Compare Health Insurance

Unveiling the Truth: A Comprehensive Comparison of Health Insurance Plans

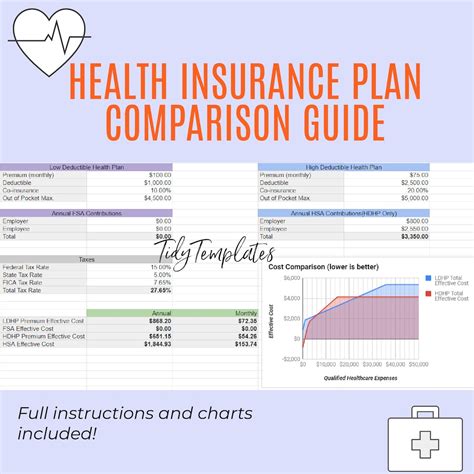

In the vast landscape of healthcare, choosing the right health insurance plan can be a daunting task. With numerous options available, it's crucial to make an informed decision that aligns with your unique needs and circumstances. This comprehensive guide aims to shed light on the intricacies of health insurance, providing an in-depth analysis to help you navigate the complexities and make the best choice for your well-being.

Understanding Health Insurance: The Basics

Health insurance is a vital component of modern healthcare systems, offering financial protection against unexpected medical expenses. It provides coverage for a range of healthcare services, including doctor visits, hospital stays, prescription medications, and preventive care. The primary goal is to ensure individuals have access to necessary medical treatment without incurring substantial financial burdens.

Health insurance plans vary widely in terms of coverage, cost, and provider networks. Understanding these key factors is essential when comparing plans and selecting the one that best suits your requirements.

Coverage and Benefits

Coverage refers to the types of medical services and treatments that are included in a health insurance plan. It typically encompasses:

- Doctor Visits: Coverage for consultations with primary care physicians and specialists.

- Hospitalization: Financial protection for hospital stays, including surgical procedures.

- Prescription Drugs: Coverage for medications, which can vary widely among plans.

- Preventive Care: Services aimed at disease prevention and early detection, such as vaccinations and screenings.

- Mental Health Services: Coverage for counseling, therapy, and psychiatric care.

- Maternity and Newborn Care: Benefits for prenatal care, childbirth, and postnatal support.

- Dental and Vision Care: Coverage for routine dental and eye exams, as well as corrective procedures.

It's important to note that the level of coverage and the specific services included can vary significantly among different insurance providers and plan types.

Cost and Premiums

The cost of health insurance is a critical factor in your decision-making process. It includes two main components:

- Premiums: The amount you pay regularly (usually monthly) to maintain your health insurance coverage. Premiums can vary based on the plan’s benefits, provider network, and other factors.

- Out-of-Pocket Costs: These are the expenses you incur when receiving medical services. They include deductibles (the amount you pay before insurance coverage kicks in), copayments (fixed amounts paid for specific services), and coinsurance (a percentage of the cost you pay after meeting the deductible).

Balancing the cost of premiums with the potential out-of-pocket expenses is a key consideration when choosing a health insurance plan.

Provider Networks

Health insurance plans often have networks of healthcare providers, including doctors, hospitals, and other medical facilities. These networks can be:

- In-Network: Providers that have a contract with your insurance company, offering discounted rates. Using in-network providers typically results in lower out-of-pocket costs.

- Out-of-Network: Providers that do not have a contract with your insurance company. Visiting out-of-network providers often leads to higher out-of-pocket expenses.

Understanding the provider network and its impact on your healthcare choices is crucial when comparing plans.

Comparing Health Insurance Plans: A Comprehensive Analysis

Now that we’ve covered the fundamentals, let’s delve into a detailed comparison of health insurance plans to help you make an informed decision.

Plan A: Comprehensive Coverage

Plan A is designed for individuals seeking extensive coverage for a wide range of healthcare needs. Here’s a closer look at its features:

- Coverage: Plan A offers comprehensive coverage, including doctor visits, hospital stays, and prescription medications. It also provides coverage for specialized treatments, such as cancer care and organ transplants.

- Premiums: The monthly premiums for Plan A are relatively higher compared to other plans. However, the comprehensive coverage and lower out-of-pocket costs make it a preferred choice for those with significant healthcare needs.

- Provider Network: Plan A boasts an extensive network of healthcare providers, ensuring easy access to a wide range of medical specialists and facilities. This network includes top-rated hospitals and renowned medical centers.

- Additional Benefits: Plan A goes beyond basic coverage by offering additional benefits such as mental health support, maternity care, and dental and vision coverage. It also provides access to wellness programs and health coaching services.

Plan B: Affordable Essentials

Plan B is tailored for individuals seeking affordable insurance coverage with essential benefits. Let’s explore its key features:

- Coverage: Plan B provides coverage for essential healthcare services, including doctor visits, basic hospital care, and limited prescription drug coverage. It focuses on providing cost-effective coverage for common medical needs.

- Premiums: The monthly premiums for Plan B are significantly lower compared to Plan A. This plan is ideal for those who prioritize affordability and have relatively low healthcare needs.

- Provider Network: Plan B has a more limited provider network compared to Plan A. While it includes a range of primary care physicians and hospitals, the network may be narrower for specialized care.

- Additional Benefits: Plan B offers basic preventive care services, such as annual check-ups and vaccinations. However, it may have limited or no coverage for specialized treatments or procedures.

Plan C: Customizable Options

Plan C stands out for its customizable features, allowing individuals to tailor their coverage based on personal preferences and needs. Here’s what sets it apart:

- Coverage: Plan C offers a flexible coverage approach, allowing you to choose the level of coverage for different healthcare services. You can opt for higher coverage limits for specific treatments or procedures while maintaining a lower premium.

- Premiums: The premiums for Plan C can vary depending on the level of coverage you select. It provides the flexibility to adjust your coverage and premiums based on your changing healthcare needs.

- Provider Network: Plan C offers a wide network of healthcare providers, similar to Plan A. This ensures access to a diverse range of medical professionals and facilities, catering to various specialties.

- Additional Benefits: Plan C includes a wellness program with incentives for maintaining a healthy lifestyle. It also provides access to a dedicated health coach who can help you navigate your healthcare journey and make informed decisions.

Real-World Performance: A Comparative Analysis

To provide a comprehensive evaluation, let’s analyze the real-world performance of these health insurance plans based on customer feedback and industry insights.

Customer Satisfaction and Claims Experience

Customer satisfaction is a key indicator of the overall quality of a health insurance plan. Here’s how Plans A, B, and C fare in this regard:

- Plan A: Customers of Plan A highly appreciate the comprehensive coverage and the extensive provider network. The plan’s focus on specialized treatments and additional benefits has led to positive feedback, especially from individuals with complex healthcare needs.

- Plan B: Plan B’s affordability and simplicity have earned it a loyal customer base. While it may not offer extensive coverage, it provides peace of mind for those with basic healthcare requirements. Customers appreciate the straightforward claims process and the cost-effective nature of the plan.

- Plan C: The customizable nature of Plan C has resonated well with customers. It allows individuals to align their coverage with their specific needs, leading to a high level of satisfaction. The plan’s wellness program and health coaching services have been particularly well-received, promoting a proactive approach to healthcare.

Financial Strength and Stability

The financial strength of an insurance provider is crucial for ensuring the long-term viability of your health insurance plan. Here’s an overview of the financial stability of the companies behind Plans A, B, and C:

- Plan A: The insurance company behind Plan A is a well-established industry leader with a strong financial foundation. It has consistently demonstrated stability and has a track record of meeting its obligations. This provides assurance to policyholders regarding the plan’s long-term sustainability.

- Plan B: Plan B is backed by a financially sound insurance provider with a solid reputation. While it may not have the same scale as Plan A, it has shown consistent growth and has a solid financial outlook. Policyholders can have confidence in the plan’s financial stability.

- Plan C: The company offering Plan C has a strong focus on innovation and customer-centric approaches. While it may be slightly smaller in scale compared to Plans A and B, it has demonstrated impressive financial growth and stability. Policyholders can expect a reliable and financially secure experience with Plan C.

Future Implications and Considerations

As you navigate the health insurance landscape, it’s essential to consider the potential future implications and evolving trends. Here are some key factors to keep in mind:

Healthcare Reform and Policy Changes

The healthcare industry is subject to ongoing reforms and policy changes. Stay informed about any potential changes that may impact your health insurance coverage. Keep an eye on legislative developments and industry trends to ensure you’re prepared for any adjustments in the healthcare landscape.

Personal Healthcare Needs

Your healthcare needs may evolve over time. Whether it’s due to age, changing circumstances, or new medical conditions, it’s crucial to periodically review your health insurance plan to ensure it aligns with your current and future needs. Regularly assess your coverage to make any necessary adjustments.

Provider Network Changes

Health insurance providers may periodically update their provider networks. Stay informed about any changes to the network, especially if you have established relationships with specific healthcare providers. Ensure that your preferred doctors and facilities remain in-network to avoid unexpected out-of-pocket expenses.

Conclusion: Empowering Your Healthcare Journey

Choosing the right health insurance plan is a pivotal decision that can significantly impact your well-being and financial stability. By conducting a thorough comparison, considering real-world performance, and staying informed about future implications, you can make an informed choice that aligns with your unique healthcare needs.

Remember, health insurance is not a one-size-fits-all proposition. It's essential to evaluate your personal circumstances, assess your healthcare priorities, and select a plan that provides the coverage and benefits you require. With the right health insurance coverage, you can navigate the healthcare system with confidence and peace of mind.

How do I choose the right health insurance plan for my family?

+When selecting a health insurance plan for your family, consider factors such as the age and health status of each family member, their healthcare needs, and the level of coverage required. Evaluate the plans based on their provider networks, coverage benefits, and out-of-pocket costs. It’s also essential to assess the financial stability of the insurance provider to ensure long-term reliability.

What are some common exclusions or limitations in health insurance plans?

+Common exclusions and limitations in health insurance plans may include pre-existing conditions, cosmetic procedures, experimental treatments, and certain types of prescription medications. It’s crucial to carefully review the plan’s coverage details and exclusions to understand what is and isn’t covered.

How can I reduce my out-of-pocket costs while maintaining adequate coverage?

+To minimize out-of-pocket costs, consider choosing a plan with a higher premium but lower deductibles and copayments. Additionally, staying within the plan’s provider network and utilizing preventive care services can help reduce expenses. Some plans also offer wellness programs and incentives to promote healthy behaviors and lower healthcare costs.

What are the potential consequences of not having health insurance coverage?

+Not having health insurance coverage can lead to significant financial burdens in the event of unexpected medical emergencies or chronic health conditions. It may result in high out-of-pocket expenses, limited access to healthcare services, and difficulty managing ongoing healthcare needs. Additionally, certain countries may impose penalties for not having adequate health insurance coverage.