preventive care, 75% for basic services, and 50% for major treatments. Orthodontic coverage is included with a 1500 annual maximum.</li> <li><strong>Cost:</strong> Monthly premiums start at 25, with no deductibles and a 25% copayment for most services.

- Benefits: Provides coverage for dental injuries, offers a 24⁄7 dental hotline, and includes routine vision exams.

- Suitable for: Individuals and families on a tight budget who prioritize affordability and personalized dental care. The limited network ensures a more intimate dental experience.

Plan C: Dental360 Discount Plan

Dental360 is a unique dental discount plan that offers savings on a wide range of dental services. Here are the key features:

- Network: A network of over 100,000 participating dentists nationwide, providing flexibility in choosing providers.

- Coverage: Members receive discounts ranging from 15% to 50% on most dental procedures, including preventive care, restorative treatments, and orthodontics.

- Cost: Annual membership fees start at 99 for individuals and 149 for families, with no additional costs or insurance claims.

- Benefits: Includes discounts on dental specialties like implants and cosmetic procedures. Members also receive discounts on vision care and hearing aids.

- Suitable for: Those who prefer a straightforward, cost-effective approach to dental care. The discount plan is ideal for individuals with limited dental needs or those who prioritize saving on specialty treatments.

Performance Analysis and Expert Insights

To further assist readers in making an informed decision, let’s analyze the performance and key features of these dental insurance plans based on real-world scenarios and expert opinions.

Scenario 1: Routine Dental Care

For individuals seeking comprehensive coverage for routine dental care, Bright Dental Insurance stands out. With 100% coverage for preventive care and reasonable copayments, it ensures that essential check-ups and cleanings are fully covered. Additionally, the extensive network provides flexibility in choosing a preferred dentist.

Scenario 2: Major Dental Procedures

When it comes to major dental procedures like root canals or dental implants, SmilesFirst shines. With higher coverage percentages for basic and major treatments, individuals can save significantly on these costly procedures. The limited network ensures personalized care and attention from skilled dentists.

Scenario 3: Orthodontic Care

For individuals requiring orthodontic treatment, Dental360 offers an attractive option. While it may not provide traditional insurance coverage, the substantial discounts on orthodontic procedures can make braces or Invisalign more affordable. The flexibility to choose any participating orthodontist is an added advantage.

Expert Tips and Recommendations

Future Implications and Considerations

As dental insurance plans continue to evolve, it’s essential to stay informed about emerging trends and potential changes. Here are some considerations for the future:

- Digital Dentistry: The integration of digital technologies in dentistry is on the rise. Look for plans that cover digital X-rays, 3D printing, and other innovative treatments.

- Preventive Care Focus: Emphasize the importance of preventive care by choosing plans that offer incentives or discounts for maintaining good oral health.

- Telehealth Services: Explore plans that provide telehealth options for dental consultations, especially during emergencies or for follow-up appointments.

- Value-Based Care: Seek plans that prioritize value-based care, ensuring you receive high-quality treatment at a reasonable cost.

Conclusion

Comparing dental insurance plans is a crucial step in ensuring your oral health and financial well-being. By understanding the different types of plans, evaluating coverage and costs, and considering real-world scenarios, you can make an informed decision. Remember, the right dental insurance plan should align with your unique needs and budget, providing peace of mind and access to quality dental care.

What is the average cost of dental insurance plans?

+The average cost of dental insurance plans can vary significantly based on factors such as the type of plan, coverage, and location. Monthly premiums typically range from 25 to 50 for individual plans and can be higher for family coverage. It’s essential to compare plans and consider your specific needs to find the best value.

Do all dental insurance plans cover orthodontic treatment?

+Not all dental insurance plans cover orthodontic treatment. While some plans offer comprehensive coverage for braces or Invisalign, others may have limited or no coverage for orthodontics. It’s crucial to review the plan’s benefits and exclusions to understand the orthodontic coverage options.

Can I switch dental insurance plans during the year?

+Switching dental insurance plans during the year is generally possible, but it may depend on your specific circumstances. Some plans have open enrollment periods, while others may allow changes due to life events like marriage or job changes. Check with your insurance provider or an insurance broker for guidance on switching plans.

How can I find a dentist within my insurance network?

+Most insurance providers offer online directories or tools to help you find dentists within their network. You can search by location, specialty, or dentist name. Additionally, contacting your insurance company’s customer service or using their mobile app can provide convenient access to network information.

Are there any tax benefits associated with dental insurance plans?

+In some cases, dental insurance premiums may be tax-deductible, especially if they are part of a comprehensive health insurance plan. It’s recommended to consult with a tax professional or refer to the tax guidelines in your country to understand the specific tax benefits associated with dental insurance.