Compare Insurance Quotes

In the vast landscape of insurance, understanding the intricacies of coverage and costs is essential. This comprehensive guide aims to delve into the process of comparing insurance quotes, shedding light on the factors that influence them and empowering readers to make informed decisions. From understanding the basic principles of insurance to navigating the complexities of various coverage options, we'll explore the tools and strategies to secure the best value for your needs.

Navigating the World of Insurance Quotes

Insurance quotes are more than just numbers on a page; they are a reflection of your specific needs and the risks you wish to mitigate. Whether it’s auto insurance, health coverage, or home insurance, the process of comparison is key to ensuring you’re not overpaying for the protection you require.

Understanding the Basics of Insurance Quotes

At its core, an insurance quote is an estimation of the cost you’ll pay for a specific type of insurance coverage. This quote is determined by a variety of factors, including the type of insurance, your personal details, and the level of coverage you select. For instance, auto insurance quotes can vary based on factors like your driving history, the make and model of your vehicle, and the coverage limits you choose.

| Insurance Type | Key Factors Affecting Quotes |

|---|---|

| Auto Insurance | Driving History, Vehicle Type, Coverage Limits |

| Health Insurance | Age, Health Status, Plan Deductibles |

| Home Insurance | Location, Property Value, Risk Factors (e.g., Flood Zones) |

The Art of Comparison: Why It Matters

Comparing insurance quotes is a vital step in the insurance-buying process. It allows you to evaluate different policies, understand the range of prices, and identify the best value for your money. By comparing quotes, you can ensure you’re not paying more than necessary for the coverage you need, and you can also identify the additional benefits or features that different insurers offer.

Unraveling the Factors That Influence Quotes

Insurance quotes are influenced by a multitude of factors, each playing a unique role in determining the final cost. Understanding these factors is key to making sense of the quotes you receive and ensuring you’re getting the best deal.

Personal Details: The Foundation of Insurance Quotes

Your personal information is a significant determinant in insurance quotes. This includes basic details like your age, gender, and marital status, as well as more specific information such as your occupation, health status, and even your credit score. For instance, in auto insurance, younger drivers are often considered higher risk and may pay higher premiums. Similarly, in health insurance, pre-existing conditions can influence the cost of your coverage.

The Role of Location and Geographical Factors

Where you live can significantly impact your insurance quotes. Geographical factors like the crime rate, weather conditions, and natural disaster risks in your area can all play a role. For example, living in an area prone to hurricanes or floods may result in higher home insurance premiums, as the risk of damage is greater. Similarly, high-crime areas may see higher auto insurance rates due to the increased likelihood of theft or vandalism.

Coverage Limits and Deductibles: Balancing Risk and Cost

The level of coverage you choose and the deductibles you’re willing to pay also influence your insurance quotes. Higher coverage limits typically result in higher premiums, as the insurer is taking on more risk. Conversely, opting for higher deductibles can lower your premiums, as you’re agreeing to pay more out-of-pocket before the insurance kicks in. This balance between coverage and cost is a key consideration in the quote comparison process.

Strategies for Securing the Best Insurance Quotes

Comparing insurance quotes is just the first step. To truly secure the best deal, you need a strategic approach that considers your specific needs and circumstances. Here are some expert tips to help you navigate the process effectively.

The Power of Online Comparison Tools

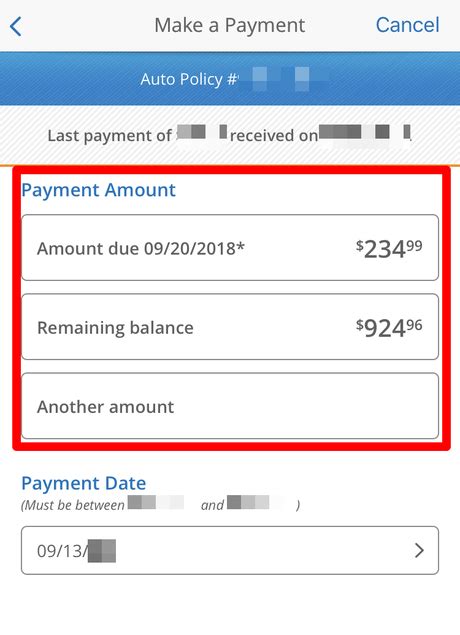

In today’s digital age, online comparison tools are a powerful resource for evaluating insurance quotes. These platforms allow you to quickly and easily compare quotes from multiple insurers, often with just a few clicks. By inputting your details and coverage preferences, you can get a snapshot of the market and see how different insurers stack up against each other. This not only saves time but also ensures you’re getting a comprehensive view of your options.

Understanding Discounts and Bundling Options

Insurance providers often offer a range of discounts to make their policies more attractive. These can include discounts for safe driving habits, loyalty rewards, or even occupational discounts. Additionally, bundling your insurance policies (e.g., auto and home insurance) with the same provider can often lead to significant savings. Understanding these discounts and bundling options is crucial in securing the best value for your insurance needs.

The Importance of Personalized Advice

While online tools are invaluable, seeking personalized advice from insurance professionals can also be beneficial. An insurance agent or broker can provide tailored recommendations based on your unique circumstances, helping you navigate the complexities of coverage and costs. They can also guide you through the process of comparing quotes, ensuring you understand the fine print and make informed decisions.

Conclusion: Empowering Informed Decisions

Comparing insurance quotes is a critical step in ensuring you get the best value for your insurance needs. By understanding the factors that influence quotes, utilizing online comparison tools, and seeking personalized advice, you can make informed decisions that protect your assets and your finances. Remember, insurance is about more than just the cost; it’s about peace of mind and the security of knowing you’re covered when it matters most.

How often should I review and compare my insurance quotes?

+

It’s generally recommended to review your insurance quotes and policies annually, or whenever your circumstances change significantly. This could include a move to a new location, a change in your marital status, or a major life event like having a child. Regular reviews ensure your coverage remains adequate and that you’re not overpaying.

What are some common mistakes to avoid when comparing insurance quotes?

+

One common mistake is focusing solely on the price without considering the coverage details. Always read the fine print to understand what’s included and excluded in the policy. Additionally, be wary of significantly low quotes, as they may indicate inadequate coverage or hidden fees. Finally, ensure you’re comparing apples to apples by evaluating quotes with similar coverage limits and deductibles.

How can I ensure I’m getting the best value for my insurance needs?

+

To get the best value, consider both the cost and the coverage. Look for policies that offer comprehensive coverage at a competitive price. Utilize online comparison tools, but also seek advice from insurance professionals who can guide you based on your specific needs. Additionally, don’t forget to explore potential discounts and bundling options to further enhance your savings.